Federal Rebate For Homeowners Web 29 ao 251 t 2022 nbsp 0183 32 If your household income falls Below 80 of the area median income you can claim rebates for 100 of your upgrades up

Web 30 d 233 c 2022 nbsp 0183 32 Savings for Homeowners New federal income tax credits are available through 2032 providing up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent Improvements Web Introduction Useful Items You may want to see State and Local Real Estate Taxes Where to deduct real estate taxes Real estate taxes paid at settlement or closing

Federal Rebate For Homeowners

Federal Rebate For Homeowners

https://image.slideserve.com/1400751/homeowners-rebate-l.jpg

300 Federal Tax Credits For Homeowners Are BACK RonUsa Product

https://ronusa.blog/wp-content/uploads/2022/09/300-Rebates-are-BACK-2-1024x577.png

Solar Incentives Tax Credits And Rebates For Homeowners In 2022 Tax

https://i.pinimg.com/736x/94/93/37/949337ce8fa21213fb85631dc6c2e12b.jpg

Web 28 ao 251 t 2023 nbsp 0183 32 The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through Web 1 janv 2023 nbsp 0183 32 Clean Vehicle Credits If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can

Web 21 ao 251 t 2023 nbsp 0183 32 The Canada Greener Homes Loan is an interest free loan of up to 40 000 with a repayment term of 10 years open to homeowners who have an active application Web 17 juil 2023 nbsp 0183 32 Date modified 2023 03 08

Download Federal Rebate For Homeowners

More picture related to Federal Rebate For Homeowners

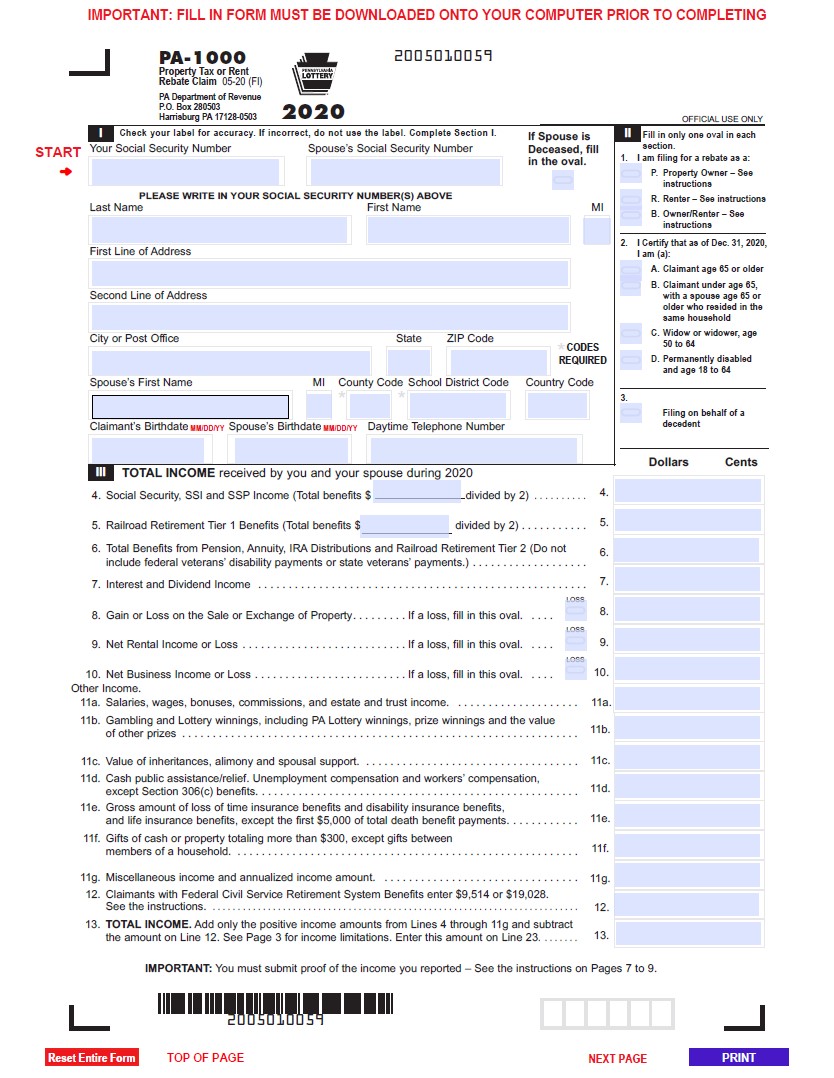

PA Rent Rebate Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/08/PA-Rent-Rebate-Form-2021.jpg

Energy Efficient Rebates Tax Incentives For MA Homeowners

https://myenergymonster.com/ma/wp-content/uploads/sites/2/2012/08/energy-efficient-rebates-ma.png

Federal Rebate Ready To Go Out YouTube

https://i.ytimg.com/vi/WjU4ZIUW9RY/maxresdefault.jpg

Web Sept 11 2023 3 22 a m PT 5 min read Federal tax credits can help you cover the cost of insulation saving you money on energy and keeping your home more comfortable Web The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer

Web 22 d 233 c 2022 nbsp 0183 32 The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs Web 1 What is the Inflation Reduction Act 2 Which provisions in the Inflation Reduction Act IRA establish home energy rebates 3 HOW MUCH MONEY IS THERE FOR HOME

Federal Recovery Rebates California Budget And Policy Center

https://calbudgetcenter.org/app/uploads/2020/04/2-Federal-recovery-42020-1536x1182.png

Tax Rebate Checks Come Early This Year Yonkers Times

https://yonkerstimes.com/wp-content/uploads/2018/09/check-2-2.jpg

https://www.investopedia.com/tax-credits-for-…

Web 29 ao 251 t 2022 nbsp 0183 32 If your household income falls Below 80 of the area median income you can claim rebates for 100 of your upgrades up

https://www.energystar.gov/about/federal_tax…

Web 30 d 233 c 2022 nbsp 0183 32 Savings for Homeowners New federal income tax credits are available through 2032 providing up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent Improvements

Toro Special New Rebate Offers On The Credit Card For Homeowners Ad

Federal Recovery Rebates California Budget And Policy Center

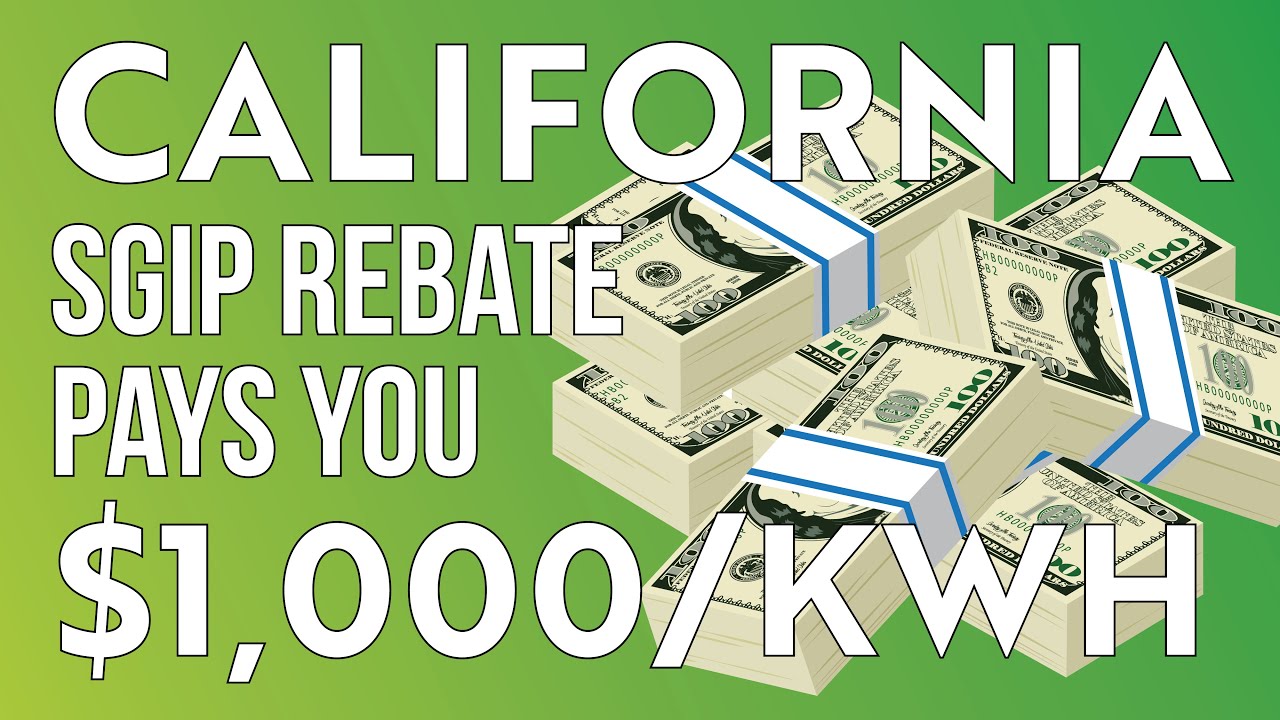

Updated SGIP 2020 Rebate Pays Homeowners To Add Batteries YouTube

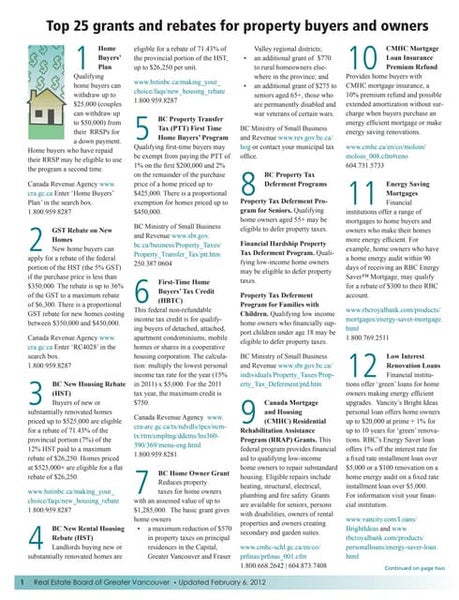

Top 26 Grants And Rebates For Homeowners

Federal And Provincial Energy Rebate Programs Pittracker

Senior Homeowners Qualify For A Rebate Senior Discounts Rebates

Senior Homeowners Qualify For A Rebate Senior Discounts Rebates

Cash Up For Grabs In Federal Rebate Program YouTube

Provincial And Federal Governments Work Together To Expand Oil To

Solar Panel Rebates Solar Tax Incentives GreenLight Solar Roofing

Federal Rebate For Homeowners - Web 27 mai 2021 nbsp 0183 32 Homeowners will be able to receive grants of up to 5 000 to make energy efficient retrofits to their primary residences and up to 600 to help with the cost of home