Federal Insulation Rebate 2024 On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates

Insulation Tax Credit Information updated 12 30 2022 Subscribe to ENERGY STAR s Newsletter for updates on tax credits for energy efficiency and other ways to save energy and money at home See tax credits for 2022 and previous years This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 The Inflation Reduction Act is a piece of federal legislation passed in August 2022 that included 370 billion in clean energy investments Despite its name it s largely seen as a climate change

Federal Insulation Rebate 2024

Federal Insulation Rebate 2024

https://cdn-www.terminix.com/-/media/Feature/Terminix/Articles/Insulation-Attic-Installment-Technician.jpg?rev=1a8cb3da7c0a447989639e28fe8462d4

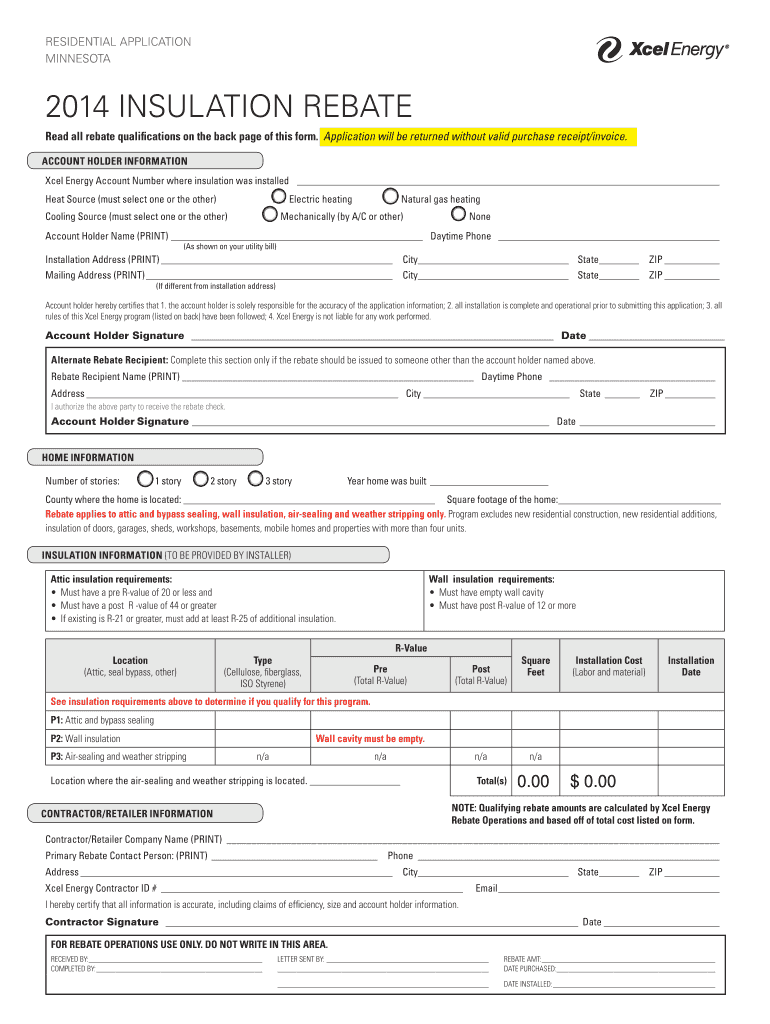

2022 SRP ATTIC INSULATION REBATE UPDATE Convenient Home Services Inc

https://www.chsenergyaudit.com/wp-content/uploads/2021/09/Air-sealing-and-attic-insulation-6.jpg

Rebate Insulation Program 911 Attic Insulation

https://911atticinsulation.com/wp-content/uploads/2023/04/23-1152x1536.jpg

For heat pump and heat pump water heater projects the tax credit amount is 30 of the total project cost includes equipment and installation up to a 2 000 maximum So if your project Solar water heaters Fuel cells Battery storage beginning in 2023 The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 to 2032 30 no annual maximum or lifetime limit 2033 26 no annual maximum or lifetime limit 2034 22 no annual maximum or lifetime limit

Note that beginning in January 2024 energy assessment will need to list their federal EIN number and credentials on their energy report if you want to receive the 150 tax credit Insulation and Efficiency Insulation materials see more details for what qualifies windows including skylights and exterior doors are all eligible for tax credits Jan 13 2023 The Inflation Reduction Act also includes a 2 000 federal tax credit for heat pumps which can be taken now Some states and utilities also offer their own rebates

Download Federal Insulation Rebate 2024

More picture related to Federal Insulation Rebate 2024

Attic Insulation Rebate Ontario Apply For Your Attic Insulation Rebate Now

https://www.weaverecohome.ca/wp-content/uploads/2021/11/attic-insulation-rebate-ontario-768x512.jpg

LADWP Rebate Insulation Program Progressive Insulation Windows

https://www.progressiveiw.com/wp-content/uploads/2020/11/square-attic-02.jpg

Get Up To 1 900 In Rebates For Air Sealing Attic Insulation Wall Insulation And More From

https://i.pinimg.com/736x/88/09/42/880942e9dfc34e4d6390e5b2b75cf6a2.jpg

The HOMES rebates can start anytime according to the IRA which specified that SEOs provide rebates for whole house energy saving retrofits begun on or after the date of enactment of this Act or August 16 2022 136 Stat 2034 The SEOs have yet to issue the guidance to consumers pending conclusion of the application process with DOE Section 50121 established the Home Efficiency Rebates and IRA Section 50122 established the IRA Home Electrification and Appliance Rebates collectively the Home Energy Rebates The Home Energy Rebates together authorize 8 8 billion in funds for the benefit of Uhouseholds S

Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent In addition to the energy efficiency credits homeowners can also take advantage of the modified and extended Residential Clean Energy credit which provides a 30 About Home Energy Rebates On Aug 16 2022 President Biden signed the landmark Inflation Reduction Act The law includes nearly 400 billion to support clean energy and address climate change including 8 8 billion in Home Energy Rebates which will provide two separate rebates to consumers The Home Efficiency Rebates will provide 4 3 billion to discount the price of energy saving

Commercial Roof Insulation And Efficient Unit Heater Rebate Application PGW EnergySense

https://pgwenergysense.com/wp-content/uploads/2020/08/insulation.png

Attic Insulation Rebate Charlottesville VA

https://charlottesville.gov/ImageRepository/Document?documentId=3464

https://www.energy.gov/scep/home-energy-rebates-programs

On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates

https://www.energystar.gov/about/federal_tax_credits/insulation

Insulation Tax Credit Information updated 12 30 2022 Subscribe to ENERGY STAR s Newsletter for updates on tax credits for energy efficiency and other ways to save energy and money at home See tax credits for 2022 and previous years This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032

8 CPS Energy Rebates That Could Save San Antonio Homeowners Hundreds

Commercial Roof Insulation And Efficient Unit Heater Rebate Application PGW EnergySense

Attic Insulation Pasco WA Energy Pro Insulation

CD Weld Insulation Pins Insulation Fasteners hvacinsulationsupplies hvacinsulationsupplies

Rebate Form Template Fill Out And Sign Printable PDF Template SignNow

LADWP Insulation Rebate Program In Los Angeles Call Atticare 866 692 5449

LADWP Insulation Rebate Program In Los Angeles Call Atticare 866 692 5449

Ceiling Insulation Cashbuild

Wall Insulation Rebate 2650 Canada EnerExpert

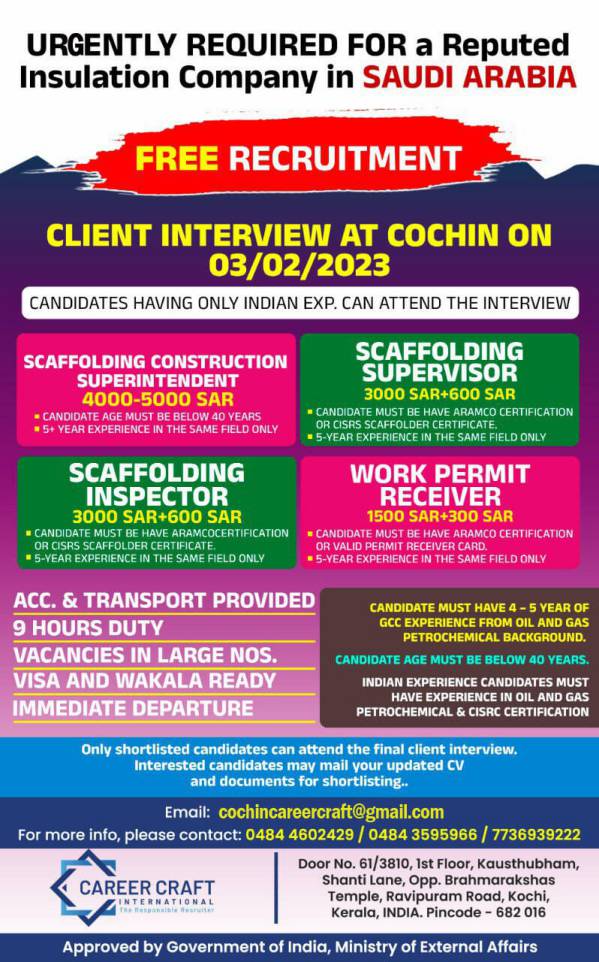

Insulation Job Want For Insulation Co Saudi Arabia

Federal Insulation Rebate 2024 - On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 This legislation is designed to provide crucial support to American job creators small businesses and working families By accelerating the end of the COVID era Employee Retention Tax