Federal Rebate For Heat Pump 2024 1 Angi Task Type HVAC Estimation Fee None Free Estimates Response Time Excellent Get Free Estimates

These rebate incentives are part of a program with 4 5 billion in federal funding available through September 2031 Who Qualifies for a Heat Pump Tax Credit or Rebate Any taxpayer would There s also a 1 750 rebate for heat pump water heaters 840 cash back for induction stoves and heat pump clothes dryers and 4 000 for electrical system upgrades The federal

Federal Rebate For Heat Pump 2024

Federal Rebate For Heat Pump 2024

https://media1.moneywise.com/a/23311/heat-pump-tax-credit-rebate_facebook_thumb_1200x628_v20220927160351.jpg

Federal Rebates For Heat Pumps Save Money And Energy USRebate

https://i0.wp.com/www.usrebate.com/wp-content/uploads/2023/05/Federal-Rebates-For-Heat-Pumps.png?ssl=1

Federal Rebate For Heat Pump 2023 PumpRebate

https://www.pumprebate.com/wp-content/uploads/2023/01/new-seer-standards-for-2023-what-seer2-means-for-ac-and-heat-pump-6.png

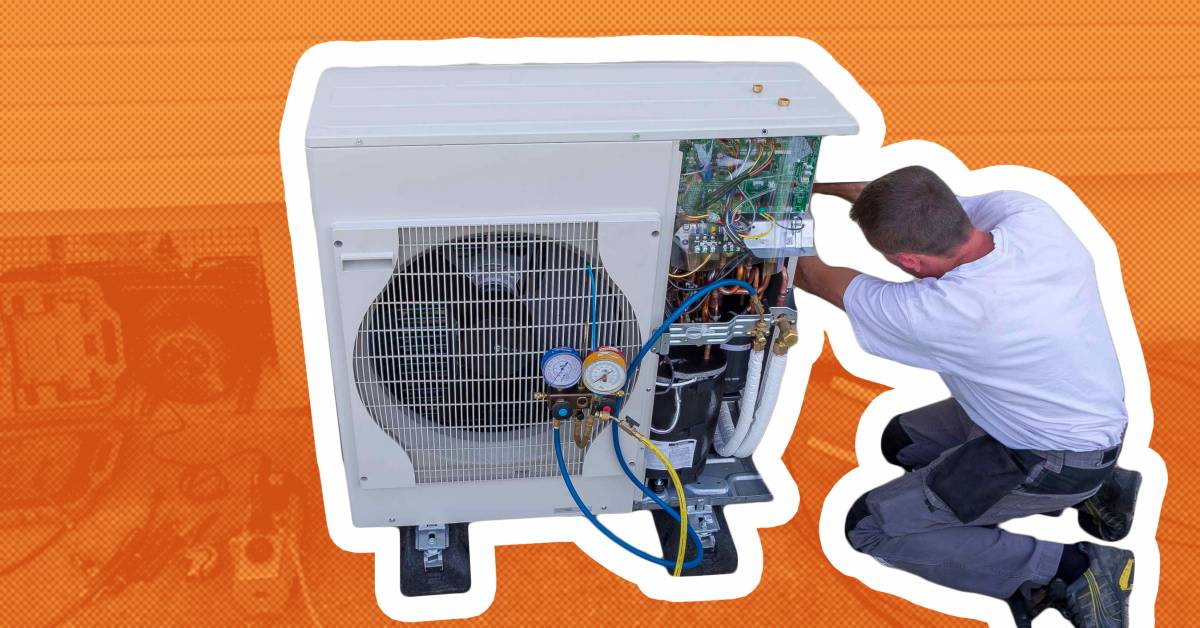

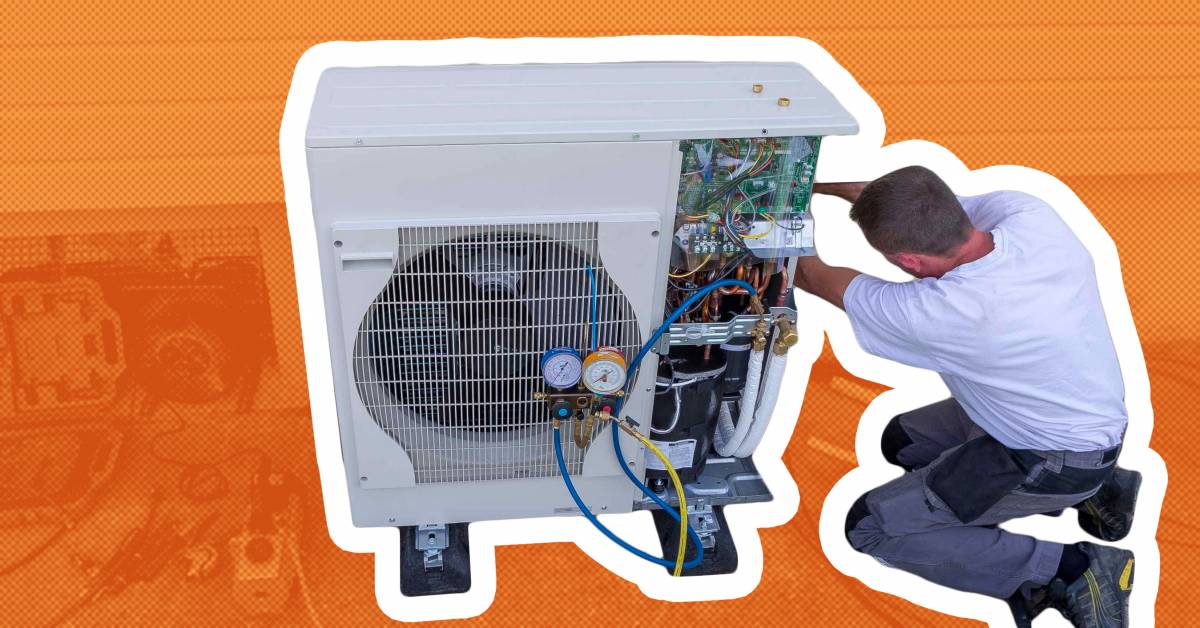

The federal Inflation Reduction Act passed in 2022 expanded and extended federal income tax credits available for energy efficiency home improvements including HVAC system components An array of Energy Star certified equipment is eligible for the tax credits including Air source heat pumps Biomass fuel stoves Boilers Central air 2 000 maximum amount credited What Products are Eligible Heat pumps are either ducted or non ducted mini splits Eligibility depends on whether you live in the north or south Ducted South All heat pumps that have earned the ENERGY STAR label North Heat pumps designated as ENERGY STAR Cold Climate that have an EER2 10 Ductless mini splits

On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent

Download Federal Rebate For Heat Pump 2024

More picture related to Federal Rebate For Heat Pump 2024

Federal Heat Pump Rebates 2022 PumpRebate PumpRebate

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2023/01/federal-heat-pump-rebates-2022-pumprebate.jpg?resize=768%2C614&ssl=1

Federal Rebates For Heat Pumps HERETAB

https://i2.wp.com/www.advantagehcp.com/wp-content/uploads/2019/09/750-rebate-for-heat-pump-with-efficiency-90-HSPF14-SEER-or-higher-when-converting-from-an-electric-furnace-Additional-250-rebate-for-variable-speed.png

Mass Save PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2021/12/Residential-Mass-Save-Rebate-Form-2021-768x513.png

2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on energy gov 2022 Up to 300 2023 through 2032 30 of your project costs up to 2 000 with an additional 600 tax credit for electric panel upgrades if needed to support heat pump installation

Heat pumps water heaters biomass stoves and boilers Home energy audits of a main home The maximum credit that can be claimed each year is 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 Key Takeaways You can receive up to 3 200 in federal tax credits for installing qualifying HVAC equipment into an existing home split between ACs furnaces or boilers 1 200 and air source heat pumps and biomass stoves 2 000 Your HVAC system must fulfill high energy efficiency requirements to qualify for tax credits

Heat Pump Rebate 2023 W2023H

https://i2.wp.com/constanthomecomfort.com/wp-content/uploads/2022/12/Copy-of-How-do-I-find-a-business-idea.jpg

New Federal Rebates Upgrading Heat Pump PumpRebate

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2022/09/heat-pump-rebates-atmosphere-climate-control-specialists-67.png

https://www.forbes.com/home-improvement/hvac/heat-pump-tax-credit/

1 Angi Task Type HVAC Estimation Fee None Free Estimates Response Time Excellent Get Free Estimates

https://www.consumerreports.org/appliances/heat-pumps/heat-pump-federal-tax-credits-and-state-rebates-a5223992000/

These rebate incentives are part of a program with 4 5 billion in federal funding available through September 2031 Who Qualifies for a Heat Pump Tax Credit or Rebate Any taxpayer would

Heat Pumps Rebates 2019 Coastal Energy PumpRebate

Heat Pump Rebate 2023 W2023H

Heat Pump Rebate Form Northern Wasco County Peoples Utility District PumpRebate

Are There Any Federal Rebates For Heat Pump Water Heaters PumpRebate

Inflation Reduction Act Heat Pump Rebate Novak Heating

Mass Save Heat Pump Rebate Save Energy And Money With Heat Pump Systems USRebate

Mass Save Heat Pump Rebate Save Energy And Money With Heat Pump Systems USRebate

California Rebate Heat Pump PumpRebate WaterRebate

Heat Pump Government Grant Or Rebate Aire One

2023 Heat Pump Rebate For Texas HEEHRA

Federal Rebate For Heat Pump 2024 - The Inflation Reduction Act signed by President Biden on August 16 2022 stands as the most significant investment in clean energy and climate action in U S history As part of this transformative law tax credit opportunities have been expanded and are available to any homeowner making energy efficient home upgrades