Federal Tax Credit Solar Asphalt Rebate Web 28 ao 251 t 2023 nbsp 0183 32 If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual

Web 22 d 233 c 2022 nbsp 0183 32 IR 2022 225 December 22 2022 WASHINGTON The Internal Revenue Service today released frequently asked questions FAQs about energy efficient home Web For example if your solar PV system was installed in 2022 installation costs totaled 18 000 and your state government gave you a one time rebate of 1 000 for installing

Federal Tax Credit Solar Asphalt Rebate

Federal Tax Credit Solar Asphalt Rebate

https://assets.solar.com/wp-content/uploads/2022/08/tax-credit-form.png

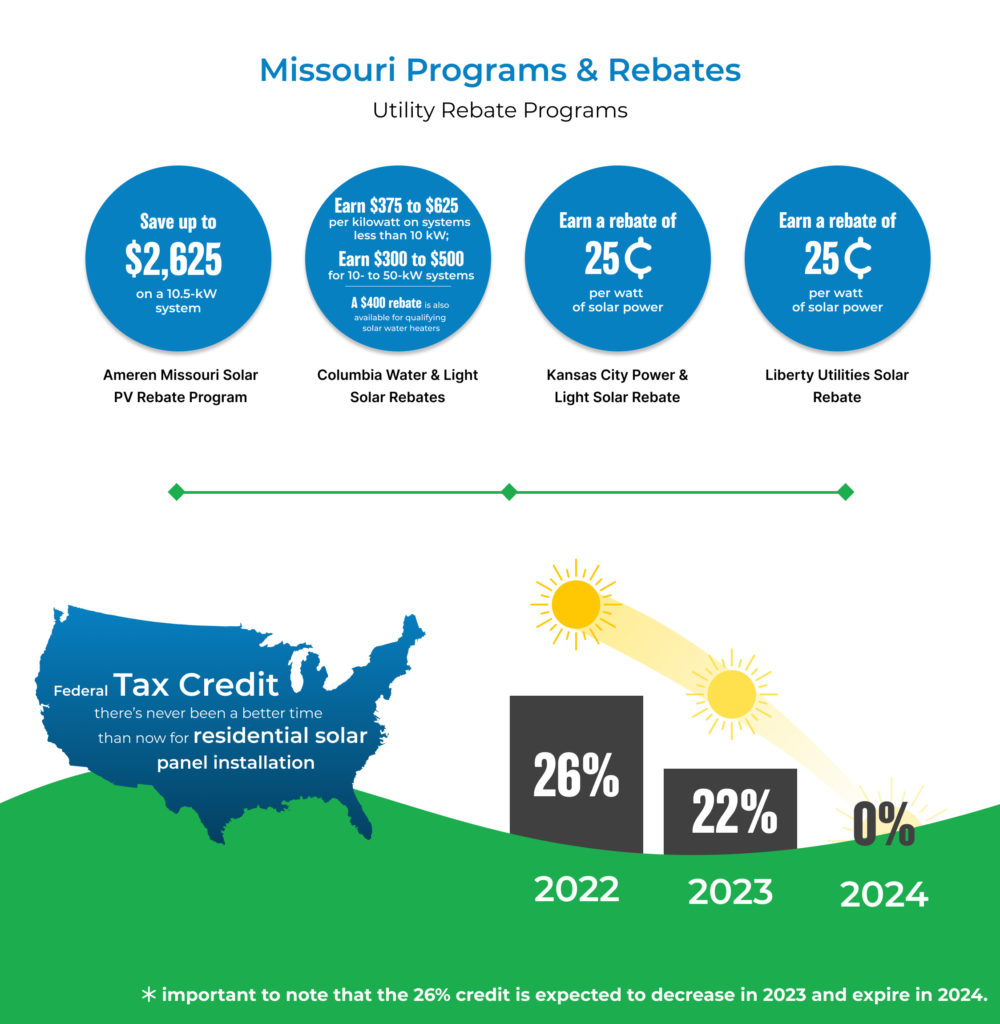

Solar Tax Credits Rebates Missouri Arkansas

https://soleraenergyllc.com/wp-content/uploads/2022/07/Graphic-1000x1024.jpg

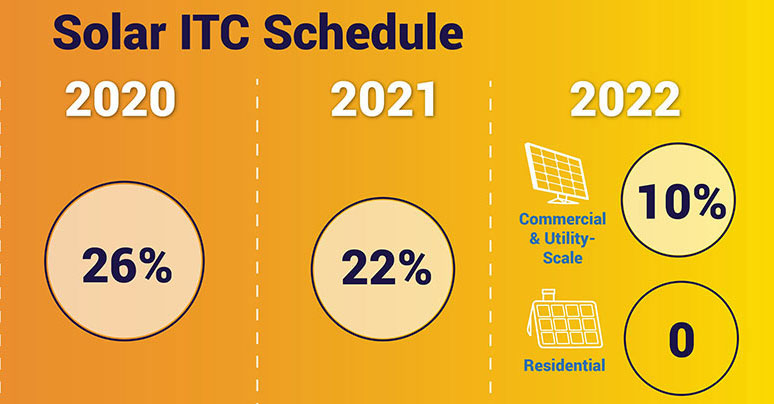

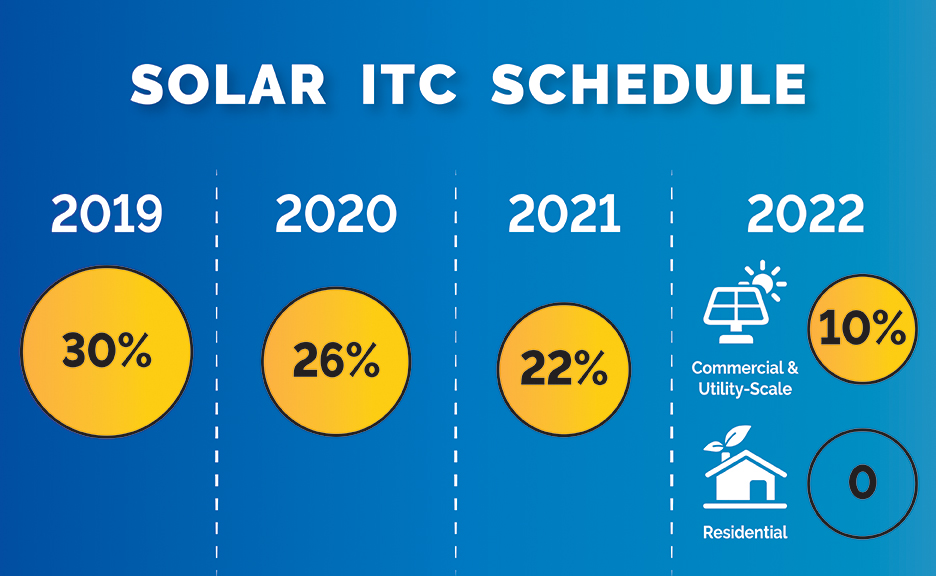

What You Need To Know About The ITC Solar Tax Credit Decreasing After

https://amsunsolar.com/wp-content/uploads/2019/02/ITC-Solar-Tax-Credit-A.M.-Sun-Solar.jpg

Web The flagship home energy discount included in the IRA is the residential clean energy credit which offers homeowners 30 off the cost of new qualified clean energy Web For example if your solar PV system was installed in 2022 installation costs totaled 18 000 and your state government gave you a one time rebate of 1 000 for installing

Web For example if your solar PV system was installed before December 31 2022 cost 18 000 and your utility gave you a one time rebate of 1 000 for installing the system Web 8 sept 2022 nbsp 0183 32 The U S Department of Energy DOE Solar Energy Technologies Office SETO developed three resources to help Americans navigate changes to the federal

Download Federal Tax Credit Solar Asphalt Rebate

More picture related to Federal Tax Credit Solar Asphalt Rebate

The Federal Solar Tax Credit Extension Can We Win If We Lose

http://ilsr.org/wp-content/uploads/2015/09/value-of-federal-itc-over-time-ilsr.jpg

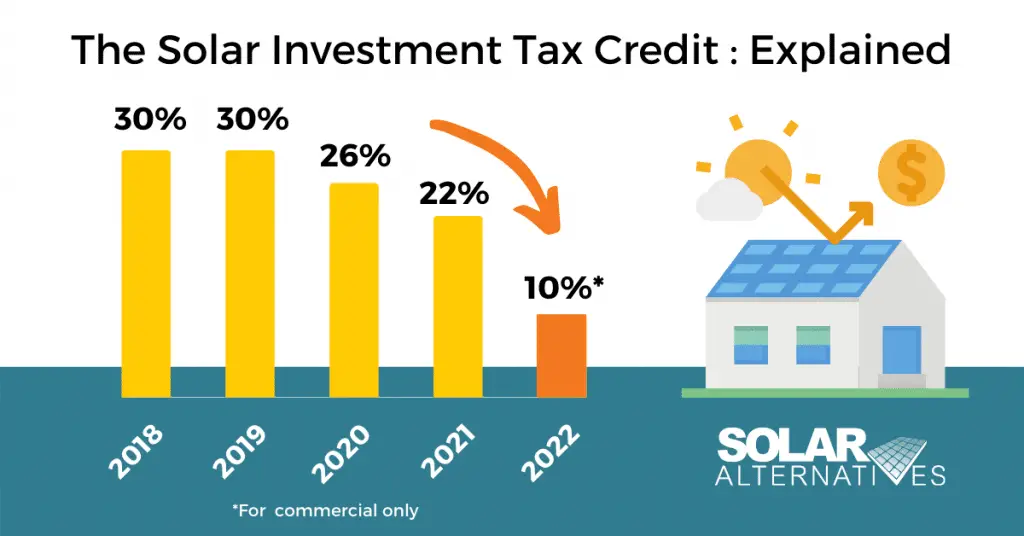

How Much Is The Federal Tax Credit For Solar SolarProGuide

https://www.solarproguide.com/wp-content/uploads/the-solar-tax-credit-explained-solalt.png

How To File For The Solar Tax Credit IRS Form 5695 Instructions 2023

https://www.solarreviews.com/content/images/blog/irs_form2021.png

Web 7 sept 2023 nbsp 0183 32 The Energy Community Tax Credit Bonus program provides 10 extra tax credits to solar and storage projects on top of the 30 investment tax credits ITCs or Web No Caution If you checked the No box you cannot claim the energy efficient home improvement credit Do not complete Part II

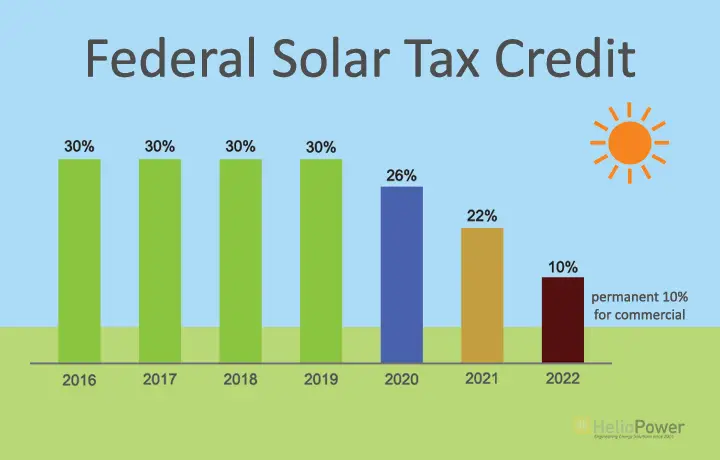

Web 16 mars 2023 nbsp 0183 32 The residential solar energy credit is worth 30 of the installed system costs through 2032 26 in 2033 22 in 2034 and expires after that What is the Web 1 ao 251 t 2023 nbsp 0183 32 The U S government offers a solar tax credit that can reach up to 30 of the cost of installing a system that uses the sun to power your home What is the federal

Federal Solar Tax Credit Take 30 Off Your Solar Cost Solar 2022

https://s3.amazonaws.com/solarassets/wp-content/uploads/2022/08/solar-tax-credit-before-and-after-inflation-reduction-act-1024x1013.jpg

Federal Solar Tax Credit 2022 SolarDailyDigest

https://www.solardailydigest.com/wp-content/uploads/2022-federal-solar-tax-credit-solarproguide-com.png

https://www.irs.gov/credits-deductions/residential-clean-energy-credit

Web 28 ao 251 t 2023 nbsp 0183 32 If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual

https://www.irs.gov/newsroom/irs-releases-frequently-asked-questions...

Web 22 d 233 c 2022 nbsp 0183 32 IR 2022 225 December 22 2022 WASHINGTON The Internal Revenue Service today released frequently asked questions FAQs about energy efficient home

2018 Guide To Wisconsin Home Solar Incentives Rebates And Tax Credits

Federal Solar Tax Credit Take 30 Off Your Solar Cost Solar 2022

How Solar Works In Florida Step By Step Guide Florida Solar Report

How To File The Federal Solar Tax Credit A Step By Step Guide Solar

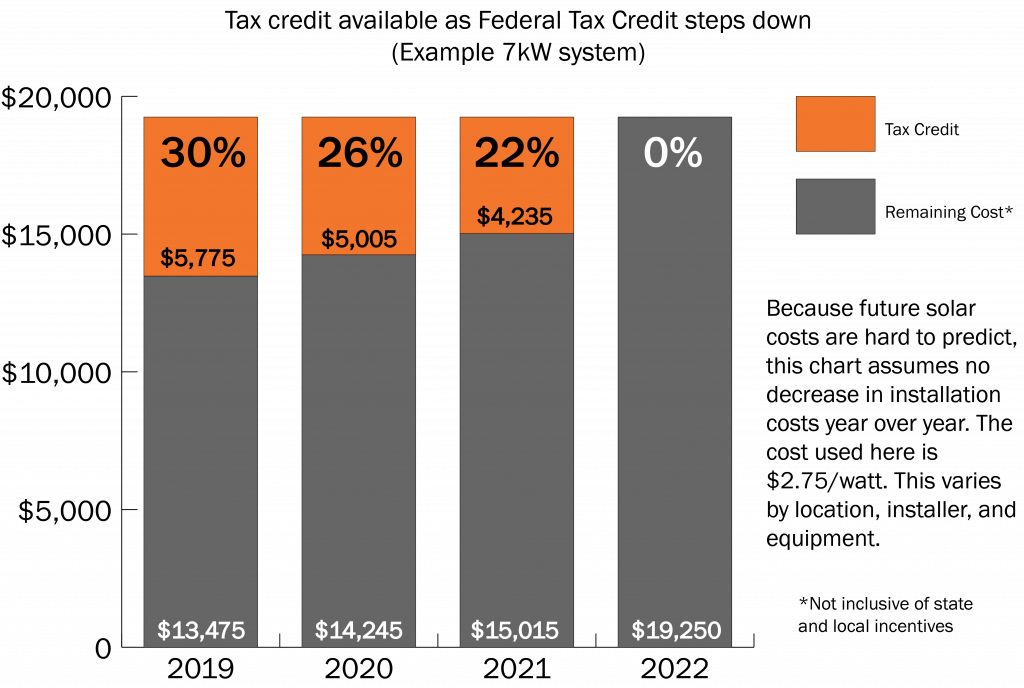

Go Solar In 2019 To Take Full Advantage Of The Federal Solar Tax Credit

When Does The Federal Solar Tax Credit Expire IWS

When Does The Federal Solar Tax Credit Expire IWS

Solar Tax Credit ITC Extension The Enrgy Miser

The Federal Solar Tax Credit Explained Sunshine Plus Solar

Is There An Income Limit For Solar Tax Credit SolarProGuide

Federal Tax Credit Solar Asphalt Rebate - Web For example if your solar PV system was installed before December 31 2022 cost 18 000 and your utility gave you a one time rebate of 1 000 for installing the system