Federal Solar Tax Credit Income Limits The solar panel tax credit allows filers to take a tax credit equal to up to 30 of eligible costs There is no income limit to qualify and you can claim the credit each year you re

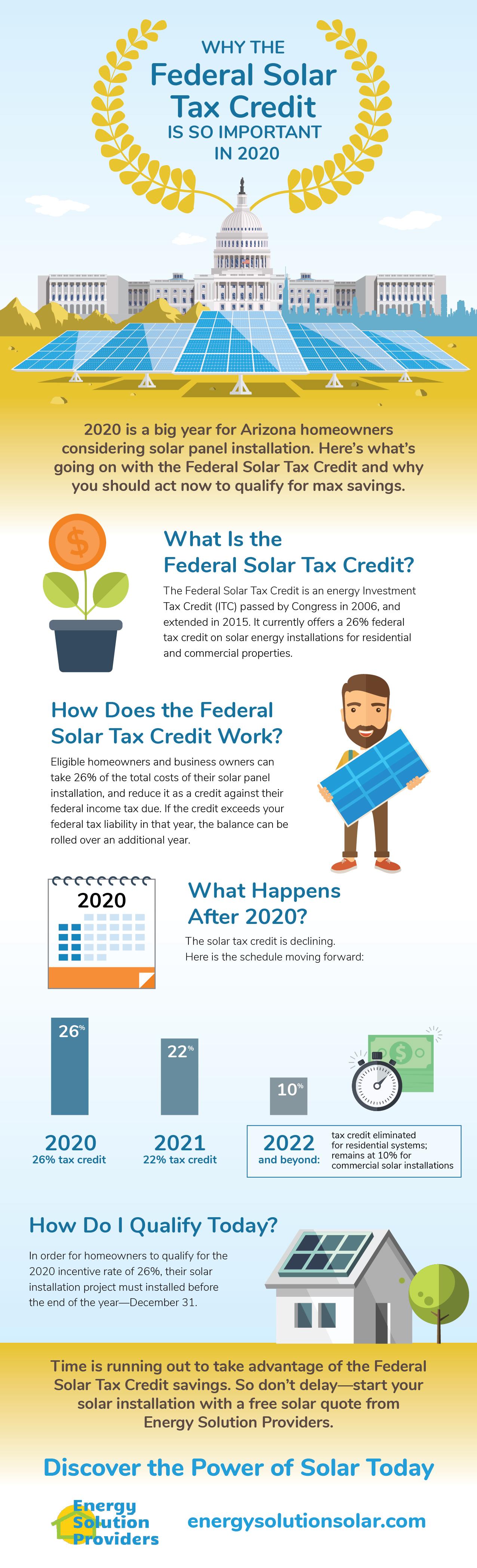

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other Claiming a 1 000 federal tax credit reduces your federal income taxes due by 1 000 1 What is the federal solar tax credit The federal residential solar energy credit is a tax

Federal Solar Tax Credit Income Limits

Federal Solar Tax Credit Income Limits

https://www.leafscore.com/wp-content/uploads/2022/08/federal-solar-tax-credit-inflation-reduction-act-scaled.jpg

The Federal Solar Tax Credit Energy Solution Providers Arizona

https://energysolutionsolar.com/sites/default/files/styles/panopoly_image_original/public/federalsolartax2020-03_1.jpg?itok=EB_bqkCL

Solar Tax Credit Explained For 2022

https://news.measuresolar.com/wp-content/uploads/2022/03/Large-Rectangle-2-1-1536x864.png

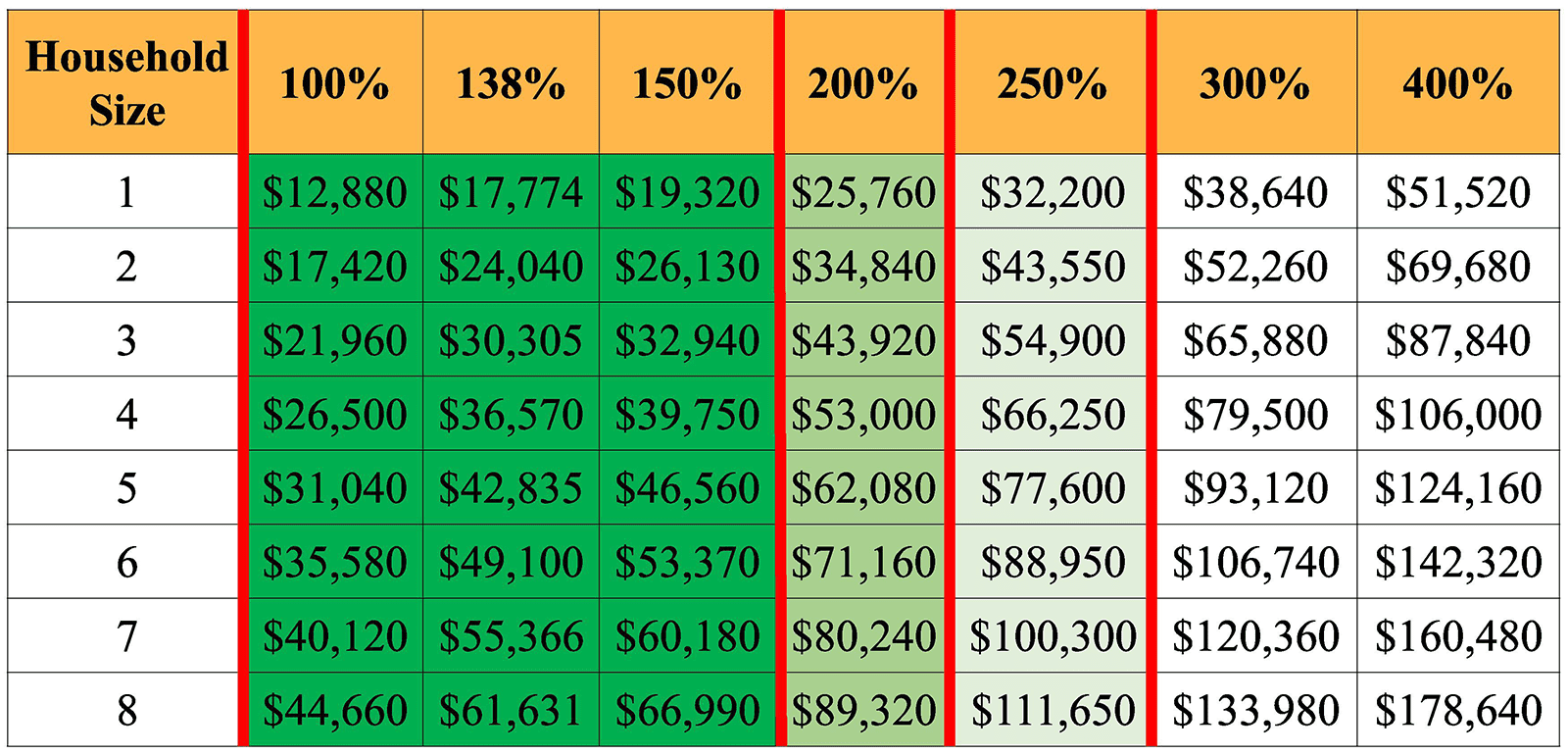

Is there an income limit for the federal solar tax credit There is no income limit but the amount you can receive from the tax credit is limited to how much you would pay in taxes for Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in

What is the income limit for the federal solar tax credit There is no income limit for the federal solar tax credit However you need a large enough taxable income IR 2024 113 April 17 2024 The Internal Revenue Service today updated frequently asked questions in Fact Sheet 2024 15 to address the federal income tax treatment of

Download Federal Solar Tax Credit Income Limits

More picture related to Federal Solar Tax Credit Income Limits

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2022-10/Summary-ITC-and-PTC-Values-Table.png?itok=_72eWNBC

So What Exactly Is The Federal Solar Tax Credit

https://img1.wsimg.com/isteam/ip/c38712da-f8d6-46c1-8478-991f150c92ac/60-0001.png

Solar Tax Credit

https://lirp.cdn-website.com/af303f9d/dms3rep/multi/opt/Screen+Shot+2022-12-11+at+5.33.42+PM-1920w.png

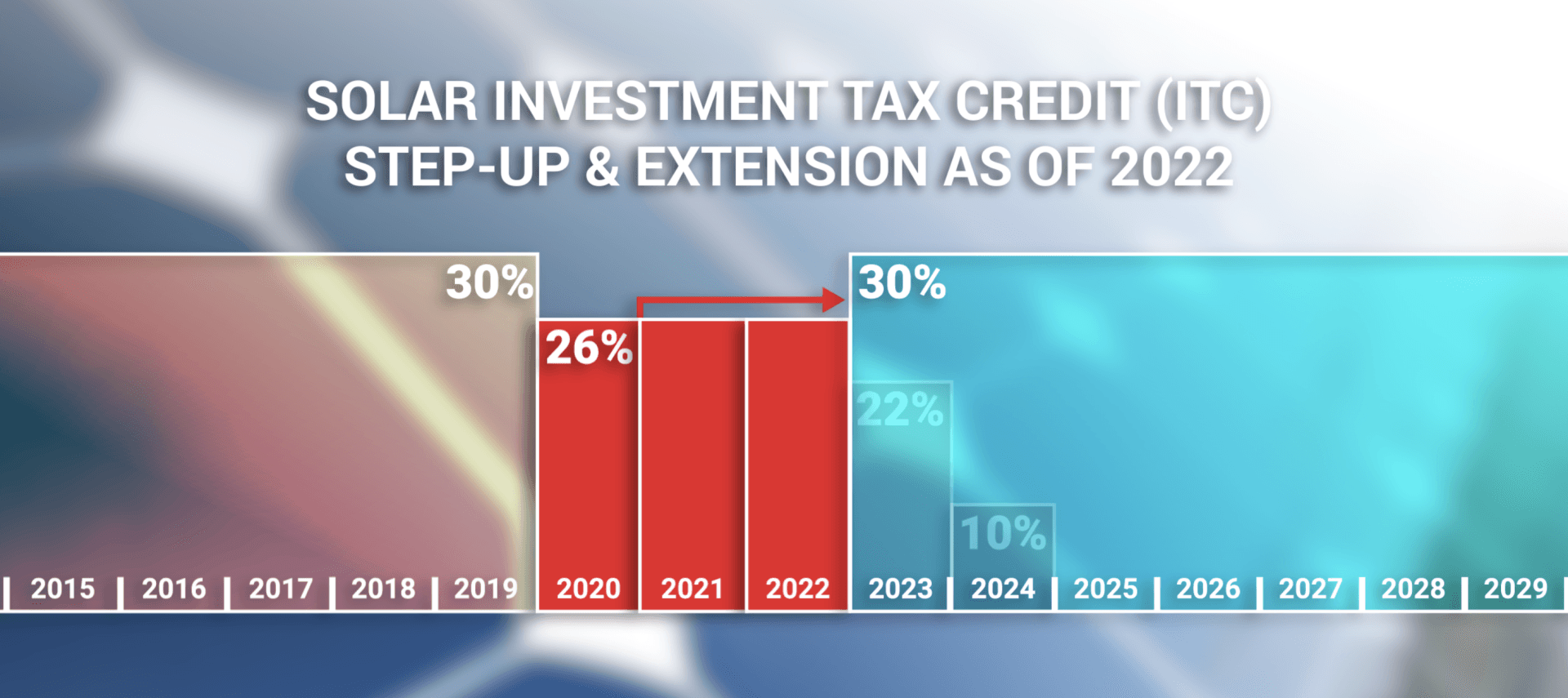

The solar tax credit which is among several federal Residential Clean Energy Credits available through 2032 allows homeowners to subtract 30 percent of the cost of There are no income limits on the solar tax credit so all individual taxpayers are eligible to claim the credit on qualifying solar energy equipment investments made to their homes within the United

In 2024 eligible homeowners can claim a federal income tax credit valued at up to 30 of solar installation costs parts labor permits etc through December 31 The federal residential solar tax credit is the most valuable incentive you can claim this year because it saves you thousands of dollars in the form of a 30 tax credit

How Does The Federal Tax Credit For Solar Work Tampa Bay Solar

https://tampabaysolar.com/wp-content/uploads/2022/04/AdobeStock_201159810-2048x1365.jpeg

The 30 Solar Tax Credit Has Been Extended Through 2032

https://quickelectricity.com/wp-content/uploads/2022/09/Solar-Federal-Tax-Credit-Increased-to-30-and-Extended-Through-2032-1030x536.jpg

https://www.nerdwallet.com/.../taxes/s…

The solar panel tax credit allows filers to take a tax credit equal to up to 30 of eligible costs There is no income limit to qualify and you can claim the credit each year you re

https://www.energy.gov/sites/default/files/2021/02...

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other

Federal Solar Tax Credit A Quick Rundown Next Energy Solution

How Does The Federal Tax Credit For Solar Work Tampa Bay Solar

How To Fill Out IRS Form 5695 To Claim The Solar Tax Credit Federal

How Does The Federal Solar Tax Credit Work PB Roofing Co

The Federal Solar Tax Credit What You Need To Know 2024 Tax

Federal Solar Tax Credit Extended At 26 To 2023 Technicians For

Federal Solar Tax Credit Extended At 26 To 2023 Technicians For

Federal Investment Solar Tax Credit Guide Learn How To Claim The

ACA Tax Credits To Help Pay Premiums White Insurance Agency

The Federal Solar Tax Credit Get Updated For 2021

Federal Solar Tax Credit Income Limits - Is there an income limit for the federal solar tax credit There is no income limit but the amount you can receive from the tax credit is limited to how much you would pay in taxes for