Federal Heat Pump Rebate Requirements If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022

Geothermal heat pumps must meet Energy Star requirements in effect at the time of purchase Battery storage technology must have a capacity of at least 3 kilowatt hours How to claim the credit File Form 5695 Residential Energy Credits with your tax return to claim the credit You must claim the credit for the tax year when the property is Program Requirements Processing and Delivering Rebate Funds to Eligible Rebate Recipients 58

Federal Heat Pump Rebate Requirements

Federal Heat Pump Rebate Requirements

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2023/01/heat-pump-rebate-baldwin-emc-1.png?fit=1119%2C659&ssl=1

How To Take Advantage Of New Federal Heat Pump Rebates HELP Plumbing

https://333help.com/wp-content/uploads/2023/04/shutterstock_153086615-2048x1262.jpg

Federal Rebates For Heat Pumps HERETAB

https://i2.wp.com/www.advantagehcp.com/wp-content/uploads/2019/09/750-rebate-for-heat-pump-with-efficiency-90-HSPF14-SEER-or-higher-when-converting-from-an-electric-furnace-Additional-250-rebate-for-variable-speed.png

2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit is available only for qualifying expenditures to an existing home or for an addition or renovation of an existing home and not for a newly constructed home Save Up to 2 000 on Costs of Upgrading to Heat Pump Technology These energy efficient home improvement credits are available for 30 of costs up to 2 000 and can be combined with credits up to 1 200 for other qualified upgrades made in one tax year

DOE has updated the core documents that outline Home Energy Rebates program requirements that states and territories must meet to apply for funding and implement their programs Consumer Reports explains the tax credits and rebates available through the Inflation Reduction Act for the purchase of a heat pump

Download Federal Heat Pump Rebate Requirements

More picture related to Federal Heat Pump Rebate Requirements

Heat Pump Rebate Baldwin EMC PumpRebate

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2022/09/heat-pump-rebate-baldwin-emc-16.png?fit=768%2C485&ssl=1

Federal Heat Pump Rebates 2022 PumpRebate

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2022/09/geothermal-rebates-take-up-to-45-off-your-total-cost-of-job-when-you-4.png

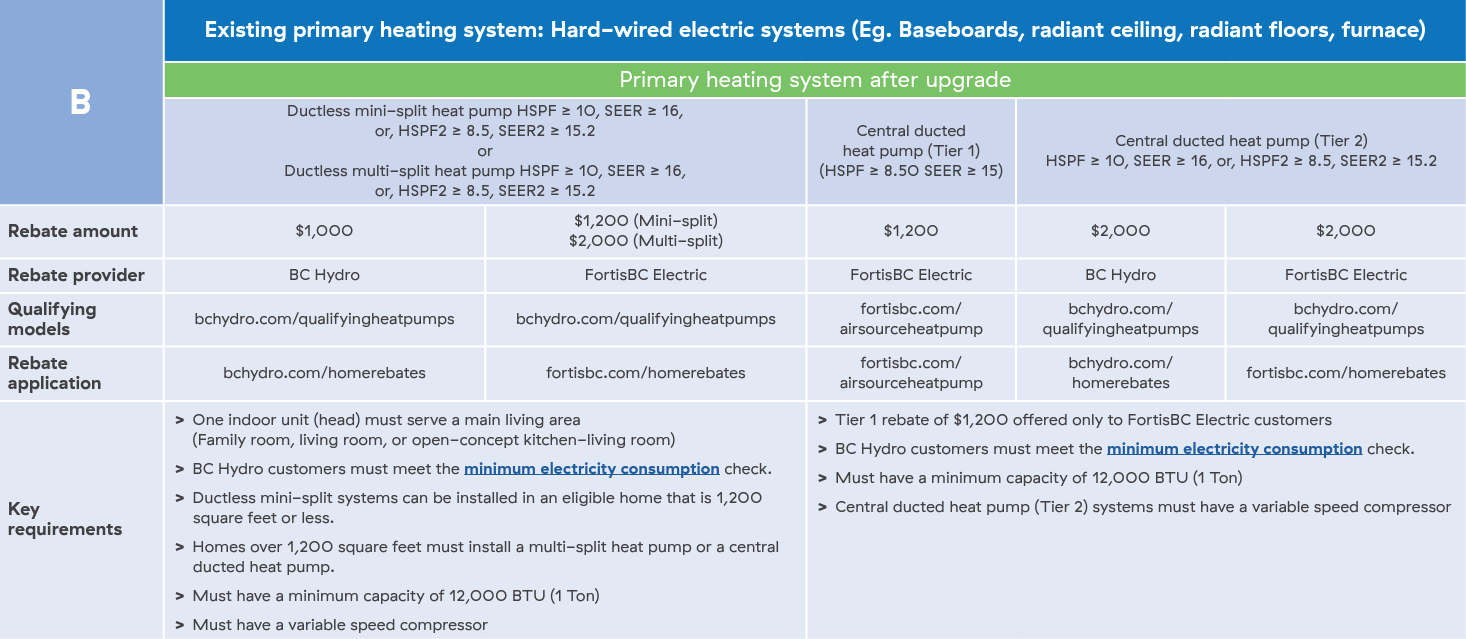

BC Heat Pump Rebates Home Heating Rebates Lockhart Industries

https://lockhart.ca/wp-content/uploads/2023/06/home-heating-rebate-bc.png

Rebates could cover as much as 8 000 for heating and cooling heat pumps and 1 750 for heat pump water heaters If your household income is less than 80 percent of your state s median household income you are eligible for 100 percent of The Inflation Reduction Act provides federal income tax credits that are specially targeted to home owners that make energy efficient home improvements involving heat pump technology 30 of project costs up to 2 000

In addition to the heat pump tax credit you may soon also be eligible for 1 750 to 8 000 towards a heat pump purchase in the form of a state administered IRA rebate The 25c tax credit allows taxpayers to claim certain home energy upgrades like heat pumps to reduce their tax burden In 2023 the maximum federal tax credit for installing a heat pump increased to 30 of your project costs up to 2 000 under the

Heat Pump Rebate Program Now Requires Homeowners To Insulate CBC News

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2022/09/heat-pump-rebate-program-now-requires-homeowners-to-insulate-cbc-news-13.png

How To Take Advantage Of New Federal Heat Pump Rebates

https://jwheatingandair.com/wp-content/uploads/2023/04/JW-Blog-How-to-Take-Advantage-of-New-Federal-Heat-Pump-Rebates-Header-1024x538.jpg

https://www.irs.gov/credits-deductions/energy...

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022

https://www.irs.gov/credits-deductions/residential-clean-energy-credit

Geothermal heat pumps must meet Energy Star requirements in effect at the time of purchase Battery storage technology must have a capacity of at least 3 kilowatt hours How to claim the credit File Form 5695 Residential Energy Credits with your tax return to claim the credit You must claim the credit for the tax year when the property is

Heat Pump Requirements For Federal Tax Credit PumpRebate

Heat Pump Rebate Program Now Requires Homeowners To Insulate CBC News

Air Source Heat Pump Rebate Form 2022 Fillable Mission Valley Power

Heat Pump Rebate Climate Bill PumpRebate

Let s Talk About Heat Pump Rebates

Professional Geothermal Cooling Services Paschal Air Plumbing Electric

Professional Geothermal Cooling Services Paschal Air Plumbing Electric

How To Take Advantage Of New Federal Heat Pump Rebates ProSkill

Federal Rebate For Heat Pump Hot Water Heater PumpRebate

How To Take Advantage Of New Federal Heat Pump Rebates ASI Hastings

Federal Heat Pump Rebate Requirements - Consumer Reports explains the tax credits and rebates available through the Inflation Reduction Act for the purchase of a heat pump