Federal Rebates 2024 Flexible Income Lookback Taxpayers can choose to use either current or prior year income to calculate the child tax credit in 2024 and 2025 providing flexibility in determining eligibility Inflation Adjustment Starting in 2024 the child tax credit will be adjusted for inflation to keep up with the rising cost of living Business tax relief

How to maximize your 2024 tax refund according to a CPA 02 34 Many Americans got a shock last year when the expiration of pandemic era federal benefits resulted in their receiving a smaller tax Improvements to the Where s My Refund tool which is the IRS most widely used taxpayer service tool However the tool provides limited information often leading taxpayers to call the IRS to inquire about their refund status Updates to Where s My Refund will allow taxpayers to see more detailed refund status messages in plain language

Federal Rebates 2024

Federal Rebates 2024

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2023-05/Summary-ITC-and-PTC-Values-Chart-2023.png?itok=_P0koCpu

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The Inflation Reduction Act

https://www.autopromag.com/usa/wp-content/uploads/2022/08/EV-Federal-Tax-Credits-5MgJUp.jpeg?is-pending-load=1

Federal Rebates For Heat Pumps Save Money And Energy USRebate

https://i0.wp.com/www.usrebate.com/wp-content/uploads/2023/05/Federal-Rebates-For-Heat-Pumps.png?ssl=1

Business use up to 20 full credit Business use more than 20 credit based on share of expenses allocable to nonbusiness use Frequently asked questions about energy efficient home improvements and residential clean energy property credits Qualified expenses and credit amounts To qualify home improvements must meet energy efficiency standards Last quarterly payment for 2023 is due on Jan 16 2024 Taxpayers may need to consider estimated or additional tax payments due to non wage income from unemployment self employment annuity income or even digital assets The Tax Withholding Estimator on IRS gov can help wage earners determine if there s a need to consider an additional tax

Justin Sullivan Getty Images If you are considering buying an electric car in 2024 there s good news and bad news A hefty federal tax credit for electric vehicles is going to get easier Researchers have found that consumers overwhelmingly prefer an immediate rebate at point of sale Under the Inflation Reduction Act consumers can choose to transfer their new clean vehicle credit of up to 7 500 and their previously owned clean vehicle credit of up to 4 000 to a car dealer starting January 1 2024

Download Federal Rebates 2024

More picture related to Federal Rebates 2024

Federal Rebates Homesol Building Solutions

https://homesolbuildingsolutions.com/wp-content/uploads/2021/08/homesol-federal-rebates-thumbnail.jpg

Mass Save Rebate Form 2021 PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2021/12/Residential-Mass-Save-Rebate-Form-2021-768x513.png

Who s Eligible For New Jersey Anchor Rebates In 2024 Check If You Are Qualify To Receive Up To

https://vegasonlyentertainment.com/wp-content/uploads/2023/07/rebate-scaled.jpg

Save up to 74 Sign up for Kiplinger s Free E Newsletters Profit and prosper with the best of expert advice on investing taxes retirement personal finance and more straight to your e mail Investors has listed the EVs that currently qualify for the 7 500 federal tax rebate in 2024 There is a downside however in that fewer cars and trucks now qualify for the rebate But it is

For EV customers everything changes on January 1 2024 The Treasury Department has now issued new rules that will turn the federal EV tax credit into what is basically a point of sale rebate Jan 27 2023 11 31 AM PT

Deductions Allowed Under The New Income Tax Regime Paisabazaar Com Www vrogue co

https://www.taxhelpdesk.in/wp-content/uploads/2020/12/Tax-Slab-1-600x600.png

Solar Tax Credits Rebates Missouri Arkansas

https://soleraenergyllc.com/wp-content/uploads/2022/07/Graphic-1000x1024.jpg

https://tax.thomsonreuters.com/blog/understanding-the-tax-relief-for-american-families-and-workers-act-of-2024/

Flexible Income Lookback Taxpayers can choose to use either current or prior year income to calculate the child tax credit in 2024 and 2025 providing flexibility in determining eligibility Inflation Adjustment Starting in 2024 the child tax credit will be adjusted for inflation to keep up with the rising cost of living Business tax relief

https://www.cbsnews.com/news/tax-refund-2024-what-to-expect-when-will-i-get/

How to maximize your 2024 tax refund according to a CPA 02 34 Many Americans got a shock last year when the expiration of pandemic era federal benefits resulted in their receiving a smaller tax

Rebates For Seniors Mark Coure MP

Deductions Allowed Under The New Income Tax Regime Paisabazaar Com Www vrogue co

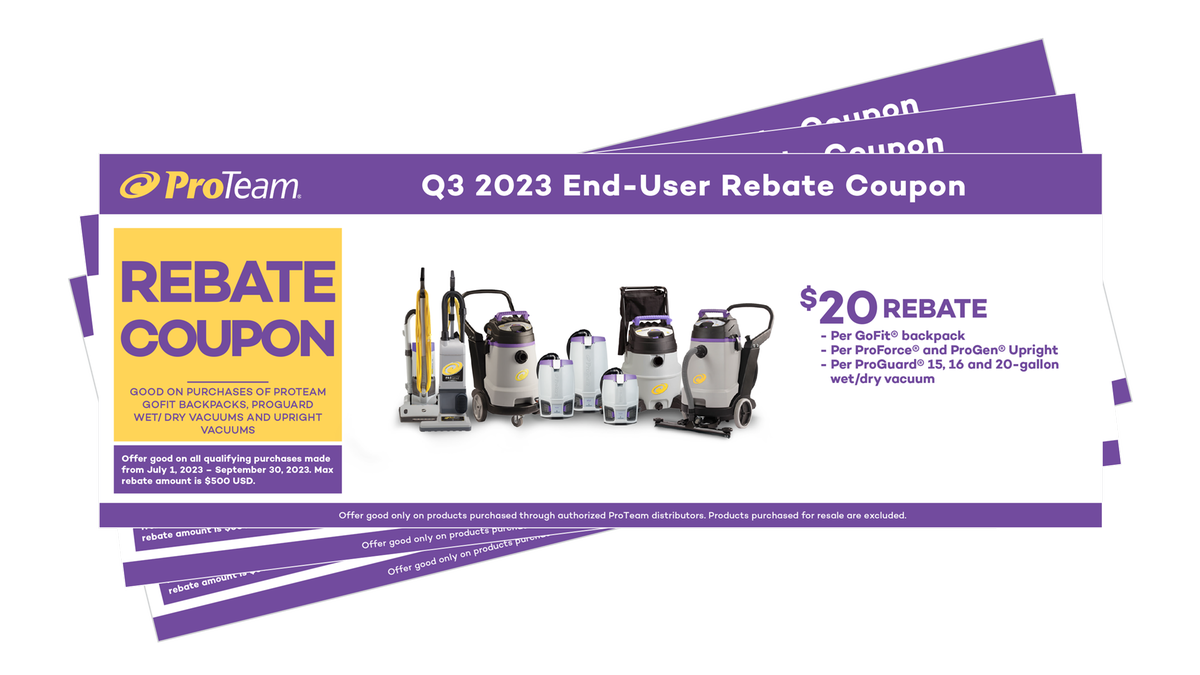

Manufacturer Rebates CleanFreak

Smith Wesson Shield EZ Holiday Rebate H H Shooting Sports Oklahoma City

How Do Home Rebates Work DC MD VA Home Rebates

Income Tax Filing With Printable Forms Printable Forms Free Online

Income Tax Filing With Printable Forms Printable Forms Free Online

Rebates Are Inherently Collaborative YouTube

NWC Tryouts 2023 2024 NWC Alliance

Milwaukee Tool Rebates Printable Rebate Form

Federal Rebates 2024 - Researchers have found that consumers overwhelmingly prefer an immediate rebate at point of sale Under the Inflation Reduction Act consumers can choose to transfer their new clean vehicle credit of up to 7 500 and their previously owned clean vehicle credit of up to 4 000 to a car dealer starting January 1 2024