Federal Income Tax Return Form 1120 Go to www irs gov Form1120 for instructions and the latest information OMB No 1545 0123 Form 1120 Department of the Treasury Internal Revenue Service U S Corporation Income Tax Return For calendar year 2023 or tax year beginning 2023 ending 20

Use Form 1120 U S Corporation Income Tax Return to report the income gains losses deductions credits and to figure the income tax liability of a corporation IRS Form 1120 is the U S Corporation Income Tax Return It s also used by partnerships but not by S corporations Find out how to complete and file it

Federal Income Tax Return Form 1120

Federal Income Tax Return Form 1120

https://img.chdrstatic.com/media/de7d8ab0-ad3d-45a7-8ce6-de0d78d3fbdd.jpg?crop=1920:1080,smart&width=1920&height=1080&auto=webp

Can You Look Over This Corporate Tax Return Form 1120 I Did Based On

http://ww2.justanswer.com/uploads/wemba02/2011-10-24_010421_just_answers_1120_p1.jpg

Form 1120 Corporate Income Tax Return 2014 Free Download

http://www.formsbirds.com/formimg/corporate-income-tax-return-form/1257/form-1120-corporate-income-tax-return-2014-l1.png

The income gains losses deductions and credits of a corporation as well as the amount of income tax that must be paid must all be reported and calculated by the U S Corporation Income Tax Return using Form 1120 You can start your return by downloading IRS Form 1120 and filling it out by hand or you can do it all electronically A 1120 tax form is an Internal Revenue Service IRS form that corporations use to find out their tax liability or how much business tax they owe It is also called the U S Corporation Income Tax Return

File your U S corporation income tax return with ease using Form 1120 Get instructions on deductions credits and tax liabilities Simplify your tax filing process What is Form 1120 Form 1120 is the tax form C corporations and LLCs filing as corporations use to file their income taxes Once you ve completed Form 1120 you should have an idea of how much your corporation needs to pay in taxes

Download Federal Income Tax Return Form 1120

More picture related to Federal Income Tax Return Form 1120

Form 1120 REIT U S Income Tax Return For Real Estate Investment Tru

https://image.slidesharecdn.com/1272358/95/form-1120reit-us-income-tax-return-for-real-estate-investment-trusts-1-728.jpg?cb=1239353937

3 11 217 Form 1120S Corporation Income Tax Returns Internal Revenue

https://www.irs.gov/pub/xml_bc/51221503.gif

3 11 16 Corporate Income Tax Returns Internal Revenue Service

https://www.irs.gov/pub/xml_bc/33500036.gif

Form 1120 which is known as the U S Corporation Income Tax Return is used to report a corporation s income gains losses deductions and credits and to calculate how much income tax the corporation owes This form is quite substantial spanning six pages and comprising seven sections Corporations use Form 1120 U S Corporate Income Tax Return to report income gains losses deductions and credits and determine income tax liability All domestic corporations regardless of if they have taxable income or not must file Form 1120 unless you have tax exempt status

Form 1120 is the standard document corporations use to conduct a federal tax return in the US They fill in the form with all their income deductions and taxes for the fiscal year All domestic US corporations have to Schedule M 1 is a form filed with the annual tax return for corporations Form 1120 to reconcile net income or loss per a company s books with taxable income or loss reported on their tax return It ensures compliance with IRS regulations by disclosing temporary and permanent differences between financial and tax accounting

.pdf/page1-1200px-Form_1040_(2021).pdf.jpg)

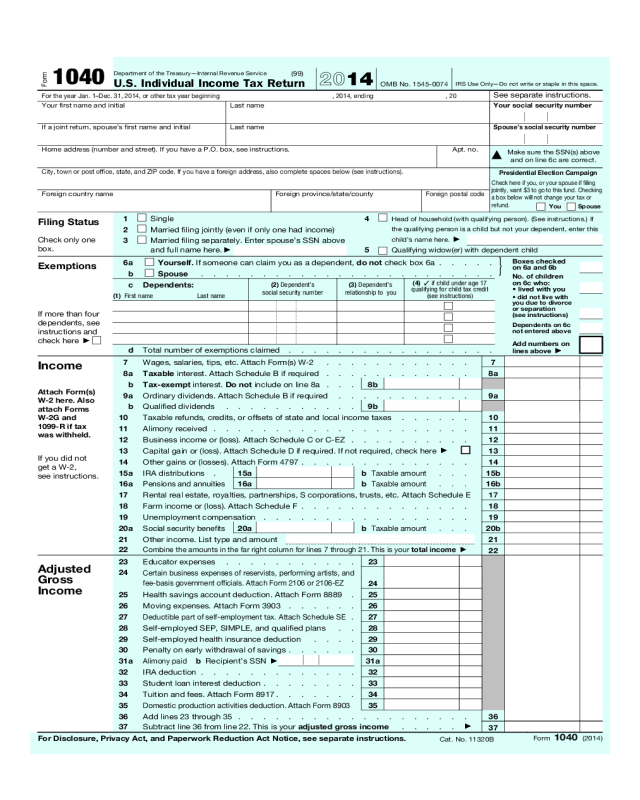

File Form 1040 2021 pdf Wikimedia Commons

https://upload.wikimedia.org/wikipedia/commons/thumb/7/73/Form_1040_(2021).pdf/page1-1200px-Form_1040_(2021).pdf.jpg

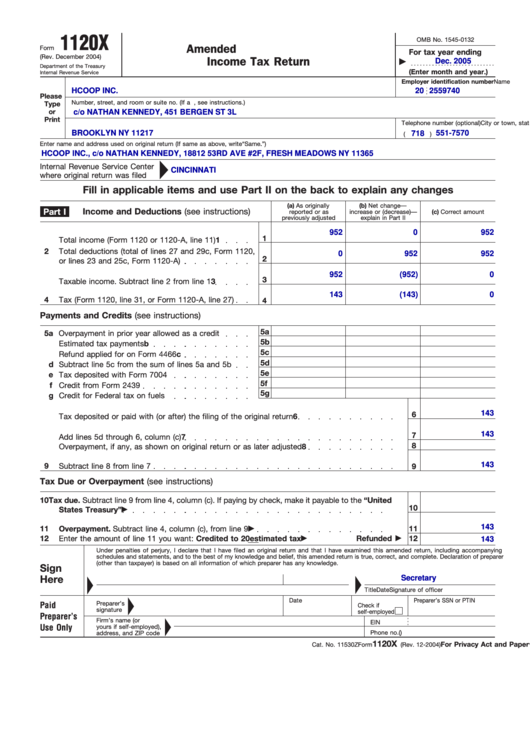

Form 1120x Amended U s Corporation Income Tax Return Printable Pdf

https://data.formsbank.com/pdf_docs_html/45/456/45665/page_1_thumb_big.png

https://www.irs.gov/pub/irs-pdf/f1120.pdf

Go to www irs gov Form1120 for instructions and the latest information OMB No 1545 0123 Form 1120 Department of the Treasury Internal Revenue Service U S Corporation Income Tax Return For calendar year 2023 or tax year beginning 2023 ending 20

https://www.irs.gov/instructions/i1120

Use Form 1120 U S Corporation Income Tax Return to report the income gains losses deductions credits and to figure the income tax liability of a corporation

Form 1120 H U S Income Tax Return For Homeowners Associations 2014

.pdf/page1-1200px-Form_1040_(2021).pdf.jpg)

File Form 1040 2021 pdf Wikimedia Commons

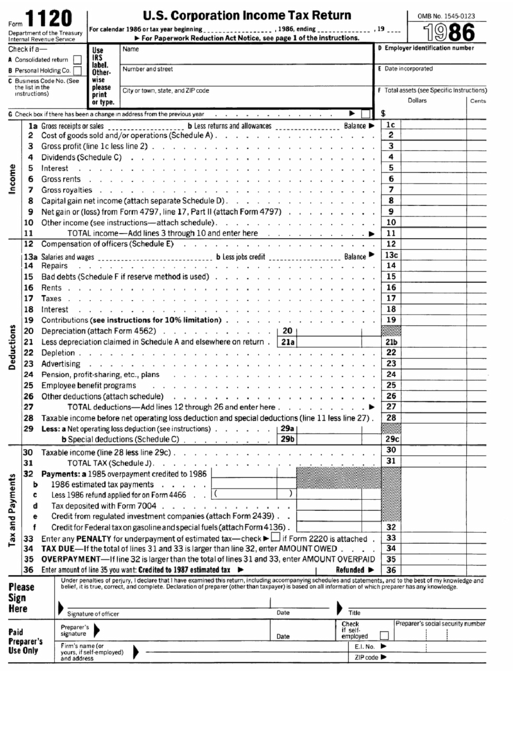

Form 1120 U s Corporation Income Tax Return 1986 Printable Pdf

3 11 106 Estate And Gift Tax Returns 397

2000 U S Individual Income Tax Return

Learn How To Fill The Form 1120 U S Corporation Income Tax Return

Learn How To Fill The Form 1120 U S Corporation Income Tax Return

Cases Where Filing Of The Income Tax Return Is Mandatory CA Cult

2024 Income Tax Statement Form Fillable Printable PDF Forms Handypdf

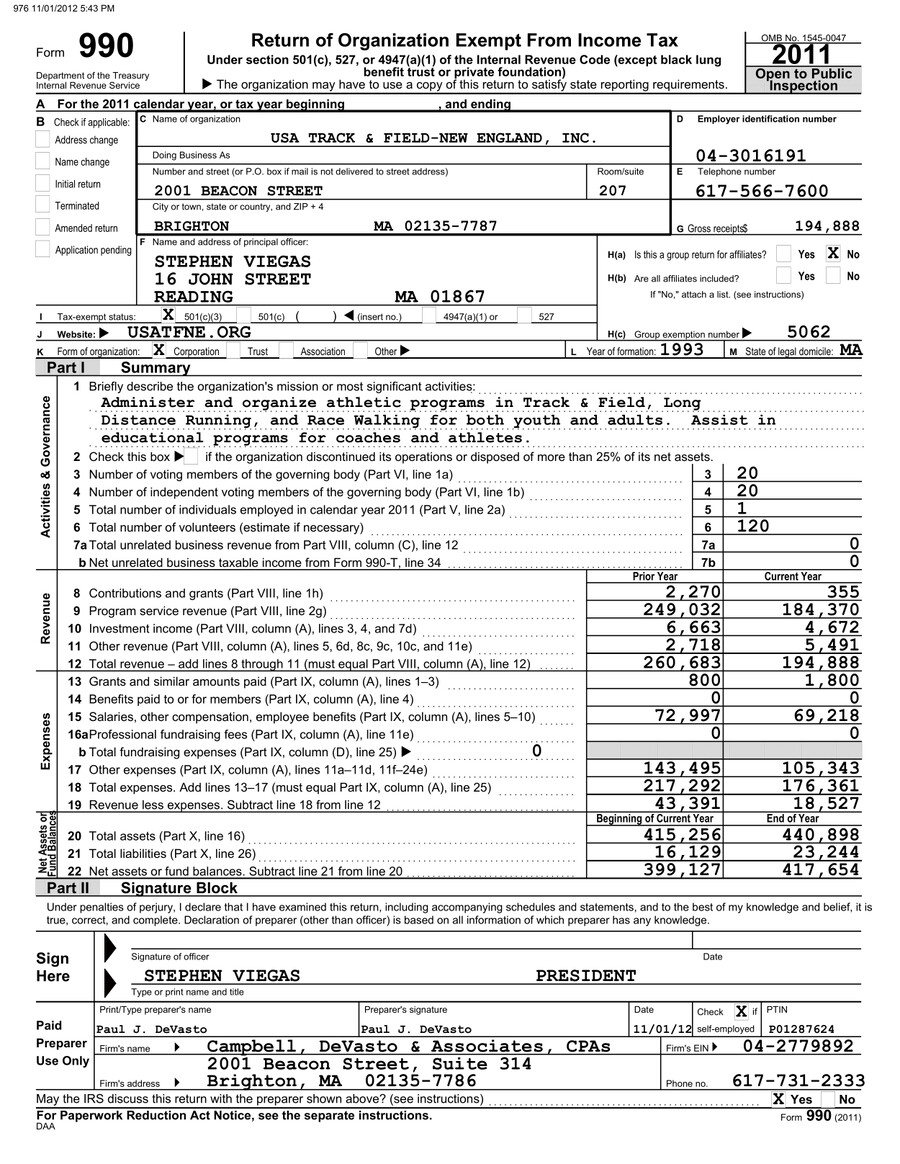

2011 Federal Tax Return By Sarah linehan Flipsnack

Federal Income Tax Return Form 1120 - What is Form 1120 Form 1120 is the tax form C corporations and LLCs filing as corporations use to file their income taxes Once you ve completed Form 1120 you should have an idea of how much your corporation needs to pay in taxes