Federal Tax Credits For Home Improvements 2022 The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations work

Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy efficient home improvement credit is increased for years after 2022 with an annual credit of generally up to 1 200 The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner energy sources Homeowners Can Save Up to 3 200 Annually on Taxes for Energy Efficient Upgrades SEE TAX

Federal Tax Credits For Home Improvements 2022

Federal Tax Credits For Home Improvements 2022

https://www.dailymoss.com/wp-content/uploads/2022/08/easy-ertc-application-how-businesses-claim-employee-tax-credits-for-2020-amp-202-62f607d891d65.png

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

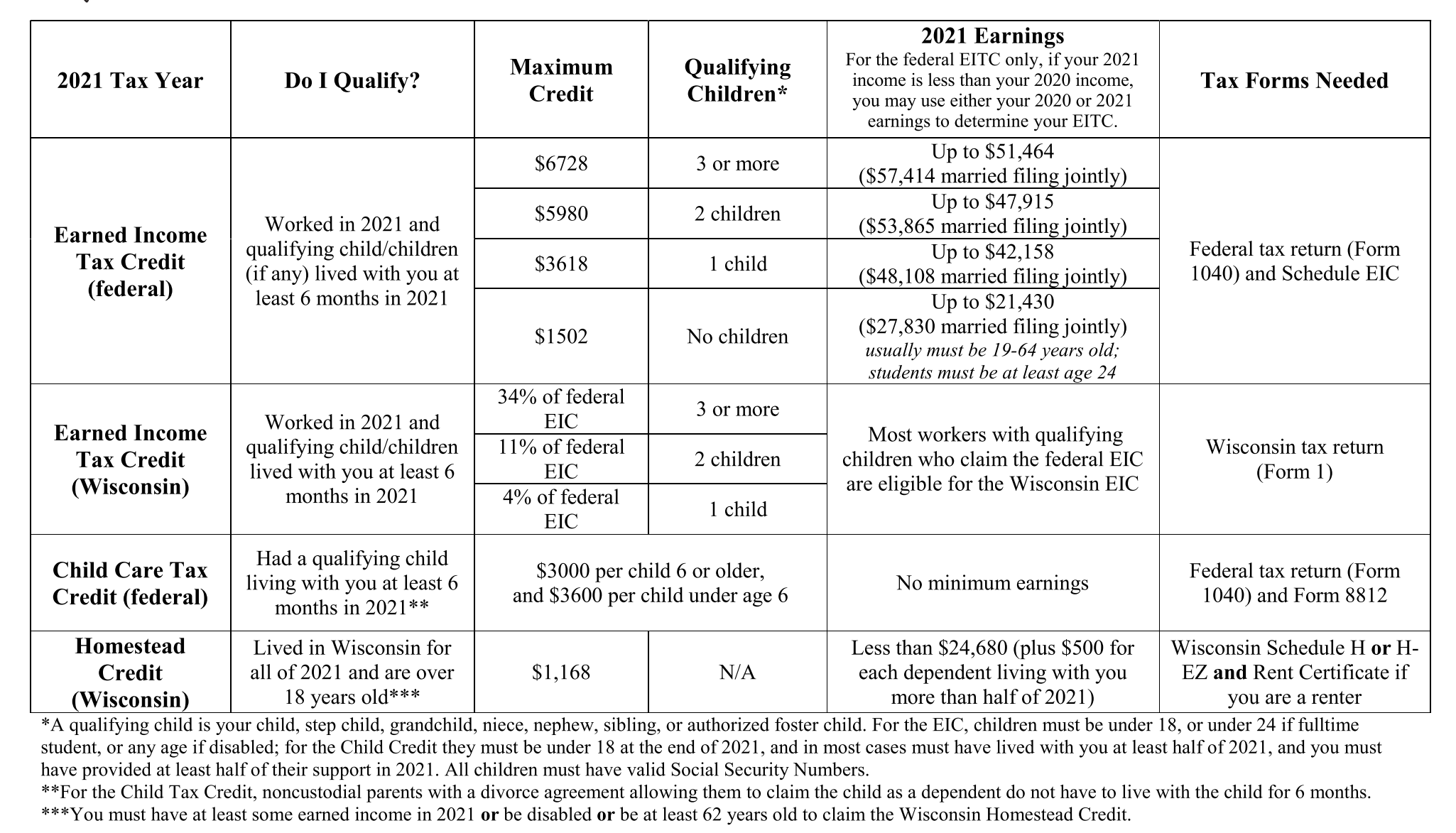

2021 Tax Credits Get The Credit You Deserve Financial Education

https://finances.extension.wisc.edu/files/2021/09/2021-tax-credits-e1643336436945.png

December 22 2022 The IRS today released frequently asked questions FAQs PDF 357 KB regarding energy efficient home improvements and residential clean energy property credits which were amended by H R 5376 commonly called the Inflation Reduction Act of 2022 IRA 150 N A Updated Tax Credit Available for 2023 2032 Tax Years 30 of cost up to 2 000 per year 30 of cost up to 600 Subject to cap of 1 200 year Frequently Asked Questions Q Who is eligible for tax credits A Homeowners including renters for certain expenditures who purchase energy and other eficient appliances and

OVERVIEW If your home renovation project includes the installation of energy efficient equipment a tax credit may be available to you TABLE OF CONTENTS Credits for renovating your home Nonbusiness Energy Property credit through 2022 Energy Efficient Home Improvement credit for 2023 through 2032 Click to expand Key Takeaways Information updated 12 30 2022 The Non Business Energy Property Tax Credits outlined below apply retroactively through 12 31 2022 Tax Credit 10 of cost up to 500 or a specific amount from 50 300 Expires December 31 2022 Details Must be placed in service in an existing home which is your principal residence by December 31 2022

Download Federal Tax Credits For Home Improvements 2022

More picture related to Federal Tax Credits For Home Improvements 2022

Get The Power Of Tax Credits For Your Businesses

https://imageio.forbes.com/specials-images/imageserve/6382a9dd088a90f846f35930/0x0.jpg?format=jpg&crop=3207,3207,x0,y0,safe&width=1200

How To Fill TD1 2022 Personal Tax Credits Return Form Federal YouTube

https://i.ytimg.com/vi/Hg0fOlxqHpU/maxresdefault.jpg

The Value Of Investment Tax Credits For Your Business

https://torontoaccountant.ca/wp-content/uploads/2014/11/Tax-credits.jpg

Published August 29 2022 Fact checked by Ryan Eichler If you ve been considering making green home improvements you might be in for some budgetary luck President Biden signed the In order to apply any qualifying tax credits on your 2022 tax return you ll want to download and complete the 2022 version of this worksheet provided by the IRS IRS Form 5695 Residential Energy Credits If you have questions during this process contact your tax preparer or the Internal Revenue Service IRS for more information

OVERVIEW Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034 and expanded starting in 2023 TABLE OF CONTENTS What are energy tax credits targeting home improvements Energy Efficient Home Improvement Credit Residential Clean Energy Credit Click to Advertiser disclosure Energy Efficient Home Improvement Credit Qualifying Expenses in 2024 If you gave your home an eco friendly makeover in 2023 don t forget to look into the IRS new

Updated Tax Exemptions And Tax Credits For The Financial Year 2021 2022

https://tax.net.pk/wp-content/uploads/2021/07/Updated-tax-exemptions-and-tax-credits.jpeg

New Tax Credits For Volunteer First Responders Introduced

https://www.vmcdn.ca/f/files/moosejawtoday/images/finance/tax-credits-concept-stock.jpg;w=1000;h=667;mode=crop

https://www. irs.gov /newsroom/irs-releases...

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations work

https://www. irs.gov /pub/taxpros/fs-2022-40.pdf

Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy efficient home improvement credit is increased for years after 2022 with an annual credit of generally up to 1 200

Can You Get A Tax Credit For Your Energy Saving Roof Slate Slate

Updated Tax Exemptions And Tax Credits For The Financial Year 2021 2022

HMRC Issue Tax Credits Claim Reminder Adapt Accountancy

2022 Education Tax Credits Are You Eligible

2023 Residential Clean Energy Credit Guide ReVision Energy

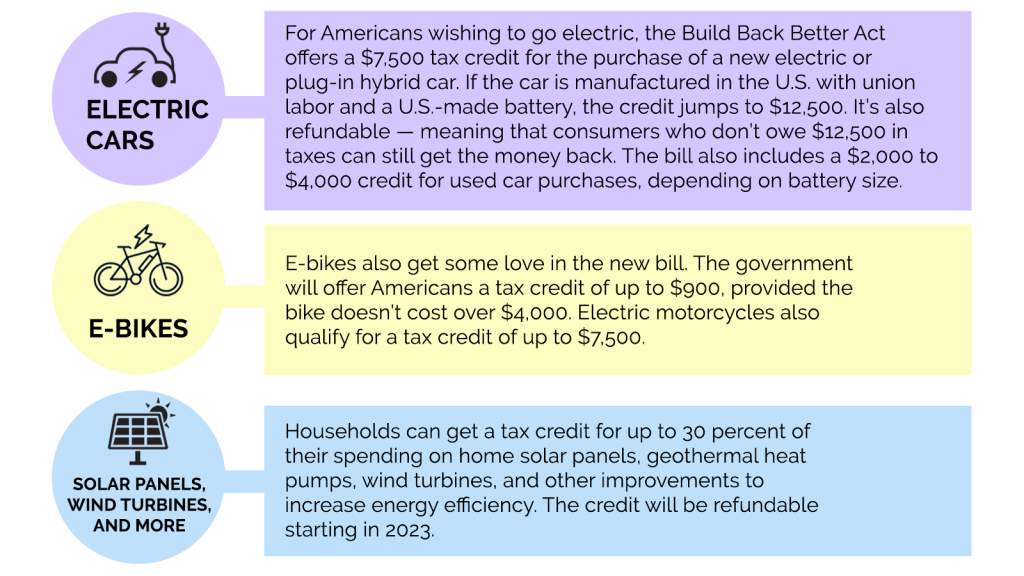

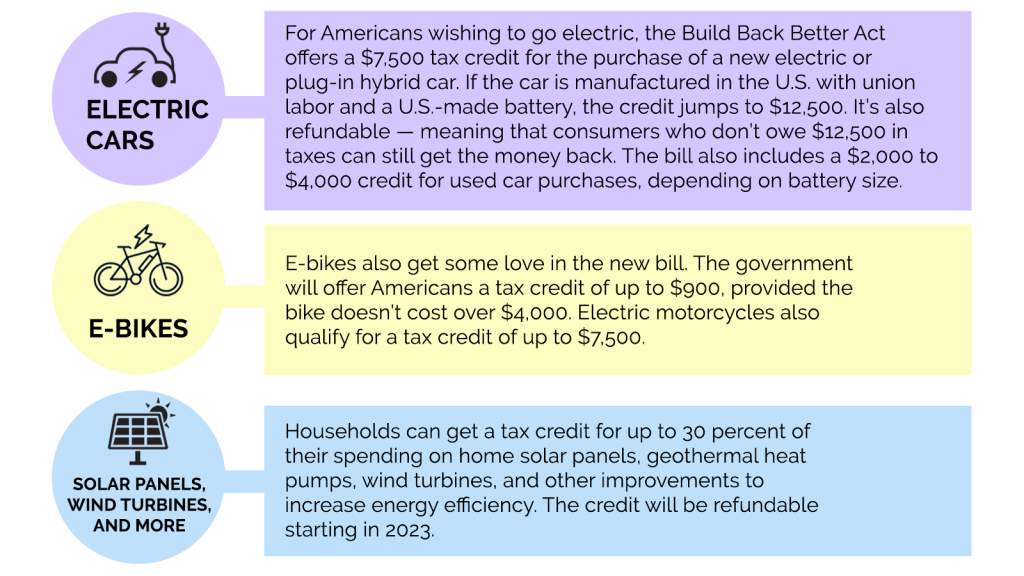

Green Incentives Usually Help The Rich Here s How The Build Back

Green Incentives Usually Help The Rich Here s How The Build Back

Renaldo Cano

Tax Credits For Paid Sick And Paid Family And Medical Leave Questions

Tax Credits For Energy Efficient Home Improvements 2022 YouTube

Federal Tax Credits For Home Improvements 2022 - OVERVIEW If your home renovation project includes the installation of energy efficient equipment a tax credit may be available to you TABLE OF CONTENTS Credits for renovating your home Nonbusiness Energy Property credit through 2022 Energy Efficient Home Improvement credit for 2023 through 2032 Click to expand Key Takeaways