Federal Tax Credits For Electric Vehicles 2022 If you bought a new qualified plug in electric vehicle EV between 2010 and 2022 you may be eligible for a new electric vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D

All electric and plug in hybrid vehicles purchased new from 2010 through 2022 may be eligible for a federal income tax credit of up to 7 500 The credit amount will vary based on the capacity of the battery used to power the vehicle View requirements State and or local incentives may also apply You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032

Federal Tax Credits For Electric Vehicles 2022

Federal Tax Credits For Electric Vehicles 2022

https://michiganadvance.com/wp-content/uploads/2022/02/IMG_5264-3-2048x1362-1.jpeg

Clean Vehicle Credits For Electric Vehicles

https://tax.thomsonreuters.com/blog/wp-content/uploads/sites/17/2022/11/AdobeStock_283667263-scaled.jpeg

Do The Current EVs In The Market Qualify For The Newly Expanded Tax

https://1401700980.rsc.cdn77.org/data/images/full/107737/do-the-current-evs-in-the-market-qualify-for-the-newly-expanded-tax-credits-for-electric-vehicles.jpg

August 16 2022 Today s guidance marks a first step in the Biden Administration s implementation of Inflation Reduction Act tax credits to lower costs for families and make electric vehicles more affordable Electric vehicles purchased in 2022 or before are still eligible for tax credits If you bought a new qualified plug in electric vehicle in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 Learn more Sign Up for Email Updates

If you purchased a new all electric vehicle EV or plug in hybrid electric vehicle PHEV during or after 2010 you may be eligible for a federal income tax credit of up to 7 500 according to the U S Department of Energy The total federal incentive amount depends on the capacity of the battery used to power your car and state and or Tucked inside the massive Inflation Reduction Act of 2022 that was signed into law in August is a complex set of requirements around which EVs and other clean vehicles do and do not qualify for a

Download Federal Tax Credits For Electric Vehicles 2022

More picture related to Federal Tax Credits For Electric Vehicles 2022

Qualifying Cars For The 2022 Electric Vehicle Tax Credit Verified

https://verified.imgix.net/articles/en-us/guides/electric-vehicle-tax-credits/electric-vehicle-tax-credit.jpg

New EV Tax Credits In 2024 Every Electric Vehicle Incentive

https://www.motortrend.com/uploads/sites/5/2021/02/2022-Chevrolet-Bolt-EUV-Electric-SUV-13.jpg

Tax Credits For Electric Vehicles Are About To Get Confusing The New

https://static01.nyt.com/images/2022/12/28/multimedia/28ev-credits-1-5aaf/28ev-credits-1-5aaf-superJumbo.jpg?quality=75&auto=webp

The Inflation Reduction Act of 2022 Public Law 117 169 amended the Qualified Plug in Electric Drive Motor Vehicle Credit IRC 30D now known as the Clean Vehicle Credit and added a new requirement for final assembly in North America that took effect on August 17 2022 If you re thinking about buying an electric car or a plug in hybrid you should be aware that the list of vehicles that are eligible for a federal EV tax credit of up to 7 500 is different as of

Federal income tax credit up to 7 500 Currently 7 500 is the maximum amount available to buyers of new fully electric or plug in hybrid cars leasing only qualifies for the leasing The big climate and health care bill signed into law by President Biden has what at first sight looks like a big incentive for those shopping for a car a revamped 7 500 tax credit if you buy a

Tax Credits For Electric Vehicles Are Coming How Will They Work

https://d3i6fh83elv35t.cloudfront.net/static/2022/12/2022-12-15T060110Z_413186042_RC2V9R9KNSRR_RTRMADP_3_USA-BIOFUELS-1024x683.jpg

Income Tax Credit Electric Vehicle Update Income Tax Payments Deferred

https://www.taxproadvice.com/wp-content/uploads/tax-credits-drive-electric-northern-colorado-932x1024.png

https://www.irs.gov/credits-deductions/...

If you bought a new qualified plug in electric vehicle EV between 2010 and 2022 you may be eligible for a new electric vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D

https://www.fueleconomy.gov/feg/tax2022.shtml

All electric and plug in hybrid vehicles purchased new from 2010 through 2022 may be eligible for a federal income tax credit of up to 7 500 The credit amount will vary based on the capacity of the battery used to power the vehicle View requirements State and or local incentives may also apply

How The Inflation Reduction Act And Bipartisan Infrastructure Law Work

Tax Credits For Electric Vehicles Are Coming How Will They Work

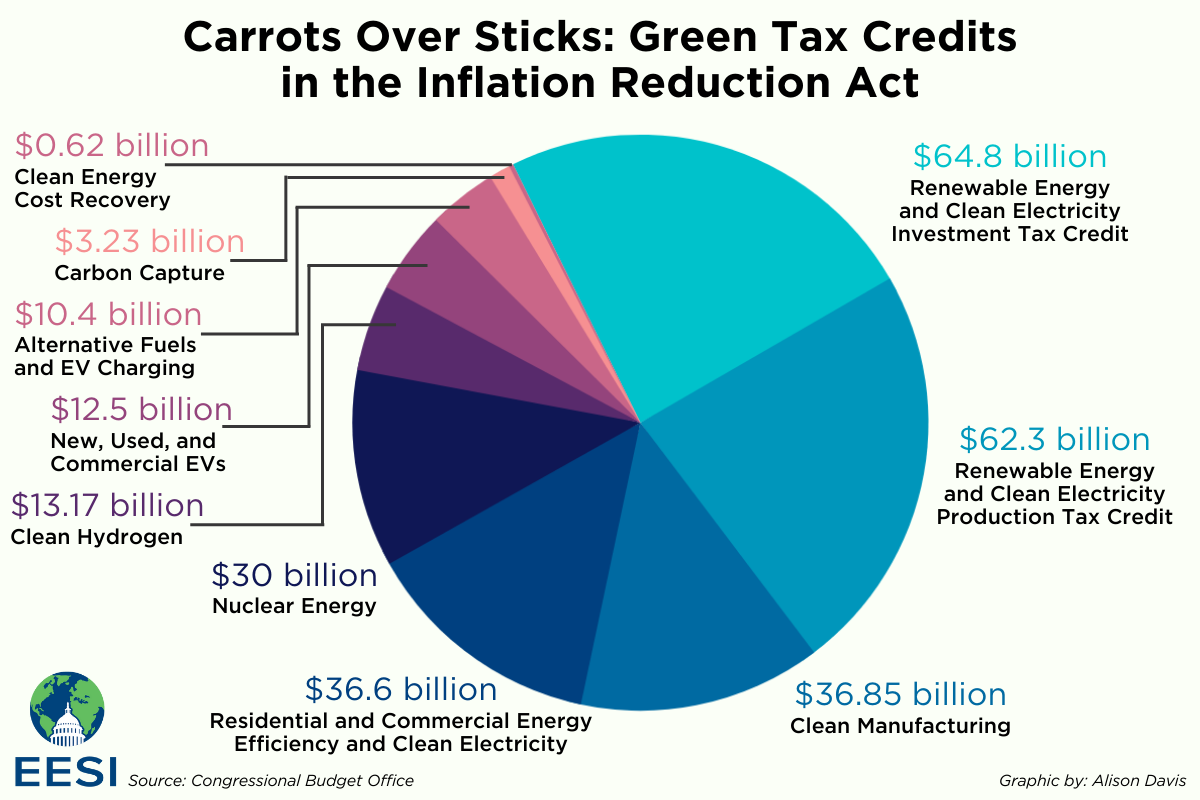

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

What s The Deal With Tax Credits For Electric Vehicles Publications

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

Federal Solar Tax Credit What It Is How To Claim It For 2024

Ford Confirms Tax Credits For Electric Vehicles And Plug In Hybrids In

2023 Electric Vehicle Tax Credit BenefitsFinder

Federal Tax Credits For Electric Vehicles 2022 - Dec 29 Reuters The U S Treasury Department said on Thursday that electric vehicles leased by consumers can qualify starting Jan 1 for up to 7 500 in commercial clean vehicle