Federal Income Tax On Rebates Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

Web IRS Free File Prepare and file your federal income tax return for free 2020 Recovery Rebate Credit Must file a 2020 tax return to claim if eligible Get My Payment When Web 20 d 233 c 2022 nbsp 0183 32 Most eligible people already received their stimulus payments and won t be eligible to claim a Recovery Rebate Credit People who are missing a stimulus payment

Federal Income Tax On Rebates

Federal Income Tax On Rebates

http://taxguru.in/wp-content/uploads/2016/05/87A-Computation.jpg

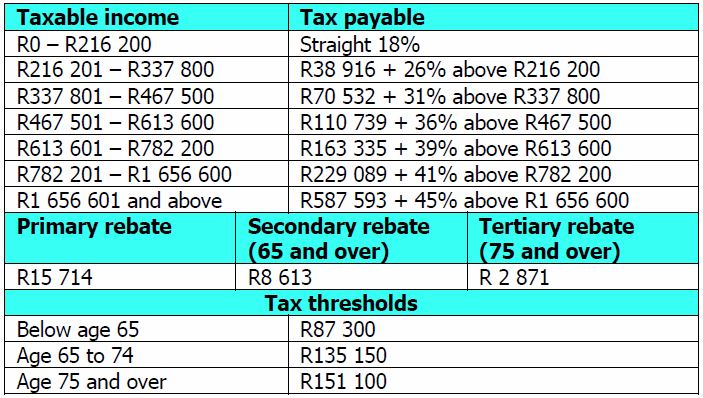

Budget Highlights For 2021 22 Nexia SAB T

https://www.nexia-sabt.co.za/wp-content/uploads/2021/03/Tax-Table-and-Rebates-2021-2022.jpg

T20 0233 Additional 2020 Recovery Rebates For Individuals In Senate

https://www.taxpolicycenter.org/sites/default/files/model-estimates/images/t20-0233.gif

Web 7 f 233 vr 2023 nbsp 0183 32 Eighteen states issued special rebates and payments to tax filers last year The IRS said it will soon issue guidance as to whether those payment will be subject to Web 1 janv 2023 nbsp 0183 32 Clean Vehicle Credits If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can

Web 9 sept 2023 nbsp 0183 32 If you itemize deductions on your federal income tax return and receive a state tax refund or special payment the IRS says you might need to include it in your Web 13 f 233 vr 2023 nbsp 0183 32 The exception to that is if a tax filer s total state tax deduction minus the rebate already exceeds the 10 000 SALT cap In that case no federal taxes are owed

Download Federal Income Tax On Rebates

More picture related to Federal Income Tax On Rebates

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

https://enterslice.com/learning/wp-content/uploads/2019/06/image-91.png

How Much Extra Is Tax In Canada Mutualgreget

https://workingholidayincanada.com/wp-content/uploads/2020/02/Federal-rates-min.jpg

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

https://i.pinimg.com/originals/2d/3d/8c/2d3d8c83aee5a3115e206b0fac97c875.jpg

Web The Coronavirus Aid Relief and Economic Security CARES Act established Internal Revenue Code IRC section 6428 2020 Recovery Rebates for Individuals which can Web 11 f 233 vr 2023 nbsp 0183 32 The IRS announced Friday that most relief checks issued by states last year aren t subject to federal taxes providing 11th hour guidance as tax returns start to pour in A week after telling

Web 1 d 233 c 2022 nbsp 0183 32 The 2001 federal tax rebate Click to expand Getting money back Federal state and local legislatures frequently issue tax rebates to encourage taxpayers to make Web 24 juil 2023 nbsp 0183 32 February 13th update On Friday evening the IRS announced that rebates in most states would not be tax ed but that payments from Georgia Massachusetts South

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

https://i1.wp.com/only30sec.com/wp-content/uploads/2020/12/Income-tax-Sections-of-deductions-and-rebates-for-Residents-and-Non-Residents.png?w=1303&ssl=1

Income Tax Rebate U s 87A For The Financial Year 2022 23

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

https://www.irs.gov/coronavirus/coronavirus-tax-relief-and-economic...

Web IRS Free File Prepare and file your federal income tax return for free 2020 Recovery Rebate Credit Must file a 2020 tax return to claim if eligible Get My Payment When

T20 0261 Additional 2020 Recovery Rebates For Individuals In The

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

Tax Rebate Checks Come Early This Year Yonkers Times

Standard Deduction For 2021 22 Standard Deduction 2021

Rebate Under Section 87A AY 2021 22 CapitalGreen

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

Warren Buffett Updates He Sheltered Millions Through Giving To Charity

Tax Rebate On Income Upto 5 Lakh Under Section 87A

Albertans Will Pay Either Provincial Or Federal Carbon Tax Which Will

Federal Income Tax On Rebates - Web 24 juil 2023 nbsp 0183 32 Under the Coronavirus Aid Relief and Economic Security CARES Act up to 1 200 rebates are provided for individuals 2 400 for joint filers with an additional