Federal Tax Deduction Form 2022 For 2022 you will use Form 1040 or if you were born before January 2 1958 you have the option to use Form 1040 SR You may only need to le Form 1040 or 1040 SR and none

The standard deduction amount for the 2022 tax year jumps to 12 950 for single taxpayers up 400 and 25 900 for a married couple filing jointly up 800 The IRS released the federal marginal tax rates and income brackets for 2022 on Wednesday as well as the new standard deduction for filers

Federal Tax Deduction Form 2022

Federal Tax Deduction Form 2022

https://imgv2-1-f.scribdassets.com/img/document/88820547/original/d5dd8d49e2/1619127068?v=1

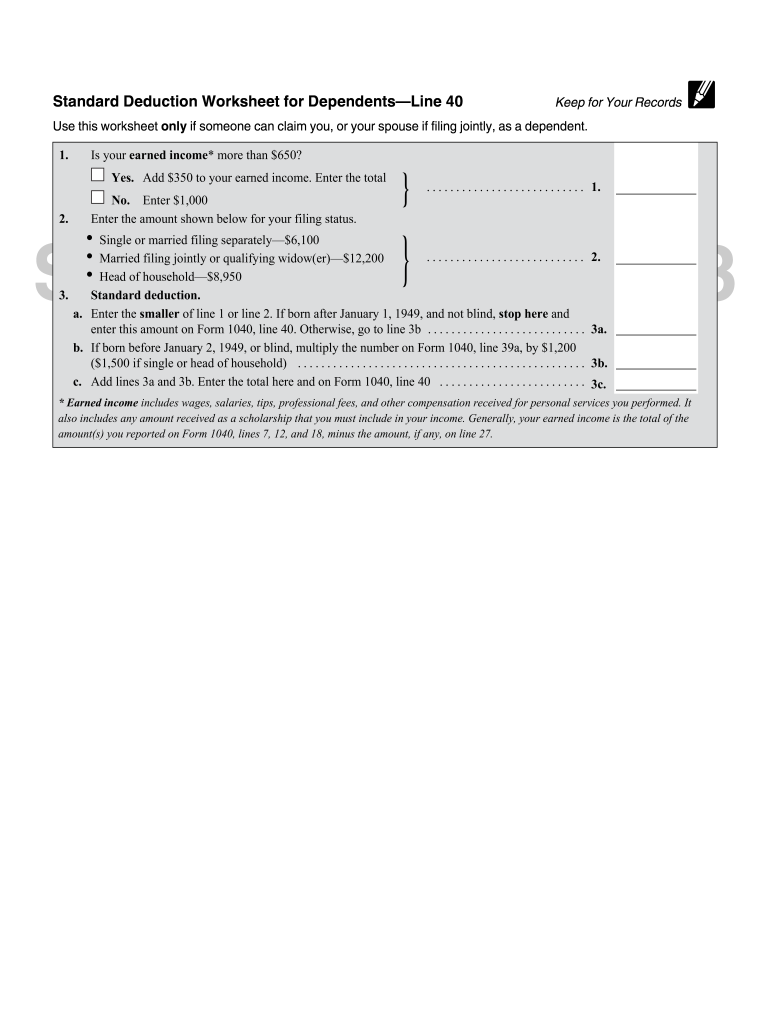

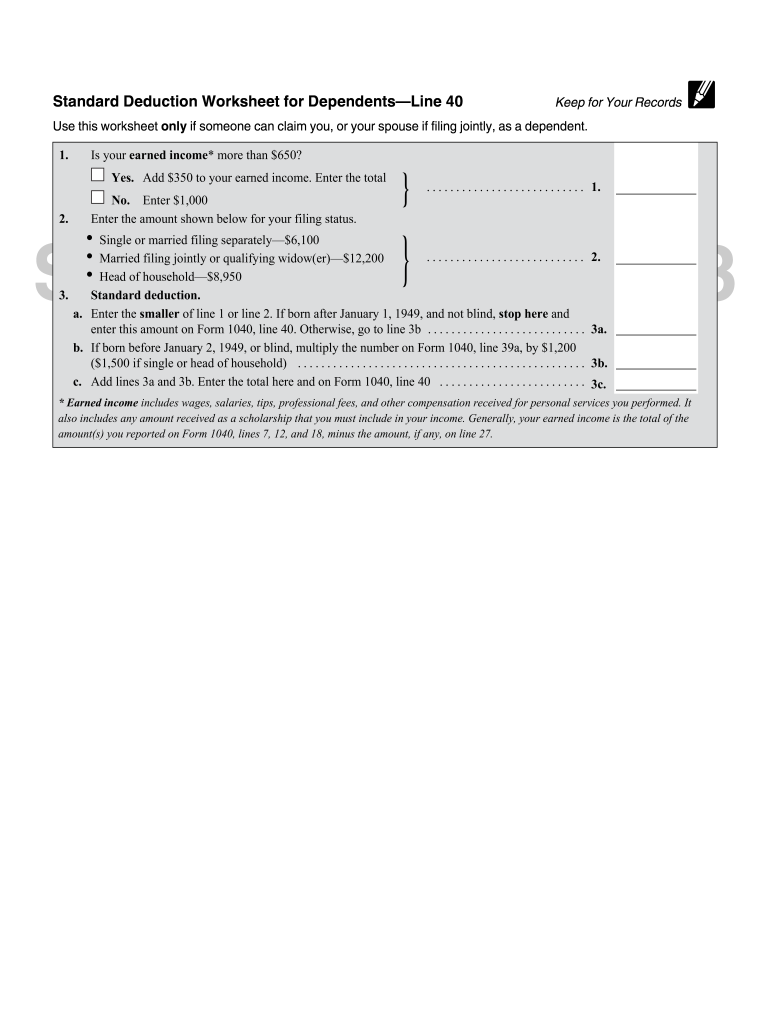

IRS Form 1040 Standard Deduction Worksheet 1040 Form Printable

https://1044form.com/wp-content/uploads/2020/08/8-best-images-of-tax-itemized-deduction-worksheet-irs.png

Cra Tax Forms 2023 Printable Printable Forms Free Online

https://www.pdffiller.com/preview/535/276/535276248/large.png

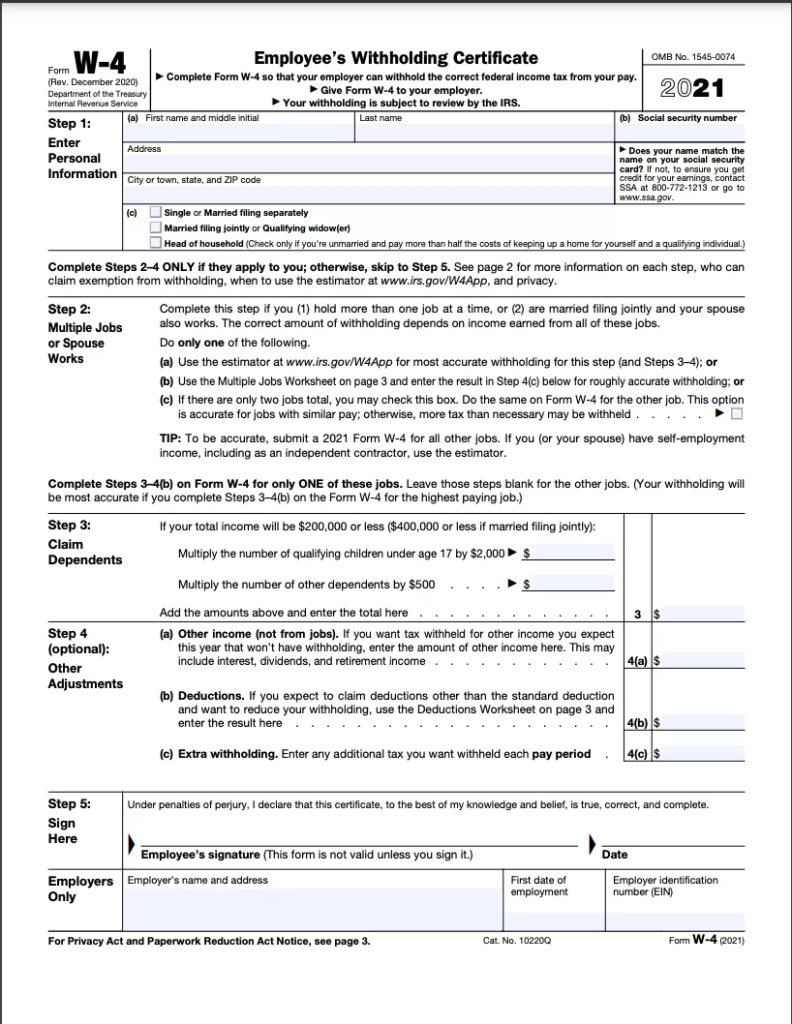

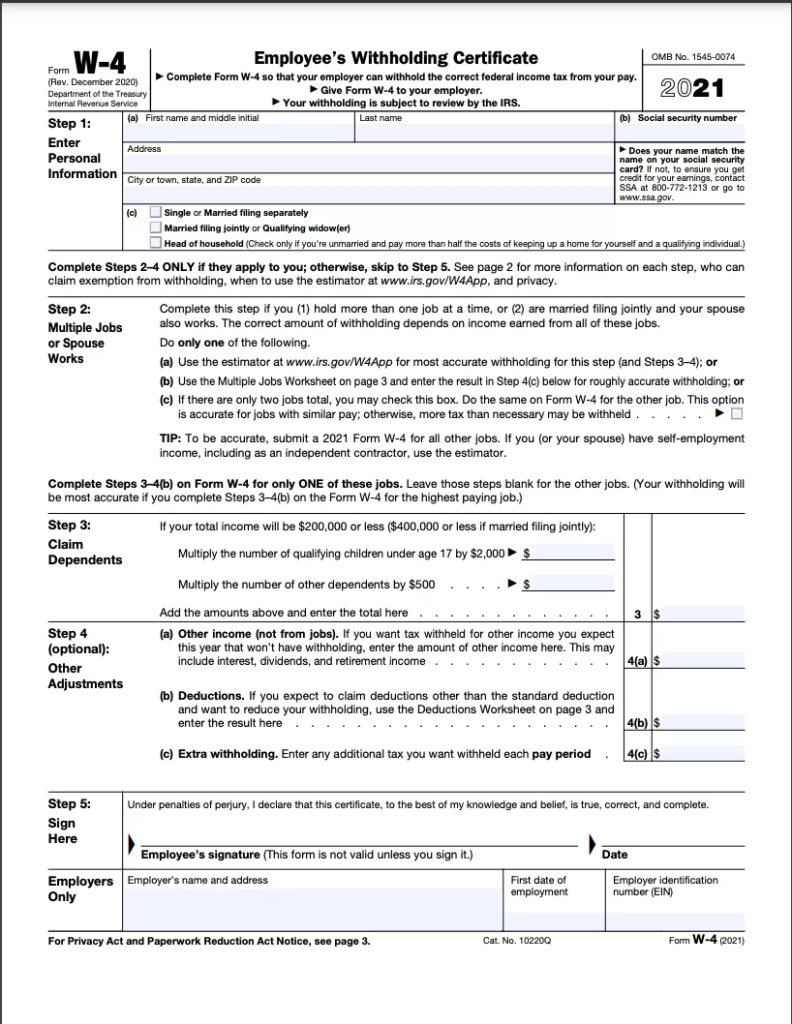

As an employee you complete this form if you have a new employer or payer and will receive salary wages or any other remuneration or if you wish to increase the Explore updated credits deductions and exemptions including the standard deduction personal exemption Alternative Minimum Tax AMT Earned Income Tax

These are broken down into seven 7 taxable income groups based on your federal filing statuses e g whether you are single a head of household married December 2 2021 The IRS Announces New Tax Numbers for 2022 Each year the IRS updates the existing tax code numbers for items that are indexed for inflation This

Download Federal Tax Deduction Form 2022

More picture related to Federal Tax Deduction Form 2022

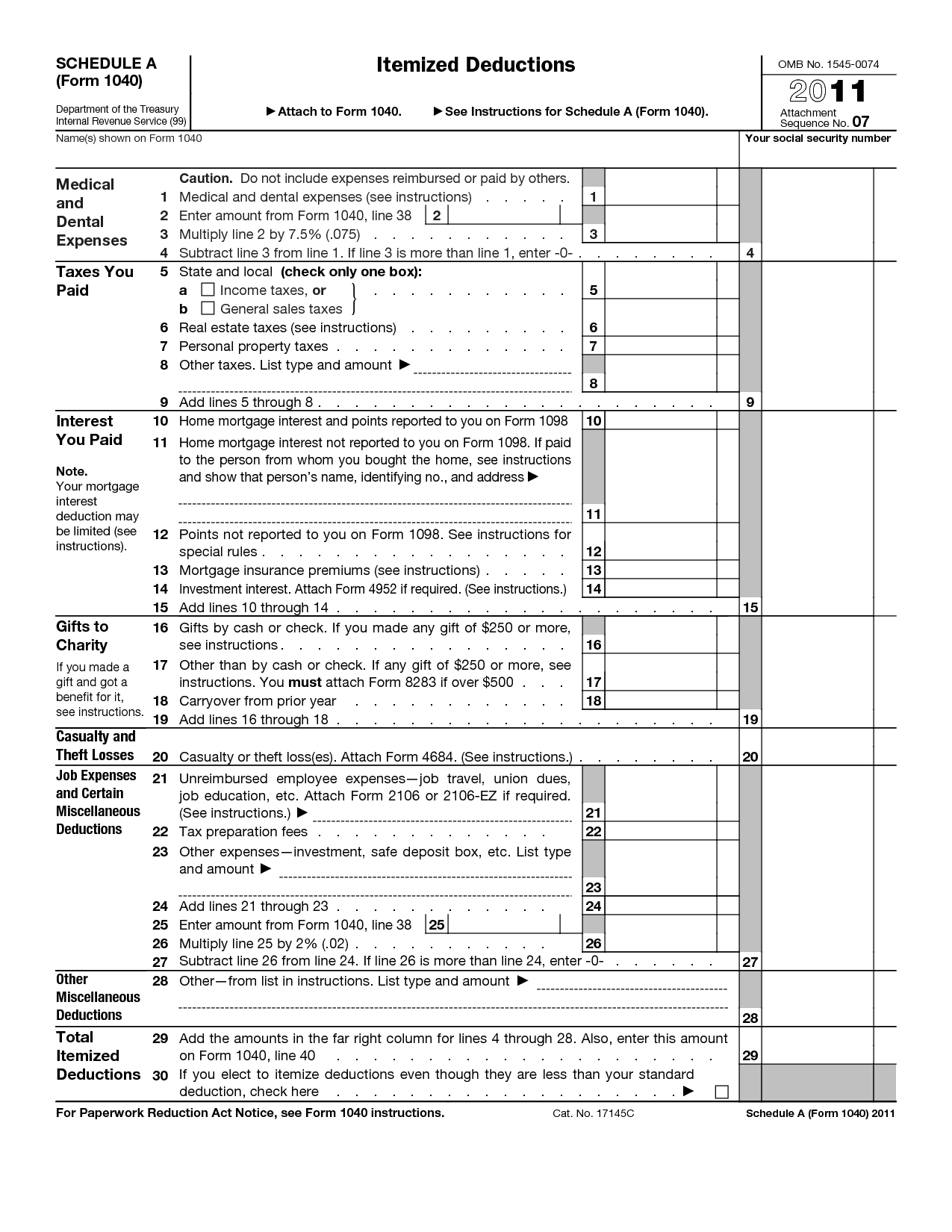

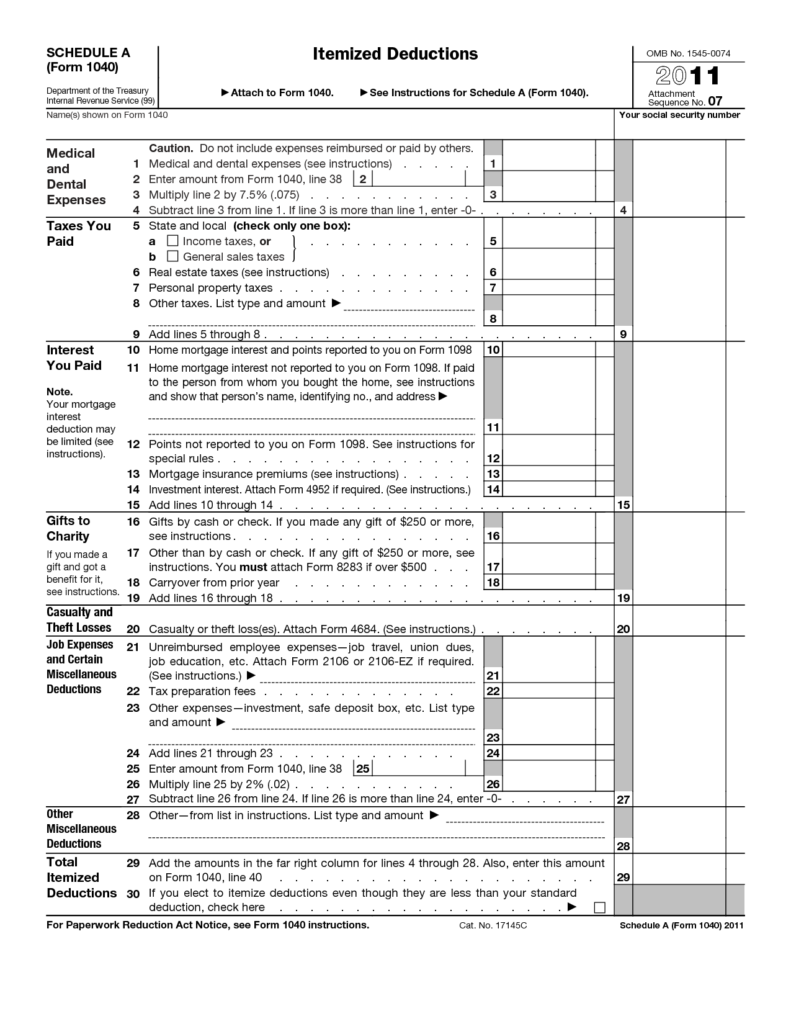

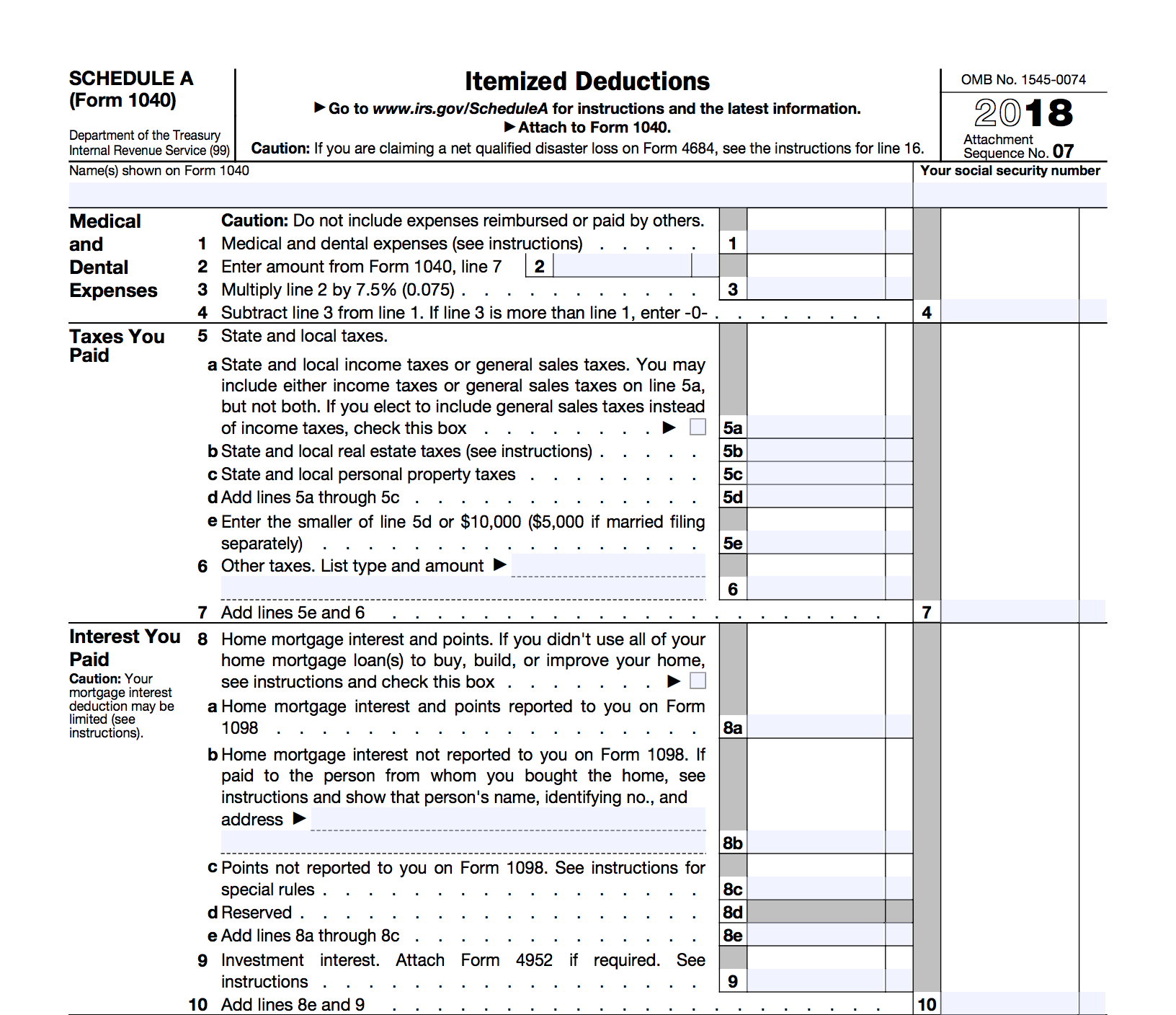

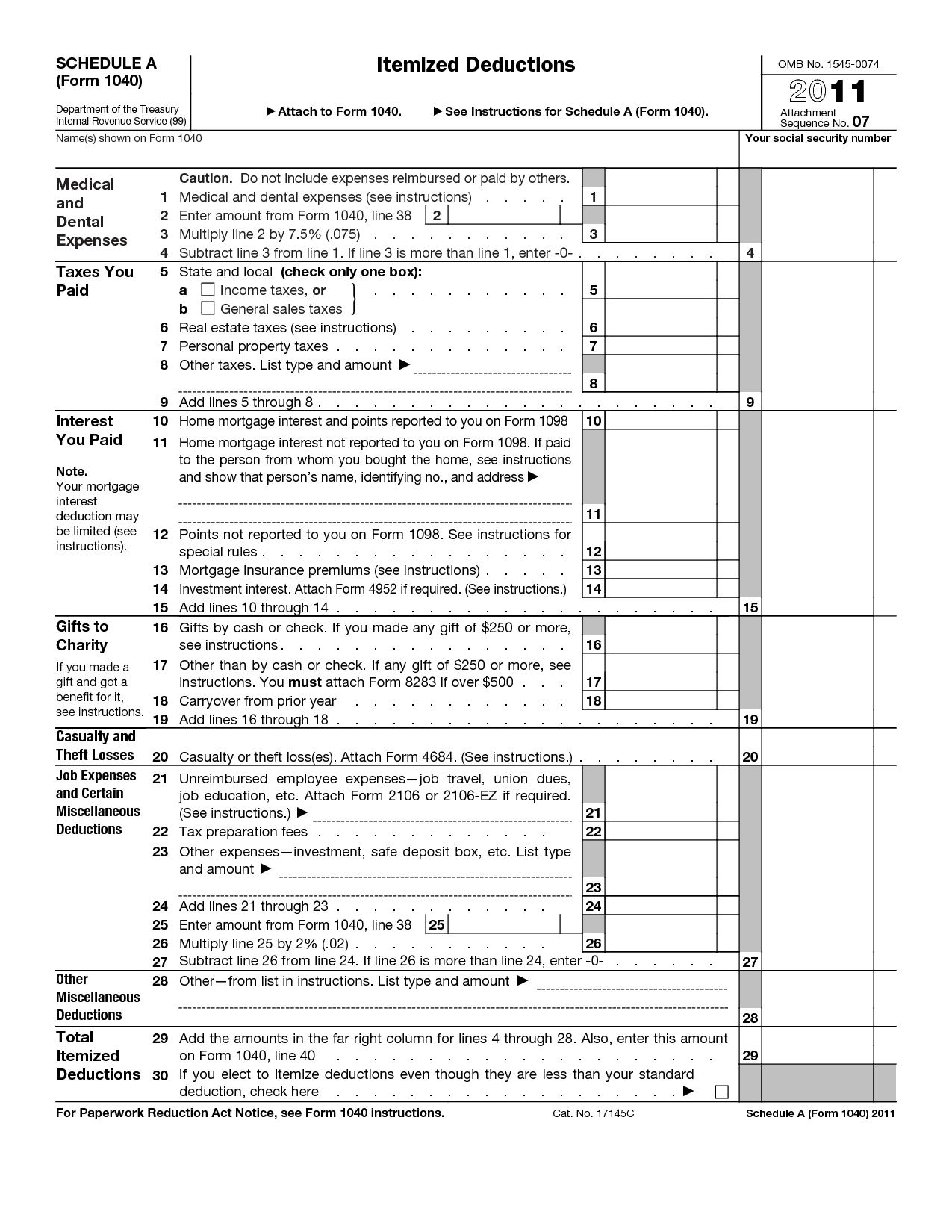

8 Best Images Of Tax Itemized Deduction Worksheet IRS 2021 Tax Forms

https://1044form.com/wp-content/uploads/2020/08/8-best-images-of-tax-itemized-deduction-worksheet-irs-791x1024.png

8 Tax Itemized Deduction Worksheet Worksheeto

https://www.worksheeto.com/postpic/2009/10/list-itemized-tax-deductions-worksheet_449386.png

Form 1040 Standard Deduction 2019 2021 Tax Forms 1040 Printable

https://1044form.com/wp-content/uploads/2020/08/how-to-reduce-your-tax-bill-with-itemized-deductions-1.png

Employers and payers must get Form TD1 Personal Tax Credits Return when individuals start a new job or they want to increase income tax deductions This is used to calculate For heads of households the standard deduction will be 19 400 for tax year 2022 600 more than this year Beginning in 2022 the additional standard

Form 941 Employer s Quarterly Federal Tax Return Employers who withhold income taxes social security tax or Medicare tax from employee s paychecks Schedule A is an IRS form used to claim itemized deductions on a tax return Form 1040 See how to fill it out how to itemize tax deductions and helpful tips

Top 20 US Tax Forms In 2022 Explained PDF co

https://s29840.pcdn.co/wp-content/uploads/2021/06/Form-W-4-792x1024.png

Tax Deduction For A Nanny IRS Tax Attorney

http://www.unclefed.com/TaxHelpArchives/2002/Pub17/graphics/10311g76.gif

https://www.irs.gov/pub/irs-prior/i1040gi--2022.pdf

For 2022 you will use Form 1040 or if you were born before January 2 1958 you have the option to use Form 1040 SR You may only need to le Form 1040 or 1040 SR and none

https://www.forbes.com/sites/ashleaebeling/2021/11/...

The standard deduction amount for the 2022 tax year jumps to 12 950 for single taxpayers up 400 and 25 900 for a married couple filing jointly up 800

2022 Federal Tax Brackets And Standard Deduction Printable Form

Top 20 US Tax Forms In 2022 Explained PDF co

10 Business Tax Deductions Worksheet Worksheeto

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.13.55PM-a2b3cbcfea7346ccb4ca3b2564f1692f.png)

W 4 Form How To Fill It Out In 2022 2022

Printable Itemized Deductions Worksheet

Standard Deduction Worksheet For Dependents Complete With Ease

Standard Deduction Worksheet For Dependents Complete With Ease

Fillable Online Apps Irs Standard Deduction Worksheet Line 40 Form Fax

EXCEL Of Tax Deduction Form xlsx WPS Free Templates

IRS Announces 2022 Tax Rates Standard Deduction

Federal Tax Deduction Form 2022 - Follow these five steps to fill out IRS Form 1040 for the 2022 tax year If you ve ever filed a federal income tax return chances are you used IRS Form 1040