Federal Rebates Furnace Energy Efficient Web The U S Department of Energy DOE estimates that these rebates will save households up to a 1 billion on energy bills each year and support over 50 000 U S jobs This

Web 30 d 233 c 2022 nbsp 0183 32 The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope Web 9 sept 2022 nbsp 0183 32 The HOMES Rebate Program This provides more than 4 billion to states to help residents make their entire home more energy efficient The program provides

Federal Rebates Furnace Energy Efficient

Federal Rebates Furnace Energy Efficient

https://www.coastalenergy.ca/wp-content/uploads/2019/10/Furnace-Rebates-2019.png

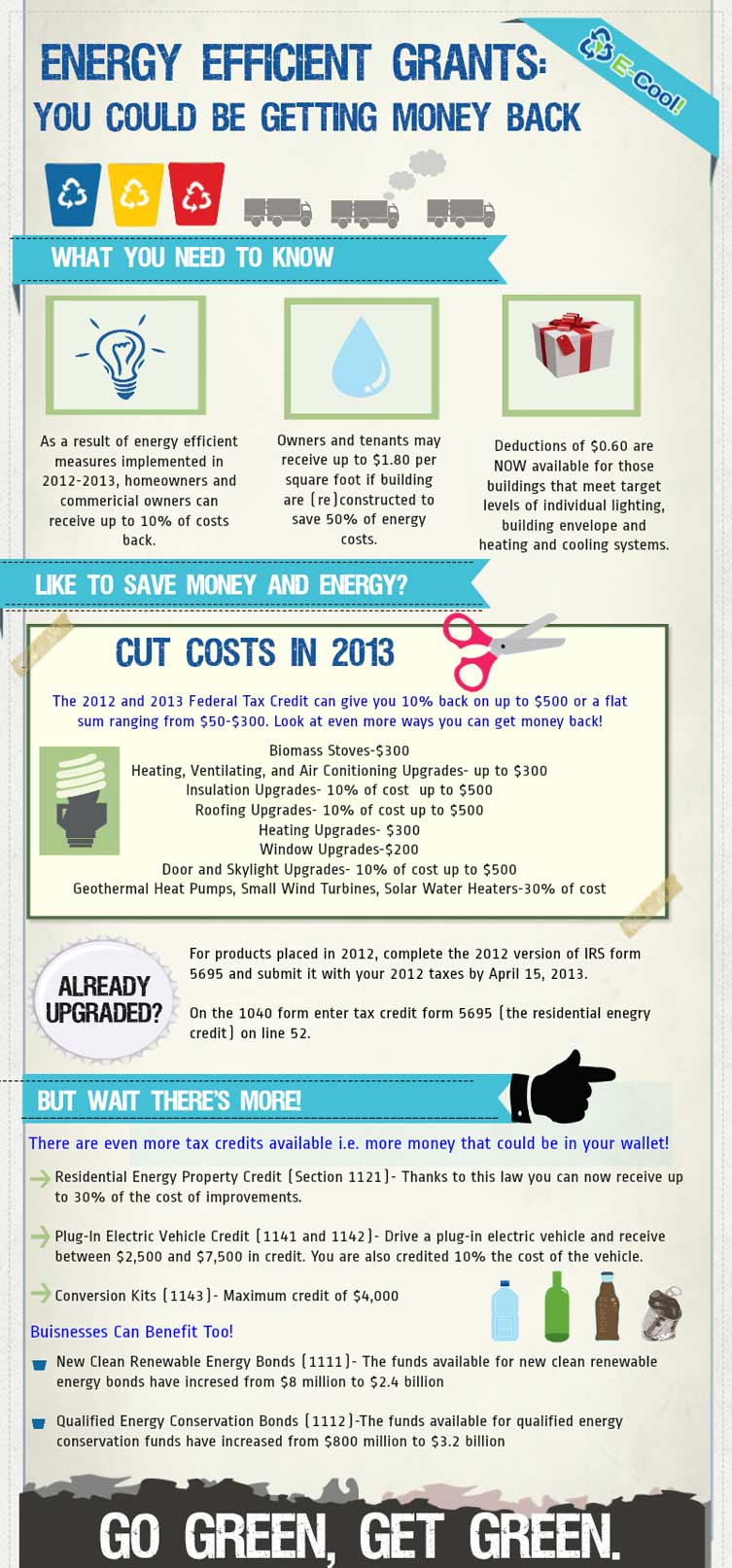

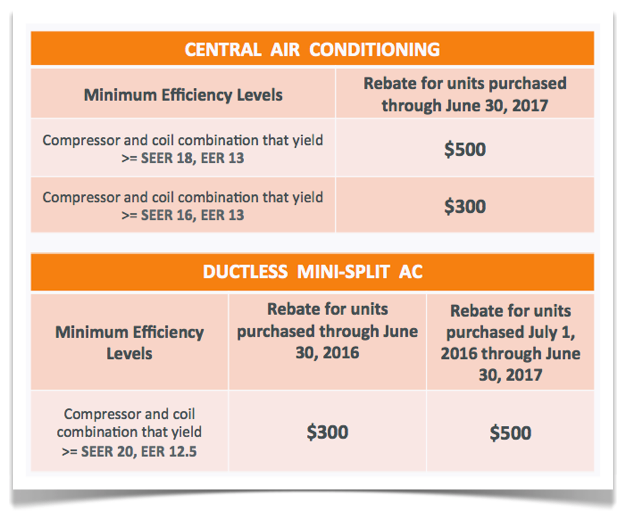

Energy Efficiency Tax Rebates Infographic

https://infographicjournal.com/wp-content/uploads/2013/02/My-Infographic1.jpg

Energy Efficiency Rebates Rebates Save Energy Energy Efficiency

https://i.pinimg.com/originals/ba/b9/38/bab9382d087a391257489817a55ad031.png

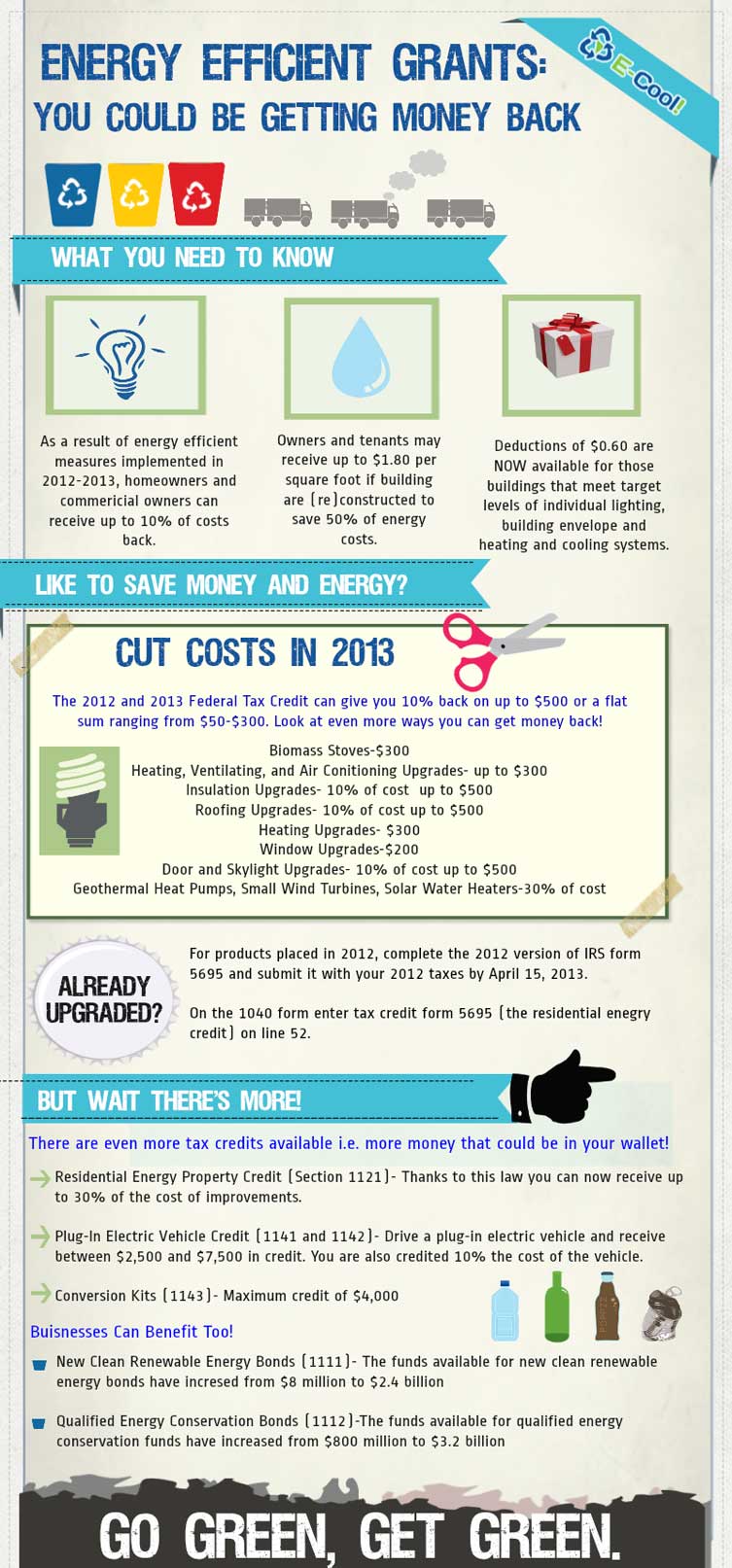

Web 1 janv 2023 nbsp 0183 32 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and Web 27 avr 2021 nbsp 0183 32 150 for any qualified natural gas propane or oil furnace or hot water boiler 300 for any item of energy efficient building property The residential energy property

Web 13 juin 2022 nbsp 0183 32 WASHINGTON D C The Biden Administration through the U S Department of Energy DOE today proposed new energy efficiency standards for Web 30 d 233 c 2022 nbsp 0183 32 Tax Credits for Homeowners Information updated 12 30 2022 Under the Inflation Reduction Act of 2022 federal income tax credits for energy efficiency home improvements will be available

Download Federal Rebates Furnace Energy Efficient

More picture related to Federal Rebates Furnace Energy Efficient

Taking Advantage Of HVAC Rebates Federal Tax Credits With An

https://149354076.v2.pressablecdn.com/wp-content/uploads/2020/10/Taking-Advantage-of-HVAC-Rebates-and-Federal-Tax-Credits-with-An-HVAC-System.png

New Furnace Rebates 2022 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/04/Government-Rebate-for-Furnaces-2022-1024x769.png

How To Claim FortisBC s Furnace Rebates Murray s Solutions

https://murrayssolutions.com/wp-content/uploads/2021/11/furnaceRebate2.jpg

Web The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your primary residence after December 31 2021 you Web 27 mai 2021 nbsp 0183 32 Homeowners will be able to receive grants of up to 5 000 to make energy efficient retrofits to their primary residences and up to 600 to help with the cost of

Web the IRA the energy efficient home improvement credit is increased for years after 2022 with an annual credit of generally up to 1 200 Beginning January 1 2023 the amount Web 26 juil 2023 nbsp 0183 32 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 biomass stoves and boilers have a separate annual credit limit of

Fortis Rebates For Furnaces 2020 TEK Climate Heating And Air Conditioning

https://tekclimate.ca/wp-content/uploads/2020/03/furnace-rebate-program.jpg

Affordable Furnace Installation 2016 Federal And Provincial Government

https://blog.antaplumbing.com/wp-content/uploads/2016/05/Furnace-Installation-768x512.jpg

https://www.energy.gov/scep/home-energy-rebate-program

Web The U S Department of Energy DOE estimates that these rebates will save households up to a 1 billion on energy bills each year and support over 50 000 U S jobs This

https://www.energystar.gov/about/federal_tax_credits/natural_gas...

Web 30 d 233 c 2022 nbsp 0183 32 The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope

High Efficiency Air Conditioner Rebates Alberta Furnace Rebates 2019

Fortis Rebates For Furnaces 2020 TEK Climate Heating And Air Conditioning

Enbridge Rebates Are You Taking Advantage Of These 11 Rebates 2022

The Homeowners Guide To Tax Credits And Rebates

New LADWP Program Offers 225 Rebate On Energy efficient AC Units For

Utility Company Rebates And Government Tax Incentives AEE

Utility Company Rebates And Government Tax Incentives AEE

Inspecting High Efficiency Gas Furnaces And Venting YouTube Gas Rebates

2020 21 Enbridge Home Efficiency Rebates 24 7 Furnace AC Pricing

Big Connecticut Rebates For Energy Efficient Renovations New Homes

Federal Rebates Furnace Energy Efficient - Web 1 janv 2023 nbsp 0183 32 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and