Federal Tax Credit For 2023 Ev Federal Tax Credit Up To 7 500 All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to

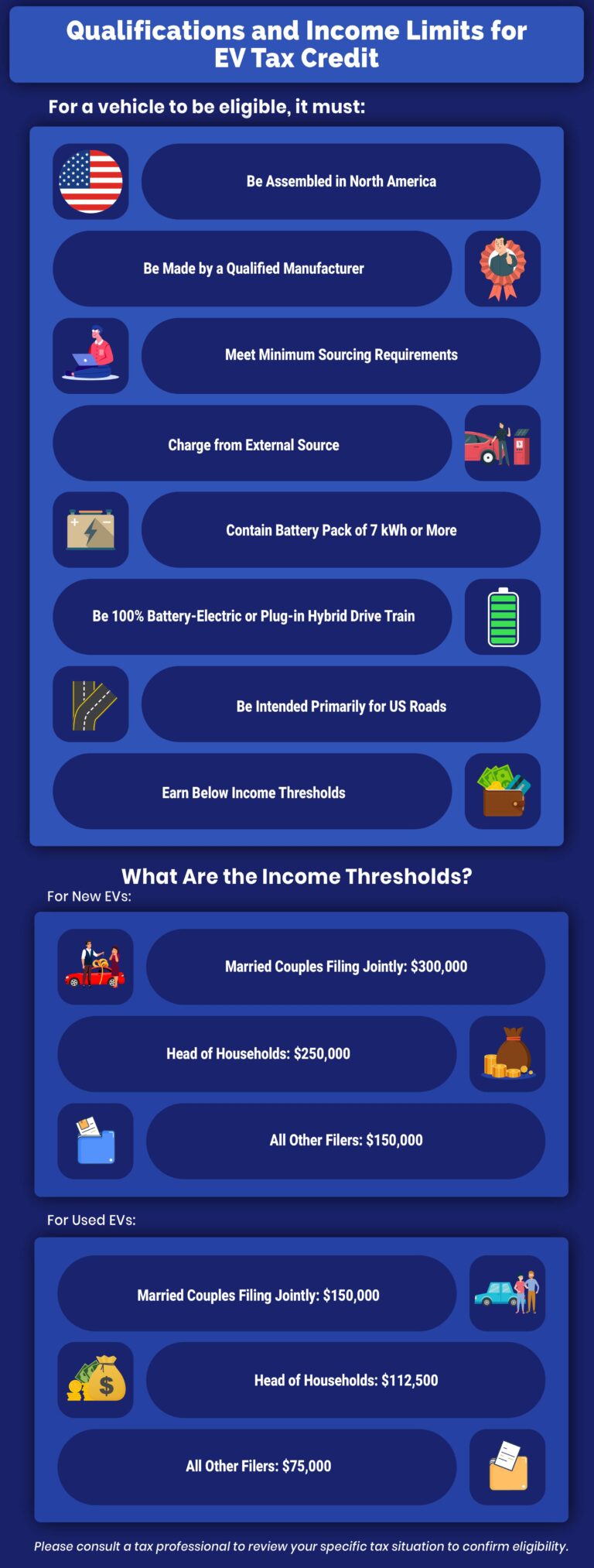

Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified The EV tax credit is a federal tax incentive for taxpayers looking to go green on the road Here are the rules income limit qualifications and how to claim the credit in 2024

Federal Tax Credit For 2023 Ev

Federal Tax Credit For 2023 Ev

https://thegreencarguy.com/wp-content/uploads/2016/05/GCG-CashandCar-1024x1024.jpg

How To Calculate Electric Car Tax Credit OsVehicle

https://cdn.osvehicle.com/how_is_tax_credit_for_ev_calculated.png

CHP Federal Tax Credit To Expire In 2024 EnergyLink

https://goenergylink.com/wp-content/uploads/2021/07/AdobeStock_98024254-1536x1022.jpeg

Beginning Jan 1 2023 eligible vehicles may qualify for a tax credit of up to 7 500 The amount of the credit depends on when the eligible new clean vehicle is For the first time in years some Teslas will qualify for a 7 500 federal tax credit for new electric vehicles But only some vehicles and only some buyers are

The Inflation Reduction Act IRA provides new opportunities for consumers to save money on clean vehicles offering multiple incentives for the purchase or lease of electric vehicles EVs plug in hybrid vehicles Today s guidance marks a first step in the Biden Administration s implementation of Inflation Reduction Act tax credits to lower costs for families and

Download Federal Tax Credit For 2023 Ev

More picture related to Federal Tax Credit For 2023 Ev

The Complete List Of Cars Eligible For The 7 500 EV And PHEV Federal

https://www.carscoops.com/wp-content/uploads/2023/01/EV-PHEV-Tax-Credit-7500-Carscoops-1024x576.jpg

Ev Tax Credit 2022 Cap Clement Wesley

https://electrek.co/wp-content/uploads/sites/3/2021/07/EV-Federal-Tax-Credit-Hero-2.jpg?quality=82&strip=all

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

https://www.ecohousesolar.com/wp-content/uploads/2022/09/Ecohouse-Tax-Credit-Featured-09.png

Until now the IRS allowed taxpayers to claim a tax credit of up to 7 500 on a new plug in vehicle with the exact amount determined by the battery s capacity in kWh Consumer Reports details the list of 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500 under the Inflation Reduction Act

Effective immediately after enactment of the Inflation Reduction Act after August 16 2022 the tax credit is only available for qualifying electric vehicles for which final assembly The IRS has given automakers a little more wiggle room around which electric vehicles will qualify for a federal tax credit worth up to 7 500 The change

C mo Funcionan Los Cr ditos Fiscales Para Veh culos Limpios Usados Y

https://blinkcharging.com/wp-content/uploads/2023/04/BlogGraphic_AprilWk2-scaled.jpg

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

https://www.autopromag.com/usa/wp-content/uploads/2022/08/EV-Federal-Tax-Credits-5MgJUp.jpeg?is-pending-load=1

https://www.fueleconomy.gov/feg/tax2023.shtml?os=...

Federal Tax Credit Up To 7 500 All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to

https://www.irs.gov/newsroom/qualifying-clean...

Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified

Federal Solar Tax Credit What It Is How To Claim It For 2024

C mo Funcionan Los Cr ditos Fiscales Para Veh culos Limpios Usados Y

EU built Electric Vehicle Tax Credit Approval Will Face Internal And

What Is An R D Tax Credit

Tution Tax Credit For Students NCS CA

Unified Tax Credit Definition InfoComm

Unified Tax Credit Definition InfoComm

EV Tax Credit 2023 New Rule Changes And What s Ahead Kiplinger

Everything You Need To Know About The IRS s New EV Tax Credit Guidance

EV Tax Credits Explained 2023 EV Tax Credit Calculator

Federal Tax Credit For 2023 Ev - You may qualify for a federal tax credit that covers 30 percent of the charger s installation cost up to 1 000