Federal Rebates Energy Efficiency Web 27 avr 2021 nbsp 0183 32 In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the

Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for Web 27 juil 2023 nbsp 0183 32 The Home Efficiency Rebates program offers 4 3 billion in formula grants to state energy offices to cut the upfront costs for whole home energy efficiency upgrades

Federal Rebates Energy Efficiency

Federal Rebates Energy Efficiency

http://www.myenergymonster.com/ma/wp-content/uploads/sites/2/2017/04/energy-rebates-ma.jpg

Energy Efficient Rebates Tax Incentives For MA Homeowners

http://www.myenergymonster.com/ma/wp-content/uploads/sites/2/2012/08/energy-efficient-rebates-ma.png

Extra Tax Benefits For Installing Energy Efficient Lighting

https://retrofitcompanies.com/wp-content/uploads/2021/01/Xcel-Energy-Rebates-2021.png

Web Tax Credits Rebates amp Savings Department of Energy Energy gov Tax Credits Rebates amp Savings Please visit the Database of State Incentives for Renewables amp Web 26 juil 2023 nbsp 0183 32 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 biomass stoves and boilers have a separate annual credit limit of

Web Electric stoves including induction ranges provide better energy efficiency and indoor air quality than gas stoves helping families save money and keep unhealthy pollution out of Web 22 d 233 c 2022 nbsp 0183 32 The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide

Download Federal Rebates Energy Efficiency

More picture related to Federal Rebates Energy Efficiency

2023 Home Energy Rebates Grants And Incentives Top Rated Barrie

https://weaverexterior.ca/wp-content/uploads/2022/01/Weaver-Ontario-Energy-Rebate.jpg

Federal Rebates Homesol Building Solutions

http://homesolbuildingsolutions.com/wp-content/uploads/2021/08/homesol-federal-rebates-thumbnail.jpg

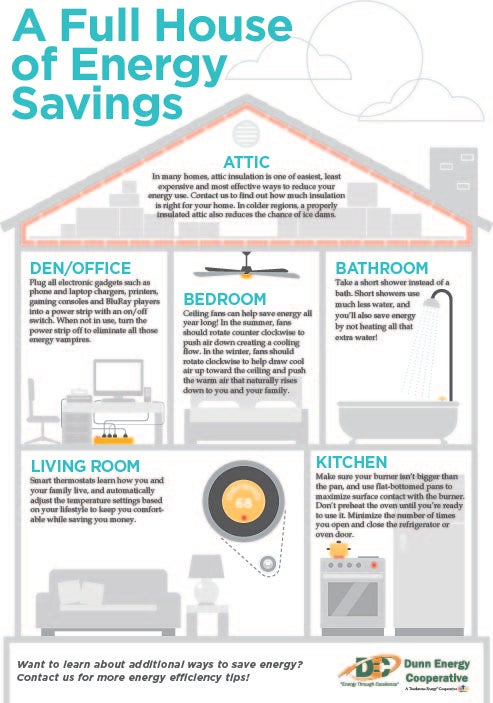

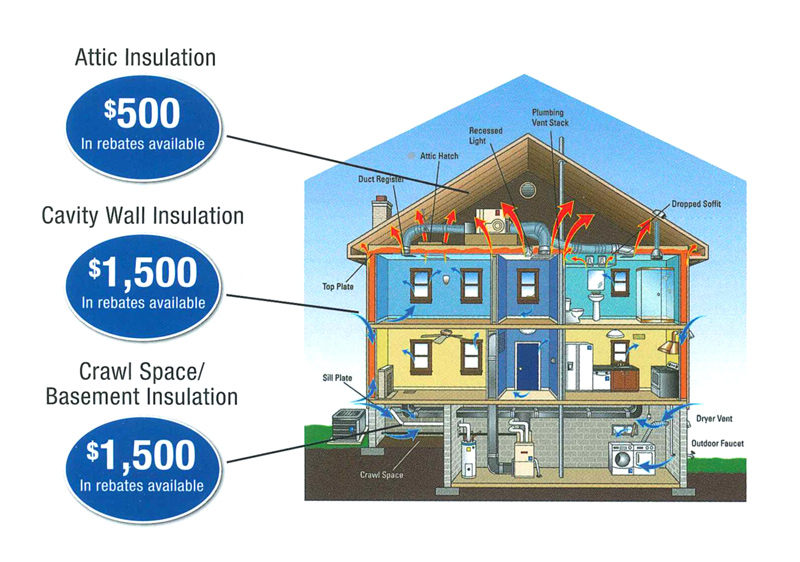

Home Performance Rebates Dunn Energy Cooperative

https://www.dunnenergy.com/sites/dunnenergy/files/2018-11/2018_10_DS_EFF_FullHouseOfEnergySavings.jpg

Web the IRA the energy efficient home improvement credit is increased for years after 2022 with an annual credit of generally up to 1 200 Beginning January 1 2023 the amount Web 27 juil 2023 nbsp 0183 32 The Home Efficiency Rebates Program will offer 4 300 000 000 in formula grants to state energy offices to reduce the upfront cost of whole home energy

Web Water heaters non solar 300 for most ENERGY STAR certified heat pump water heaters i e those with an energy factor of 2 2 or more The 300 credit can also be Web 9 sept 2022 nbsp 0183 32 High Efficiency Electric Home Rebate Act HEEHRA This provides rebates for low and middle income families to electrify their homes such as by installing heat

The New Federal Tax Credits And Rebates For Home Energy Efficiency

https://www.ny-engineers.com/hs-fs/hubfs/energy efficient home.jpg?width=1500&name=energy efficient home.jpg

Rebates For Energy efficient Appliances Available In Massachusetts

https://www.masslive.com/resizer/bBMnesUEICg-VyJRAAhygvblUQE=/1280x0/smart/advancelocal-adapter-image-uploads.s3.amazonaws.com/image.masslive.com/home/mass-media/width2048/img/breakingnews/photo/2010/03/rebate0324jpg-51fe872f64c70f53.jpg

https://www.irs.gov/newsroom/energy-incentives-for-individuals...

Web 27 avr 2021 nbsp 0183 32 In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the

https://www.irs.gov/credits-deductions/energy-efficient-home...

Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

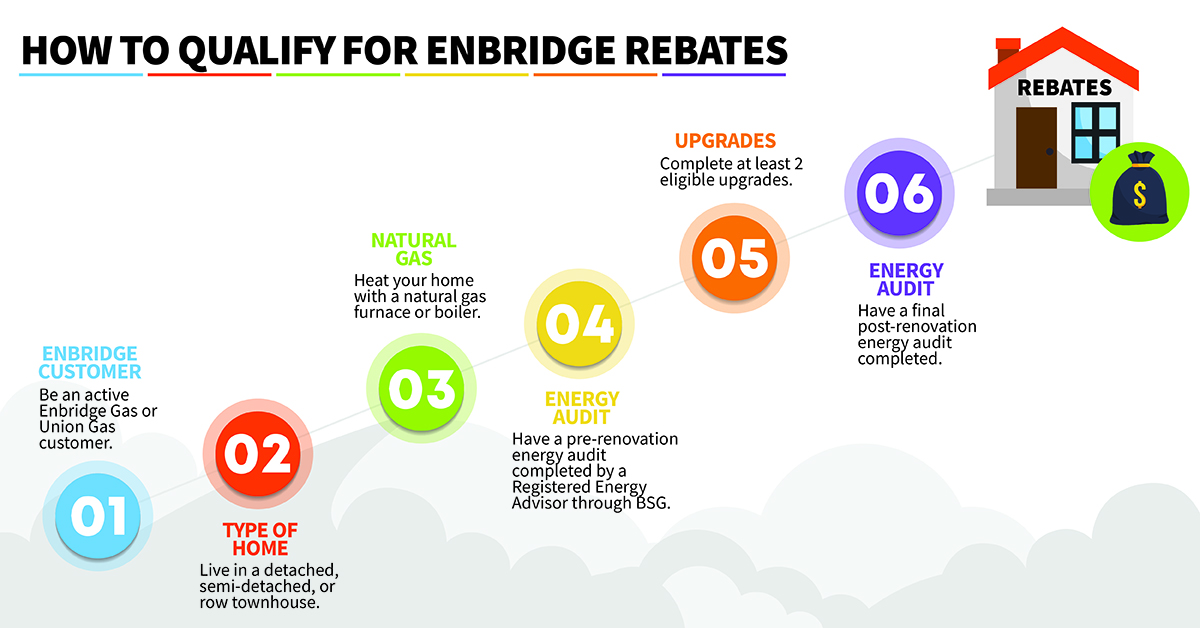

What Are The Enbridge Rebates Home Efficiency Rebates

The New Federal Tax Credits And Rebates For Home Energy Efficiency

2023 Home Energy Rebates Grants And Incentives Top Rated Barrie

2023 Home Energy Rebates Grants And Incentives Top Rated Barrie

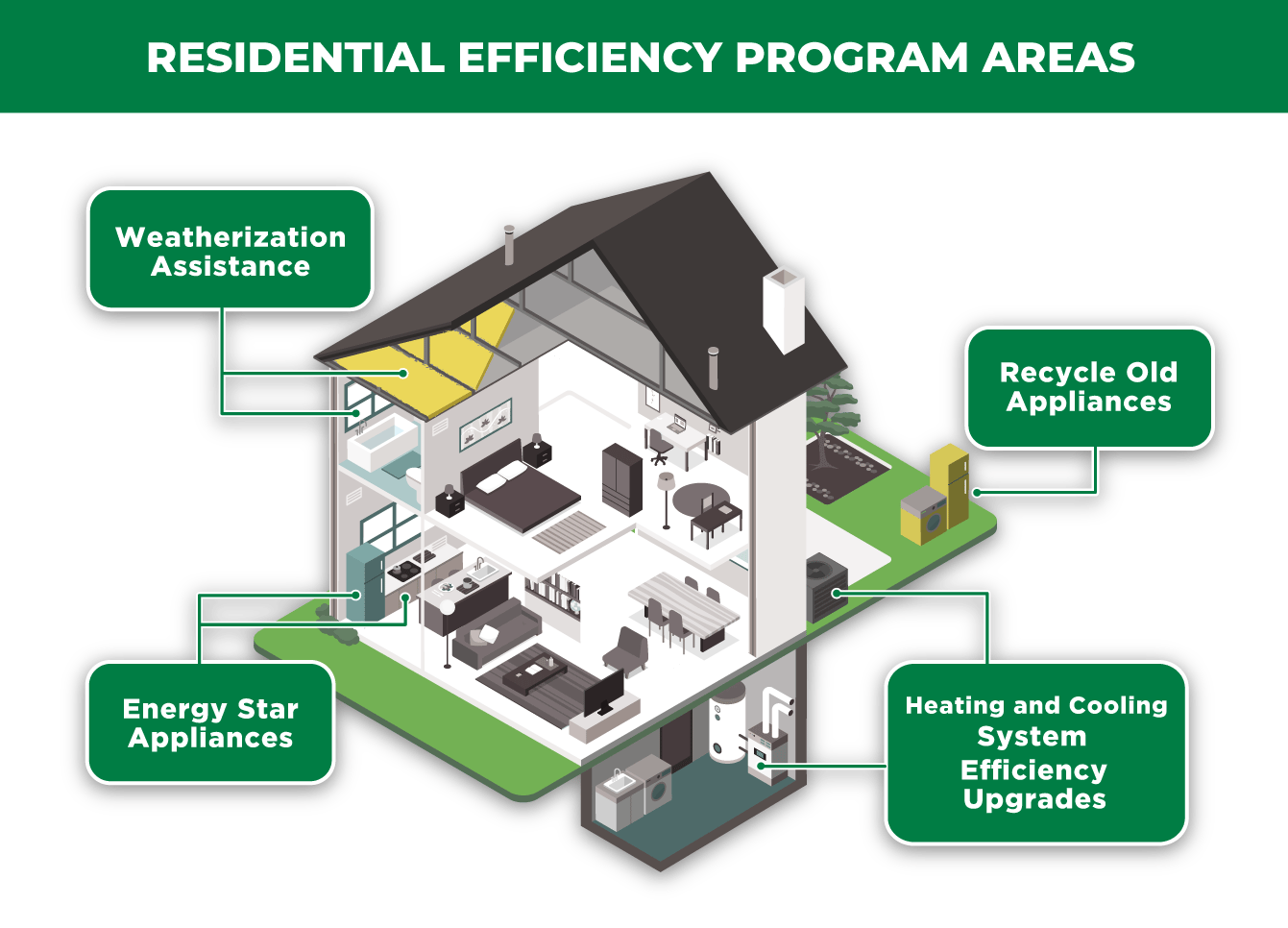

Energy Efficiency Rebates UPPCO

Stacking Energy Efficiency Rebates

Stacking Energy Efficiency Rebates

Everything You Need To Know About Home Energy Rebates In Ontario GNI

How To Get Energy Efficiency Improvement Rebates Air Assurance

Home Energy Rebates NRGwise Home Energy Assessments Ontario

Federal Rebates Energy Efficiency - Web 19 ao 251 t 2022 nbsp 0183 32 The IRA s 4 28 billion High Efficiency Electric Home Rebate Program will provide an upfront rebate of up to 8 000 to install heat pumps that can both heat and