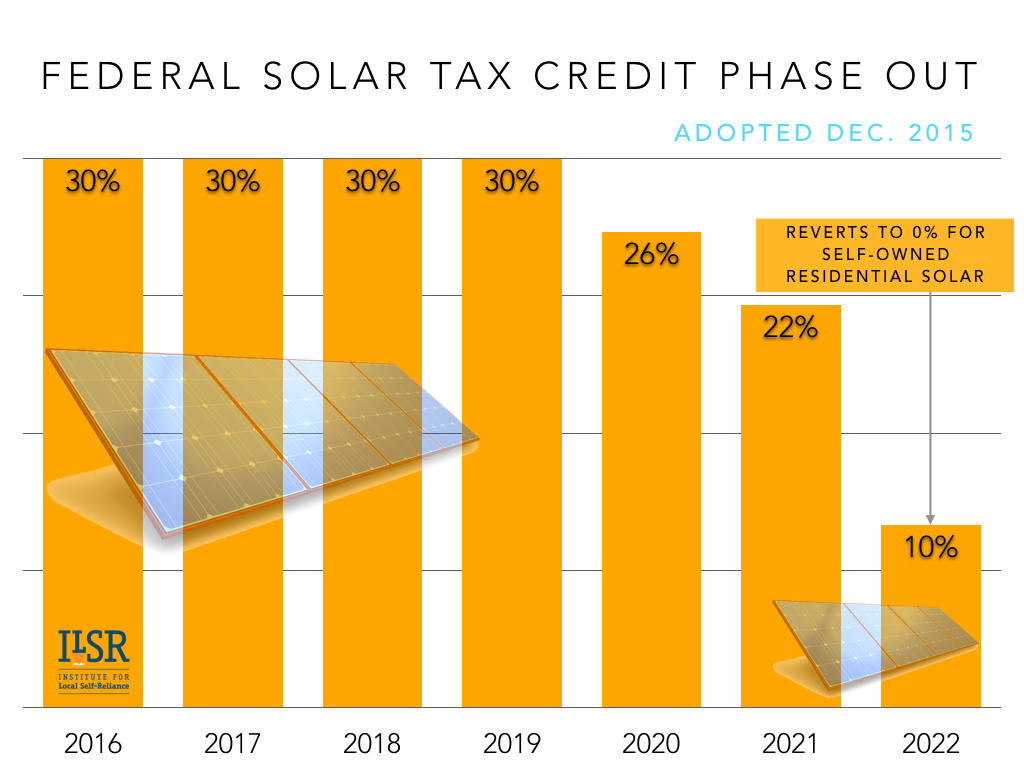

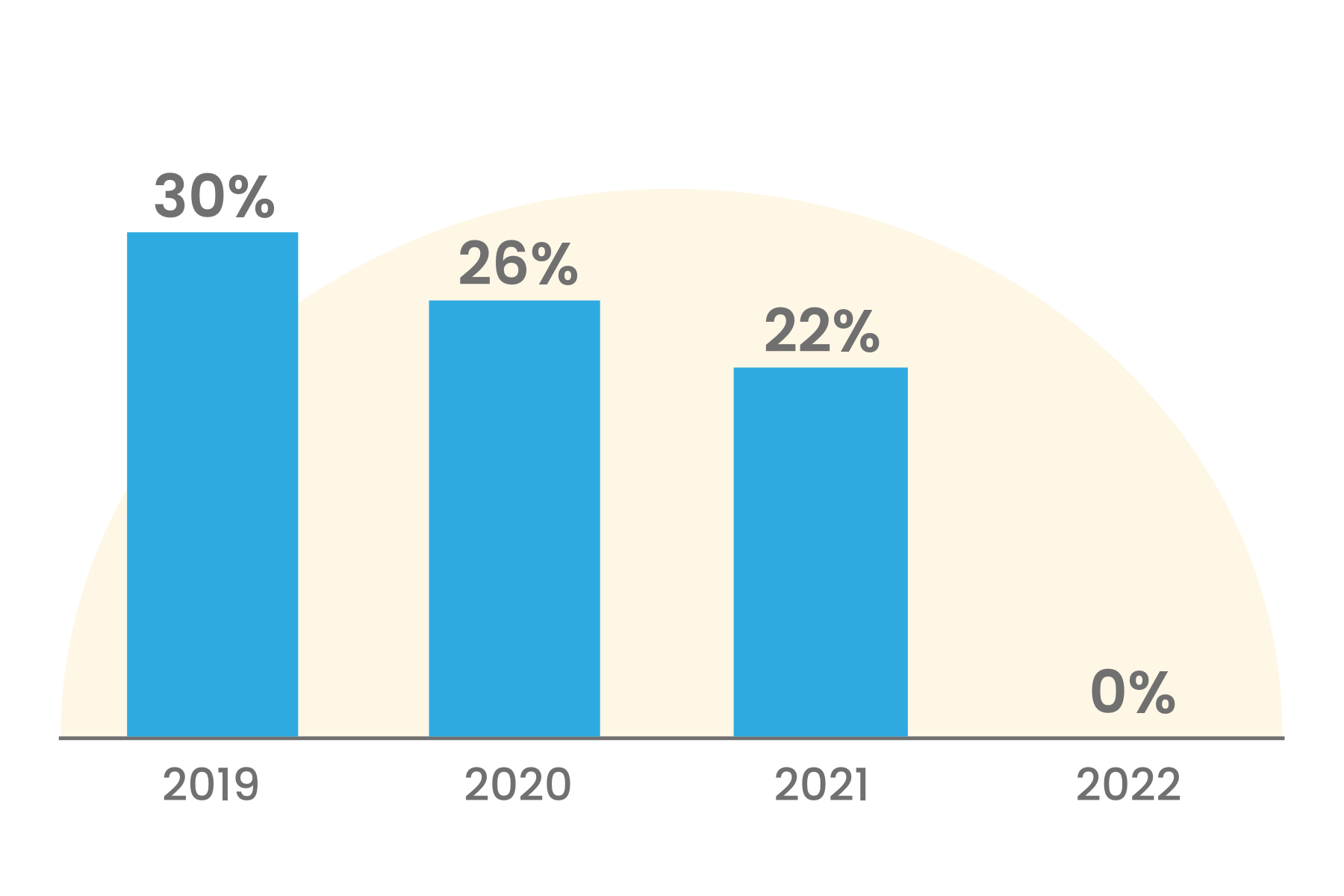

Federal Solar Tax Credit Rules Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before

Claiming a 1 000 federal tax credit reduces your federal income taxes due by 1 000 1 What is the federal solar tax credit The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by What is the federal solar tax credit The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other types of renewable energy are also eligible for similar credits but are

Federal Solar Tax Credit Rules

Federal Solar Tax Credit Rules

https://www.livesmartconstruction.com/wp-content/uploads/2020/05/solar-tax-credit.jpg

Your Guide To The Increased 30 Federal Solar Tax Credit Absolute

https://www.aesinspect.com/wp-content/uploads/2022/11/AdobeStock_535970711-scaled.jpeg

The Federal Solar Tax Credit Energy Solution Providers Arizona

https://energysolutionsolar.com/sites/default/files/styles/panopoly_image_original/public/federalsolartax2020-03_1.jpg?itok=EB_bqkCL

You will need to file Form 5695 Residential Energy Credits when you file your tax return for year in which your residential energy property was put in service Learn the steps for claiming a residential clean energy tax credit Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in 2022 If you make energy improvements to your home tax credits are available for a portion of qualifying expenses

How to File for the Federal Solar Tax Credit Step by Step Fill in Form 1040 as you normally would When you get to line 5 of Schedule 3 Form 1040 shown below it s time to switch to Form 5695 Step 1 Calculate how Solar Energy Systems Tax Credit The following Residential Clean Energy Tax Credit amounts apply for the prescribed periods 30 for property placed in service after December 31 2016 and before January 1 2020 26 for property placed in service after December 31 2019 and

Download Federal Solar Tax Credit Rules

More picture related to Federal Solar Tax Credit Rules

How Does The Federal Tax Credit For Solar Work Tampa Bay Solar

https://tampabaysolar.com/wp-content/uploads/2022/04/AdobeStock_201159810-2048x1365.jpeg

The Solar Tax Credit Also Know As The ITC Is A Dollar For Dollar

https://i.pinimg.com/originals/58/28/2c/58282c905274c1827d1d8b95646b152a.jpg

How Does The Federal Solar Tax Credit Work PB Roofing Co

https://pbroofingco.com/wp-content/uploads/2021/06/federal-solar-tax-credit.png

Check out our updated Federal Solar Tax Credit guide for 2024 including how much the credit is worth instructions on how to apply and other solar savings The federal solar tax credit commonly referred to as the investment tax credit or ITC allows you to claim 30 of the cost of your solar energy system as a credit to your federal tax bill If it costs 10 000 to install your solar panel system you ll receive a 3 000 credit

The Inflation Reduction Act expanded the federal solar tax credit to 30 until 2032 We ll show you exactly how to take advantage of it To qualify for claiming the solar tax credit on your tax return you ll first need to meet some eligibility criteria Your solar equipment needs to be installed between January 1 2017 and December 31 2034 The solar equipment must be located at a residence of yours within the

Solar Tax Credit Graph without Header Solar United Neighbors

https://www.solarunitedneighbors.org/wp-content/uploads/2019/03/Solar-tax-credit-graph-without-header.png

Federal Solar Tax Credit A Quick Rundown Next Energy Solution

https://nextenergysolution.com/wp-content/uploads/82527958_l-scaled.jpg

https://www.energy.gov/eere/solar/hom…

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before

https://www.energy.gov/sites/default/files/2023-03/...

Claiming a 1 000 federal tax credit reduces your federal income taxes due by 1 000 1 What is the federal solar tax credit The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by

Your Guide To Solar Federal Tax Credit

Solar Tax Credit Graph without Header Solar United Neighbors

How The Solar Tax Credit Works 2022 Federal Solar Tax Credit

Congress Gets Renewable Tax Credit Extension Right Institute For

Federal Investment Solar Tax Credit Guide Learn How To Claim The

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

The Federal Solar Tax Credit What You Need To Know 2022

Federal Solar Tax Credit Guide Atlantic Key Energy

Upcoming Changes To The Solar Tax Credit And How They Affect You

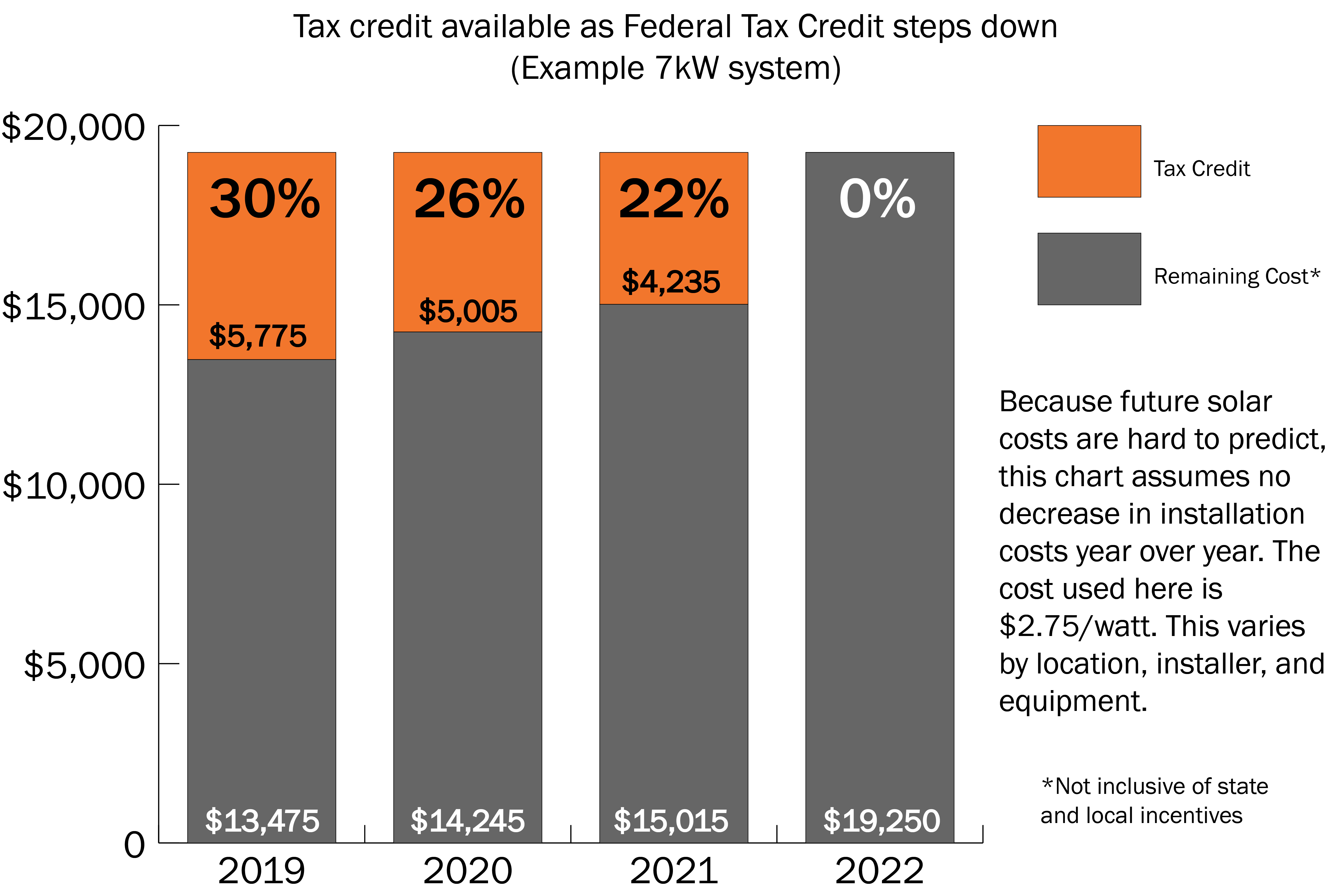

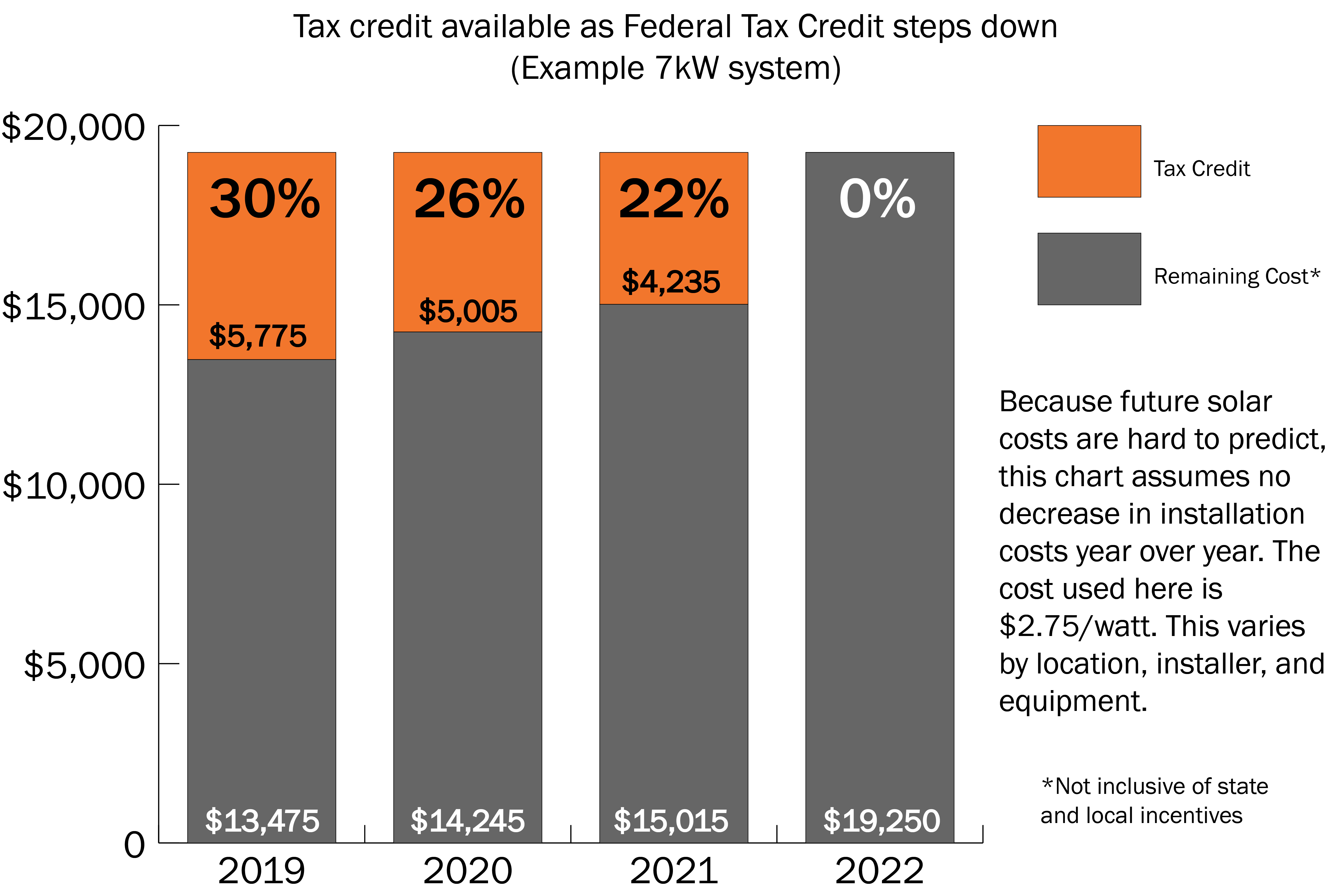

Federal Solar Tax Credit Rules - At 30 the tax credit is worth 7 500 for a 25 000 solar system effectively knocking the price down to 17 500 The credit was previously at 26 for systems installed in 2022 and scheduled to step down to 22 in 2023 before going away entirely in 2024