Federal Tax Credit For Solar Panels 2021 Irs Verkko 28 elok 2023 nbsp 0183 32 About Form 5695 Residential Energy Credits Instructions for Form 5695 2022 Page Last Reviewed or Updated 28 Aug 2023 If you invest in renewable energy for your home such as solar wind geothermal biomass fuel cells or battery storage you may qualify for a tax credit

Verkko claiming a 1 000 federal tax credit reduces your federal income taxes due by 1 000 1 What is the federal solar tax credit The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other types of renewable energy are also Verkko 17 helmik 2023 nbsp 0183 32 Information about Form 5695 Residential Energy Credits including recent updates related forms and instructions on how to file Use Form 5695 to figure and take your nonbusiness energy property credit

Federal Tax Credit For Solar Panels 2021 Irs

Federal Tax Credit For Solar Panels 2021 Irs

https://southfacesolar.com/wp-content/uploads/2021/01/136682227_5076885039018728_2629942985947998441_n-600x503.png

Federal Tax Credit For Solar Panels In 2023

https://static.wixstatic.com/media/f52547_b11ebc1fe3de463497ba3e65f14f30bc~mv2.png/v1/fill/w_980,h_548,al_c,q_90,usm_0.66_1.00_0.01,enc_auto/f52547_b11ebc1fe3de463497ba3e65f14f30bc~mv2.png

Solar Tax Credit 2022 Incentives For Solar Panel Installations

https://quickelectricity.com/wp-content/uploads/2020/12/Federal-Solar-Tax-Credit-Extension-2022.jpg

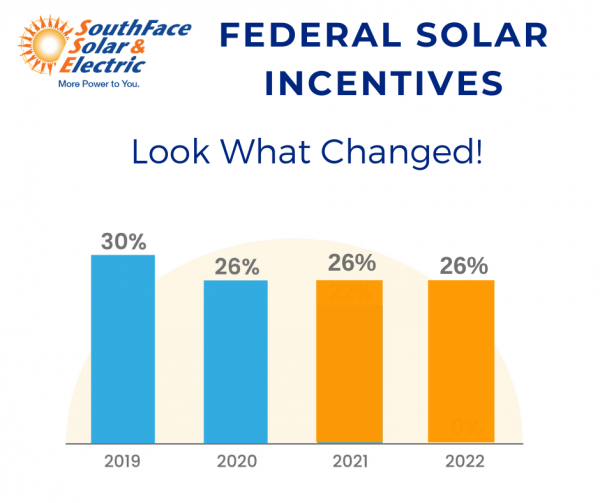

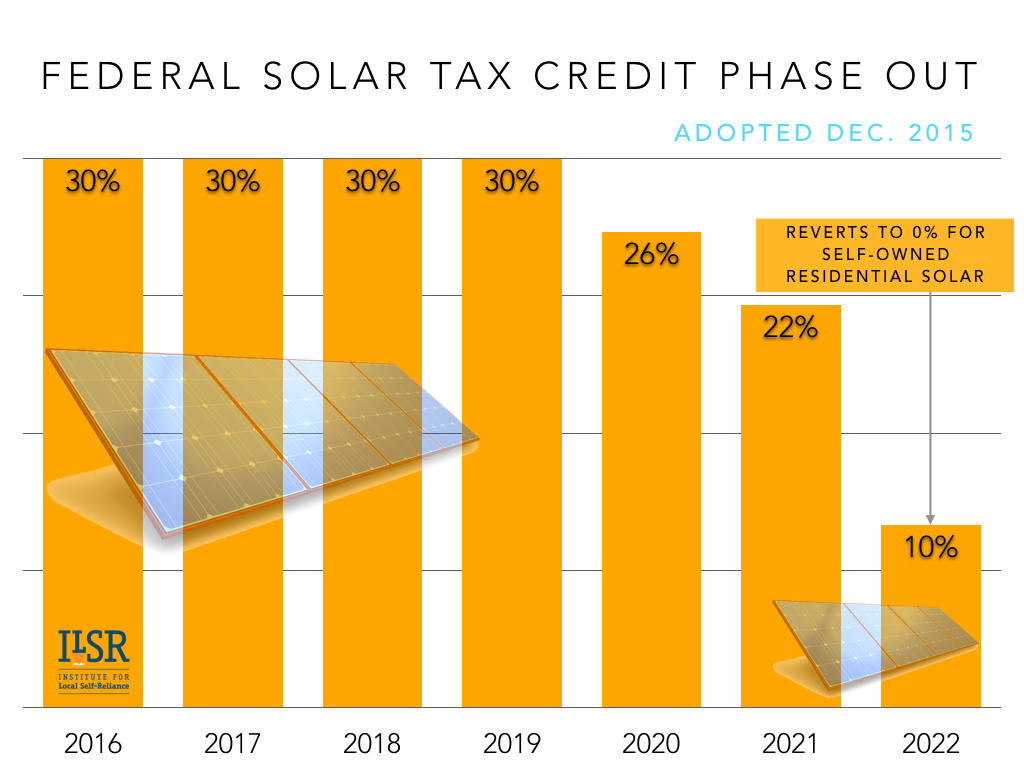

Verkko 27 huhtik 2021 nbsp 0183 32 In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year subject to the overall credit limit of 500 Verkko Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit

Verkko General Instructions Future Developments For the latest information about developments related to Form 5695 and its instructions such as legislation enacted after they were published go to IRS gov Form5695 What s New Residential clean energy credit The residential energy efficient property credit is now the residential clean energy credit Verkko Part I Residential Clean Energy Credit See instructions before completing this part Note Skip lines 1 through 11 if you only have a credit carryforward from 2021 1 Qualified solar electric property costs 1 2 Qualified solar water heating property costs 2 3

Download Federal Tax Credit For Solar Panels 2021 Irs

More picture related to Federal Tax Credit For Solar Panels 2021 Irs

How Does The Federal Tax Credit For Solar Work Tampa Bay Solar

https://tampabaysolar.com/wp-content/uploads/2022/04/AdobeStock_201159810-2048x1365.jpeg

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2022-10/Summary-ITC-and-PTC-Values-Table.png?itok=_72eWNBC

California Solar Tax Credit LA Solar Group

https://la-solargroup.com/wp-content/uploads/2020/10/Calculating-Solar-Tax-Credit.jpg

Verkko 19 lokak 2023 nbsp 0183 32 In an effort to encourage Americans to use solar power the US government offers tax credits for solar systems The Inflation Reduction Act renamed and extended the existing solar tax credit through 2034 for solar system installations on residential property It also increased the credit s value Verkko 8 syysk 2022 nbsp 0183 32 The U S Department of Energy DOE Solar Energy Technologies Office SETO developed three resources to help Americans navigate changes to the federal solar Investment Tax Credit ITC which was expanded in 2022 through the passage of the Inflation Reduction Act IRA

Verkko Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 4 It will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034 Verkko 22 marrask 2023 nbsp 0183 32 To claim the solar tax credit you ll need all the receipts from your solar installation as well as IRS form 1040 and form 5695 and instructions for both of those forms We ve included an example below of how to fill out the tax forms

The Federal Solar Tax Credit What You Need To Know 2022

https://sandbarsc.com/wp-content/uploads/2017/07/solar-tax-credit.jpg

Irs Solar Tax Credit 2022 Form

https://hub.utahcleanenergy.org/wp-content/uploads/2021/02/Federal-ITC-Solar1.png

https://www.irs.gov/credits-deductions/residential-clean-energy-credit

Verkko 28 elok 2023 nbsp 0183 32 About Form 5695 Residential Energy Credits Instructions for Form 5695 2022 Page Last Reviewed or Updated 28 Aug 2023 If you invest in renewable energy for your home such as solar wind geothermal biomass fuel cells or battery storage you may qualify for a tax credit

https://www.energy.gov/sites/default/files/2021/02/f82/Guid…

Verkko claiming a 1 000 federal tax credit reduces your federal income taxes due by 1 000 1 What is the federal solar tax credit The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other types of renewable energy are also

How Does The Federal Solar Tax Credit Work Nicki Karen

The Federal Solar Tax Credit What You Need To Know 2022

Federal Solar Tax Credit A Quick Rundown Next Energy Solution

How To Claim Solar Tax Credit 2023 Internal Revenue Code Simplified

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

Federal Solar Tax Credit Take 30 Off Your Solar Cost Page 2 Of 3

Federal Solar Tax Credit Take 30 Off Your Solar Cost Page 2 Of 3

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

Solar Tax Credit Guide And Calculator

Congress Gets Renewable Tax Credit Extension Right Institute For

Federal Tax Credit For Solar Panels 2021 Irs - Verkko Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit