Federal Tax Credit 2023 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through

Explore updated credits deductions and exemptions including the standard deduction personal exemption Alternative Minimum Tax AMT Earned Income Tax Credit EITC Child Tax Credit CTC capital gains All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500

Federal Tax Credit 2023

Federal Tax Credit 2023

https://i.ytimg.com/vi/1fI71WzZo5w/maxresdefault.jpg

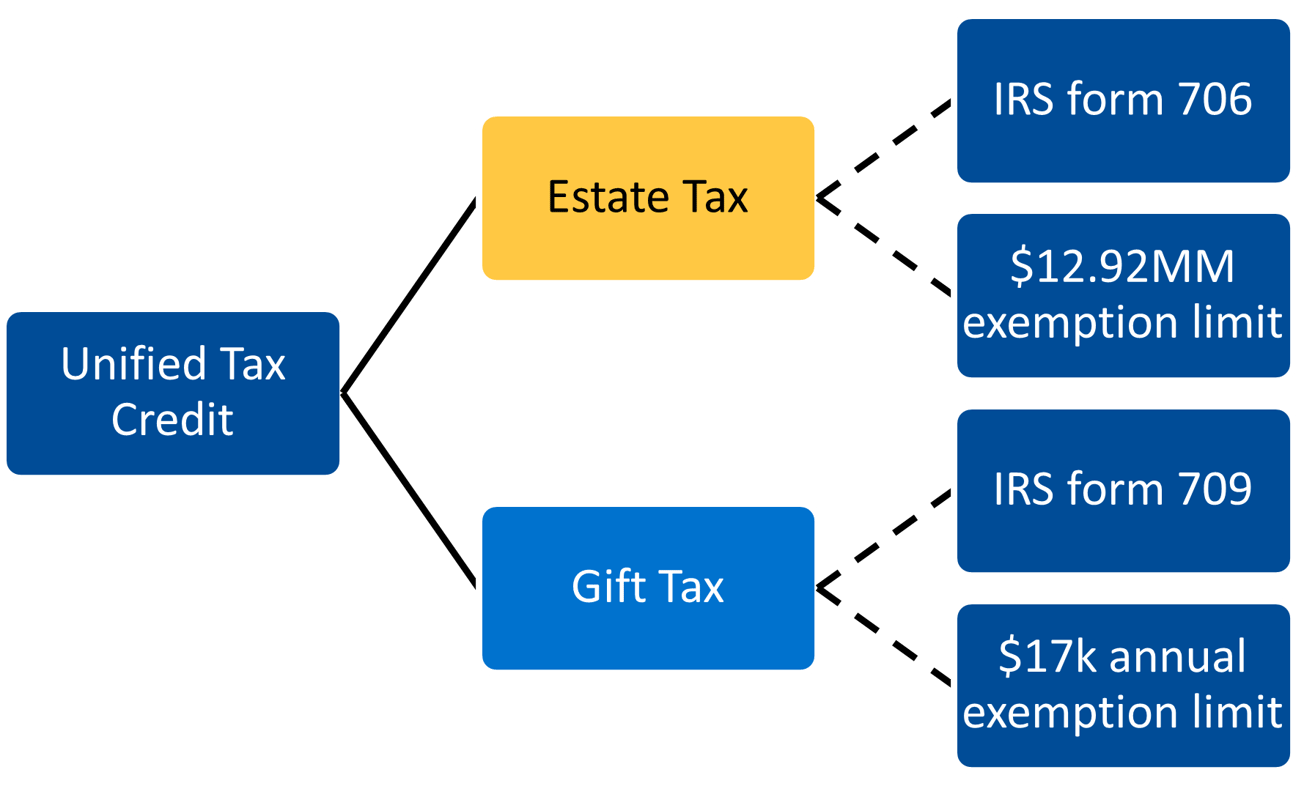

2023 Guide To The Unified Tax Credit

https://www.oakstreetfunding.com/hs-fs/hubfs/unified tax credit 2023.png?width=1315&height=788&name=unified tax credit 2023.png

Federal Tax Credits For Air Conditioners Heat Pumps 2023

https://kobiecomplete.com/wp-content/uploads/2023/01/federal-tax-credits-2023-graphic-white-web.png

Earned income credit The earned income tax credit could be worth between 600 and 7 430 for the 2023 tax year depending on your filing status and the number of Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent

Starting January 1 2023 new federal tax credits will be in place for 10 years through 2032 Also while the tax credit amount is mostly limited to 30 of the project cost the previous lifetime cap of 500 has been changed Exterior residential windows or skylights must meet the ENERGY STAR Most Efficient criteria to be eligible for the 25C Federal Tax Credit Follow these 3 steps to determine if the windows and or skylights you purchased are eligible

Download Federal Tax Credit 2023

More picture related to Federal Tax Credit 2023

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/2022-10/Summary-ITC-and-PTC-Values-Table.png

EV Tax Credit 2023 New Rule Changes And What s Ahead Kiplinger

https://cdn.mos.cms.futurecdn.net/w9w82fj4s3TmdFgZDYDnT9.jpg

Your First Look At 2023 Tax Brackets Deductions And Credits 3

https://db0ip7zd23b50.cloudfront.net/dims4/default/aedfbe6/2147483647/resize/633x10000>/quality/90/?url=http:%2F%2Fbloomberg-bna-brightspot.s3.amazonaws.com%2Fae%2F00%2F2ce5bb3d4ec493a63ec4724e6e05%2Fd64957248d6c49ebb92ef34db2768c4e

With federal tax credits and utility rebates unlocking savings for homeowners there s no better time to explore energy efficient upgrades for your home Trane offers several products that qualify for the 25C tax credit For the first time in years some Teslas will qualify for a 7 500 federal tax credit for new electric vehicles But only some vehicles and only some buyers are eligible

FS 2023 09 April 2023 A tax credit is a dollar for dollar amount taxpayers claim on their tax return to reduce the income tax they owe Eligible taxpayers can use them to This guide includes an overview of the most common tax credits available for the 2023 tax year that you may be able to apply when you file taxes in 2024

https://hesabdarema.com/wp-content/uploads/2022/04/Tax-credit.jpg

Easiest EITC Tax Credit Table 2022 2023 Internal Revenue Code

https://www.irstaxapp.com/wp-content/uploads/2022/11/EITC-tax-credit-table-2.png

https://www.irs.gov › credits-deductions › energy...

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through

https://taxfoundation.org › data › all › federal

Explore updated credits deductions and exemptions including the standard deduction personal exemption Alternative Minimum Tax AMT Earned Income Tax Credit EITC Child Tax Credit CTC capital gains

2023 Tax Bracket Changes And IRS Annual Inflation Adjustments

Oct 19 Irs Here Are The New Income Tax Brackets For 2023 Free Nude

2023 Irs Tax Chart Printable Forms Free Online

Federal Corporate Income Tax Rate For 2023 Infoupdate

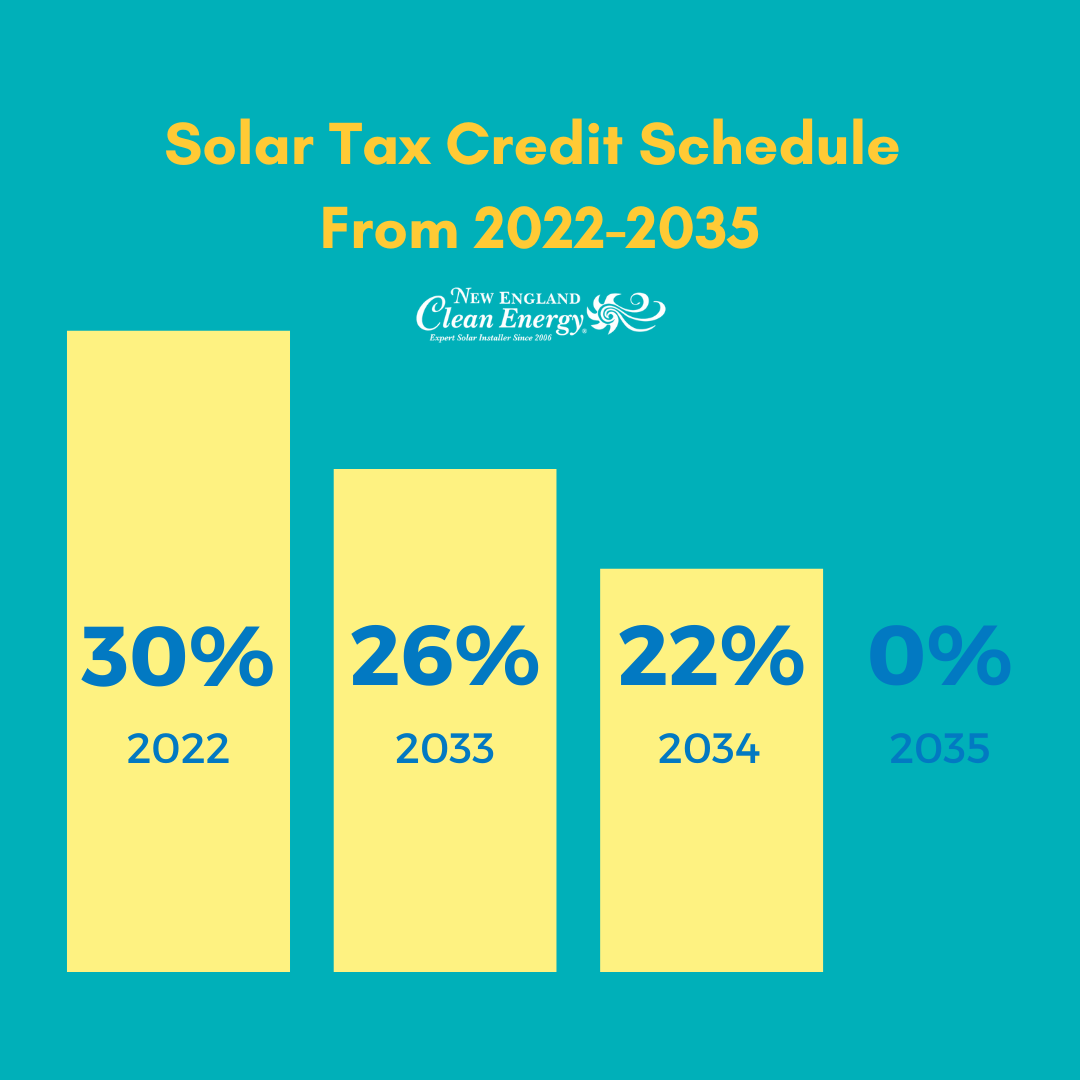

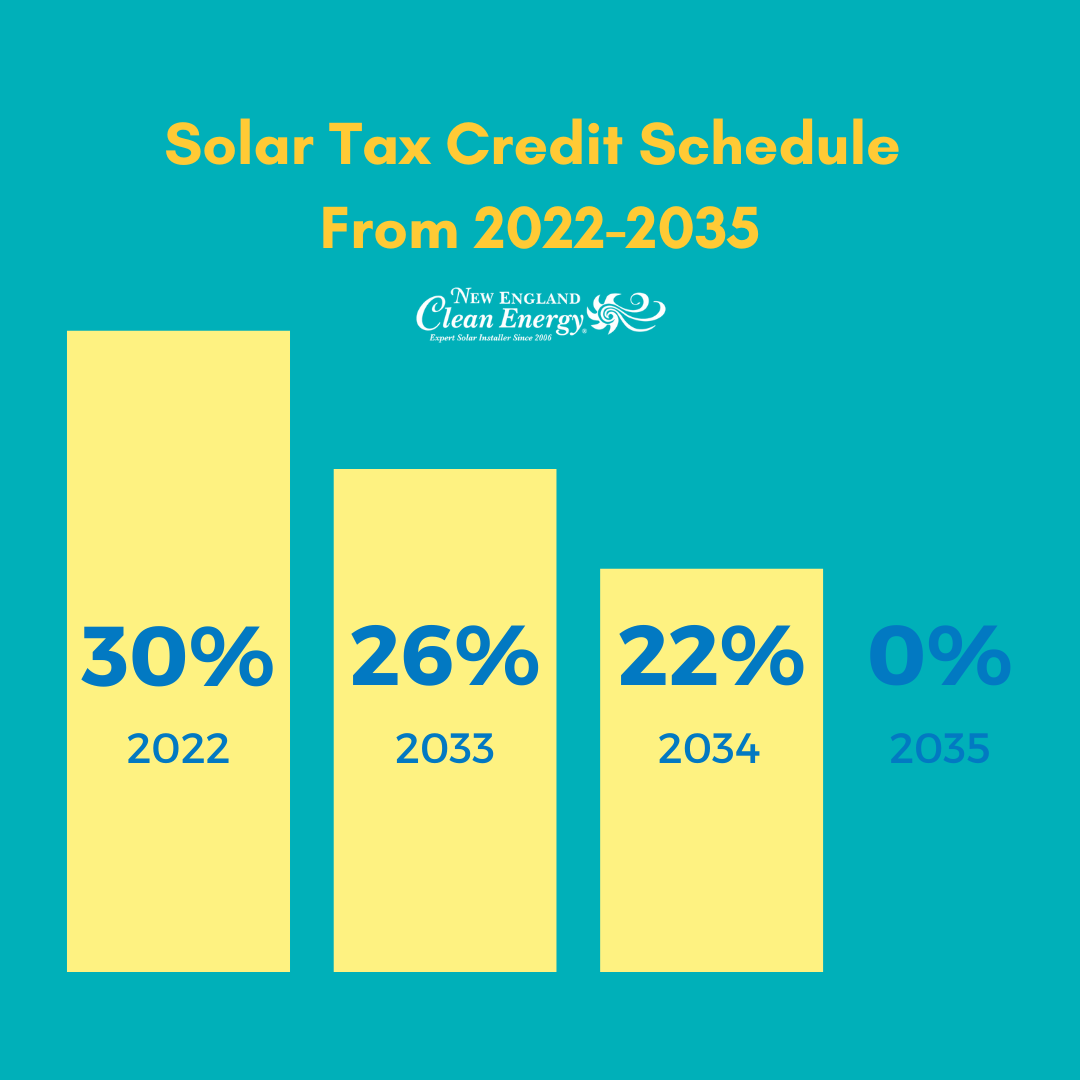

Solar Tax Credit How Do I Get It New England Clean Energy

Solar Tax Credit How Do I Get It New England Clean Energy

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

2023 Tax Brackets The Best Income To Live A Great Life

:max_bytes(150000):strip_icc()/2020IRSTaxTablesScreenShot-16679838387b47b492ac296463926902.jpg)

Astounding Gallery Of Eic Tax Table Concept Turtaras

Federal Tax Credit 2023 - Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent