Federal Income Tax Child Credit 2023 Tax credit per child for 2023 The maximum tax credit per qualifying child is 2 000 for children under 17 For the refundable portion of the credit or the additional child tax credit you

The child tax credit is limited to 2 000 for every dependent you have who s under age 17 1 600 being refundable for the 2023 tax year That increases to 1 700 for the 2024 tax year Modified adjusted gross income MAGI thresholds for single taxpayers and heads of household are set at 200 000 to qualify and 400 000 for joint filers Key Takeaways There are seven qualifying tests to determine eligibility for the Child Tax Credit age relationship support dependent status citizenship length of residency and family income If you aren t able to claim the Child Tax Credit for a dependent they might be eligible for the Credit for Other Dependent

Federal Income Tax Child Credit 2023

Federal Income Tax Child Credit 2023

https://www.the-sun.com/wp-content/uploads/sites/6/2021/06/NINTCHDBPICT000653939782-7.jpg

Record High Inflation Brings Changes To Your Tax Bill And Tax Bracket

https://tehcpa.net/wp-content/uploads/2022/09/2023-tax-bracket-married-couple.png

New 2023 IRS Income Tax Brackets And Phaseouts

https://imageio.forbes.com/specials-images/imageserve/637d001647ac19edd4588245/0x0.jpg?format=jpg&width=1200

How much is the child tax credit for 2023 Let s get down to dollar amounts The maximum amount for each qualifying child is 2 000 with the refundable portion totaling 1 600 per qualifying For 2023 the refundable portion of the credit is 1 600 For the prior year only 1 500 was refundable Note Keep in mind that not everyone can receive the full amount of the 2023 child tax

How the child tax credit will look in 2023 The child tax credit isn t going away but it has returned to its previous levels There are a handful of requirements that you and your The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying persons The credit is calculated based on your income and a percentage of expenses that you incur for the care of qualifying persons to enable you to go to work look for work or attend school

Download Federal Income Tax Child Credit 2023

More picture related to Federal Income Tax Child Credit 2023

Tax Return 2022 With Eic Latest News Update

https://i2.wp.com/www.taxpolicycenter.org/sites/default/files/model-estimates/images/T12-0177.GIF

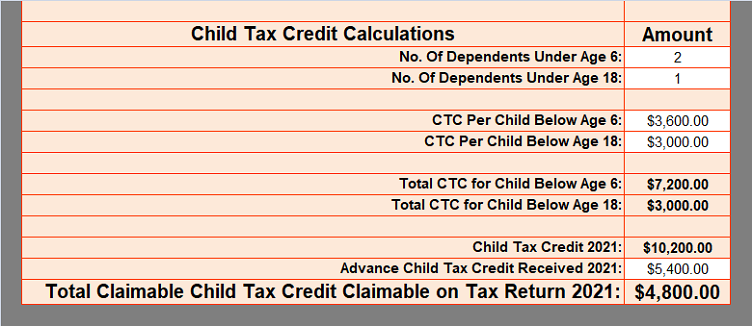

Ready To Use Child Tax Credit Calculator 2021 MSOfficeGeek

https://msofficegeek.com/wp-content/uploads/2022/03/Child-Tax-Credit-Calculations.png

Do You Have To Pay Back The Child Tax Credit In 2022 Leia Aqui Will

https://static01.nyt.com/images/2022/12/14/upshot/14up-child-tax-credit-promo-promo/14up-child-tax-credit-promo-promo-mediumSquareAt3X.png

Last quarterly payment for 2022 is due on January 17 2023 Taxpayers may need to consider estimated or additional tax payments due to non wage income from unemployment self employment annuity income or even digital assets En Espa ol The Child Tax Credit is one of the nation s strongest tools to provide tens of millions of families with some support and breathing room while raising children It has also being

For tax year 2023 you can claim the child tax credit and the additional child tax credit on the federal tax return Form 1040 or 1040 SR that was due by April 15 2024 or by Oct Proposed 2023 Child Tax Credit Changes Under the Tax Relief for American Families and Workers Act of 2024 the refundable Child Tax Credit would increase to 1 800 per child with additional

Child Tax Credit Payments 06 28 2021 News Affordable Housing

https://www.columbiahousingsc.org/plugins/show_image.php?id=2685

See The EIC Earned Income Credit Table Income Tax Return Income

https://i.pinimg.com/originals/aa/af/be/aaafbed0a4b639f5c32ede742b5dd17b.png

https://www.usatoday.com/story/money/taxes/2024/01/...

Tax credit per child for 2023 The maximum tax credit per qualifying child is 2 000 for children under 17 For the refundable portion of the credit or the additional child tax credit you

https://smartasset.com/taxes/all-about-child-tax-credits

The child tax credit is limited to 2 000 for every dependent you have who s under age 17 1 600 being refundable for the 2023 tax year That increases to 1 700 for the 2024 tax year Modified adjusted gross income MAGI thresholds for single taxpayers and heads of household are set at 200 000 to qualify and 400 000 for joint filers

Child Tax Credit Expansion Palma Financial

Child Tax Credit Payments 06 28 2021 News Affordable Housing

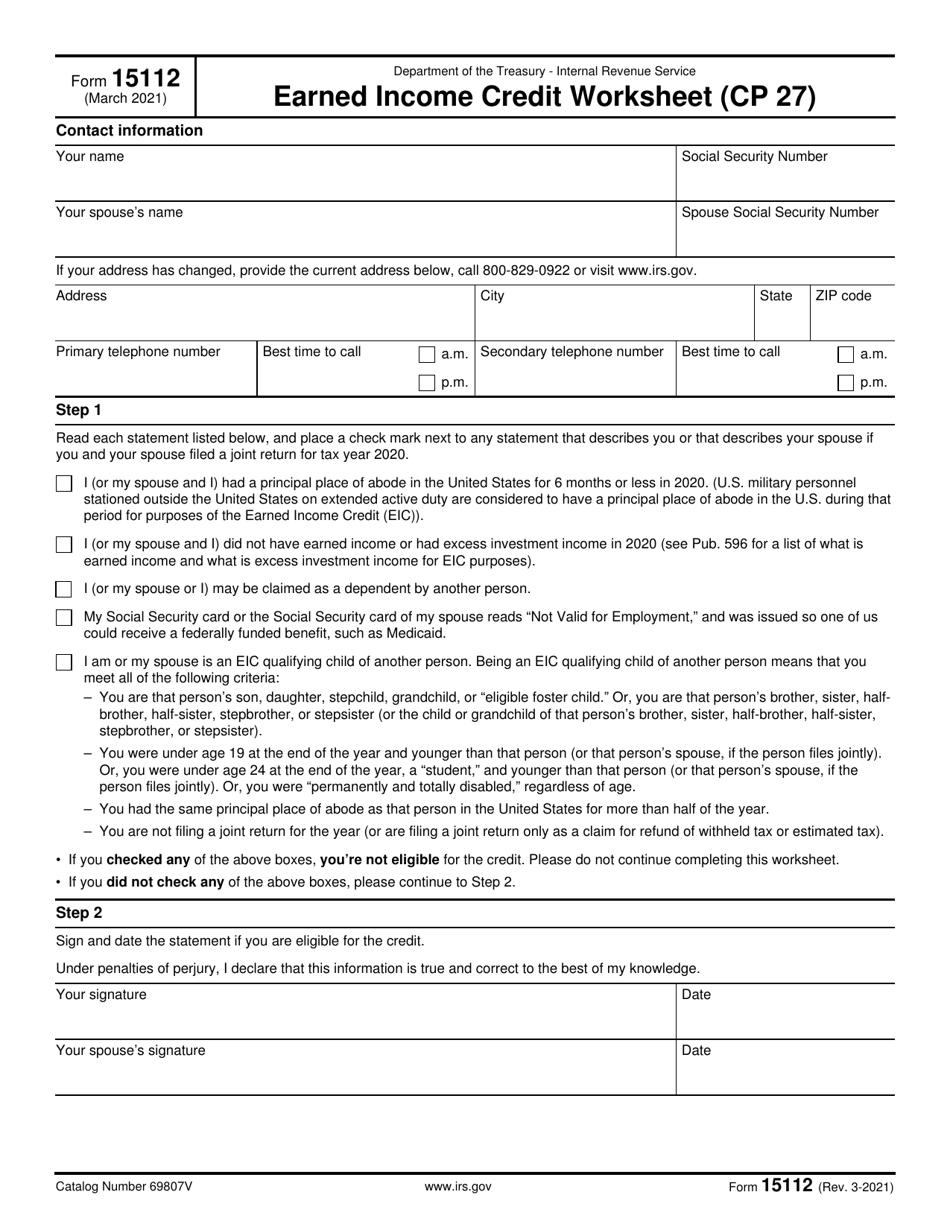

IRS Form 15112 Fill Out Sign Online And Download Fillable PDF

What To Do If You Didn t Get Your First Child Tax Credit Payment Newswire

2022 Social Security Taxable Benefits Worksheet

What Is Child Tax Benefit

What Is Child Tax Benefit

NYS Can Help Low income Working Families With Children By Increasing

What Is The Child Tax Credit And How Much Of It Is Refundable Brookings

What Is The Child Tax Credit And How Much Of It Is Refundable 2022

Federal Income Tax Child Credit 2023 - The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying persons The credit is calculated based on your income and a percentage of expenses that you incur for the care of qualifying persons to enable you to go to work look for work or attend school