Federal Solar Rebates 2024 Transparent pricing Hassle free tax filing is 50 for all tax situations no hidden costs or fees Maximum refund guaranteed Get every dollar you deserve when you file with this tax product

The Federal Solar Tax Credit for 2024 is 30 this is an increase from 26 in recent years and extends through to 2032 Tax credits and incentives can help bring the price down such as Press Releases U S Department of the Treasury IRS and Department of Energy Announce Remarkable Demand for Solar and Wind Energy in Low Income Communities Thanks to Groundbreaking Inflation Reduction Act Program December 4 2023

Federal Solar Rebates 2024

Federal Solar Rebates 2024

https://flashelectrical.b-cdn.net/wp-content/uploads/2022/07/Facebook-Solar-roof-19-e1656697167915.webp

How Do Solar Rebates Work A Guide For Beginners

https://lirp.cdn-website.com/dcc94ddc/dms3rep/multi/opt/Depositphotos_5111838_L-1920w.jpg

Federal Solar Tax Credit What It Is How To Claim It For 2023

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit An average 20 000 solar system is eligible for a solar tax credit of 6 000 The Inflation Reduction Act extended the federal solar tax credit until 2035 To qualify for the federal solar tax credit you must own the solar panels have taxable income and it must be installed at your primary or secondary residence

SCEP Announces 8 5 Billion Home Energy Rebate Programs The U S Department of Energy s Karen Zelmar explains the Inflation Reduction Act s Home Energy Rebates programs and their top energy savings goals Video courtesy of the U S Department of Energy Latest News Overview There are two tax credits available for businesses and other entities like nonprofits and local and tribal governments that purchase solar energy systems see the Homeowner s Guide to the Federal Tax Credit for Solar Photovoltaics for information for individuals The investment tax credit ITC is a tax credit that reduces the federal income tax liability for a percentage of the

Download Federal Solar Rebates 2024

More picture related to Federal Solar Rebates 2024

Federal Solar Rebates Commercial Solar Grants Incentives

https://gee.com.au/wp-content/uploads/2022/04/a-BG-01-scaled.jpg

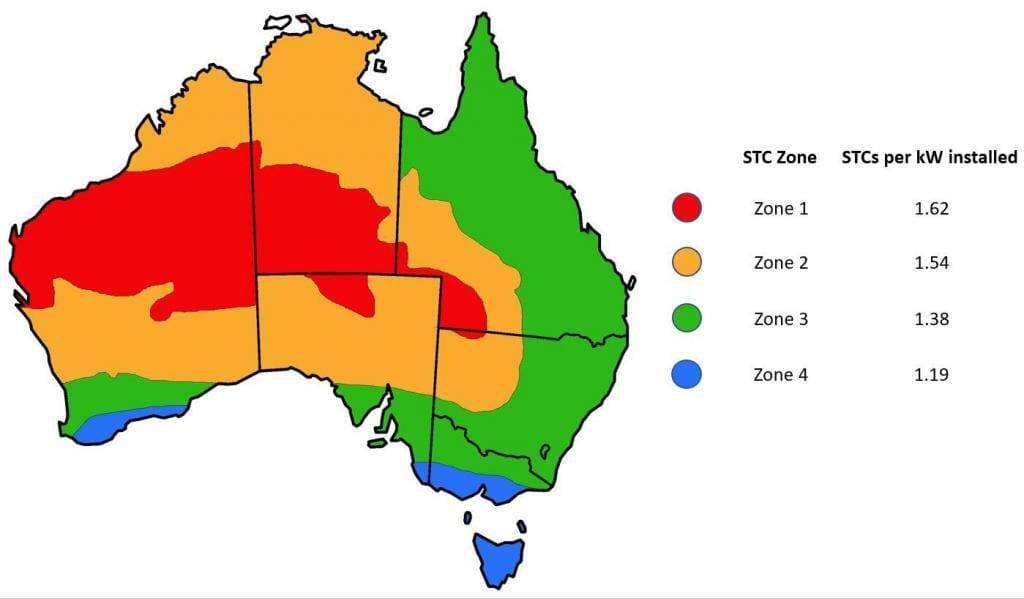

Federal Incentives Solar Rebates For Solar Power Solar Choice

https://www.solarchoice.net.au/wp-content/uploads/STC-Zones-in-Australia-as-of-1st-January-2019-1024x599.jpg

Federal california solar rebates now inter faith Inter Faith Electric Solar Installation

https://interfaithelectric.com/wp-content/uploads/2019/07/federal-california-solar-rebates-now-inter-faith--1024x768.jpg

The 2024 federal solar tax credit also known as the Residential Clean Energy Credit is worth 30 of your total solar system cost for all installations in the U S completed through 2032 The tax credit is currently set at 30 of your total solar panel system installation cost Tax credits help to reduce the amount of money you owe in taxes So for example if you claim a tax credit of 4 000 the total amount you owe in income taxes will be reduced by 4 000 It s important to note that this is not a tax deduction which

The solar tax credit which is among several federal Residential Clean Energy Credits available through 2032 allows homeowners to subtract 30 percent of the cost of installing solar Solar wind and geothermal power generation Solar water heaters Fuel cells Battery storage beginning in 2023 The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 to 2032 30 no annual maximum or lifetime limit 2033 26 no annual maximum or lifetime limit

VT NH Commercial Solar Rebates Federal Solar Incentives

https://catamountsolar.com/wp-content/uploads/2021/09/barn-with-rooftop-solar.jpg

Rebates And Funding Programs For Solar Panels In Edmonton RenovationFind Blog

https://blog.renovationfind.com/wp-content/uploads/2021/06/Untitled.png

https://www.nerdwallet.com/article/taxes/solar-tax-credit

Transparent pricing Hassle free tax filing is 50 for all tax situations no hidden costs or fees Maximum refund guaranteed Get every dollar you deserve when you file with this tax product

https://www.forbes.com/home-improvement/solar/solar-tax-credit-by-state/

The Federal Solar Tax Credit for 2024 is 30 this is an increase from 26 in recent years and extends through to 2032 Tax credits and incentives can help bring the price down such as

Massachusetts Solar Rebates Incentives 2024 Solar

VT NH Commercial Solar Rebates Federal Solar Incentives

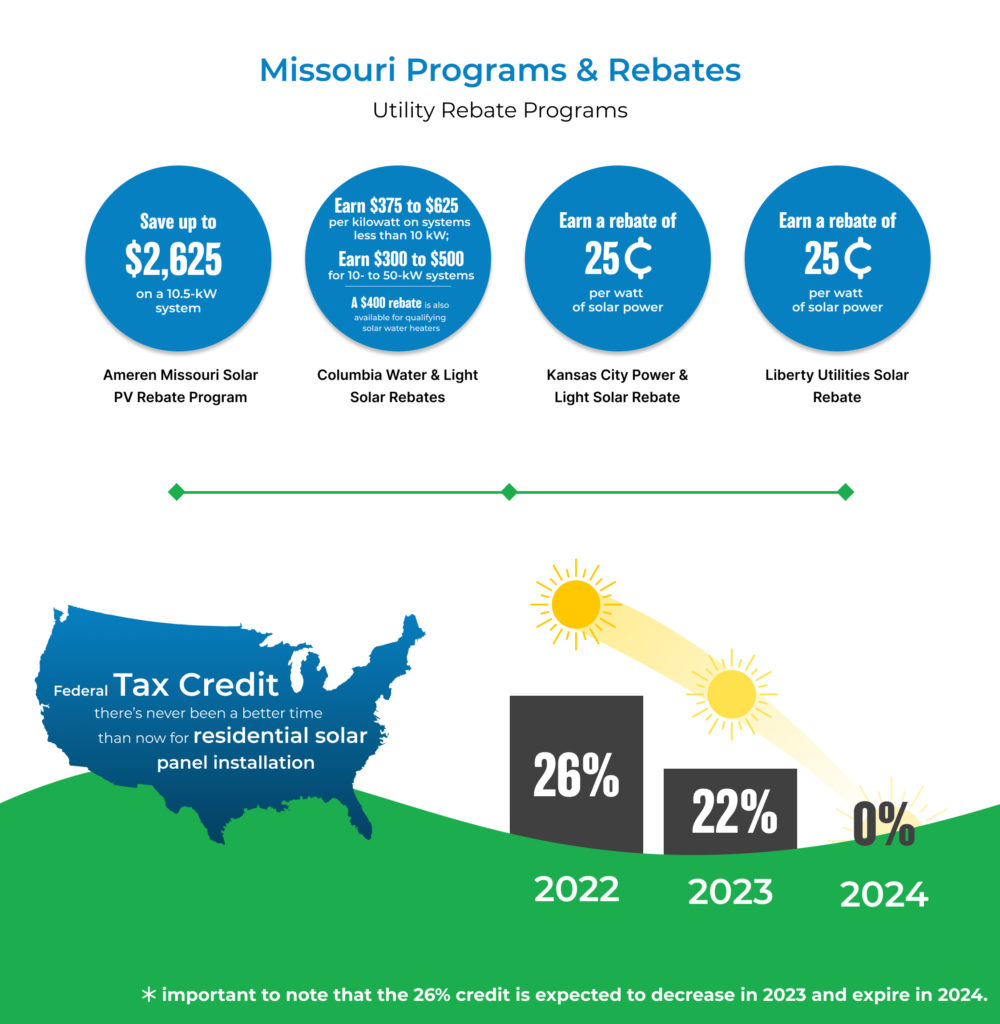

Solar Tax Credits Rebates Missouri Arkansas

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The Inflation Reduction Act

Complete Guide For WA Solar Panel Rebates 2023

Utilising Solar Rebates For Your Commercial Interests

Utilising Solar Rebates For Your Commercial Interests

Quality First Home Improvement Blog California Solar Rebate

Solar Panel Rebates Incentives Grants Available In Alberta

Solar Panel Rebates In Australia Green Loans For Solar Greencell Energy

Federal Solar Rebates 2024 - In 2024 the federal solar Investment Tax Credit is worth 30 of your total solar costs Here s how it works Let s say you spend 30 000 on your home solar installation You ll receive a federal tax credit worth 9 000 The ITC is a dollar for dollar tax credit so if you owe 10 000 in federal taxes your 9 000 credit will reduce your