Federal Solar Tax Credit 2023 Income Limit Verkko 1 elok 2023 nbsp 0183 32 The U S government offers a solar tax credit that can reach up to 30 of the cost of installing a system that uses the sun to power your home Get ready for simple tax filing with a 50

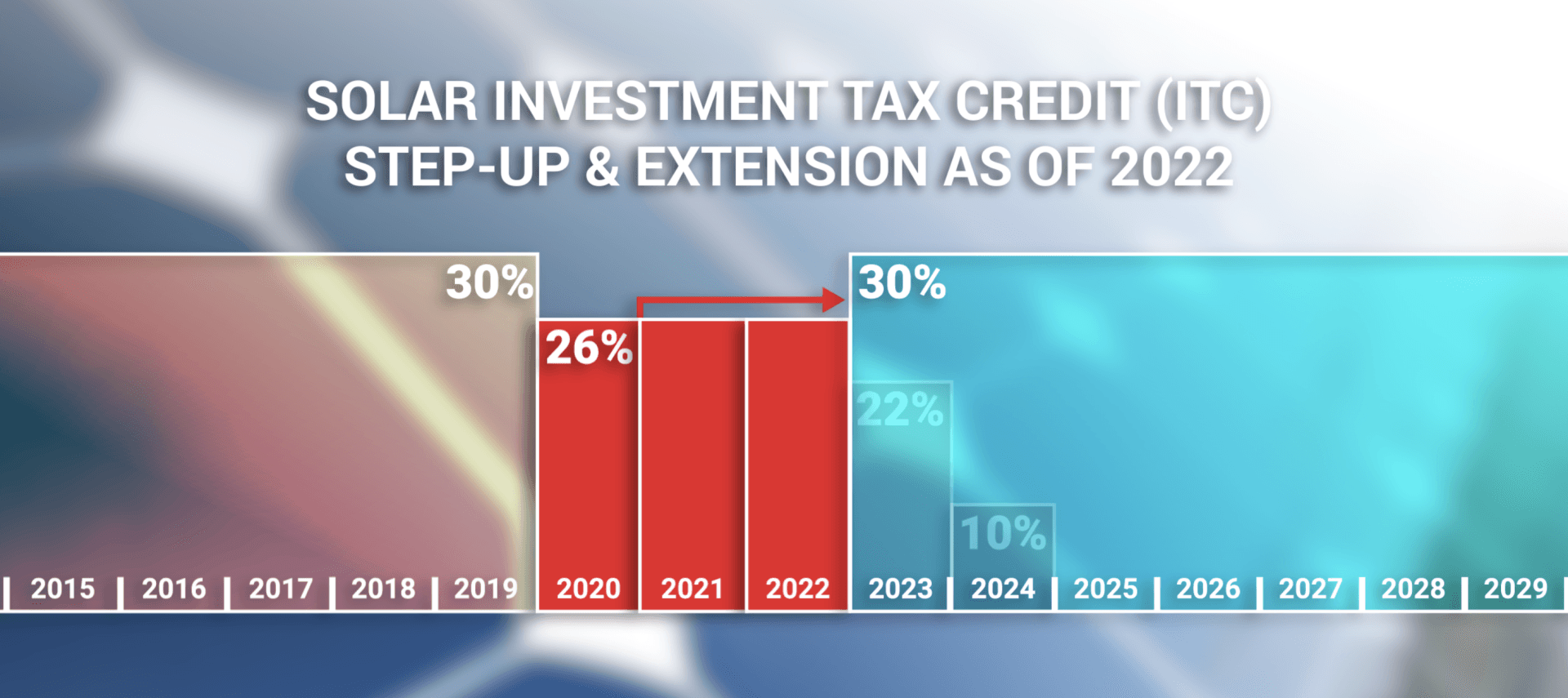

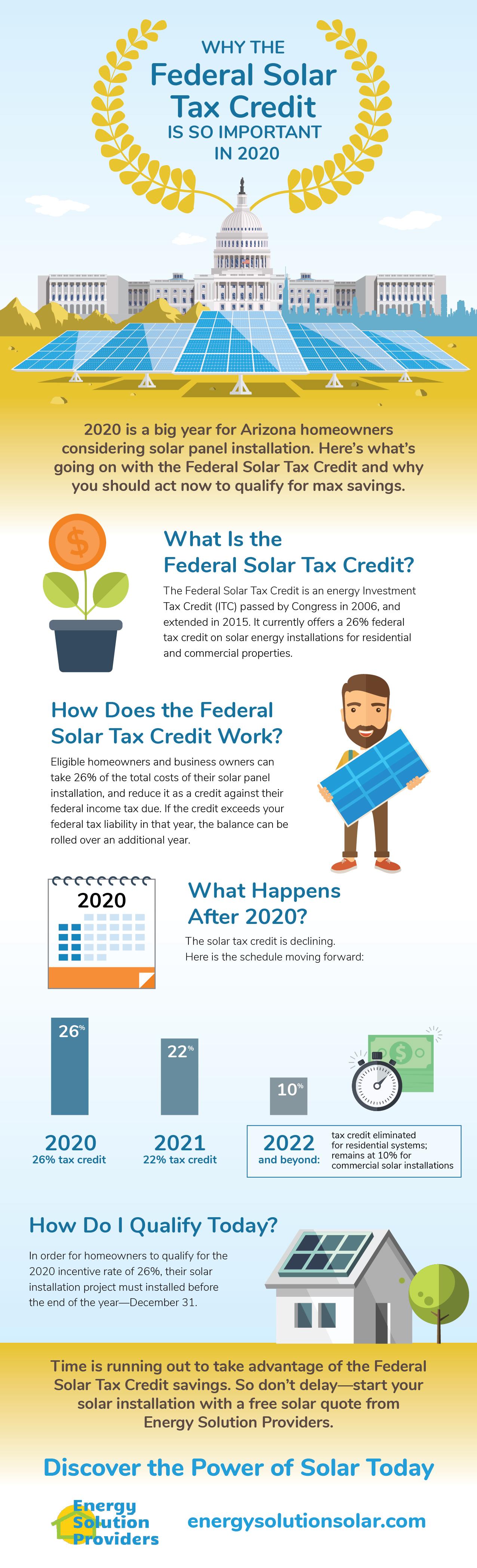

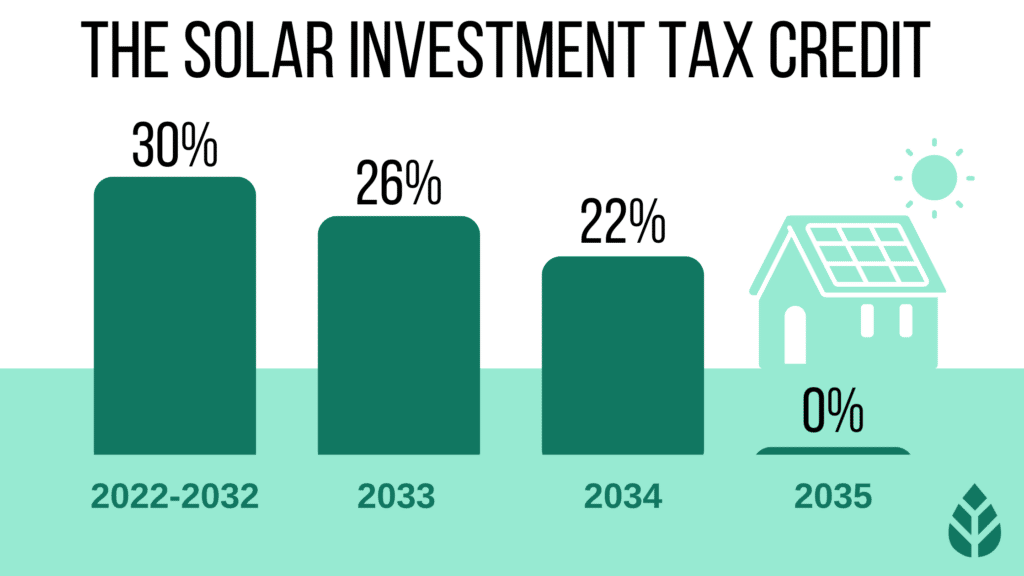

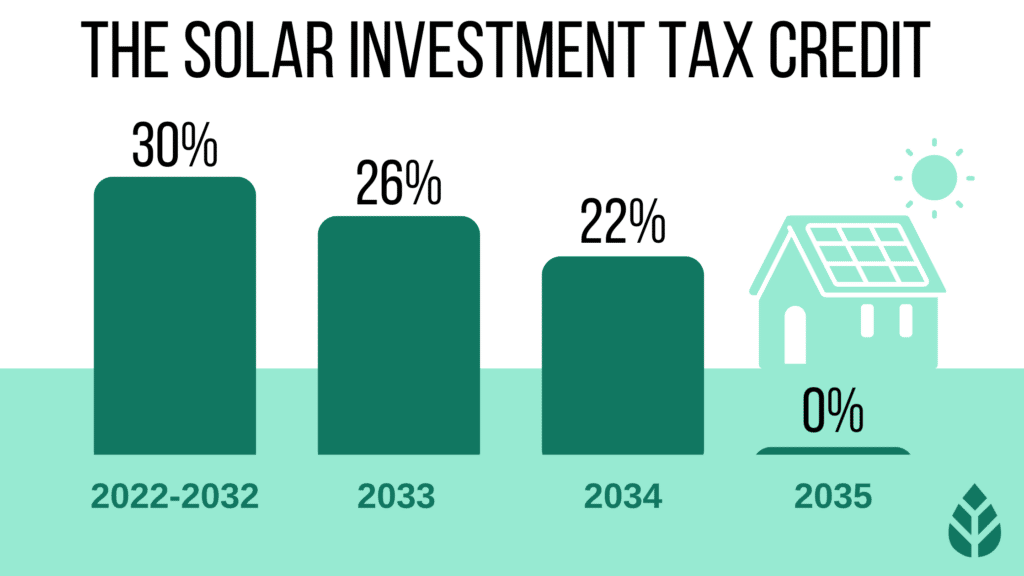

Verkko 29 jouluk 2023 nbsp 0183 32 The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 to 2032 30 no annual maximum or lifetime limit 2033 26 no annual maximum or lifetime limit 2034 22 no annual maximum or lifetime limit Get details on the Residential Clean Energy Credit Verkko For example if your solar PV system was installed in 2022 installation costs totaled 18 000 and your state government gave you a one time rebate of 1 000 for installing the system your federal tax credit would be calculated as follows 18 000 0 30 5 400 State Tax Credit

Federal Solar Tax Credit 2023 Income Limit

Federal Solar Tax Credit 2023 Income Limit

https://www.aesinspect.com/wp-content/uploads/2022/11/AdobeStock_535970711-scaled.jpeg

The Federal Solar Tax Credit Energy Solution Providers Arizona

https://energysolutionsolar.com/sites/default/files/styles/panopoly_image_original/public/federalsolartax2020-03_1.jpg?itok=EB_bqkCL

Solar Tax Credit Explained For 2022

https://news.measuresolar.com/wp-content/uploads/2022/03/Large-Rectangle-2-1-1536x864.png

Verkko 13 jouluk 2023 nbsp 0183 32 There is no income limit for the federal solar tax credit but to claim the full credit you ll need a significant enough tax liability If you owe fewer taxes than the credit Verkko Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house assuming the builder did not claim the tax credit in other words you may claim the credit in 2023

Verkko 2023 through 2032 30 up to a maximum of 1 200 water heaters heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Get details on the Energy Efficient Home Improvement Credit For 2022 biomass stoves and boilers are treated as a Residential Clean Energy Credit with no lifetime Verkko What Is the 2023 Federal Solar Tax Credit And How Does It Work The solar investment tax credit is a credit you can claim on your federal income taxes The ITC is not a

Download Federal Solar Tax Credit 2023 Income Limit

More picture related to Federal Solar Tax Credit 2023 Income Limit

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2022-10/Summary-ITC-and-PTC-Values-Table.png?itok=_72eWNBC

Solar Tax Credit

https://lirp.cdn-website.com/af303f9d/dms3rep/multi/opt/Screen+Shot+2022-12-11+at+5.33.42+PM-1920w.png

How To Claim Solar Tax Credit 2023 Internal Revenue Code Simplified

https://www.irstaxapp.com/wp-content/uploads/2022/12/solar-tax-credit-2023-750x422.png

Verkko IR 2023 97 May 4 2023 WASHINGTON The Internal Revenue Service reminds taxpayers that making certain energy efficient updates to their homes could qualify them for home energy tax credits The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022 Verkko 19 lokak 2023 nbsp 0183 32 Updated for Tax Year 2023 October 19 2023 7 36 AM OVERVIEW The Residential Clean Energy Credit for solar energy upgrades to your home has been extended through 2034 and expanded in value TABLE OF CONTENTS What is the Residential Clean Energy Credit How does the federal solar tax credit work What

Verkko 8 jouluk 2023 nbsp 0183 32 The federal solar tax credit plays a major Beginning in 2023 you can receive the 30 credit for stand alone energy The IRS has a 10 000 limit on combined state local income Verkko 22 jouluk 2022 nbsp 0183 32 For example beginning in 2023 a taxpayer can claim the maximum Energy Efficient Home Improvement Credit allowed every year that eligible improvements are made Q4 May a taxpayer carry forward unused credits to another tax year added December 22 2022 A4 The rules vary by credit

How Does The Federal Tax Credit For Solar Work Tampa Bay Solar

https://tampabaysolar.com/wp-content/uploads/2022/04/AdobeStock_201159810-2048x1365.jpeg

How Does The Federal Solar Tax Credit Work PB Roofing Co

https://pbroofingco.com/wp-content/uploads/2021/06/federal-solar-tax-credit.png

https://www.nerdwallet.com/article/taxes/solar-tax-credit

Verkko 1 elok 2023 nbsp 0183 32 The U S government offers a solar tax credit that can reach up to 30 of the cost of installing a system that uses the sun to power your home Get ready for simple tax filing with a 50

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Verkko 29 jouluk 2023 nbsp 0183 32 The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 to 2032 30 no annual maximum or lifetime limit 2033 26 no annual maximum or lifetime limit 2034 22 no annual maximum or lifetime limit Get details on the Residential Clean Energy Credit

Federal Solar Tax Credit Extended At 26 To 2023 Technicians For

How Does The Federal Tax Credit For Solar Work Tampa Bay Solar

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

The Federal Solar Tax Credit What You Need To Know 2024 Tax

Federal Solar Tax Credit A Quick Rundown Next Energy Solution

California Solar Incentives Rebates Tax Credits 2023 Guide

California Solar Incentives Rebates Tax Credits 2023 Guide

Irs Solar Tax Credit 2022 Form

Everything You Need To Know About The Federal Solar Tax Credit

The Federal Solar Tax Credit What You Need To Know 2022

Federal Solar Tax Credit 2023 Income Limit - Verkko What Is the 2023 Federal Solar Tax Credit And How Does It Work The solar investment tax credit is a credit you can claim on your federal income taxes The ITC is not a