Federal Tax Credit Solar Form Information about Form 5695 Residential Energy Credits including recent updates related forms and instructions on how to file Use Form 5695 to figure and take your nonbusiness energy property credit and residential energy

Residential clean energy credit Enter the smaller of line 13 or line 14 Also include this amount How do I claim the federal solar tax credit After seeking professional tax advice and ensuring you are eligible for the credit you can complete and attach IRS Form 5695 to your federal tax return Form 1040 or Form 1040NR

Federal Tax Credit Solar Form

Federal Tax Credit Solar Form

https://www.aesinspect.com/wp-content/uploads/2022/11/AdobeStock_535970711-scaled.jpeg

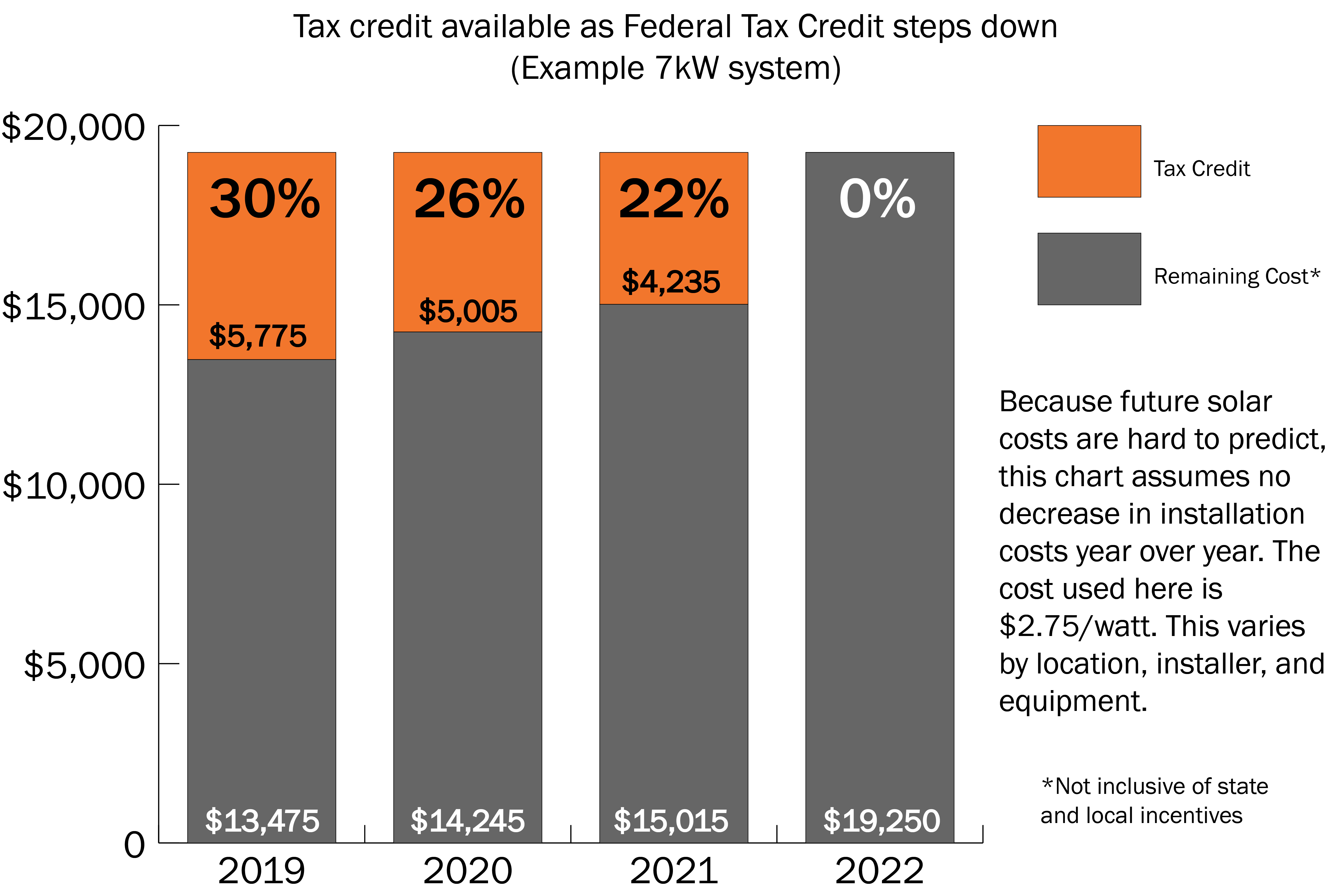

Solar Tax Credit Graph without Header Solar United Neighbors

https://www.solarunitedneighbors.org/wp-content/uploads/2019/03/Solar-tax-credit-graph-without-header.png

When Does Solar Tax Credit End SolarProGuide 2022

https://www.solarproguide.com/wp-content/uploads/when-does-the-federal-solar-tax-credit-expire.png

You will need four IRS tax forms to file for your solar tax credit Form 1040 Step by step instructions for using IRS Form 5695 to claim the 30 federal solar tax credit

This federal residential solar energy credit makes solar energy more affordable by giving a dollar for dollar tax reduction Your solar energy system must have started service during the current tax year to qualify for the To claim the solar tax credit you ll need to first determine if you re eligible then

Download Federal Tax Credit Solar Form

More picture related to Federal Tax Credit Solar Form

26 Federal Solar Tax Credit Extended SolarTech

https://solartechonline.com/wp-content/uploads/011022-Fed-Solar-Tax-Credit.jpg

26 Federal Tax Credit Extended Stateline Solar

https://statelinesolar.net/wp-content/uploads/2020/12/Federal-Investment-Tax-Credit-Graphic-1-1000x675.png

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

https://i.ytimg.com/vi/1fI71WzZo5w/maxresdefault.jpg

Steps to claim the Solar Tax Credit There are three major steps you ll need to IRS Form 5695 is needed in your Federal tax filings to calculate the number of tax credits you can gain from your qualified home energy improvements These home improvements include geothermal heat pumps solar panels solar batteries

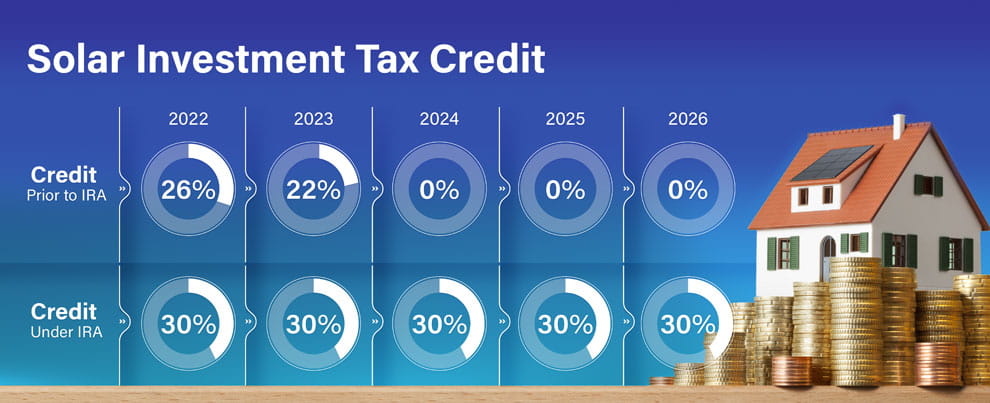

In an effort to encourage Americans to use solar power the US government offers tax credits for solar systems The Inflation Reduction Act renamed and extended the existing solar tax credit through 2034 for solar Using Form 5695 we calculated a 9 000 federal solar tax credit for purchasing

The Federal Solar Tax Credit Extension Can We Win If We Lose

http://ilsr.org/wp-content/uploads/2015/09/value-of-federal-itc-over-time-ilsr.jpg

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

https://www.altestore.com/blog/wp-content/uploads/2021/12/form-5695-example.png

https://www.irs.gov › forms-pubs

Information about Form 5695 Residential Energy Credits including recent updates related forms and instructions on how to file Use Form 5695 to figure and take your nonbusiness energy property credit and residential energy

https://www.irs.gov › pub › irs-pdf

Residential clean energy credit Enter the smaller of line 13 or line 14 Also include this amount

How Does The Federal Solar Tax Credit Work PB Roofing Co

The Federal Solar Tax Credit Extension Can We Win If We Lose

What You Need To Know About The ITC Solar Tax Credit Decreasing After

How The Solar Tax Credit Works 2022 Federal Solar Tax Credit

Solar Tax Credit In 2021 SouthFace Solar Electric AZ

Federal Solar Tax Credit A Quick Rundown Next Energy Solution

Federal Solar Tax Credit A Quick Rundown Next Energy Solution

The 30 Solar Tax Credit Has Been Extended Through 2032

How The Solar Tax Credit Works California Sustainables

Everything You Need To Know The 2023 Federal Solar Tax Credit

Federal Tax Credit Solar Form - You will need four IRS tax forms to file for your solar tax credit Form 1040