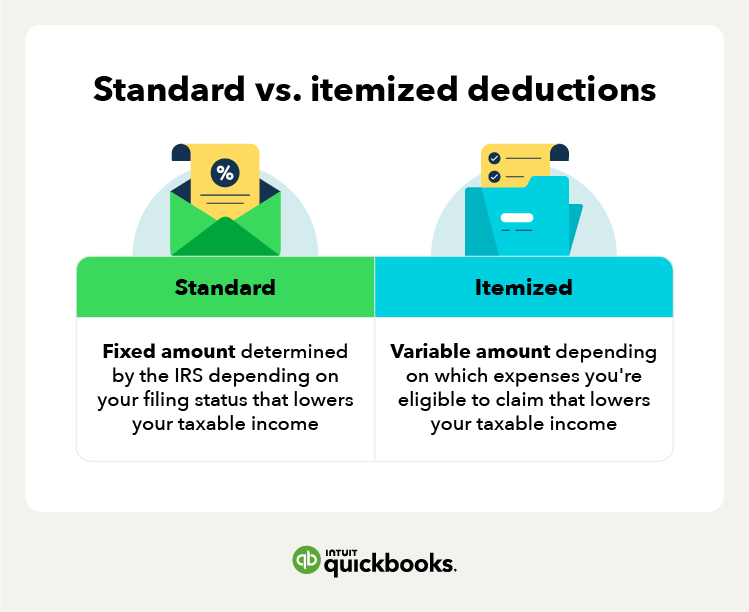

Federal Tax Deductions Amount 2023 Here s what that means If you earned 75 000 in 2023 and file as a single taxpayer taking the standard deduction of 13 850 will reduce your taxable income to 61 150 Standard Deduction

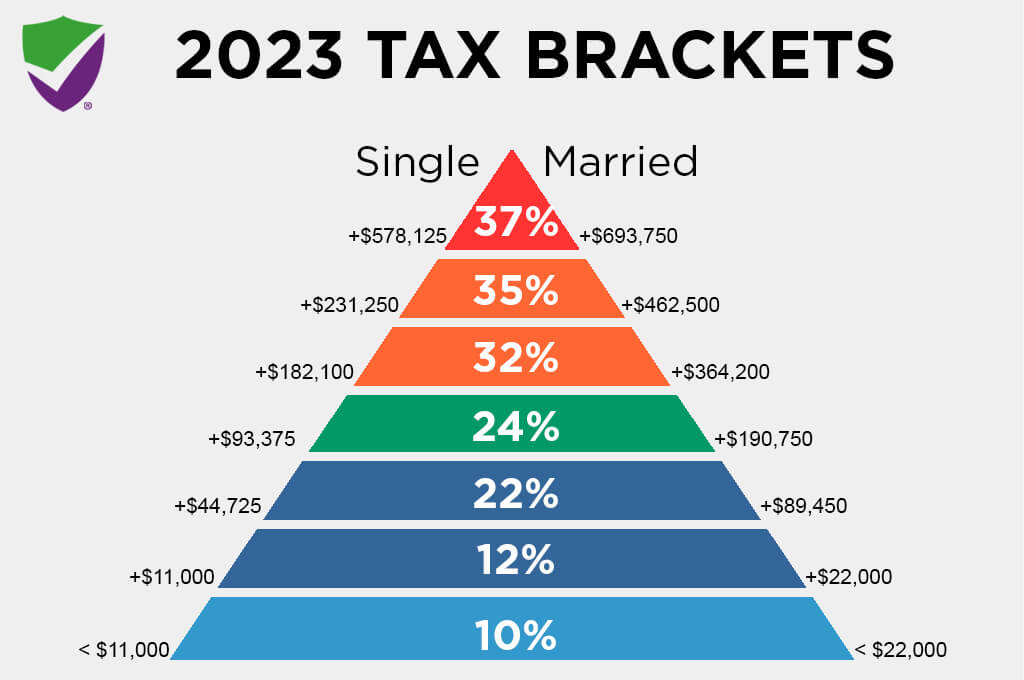

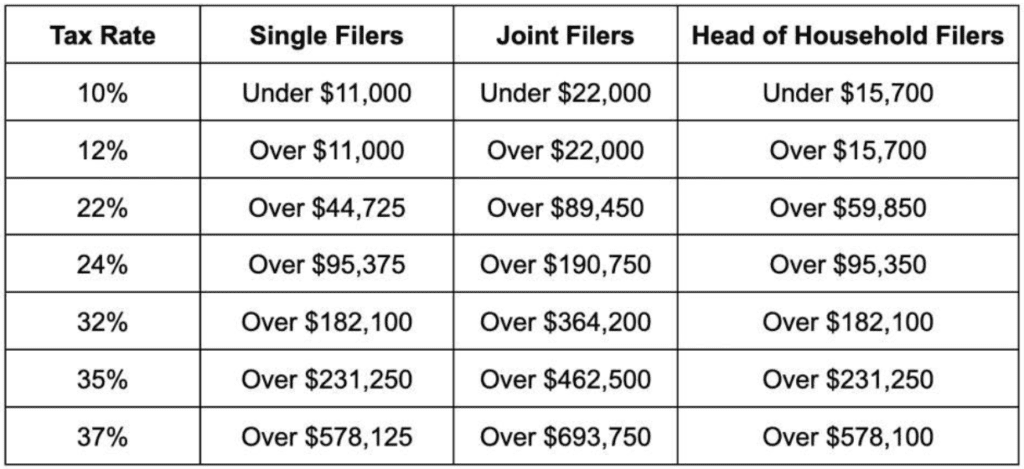

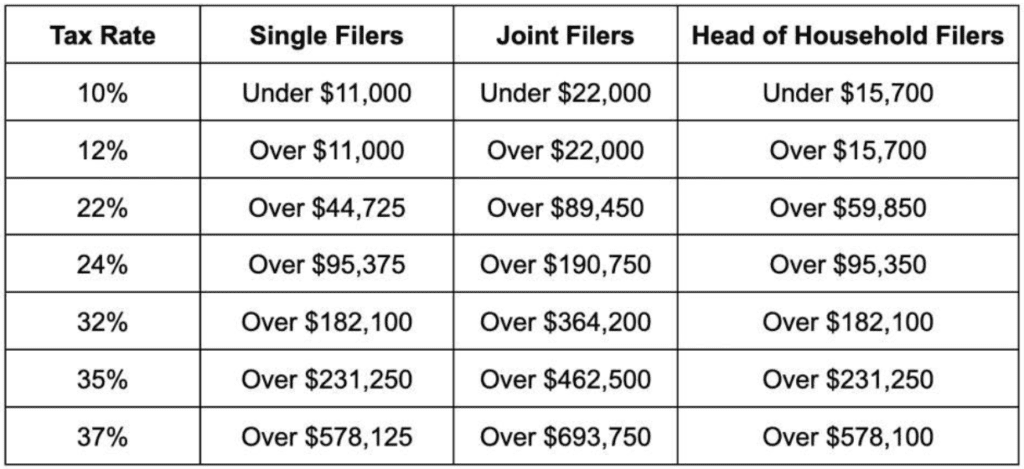

The standard deduction for taxpayers who don t itemize their deductions on Schedule A Form 1040 is higher for 2023 than it was for 2022 The amount depends on your filing status You can use the 2023 Standard Deduction Tables near the end of this publication to figure your standard deduction 2023 tax rates for a single taxpayer For a single taxpayer the rates are Here s how that works for a single person earning 58 000 per year 2023 tax rates for other filers Find the current tax rates for other filing statuses Use tab to go to the next focusable element Married filing jointly or qualifying surviving spouse

Federal Tax Deductions Amount 2023

Federal Tax Deductions Amount 2023

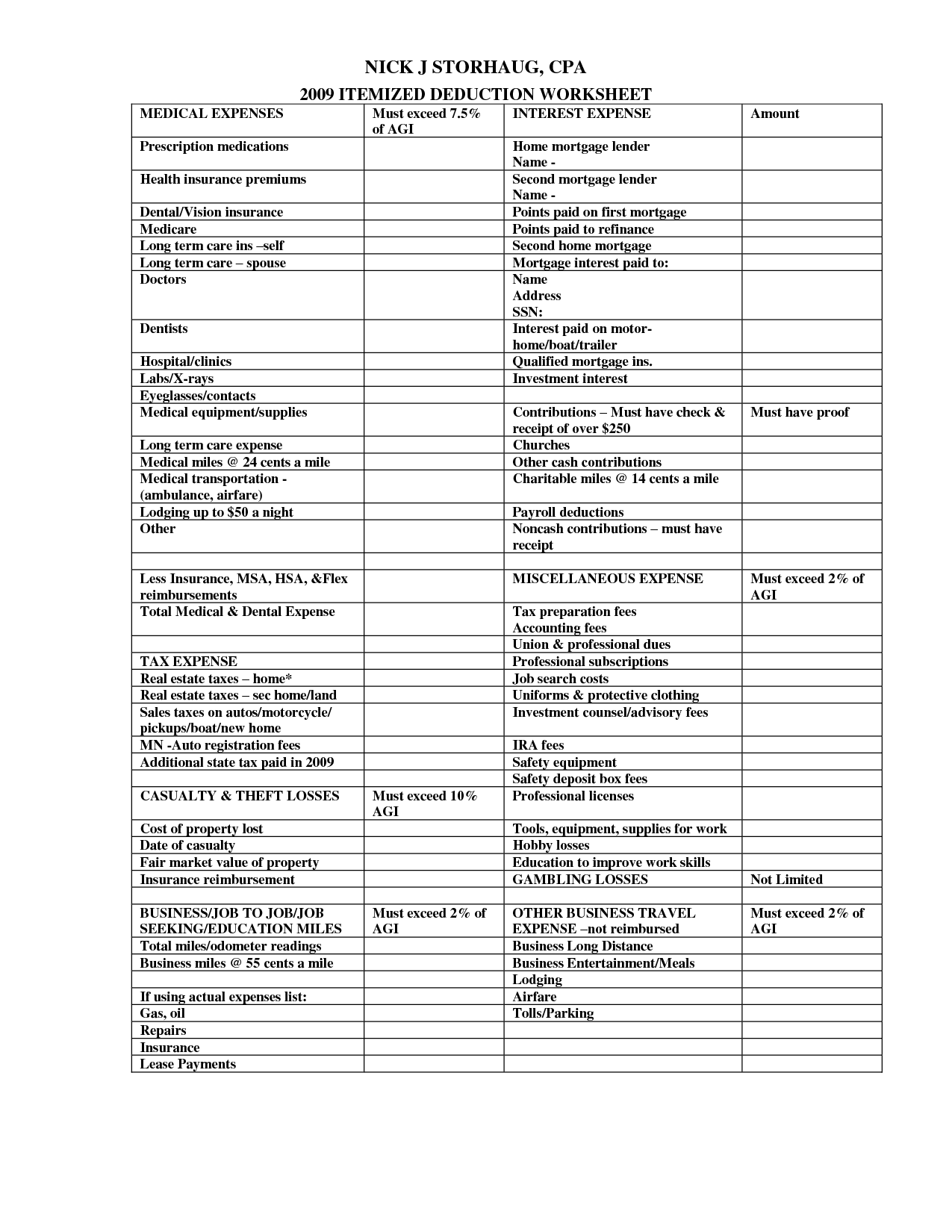

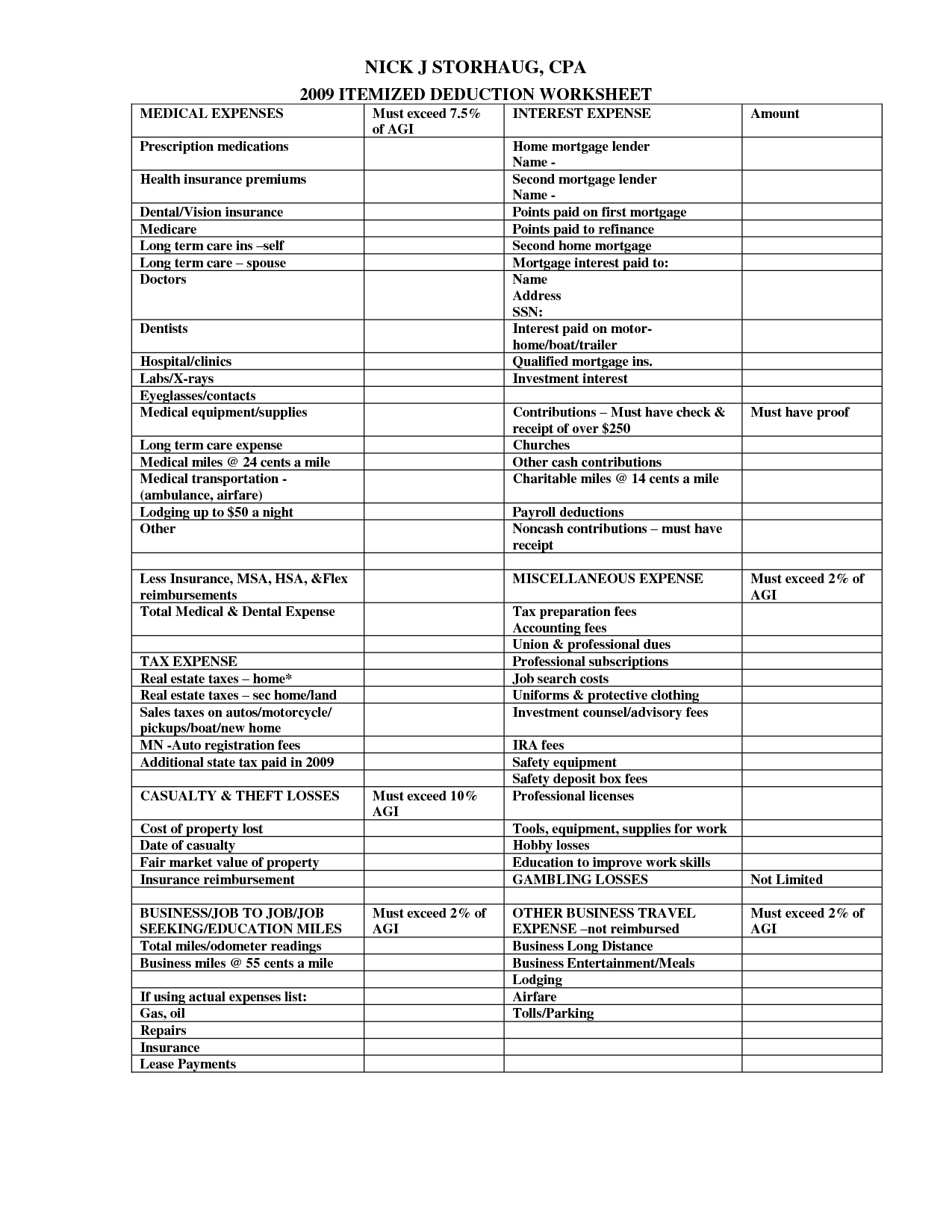

https://www.worksheeto.com/postpic/2011/08/tax-itemized-deduction-worksheet_472223.png

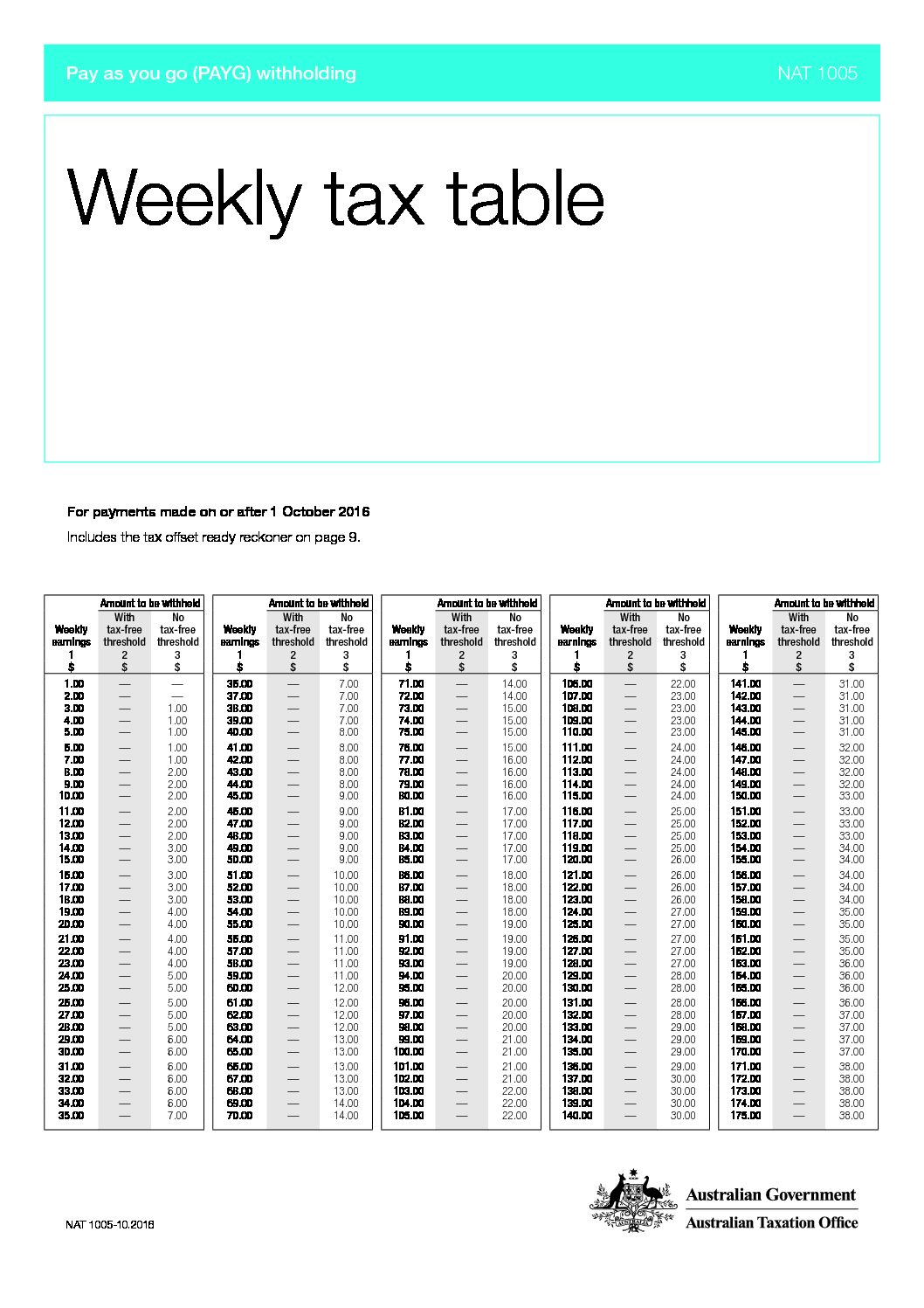

Weekly Tax Table Federal Withholding Tables 2021

https://federal-withholding-tables.net/wp-content/uploads/2021/07/weekly-tax-table-2016-17-hqb-accountants-auditors-advisors.jpg

Tax Rates Absolute Accounting Services

https://imageio.forbes.com/specials-images/imageserve/618be1b6d57aaf84e03b72d2/Standard-Deduction-2022/960x0.jpg?format=jpg&width=960

The 2023 standard deduction for tax returns filed in 2024 is 13 850 for single filers 27 700 for joint filers or 20 800 for heads of household People 65 or older may be eligible for a 2023 Tax Brackets and Rates The income limits for all 2023 tax brackets and all filers will be adjusted for inflation and will be as follows Table 1 There are seven federal income tax rates in 2023 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent

The Internal Revenue Service has released dozens of inflation adjustments affecting individual income tax brackets deductions and credits for 2023 and no surprise today s four decade high Taxes Personal Finance Money Home Your Guide to Tax Year 2023 Deductions Learn how tax deductions work and which ones you might be able to take for tax year 2023 By Jessica

Download Federal Tax Deductions Amount 2023

More picture related to Federal Tax Deductions Amount 2023

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

https://www.wiztax.com/wp-content/uploads/2022/10/3.png

IRS Inflation Adjustments Taxed Right

https://taxedright.com/wp-content/uploads/2022/10/2023-Tax-Brackets.jpg

Standard Deduction U s 16 ia For Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-3-768x432.jpg

2023 standard deduction Just FYI Most taxpayers take the standard deduction But to make your decision you must know the standard deduction amount for each tax year and how The standard deduction is a fixed dollar amount you may subtract from your taxable income meaning more of your money isn t subject to taxes resulting in either a lower tax bill or a higher

Advertiser disclosure 22 Popular Tax Deductions and Tax Breaks for 2023 2024 A deduction cuts the income you re taxed on which can mean a lower bill A credit cuts your tax bill directly In 2023 and 2024 there are seven federal income tax rates and brackets 10 12 22 24 32 35 and 37 Taxable income and filing status determine which federal tax rates apply to

2023 Tax Bracket Changes And IRS Annual Inflation Adjustments

https://boxelderconsulting.com/wp-content/uploads/2022/11/Screen-Shot-2022-11-17-at-12.20.59-PM-1024x469.png

Tax Deductions Armstrong Economics

https://www.armstrongeconomics.com/wp-content/uploads/2020/09/Tax-Deductions-2048x1536.jpg

https://www.forbes.com/advisor/taxes/standard-deduction

Here s what that means If you earned 75 000 in 2023 and file as a single taxpayer taking the standard deduction of 13 850 will reduce your taxable income to 61 150 Standard Deduction

https://www.irs.gov/publications/p501

The standard deduction for taxpayers who don t itemize their deductions on Schedule A Form 1040 is higher for 2023 than it was for 2022 The amount depends on your filing status You can use the 2023 Standard Deduction Tables near the end of this publication to figure your standard deduction

Standard Deduction 2020 Age 65 Standard Deduction 2021

2023 Tax Bracket Changes And IRS Annual Inflation Adjustments

Oct 19 Irs Here Are The New Income Tax Brackets For 2023 Free Nude

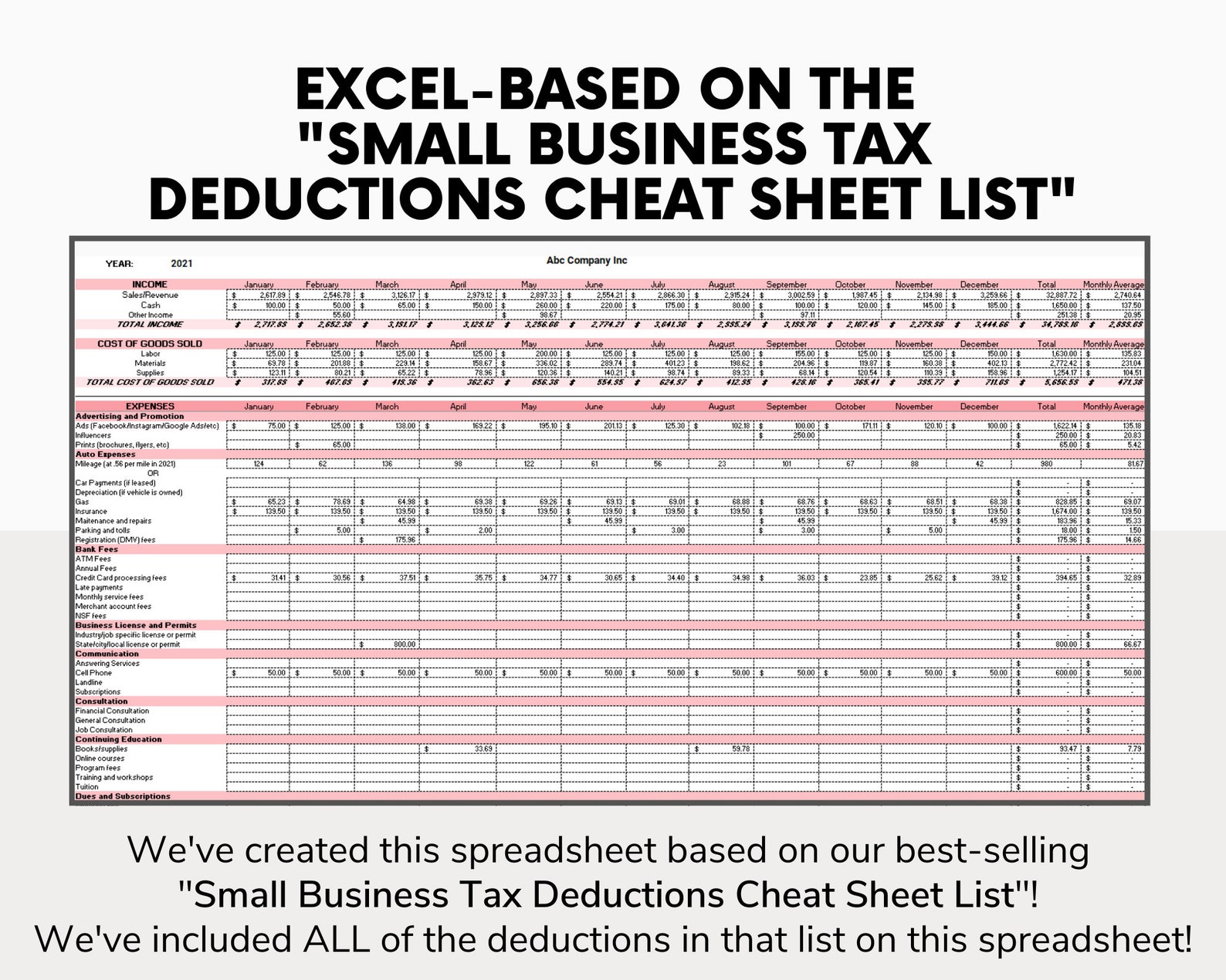

Small Business Expenses Tax Deductions 2023 QuickBooks

Business Tax Deductions Cheat Sheet Excel In PINK Tax Etsy

.jpg?width=8333&name=tax graphic_2020 (1).jpg)

What To Expect When Filing Your Taxes This Year

.jpg?width=8333&name=tax graphic_2020 (1).jpg)

What To Expect When Filing Your Taxes This Year

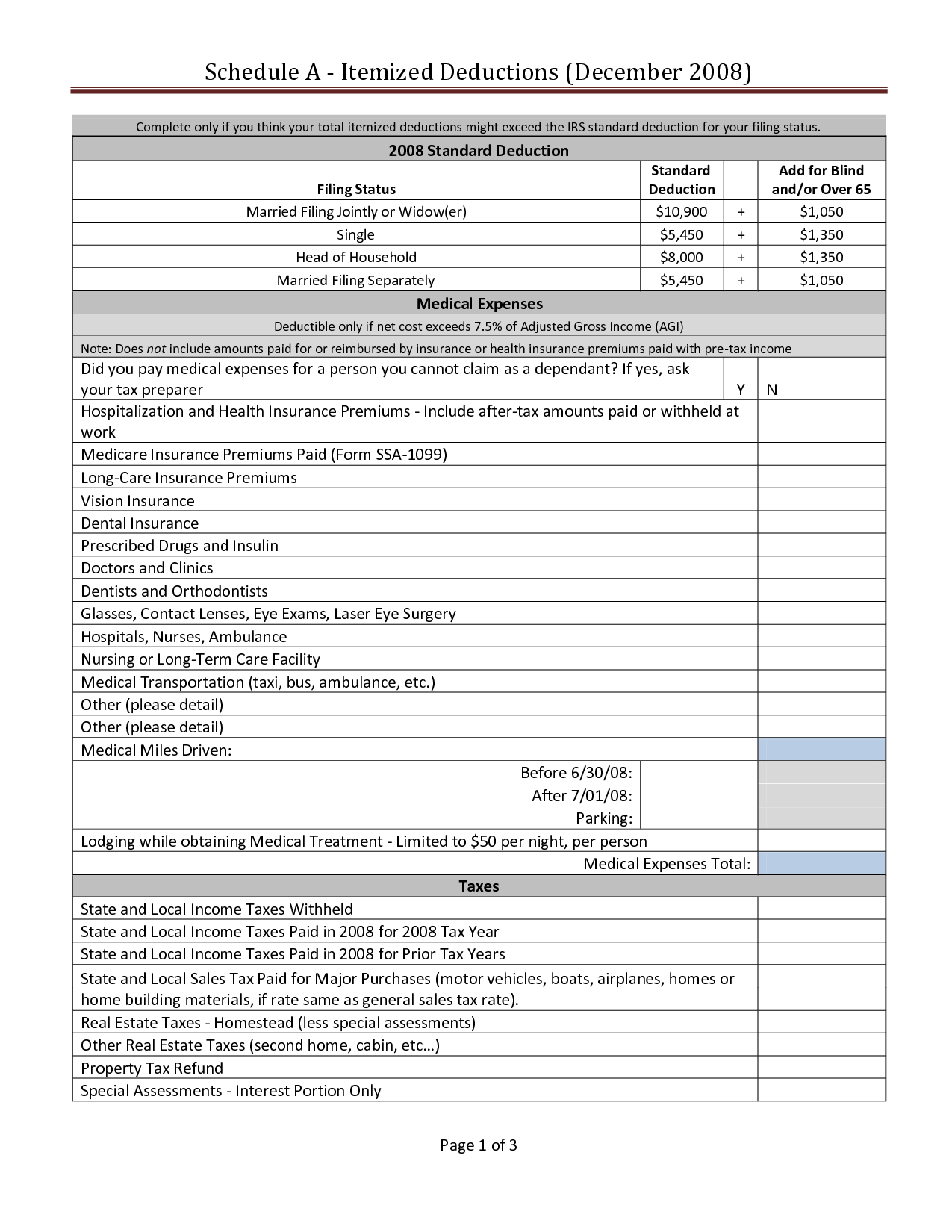

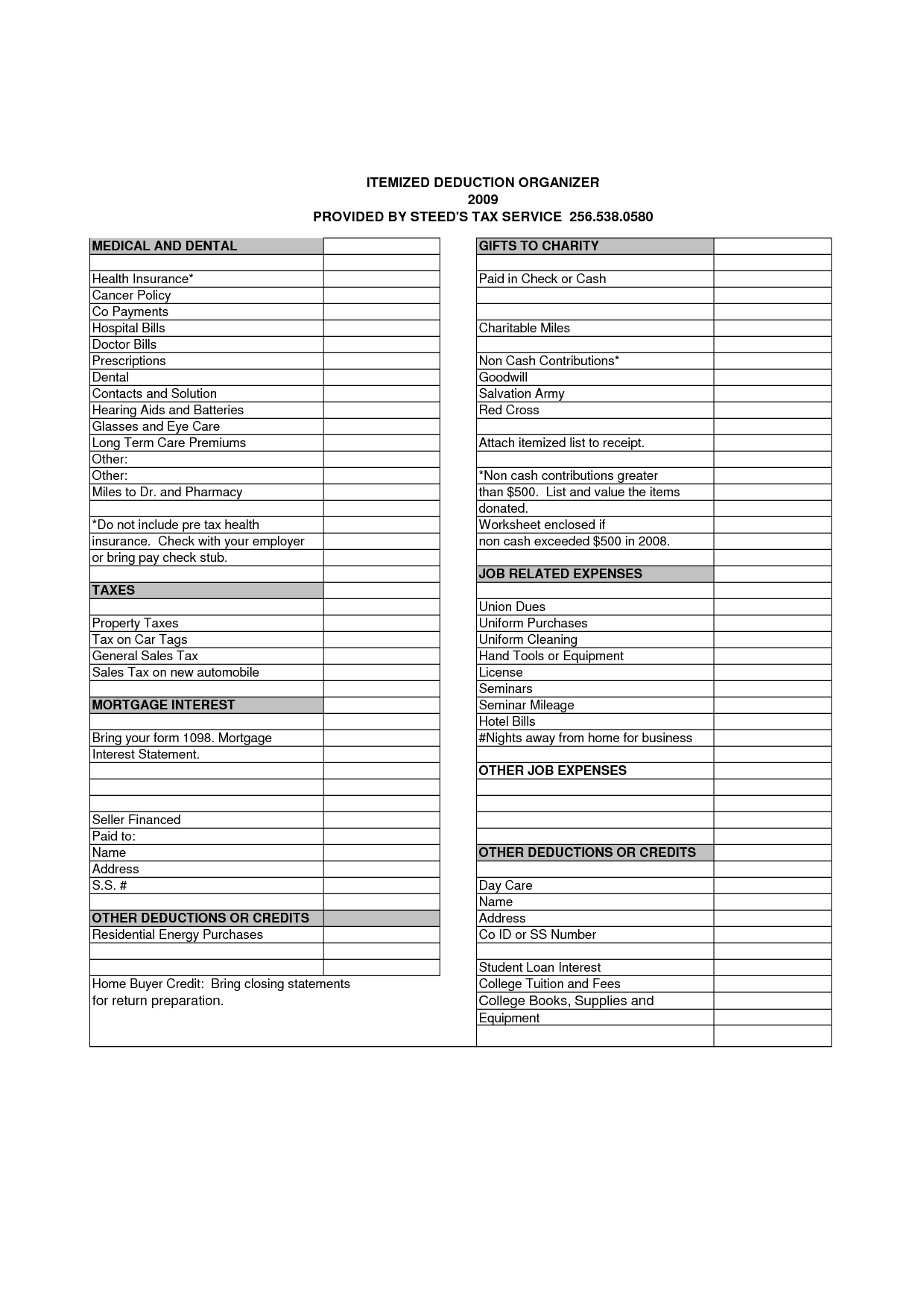

5 Itemized Tax Deduction Worksheet Worksheeto

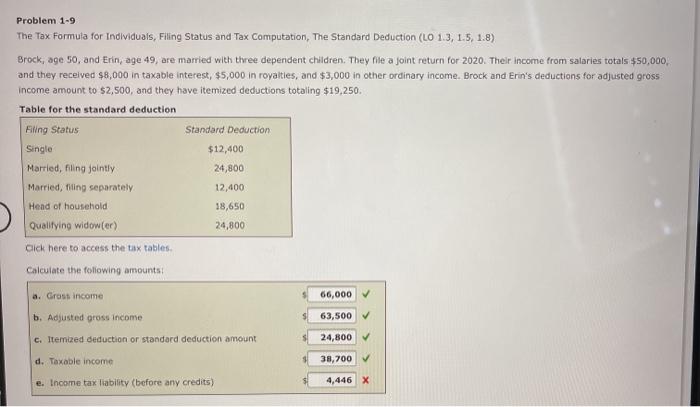

Solved Problem 1 9 The Tax Formula For Individuals Filing Chegg

Printable Itemized Deductions Worksheet

Federal Tax Deductions Amount 2023 - 2023 Tax Brackets and Rates The income limits for all 2023 tax brackets and all filers will be adjusted for inflation and will be as follows Table 1 There are seven federal income tax rates in 2023 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent