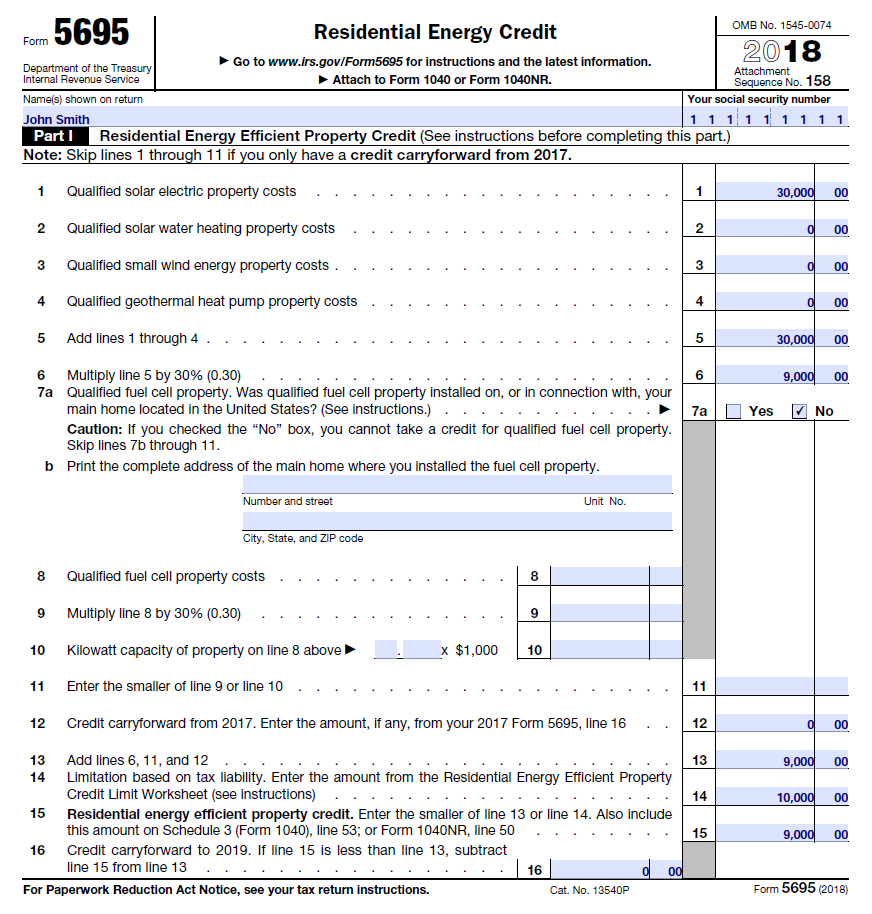

Federal Solar Rebate Form Web How do I claim the federal solar tax credit After seeking professional tax advice and ensuring you are eligible for the credit you can complete and attach IRS Form 5695 to your federal tax return Form 1040 or Form 1040NR Instructions on filling out the form

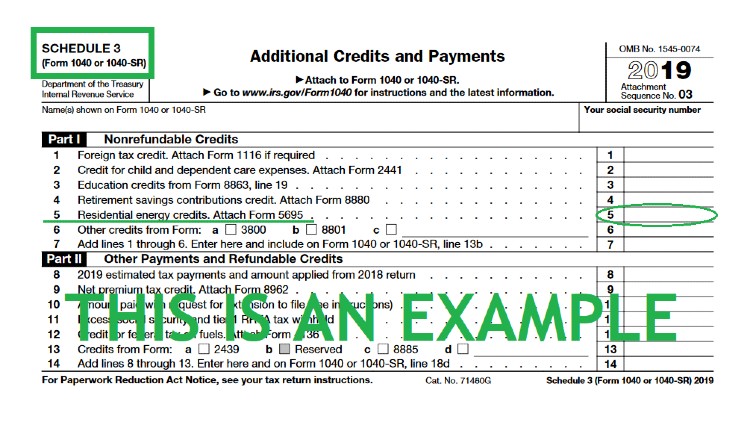

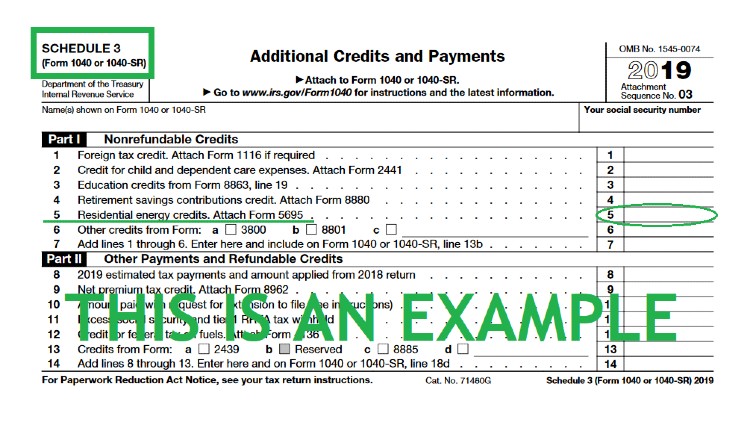

Web The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other types of renewable energy are also eligible for similar credits but are beyond the scope of this Web 26 avr 2023 nbsp 0183 32 You will need four IRS tax forms to file for your solar tax credit Form 1040 Schedule 3 Form 1040 Form 5695 Instructions for

Federal Solar Rebate Form

Federal Solar Rebate Form

http://southerncurrentllc.com/wp-content/uploads/How-To-Claim-Solar-Tax-Credit-2017.png

How To Claim The Federal Solar Tax Credit SAVKAT Inc

https://savkat.com/wp-content/uploads/2019/09/IRS-Form-5695-SAVKAT-Solar.jpg

Federal Solar Tax Credit Take 30 Off Your Solar Cost Solar

https://s3.amazonaws.com/solarassets/wp-content/uploads/2022/08/tax-credit-form.png

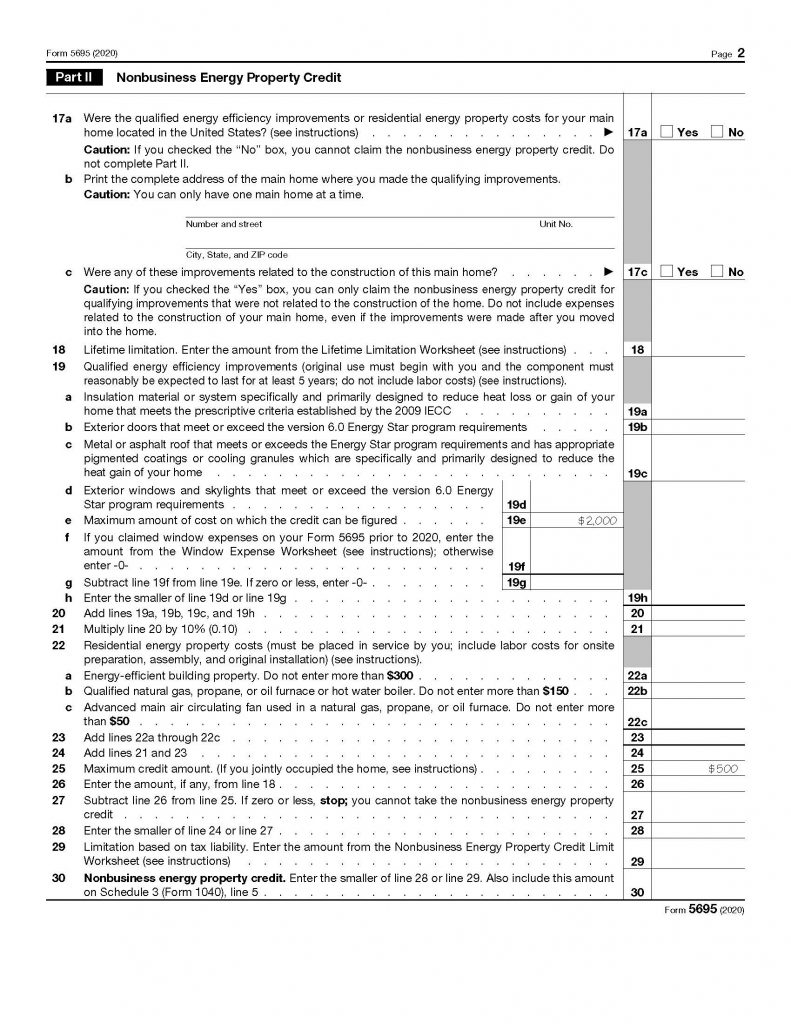

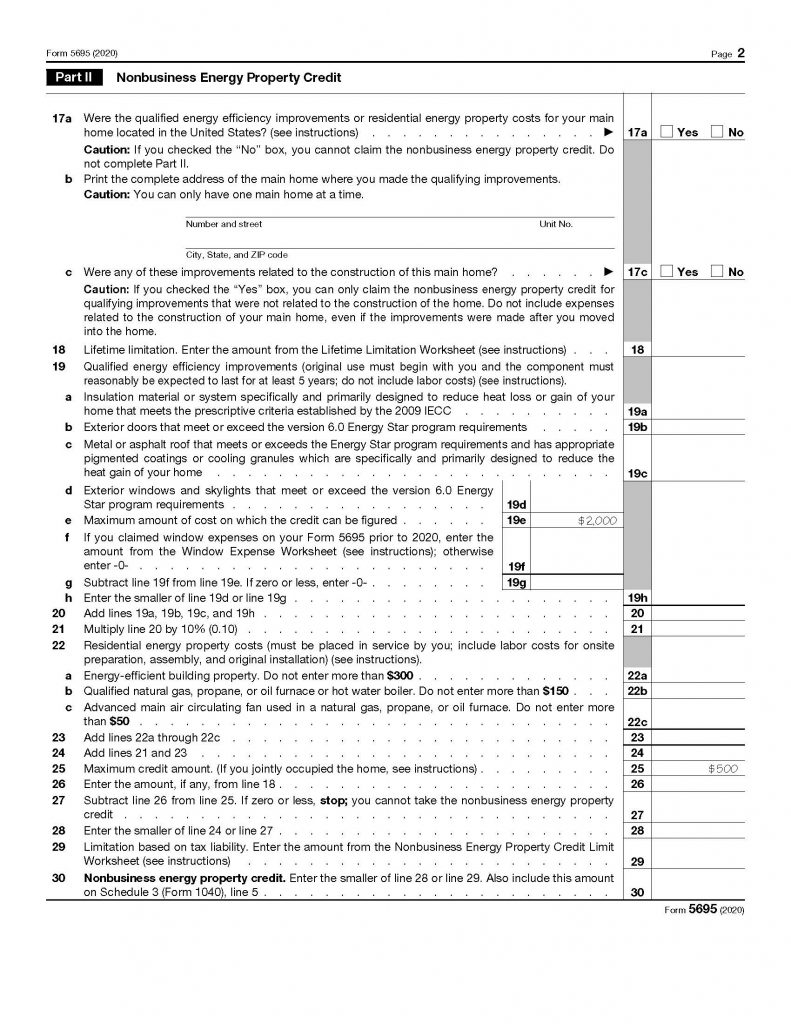

Web 8 sept 2022 nbsp 0183 32 The U S Department of Energy DOE Solar Energy Technologies Office SETO developed three resources to help Americans navigate changes to the federal solar Investment Tax Credit ITC Web 17 f 233 vr 2023 nbsp 0183 32 The residential energy credits are The nonbusiness energy property credit and The residential energy efficient property credit Current Revision Form 5695 PDF Instructions for Form 5695 Print Version PDF Recent Developments None at this time

Web 8 oct 2021 nbsp 0183 32 The IRS has not yet released their revised Form 5695 so our example below uses 2021 s version and 26 tax credit amount One of the biggest immediate benefits of installing a solar electric system is that it Web For example if your solar PV system was installed in 2022 installation costs totaled 18 000 and your state government gave you a one time rebate of 1 000 for installing the system your federal tax credit would be calculated as follows 18 000 0 30 5 400

Download Federal Solar Rebate Form

More picture related to Federal Solar Rebate Form

How To Claim The Solar Investment Tax Credit YSG Solar YSG Solar

https://www.ysgsolar.com/sites/default/files/styles/panopoly_image_original/public/form_1040_rec.png?itok=pf_SEkRq

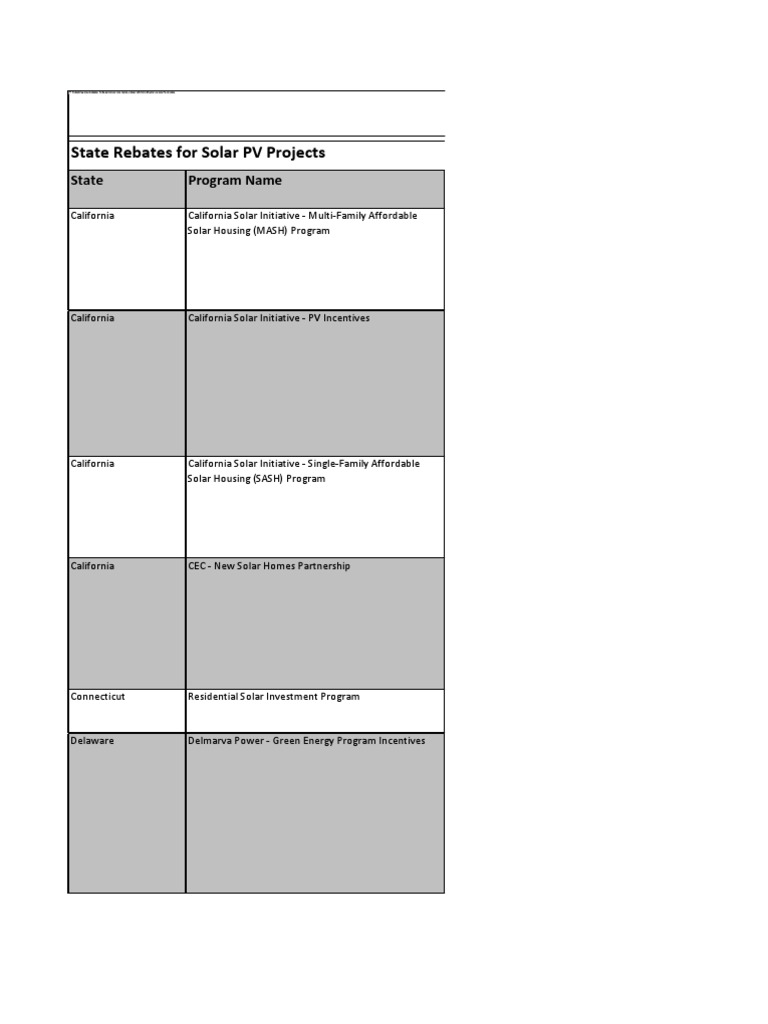

States Rebates For Solar PV Projects Photovoltaic System Renewable

https://imgv2-1-f.scribdassets.com/img/document/134605316/original/882bb48de2/1571598572?v=1

How To Claim The Solar Tax Credit Using IRS Form 5695

https://www.solarreviews.com/content/images/blog/irs_form2021.png

Web Eligibility Small scale renewable systems that may be eligible for certificates include solar photovoltaic PV panels wind turbines hydro systems solar water heaters and air source heat pumps Owners have 2 options for receiving benefit for their STCs Web 26 juil 2023 nbsp 0183 32 Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on energy gov Solar wind and geothermal power generation Solar water heaters Fuel cells Battery storage beginning in 2023 The amount of the credit

Web Form 5695 is the document you submit to get a credit on your tax return for installing solar panels on your home We commonly think of Tax Form 5695 as the Residential Clean Energy Credit Form You can request a copy of Form 5695 from the Internal Revenue Web This webpage provides an overview of the federal investment and production tax credits for businesses that own solar facilities including both photovoltaic PV and concentrating solar thermal power CSP energy generation technologies

Filing For The Solar Tax Credit Wells Solar

https://wellssolar.com/wp-content/uploads/2020/01/IRS-solar-tax-credit-schedule-3-form-1040-sm.jpg

Federal State Local Rebates Are Available Now Home Solar Rebate

https://i.pinimg.com/originals/cd/20/52/cd2052758d4782fe7d9791476c36d27b.png

https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit...

Web How do I claim the federal solar tax credit After seeking professional tax advice and ensuring you are eligible for the credit you can complete and attach IRS Form 5695 to your federal tax return Form 1040 or Form 1040NR Instructions on filling out the form

https://www.energy.gov/sites/default/files/2021/02/f82/Guide …

Web The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other types of renewable energy are also eligible for similar credits but are beyond the scope of this

Here s How To Claim The Solar Tax Credits On Your Tax Return Southern

Filing For The Solar Tax Credit Wells Solar

Federal Solar Tax Credit Take 30 Off Your Solar Cost Solar 2022

Reports Of Unfair Early FPL Solar Rebate Applications Florida Solar

Application Form Residential Solar Electric Rebate United Power

Puget Sound Solar LLC

Puget Sound Solar LLC

How Does The Federal Solar Tax Credit Work

Home Energy Tax Credit Documentation

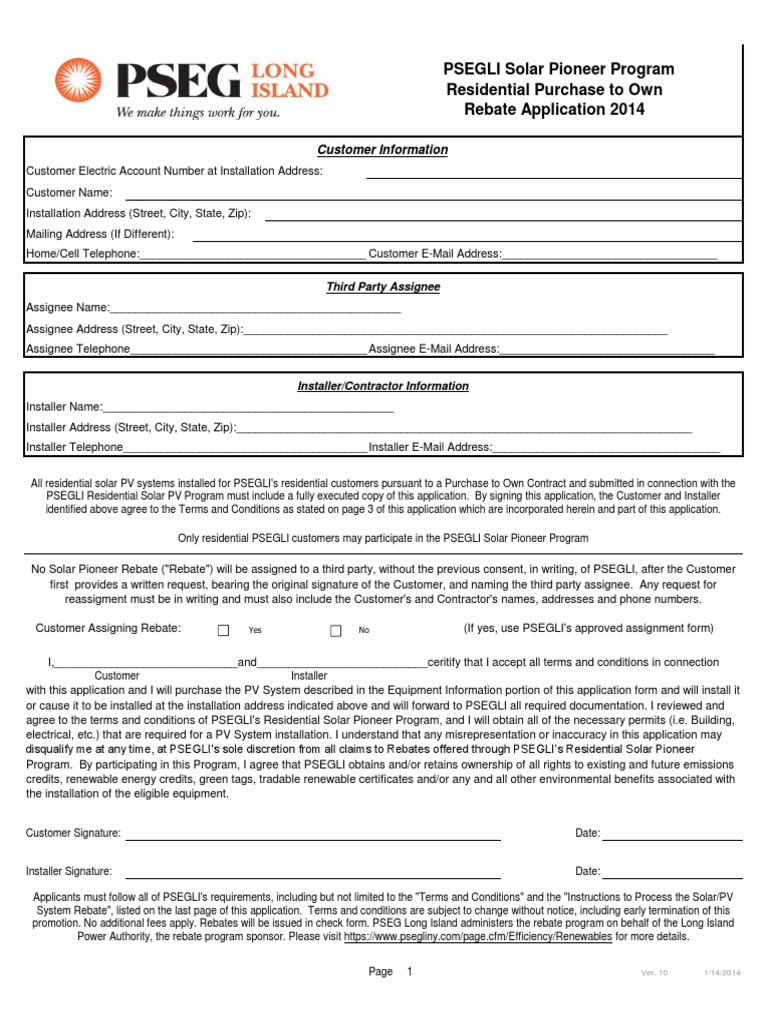

PSEG Long Island PSEGLI Solar Pioneer Program Residential

Federal Solar Rebate Form - Web 8 sept 2022 nbsp 0183 32 The U S Department of Energy DOE Solar Energy Technologies Office SETO developed three resources to help Americans navigate changes to the federal solar Investment Tax Credit ITC