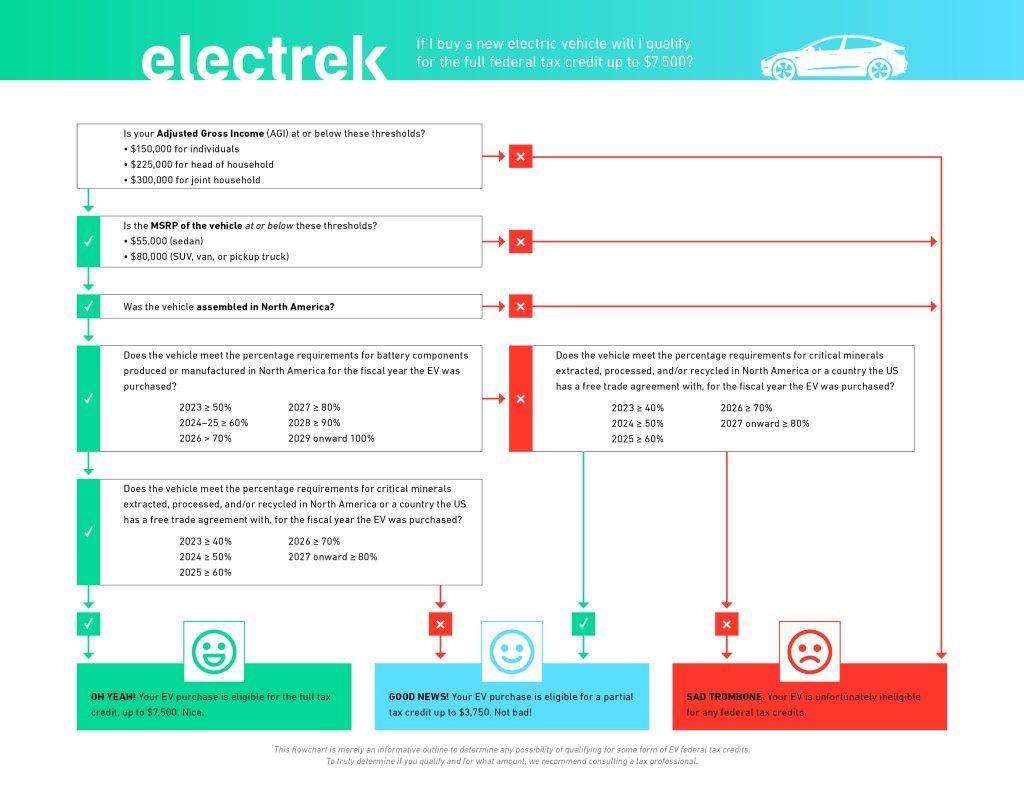

Federal Tax Credit Ev Income Limit You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction

IRS guidance limits the number of EVs that qualify for the full 7 500 EV tax credit Those EV tax credit rules address requirements for critical mineral and battery The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in section 30D of the Internal Revenue Code Code for qualified plug in

Federal Tax Credit Ev Income Limit

Federal Tax Credit Ev Income Limit

https://electrek.co/wp-content/uploads/sites/3/2022/11/EV-tax-credit-flowchart.jpg?quality=82&strip=all&w=1024

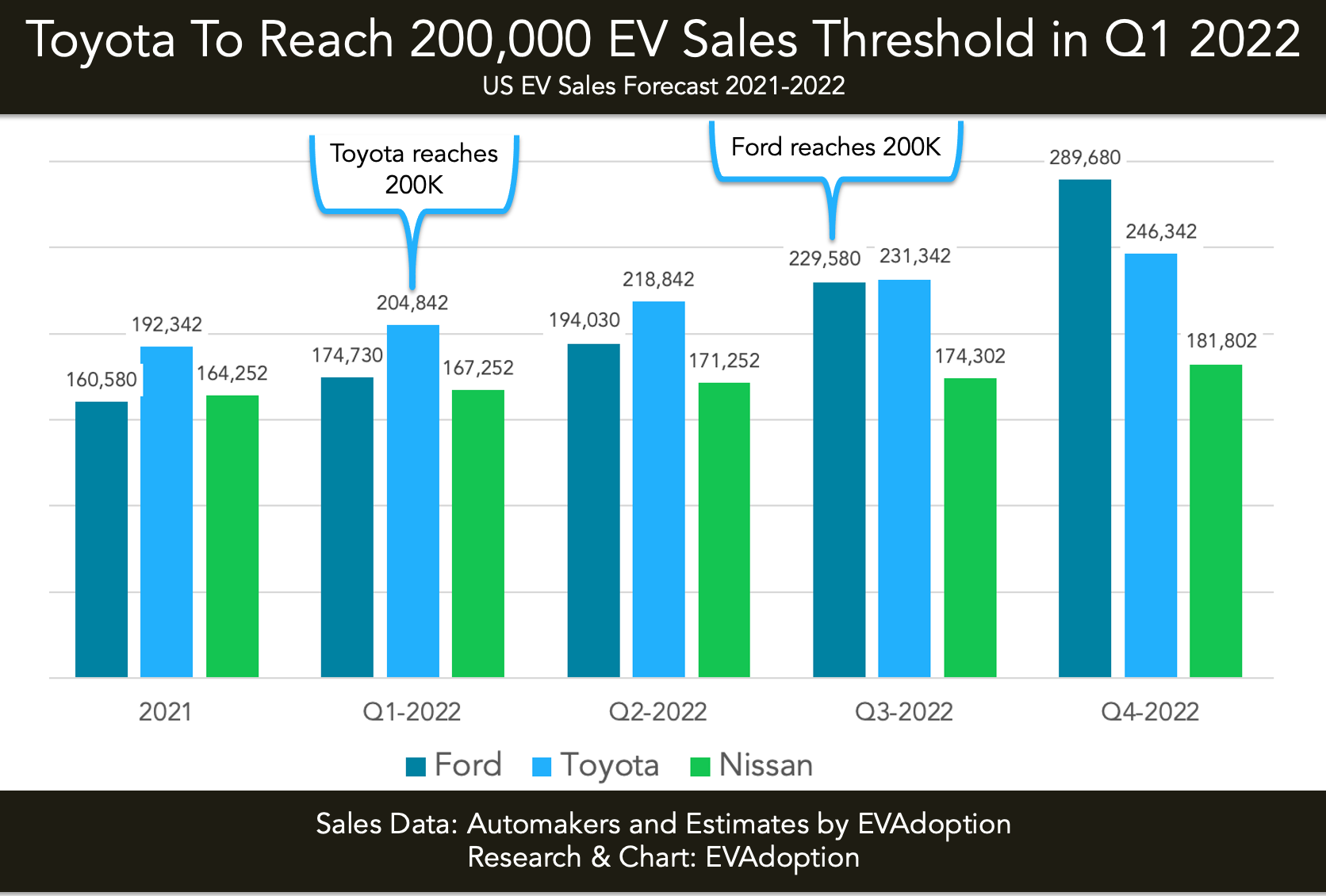

2 Automotive Companies Have Already Used Up All Their EV Tax Credits

https://www.motorbiscuit.com/wp-content/uploads/2022/08/federal-EV-tax-credits.jpg

Ev Tax Credit 2022 Cap Clement Wesley

https://electrek.co/wp-content/uploads/sites/3/2021/07/EV-Federal-Tax-Credit-Hero-2.jpg?quality=82&strip=all

All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500 Purchasing a Used Clean Vehicle Requirements Taxpayer income and status The taxpayer s modified adjusted gross income for either the current year or prior year must be 150 000 or less for joint filers and surviving

The IRS has given automakers a little more wiggle room around which electric vehicles will qualify for a federal tax credit worth up to 7 500 The change which gives companies a few more Treasury and the Internal Revenue Service released guidance and FAQs with information on how the North America final assembly requirement will work so

Download Federal Tax Credit Ev Income Limit

More picture related to Federal Tax Credit Ev Income Limit

Federal EV Tax Credit News And Reviews InsideEVs

https://cdn.motor1.com/images/mgl/zbwoq/s4/consumers-agree-with-automakers-about-the-federal-ev-tax-credit.jpg

Federal EV Tax Credit Phase Out Tracker By Automaker EVAdoption

https://evadoption.com/wp-content/uploads/2022/01/Nissan-Ford-Toyota-2021-Q1-Q4-2022-200K-chart.png

U S Federal EV Tax Credit Update For January 2019

https://cdn.motor1.com/images/mgl/kw3bM/s1/u-s-federal-ev-tax-credit-update-for-january-2019.jpg

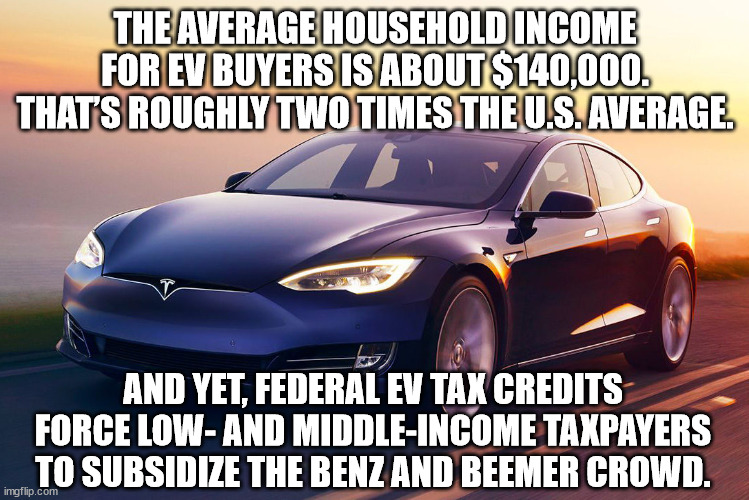

What are the income limits to qualify for any federal EV tax credits Modified adjusted gross income limits are 150 000 for individuals 225 000 for heads of households and 300 000 for Tucked inside the massive Inflation Reduction Act of 2022 that was signed into law in August is a complex set of requirements around which EVs and other clean vehicles do and do not qualify for a

Effective immediately after enactment of the Inflation Reduction Act after August 16 2022 the tax credit is only available for qualifying electric vehicles for which final assembly If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section

How The Federal EV Tax Credit Can Save You 7 500 On A New Plug in Vehicle

https://i.insider.com/612e371912b9cc00196378e9?format=jpeg

Proposed Federal EV Tax Credit Reform Will It Move The Sales Needle

https://secureservercdn.net/50.62.89.79/mvc.3f2.myftpupload.com/wp-content/uploads/2021/02/IRS-Tax-credit-by-Household-AGI-2018-updated-FINAL.png

https://www.irs.gov › credits-deductions › credits-for...

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction

https://www.kiplinger.com › taxes › ev-tax-credit

IRS guidance limits the number of EVs that qualify for the full 7 500 EV tax credit Those EV tax credit rules address requirements for critical mineral and battery

Which Electric Cars Are Still Eligible For The 7 500 Federal Tax

How The Federal EV Tax Credit Can Save You 7 500 On A New Plug in Vehicle

Electric Vehicle Tax Credit You Can Still Save Greenbacks For Going Green

A Complete Guide To The New EV Tax Credit

Federal Tax Credit For Residential EV

The Lowdown On The Federal EV Tax Credit

The Lowdown On The Federal EV Tax Credit

EV Tax Credit Are You Claiming The Correct Rebates Benefits

10 Cheapest EVs When Taking Advantage Of U S Federal EV Tax Credit

And Yet Federal EV Tax Credits Force Low And Middle income Taxpayers

Federal Tax Credit Ev Income Limit - Tax credits up to 7 500 are available for eligible new electric vehicles and up to 4 000 for eligible used electric vehicles You can claim the credit yourself or work with your