Federal Tax Credit Electric Vehicle Form You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction

We ll help you determine whether your purchase of an electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on whether you are Planning to buy a To claim the credit for vehicles placed in service before January 1 2024 file Form 8936 Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled

Federal Tax Credit Electric Vehicle Form

Federal Tax Credit Electric Vehicle Form

https://i.pcmag.com/imagery/articles/04InvhVC1HTje7XJcv9Tb7Q-4.fit_lim.v1681756100.jpg

Why The Electric Vehicle Tax Credit Was Removed OsVehicle

https://cdn.osvehicle.com/do_any_electric_cars_qualify_for_new_tax_credit.jpg

Has Federal EV Tax Credit Been Saved The Green Car Guy

https://thegreencarguy.com/wp-content/uploads/2016/05/GCG-CashandCar-1024x1024.jpg

To file Form 8936 and claim either the Qualified Plug In Electric Drive Motor Vehicle Credit for cars purchased prior to January 1 2023 or the Clean Vehicle Credit for qualifying People who buy new electric vehicles may be eligible for a tax credit of up to 7 500 and used electric car buyers may qualify for up to 4 000 New in 2024

To assist consumers identifying eligible vehicles the Department of Transportation and Department of Energy published new resources today to help those Tax credits up to 7 500 are available for eligible new electric vehicles and up to 4 000 for eligible used electric vehicles You can claim the credit yourself or work with your

Download Federal Tax Credit Electric Vehicle Form

More picture related to Federal Tax Credit Electric Vehicle Form

How To Calculate Electric Car Tax Credit OsVehicle

https://cdn.osvehicle.com/how_is_tax_credit_for_ev_calculated.png

Tax Credits For Electric Vehicles Are About To Get Confusing The New

https://static01.nyt.com/images/2022/12/28/multimedia/28ev-credits-1-5aaf/28ev-credits-1-5aaf-videoSixteenByNine3000.jpg

Income Tax Credit Electric Vehicle Update Income Tax Payments Deferred

https://www.taxproadvice.com/wp-content/uploads/tax-credits-drive-electric-northern-colorado-932x1024.png

Form 8936 is an IRS form taxpayers can use to claim a tax credit for an electric vehicle as long as they meet certain eligibility requirements Internal Revenue What Is the Electric Vehicle EV Tax Credit The EV tax credit is a federal incentive to encourage consumers to purchase EVs Taxpayers who meet the income

A federal EV tax credit is here thanks to the Inflation Reduction Act IRA massive tax and climate legislation promoting clean energy The credit of up to 7 500 All electric and plug in hybrid vehicles purchased new from 2010 through 2022 may be eligible for a federal income tax credit of up to 7 500 The credit amount will vary based

Federal Tax Credit For Redevelopment Introduced REHAB Act Greater

http://static1.squarespace.com/static/59396fee59cc6877bacf5ab5/5947ec9a2985262ece0ebb1e/5e7a6fe1b8ae72565ee2e35a/1631114839305/?format=1500w

Tax Credit For Electric Vehicles Khou

https://media.khou.com/assets/KHOU/images/fda45742-0ba4-4512-b143-375cf49d3da4/fda45742-0ba4-4512-b143-375cf49d3da4_1920x1080.jpg

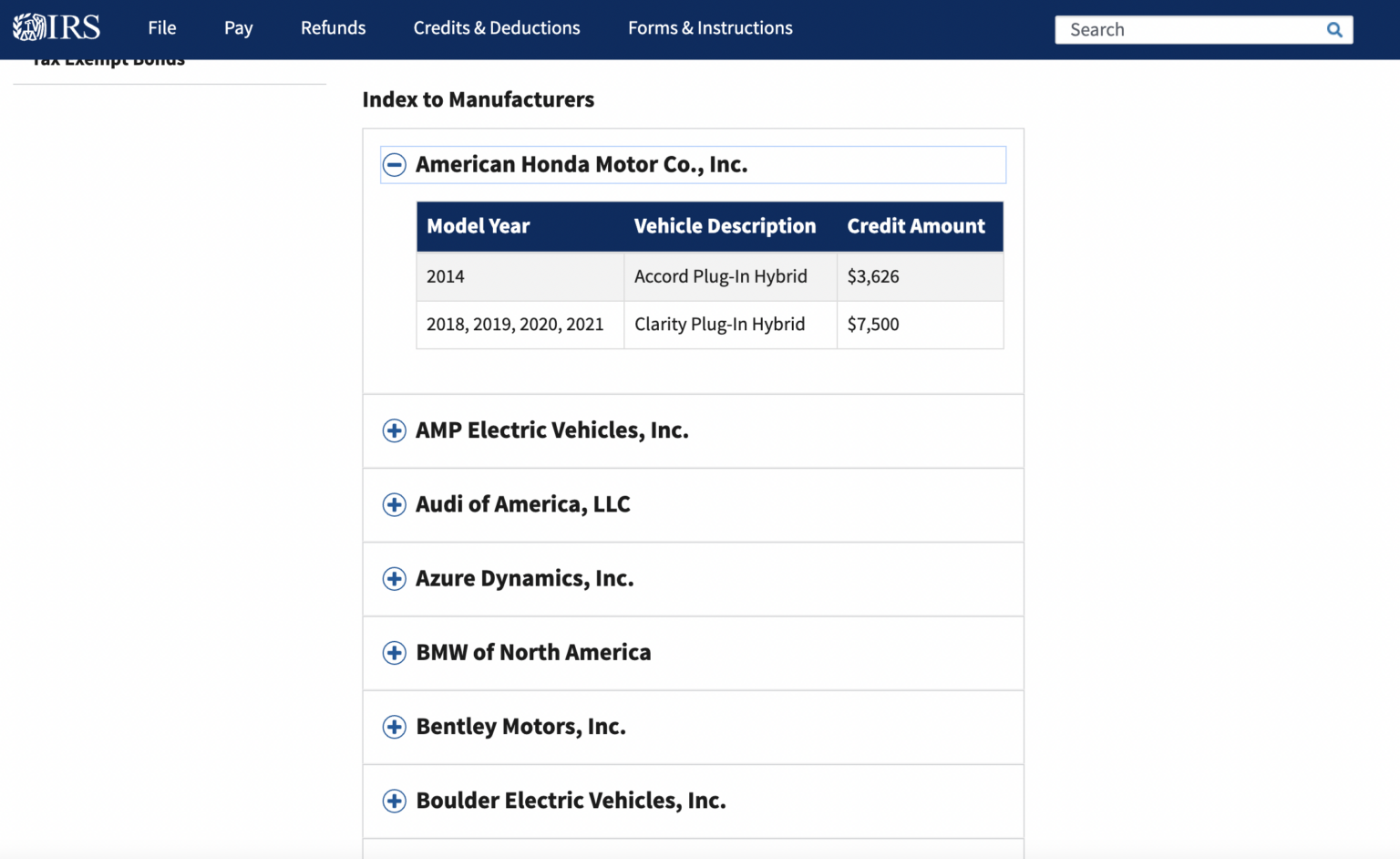

https://www.irs.gov/credits-deductions/credits-for...

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction

https://www.irs.gov/clean-vehicle-tax-credits

We ll help you determine whether your purchase of an electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on whether you are Planning to buy a

Electric Vehicle Chargers The Federal Tax Credit Is Back

Federal Tax Credit For Redevelopment Introduced REHAB Act Greater

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

The Federal Tax Credit For Electric Cars How To Save 7 500

What Is Federal Tax Credit For Electric Cars ElectricCarTalk

Ev Tax Credit 2022 Cap Clement Wesley

Ev Tax Credit 2022 Cap Clement Wesley

Electric Car Tax Credit Everything That You Have To Know Get

Electric Vehicle Tax Credit News Ev Electrek Money Qualify

U S Lawmakers Propose To Extend EV Tax Credit At A Cost Of 11 4

Federal Tax Credit Electric Vehicle Form - Until 2024 the way you claim the federal tax credit for EVs is by using IRS Form 8936 which you submit as part of your annual taxes to the federal government