Federal Rebate Plug In Hybrid Web 7 sept 2023 nbsp 0183 32 Consumer Reports details the list of 2022 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500

Web 17 ao 251 t 2022 nbsp 0183 32 Plug in hybrids PHEVs and electric vehicles EVs purchased in or after 2010 may be eligible for a federal income tax credit of up to 7 500 Save up to 7 500 Web 18 ao 251 t 2022 nbsp 0183 32 Only EVs and plug in hybrids built at plants in the U S Mexico or Canada now qualify for the federal tax credit incentive Domestics Still Eligible in 2022 General Motors and Tesla both

Federal Rebate Plug In Hybrid

Federal Rebate Plug In Hybrid

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2023/05/federal-rebates-for-hybrid-cars-2022-2022-carrebate-18.jpg?w=435&h=517&ssl=1

Federal Rebates For Hybrid Cars 2022 2022 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/08/federal-rebate-for-electric-cars-2022-carrebate-7.jpg?resize=840%2C473&ssl=1

2022 PHEV Plug in Hybrid Availability Date Pricing Acceleration Vs

https://www.tucson-forum.com/attachments/1627413708038-png.193/

Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section Web Federal Tax Credits for Plug in Electric and Fuel Cell Electric Vehicles Purchased in 2023 or After Federal Tax Credit Up To 7 500 All electric plug in hybrid and fuel cell

Web 25 janv 2022 nbsp 0183 32 Things are a bit more complicated with plug in hybrids as the federal tax credit amounts for each model vary depending on the capacity of its battery pack Here s Web 17 avr 2023 nbsp 0183 32 Release Date 4 19 2023 Federal Tax Credits for Plug in Electric and Fuel Cell Electric Vehicles Placed into Service on or after April 18 2023 Vehicle Model Year

Download Federal Rebate Plug In Hybrid

More picture related to Federal Rebate Plug In Hybrid

Federal Rebates For Hybrid Cars 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/08/where-federal-rebates-for-toyota-and-lexus-hybrids-stand-as-of-oct-1.jpg

Federal Rebates For Hybrid Cars 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/federal-rebates-for-electric-cars-kick-in-but-tesla-model-3-doesn-t.jpg

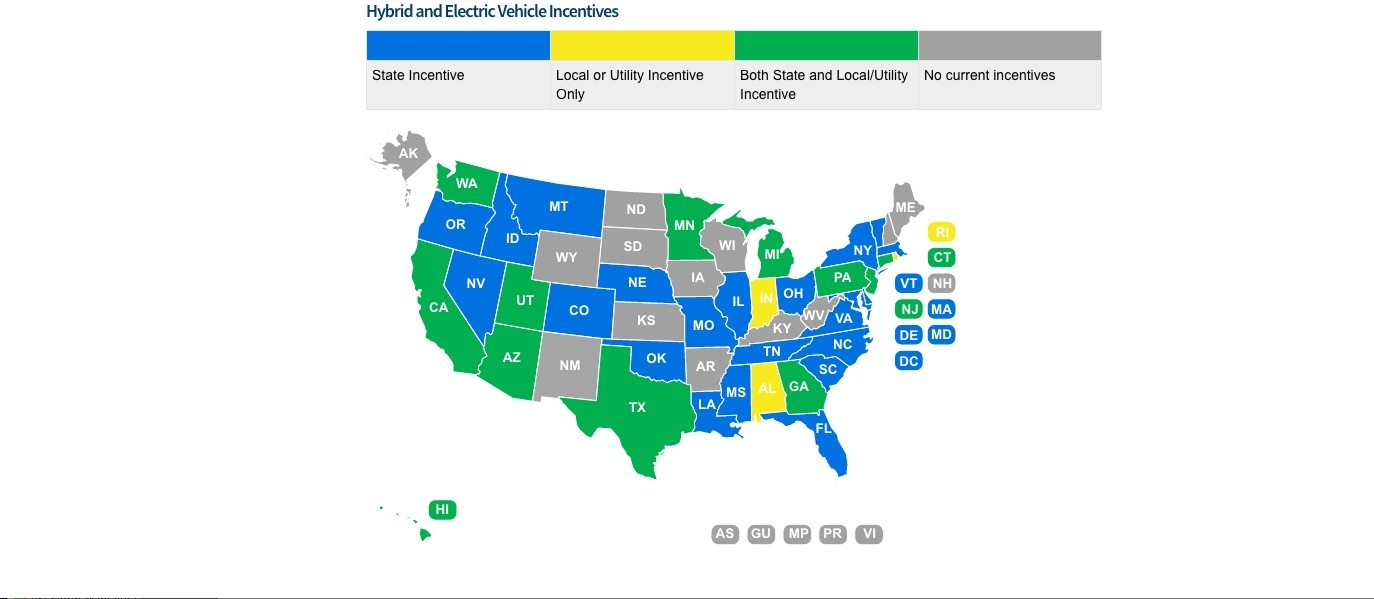

Electric Car Rebates By State ElectricRebate

https://www.electricrebate.net/wp-content/uploads/2022/08/electric-car-and-plug-in-hybrid-incentives-in-the-usa-a-quick-guide.jpg

Web Shorter range plug in hybrid electric vehicles are eligible for up to 2 500 shorter range plug in vehicles have an electric range under 50 km Eligible vehicles To be eligible Web Incentives and Rebates Available for the Purchase of Electric Vehicles and Plug In Hybrid Vehicles

Web 16 mai 2022 nbsp 0183 32 If you purchased a new all electric vehicle EV or plug in hybrid electric vehicle PHEV during or after 2010 you may be eligible for a federal income tax credit of up to 7 500 according to the U S Web 16 ao 251 t 2022 nbsp 0183 32 If you bought a new qualified plug in electric vehicle EV between 2010 and 2022 you may be eligible for a new electric vehicle tax credit up to 7 500 under Internal

Government Rebats For Hybrid Cars 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2023/05/trending-news-hybrid-cars-will-cost-less-government-is-working-on-a.jpg?resize=840%2C441&ssl=1

Federal Rebate On Hybrid Cars 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/federal-tax-credits-for-electric-and-plug-in-hybrid-cars.png

https://www.consumerreports.org/cars/hybrids-evs/electric-cars-plug-in...

Web 7 sept 2023 nbsp 0183 32 Consumer Reports details the list of 2022 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500

https://fueleconomy.gov/feg/tax2022.shtml

Web 17 ao 251 t 2022 nbsp 0183 32 Plug in hybrids PHEVs and electric vehicles EVs purchased in or after 2010 may be eligible for a federal income tax credit of up to 7 500 Save up to 7 500

2013 Ford C MAX Energi A Plug in Hybrid Qualifies For Federal And

Government Rebats For Hybrid Cars 2023 Carrebate

Florida Offering 5 000 Rebates For Plug in Hybrid Prius Conversions

Southern California Edison Hybrid Car Rebate 2023 Carrebate

California Clean Vehicle Rebate Late Filing Taxes What You Need To

Ford Rebates 2022 Fusion FordRebates

Ford Rebates 2022 Fusion FordRebates

Government EV Strategy Explained What It Means To You Herald Sun

Rebates For Hybrid Cars California 2023 Carrebate

Electric Vehicle Rebates Lessons Learning EVs Plug in Hybrid EVs

Federal Rebate Plug In Hybrid - Web 1 janv 2023 nbsp 0183 32 Federal Tax Credit Up To 4 000 Pre owned all electric plug in hybrid and fuel cell electric vehicles purchased on or after January 1 2023 may be eligible for a