Federal Tax Credits For Recycling Federal Tax Breaks for Recycling and Energy Conservation IRS recycling tax credits The IRS offers both depreciation credits for recycling and energy credits for using products such as solar panels and fuel cells

Helping the environment and receiving tax breaks at the same time It s a win win IRS tax credits The Internal Revenue Service offers the following financial incentives connected to a business s compliance with recycling standards Qualified reuse Deposit refund systems are a prominent example of a Tax Subsidy incentive approach Take for example a beverage container recycling program First a product charge or tax is initiated that increases the upfront cost of purchasing the container Second a subsidy is rewarded to the consumer for recycling or properly disposing of the container

Federal Tax Credits For Recycling

Federal Tax Credits For Recycling

https://imageio.forbes.com/specials-images/imageserve/6382a9dd088a90f846f35930/0x0.jpg?format=jpg&crop=3207,3207,x0,y0,safe&width=1200

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

https://www.ecohousesolar.com/wp-content/uploads/2022/09/Ecohouse-Tax-Credit-Featured-09.png

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

The IRS offers recycling tax credits to businesses and organizations that take part in the recycling of certain materials These credits are based on the amount of money spent on the materials as well as the type of material recycled Tax Benefits of Recycling Federal and State Tax Credits Some federal and state programs provide companies with tax breaks for companies that collect process and sell recycled materials As a result this credit can aid in lowering the expenses of recycling programs Reduced Landfill Taxes Some States have to levy taxes on companies that

We found that 22 states have recycling tax credit programs 28 do not This compares to a 1993 study by the California Integrated Waste Management Board Sacramento of state by state financial assistance programs which listed 28 states The Biden administration is expanding a federal tax credit that seeks to incentivize domestic production of components for solar and wind energy as well as batteries The Treasury Department

Download Federal Tax Credits For Recycling

More picture related to Federal Tax Credits For Recycling

Revamping The Federal EV Tax Credit Could Help Average Car Buyers

https://theicct.org/wp-content/uploads/2022/06/epv-us-tax-credit-fig-jun22.png

Federal Solar Tax Credit What It Is How To Claim It For 2024

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

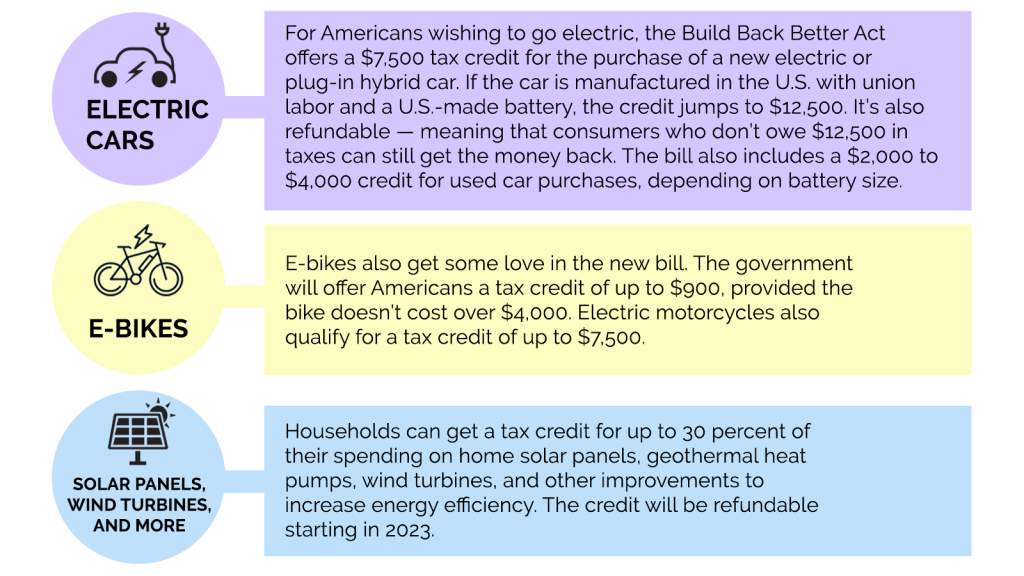

Green Incentives Usually Help The Rich Here s How The Build Back

https://grist.org/wp-content/uploads/2021/12/tax-credits-chart.png?w=1024

Recycling is an important economic driver as it helps create jobs and tax revenues The Recycling Economic Information REI Report found that in a single year recycling and reuse activities in the United States accounted for 757 000 jobs 36 6 billion in wages and 6 7 billion in tax revenues As part of President Biden s Investing in America agenda DOE Treasury and IRS announced 4 billion in tax credits for projects that expand clean energy or critical materials manufacturing or recycling with 1 6 billion set aside for

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 According to ISRI current guidance on section 45X disincentivizes recycling by providing a credit for the production within the U S and sale of certain eligible components including solar and wind energy components inverters qualifying battery components and applicable critical minerals

The Value Of Investment Tax Credits For Your Business

https://torontoaccountant.ca/wp-content/uploads/2014/11/Tax-credits.jpg

Tax Credits For Paid Sick And Paid Family And Medical Leave Questions

https://cdn.graydon.website/wp-content/uploads/2020/03/24072513/2020_03_20_2020_TAX_CREDITS_JAK-scaled.jpg

https://globaltrashsolutions.com/blog/recycling...

Federal Tax Breaks for Recycling and Energy Conservation IRS recycling tax credits The IRS offers both depreciation credits for recycling and energy credits for using products such as solar panels and fuel cells

https://bestcompany.com/tax-relief/blog/business...

Helping the environment and receiving tax breaks at the same time It s a win win IRS tax credits The Internal Revenue Service offers the following financial incentives connected to a business s compliance with recycling standards Qualified reuse

HMRC Issue Tax Credits Claim Reminder Adapt Accountancy

The Value Of Investment Tax Credits For Your Business

How Do I Apply For ERC Tax Credit In 2023 A Must Read

When Are Tax Credits Ending How To Apply For Universal Credit

Tax Credits For Giving Ozarks Food Harvest

New Tax Credits For Volunteer First Responders Introduced

New Tax Credits For Volunteer First Responders Introduced

30 Federal Tax Credits For Heat Pump Water Heaters 2023

Solar Tax Credit 2022 Incentives For Solar Panel Installations

Energy Tax Credits For Homeowners And Businesses In 2023 ACT Blogs

Federal Tax Credits For Recycling - Kamala Harris vowed to create an opportunity economy with an economic plan that includes a ban on grocery price gouging and a 6 000 tax credit to families for the first year of the child