Federal Tax Deductions Amount Meaning Deductions reduce your taxable income while credits reduce your tax There are various deductions and credits available each with its own eligibility requirements For

Simply put a tax deduction is an expense that can be subtracted from your income to reduce how much you pay in taxes Tax deductions are a good thing because they lower You are allowed to claim between 0 and 3 allowances on this form Typically the more allowances you claim the less amount of taxes will be withheld from your paycheck The fewer

Federal Tax Deductions Amount Meaning

Federal Tax Deductions Amount Meaning

https://okcredit-blog-images-prod.storage.googleapis.com/2021/01/Tax-deduction2.jpg

5 Deductions That Will Greatly Increase Your Tax Refund Tax Refund

https://i.pinimg.com/originals/e6/97/88/e697885c772ebc04e72ebb01c99fd6ae.jpg

Tax Rates Absolute Accounting Services

https://imageio.forbes.com/specials-images/imageserve/618be1b6d57aaf84e03b72d2/Standard-Deduction-2022/960x0.jpg?format=jpg&width=960

What are tax deductions and how do they work And why are tax deductions so important The purpose of tax deductions is to decrease your taxable income thus decreasing the amount of tax you owe to the federal government What Is a Tax Deduction Tax deductions also known as tax write offs lower your taxable income so you ll pay less overall You can either go with the standard deduction which is a predetermined amount that is

A deduction cuts the income you re taxed on which can mean a lower bill A credit cuts your tax bill directly Learn more about common tax breaks and how to claim them Most taxpayers opt for the standard deduction simply because it s less work than itemizing but that doesn t mean it s the right choice for everyone The standard deduction for 2024 taxes due this

Download Federal Tax Deductions Amount Meaning

More picture related to Federal Tax Deductions Amount Meaning

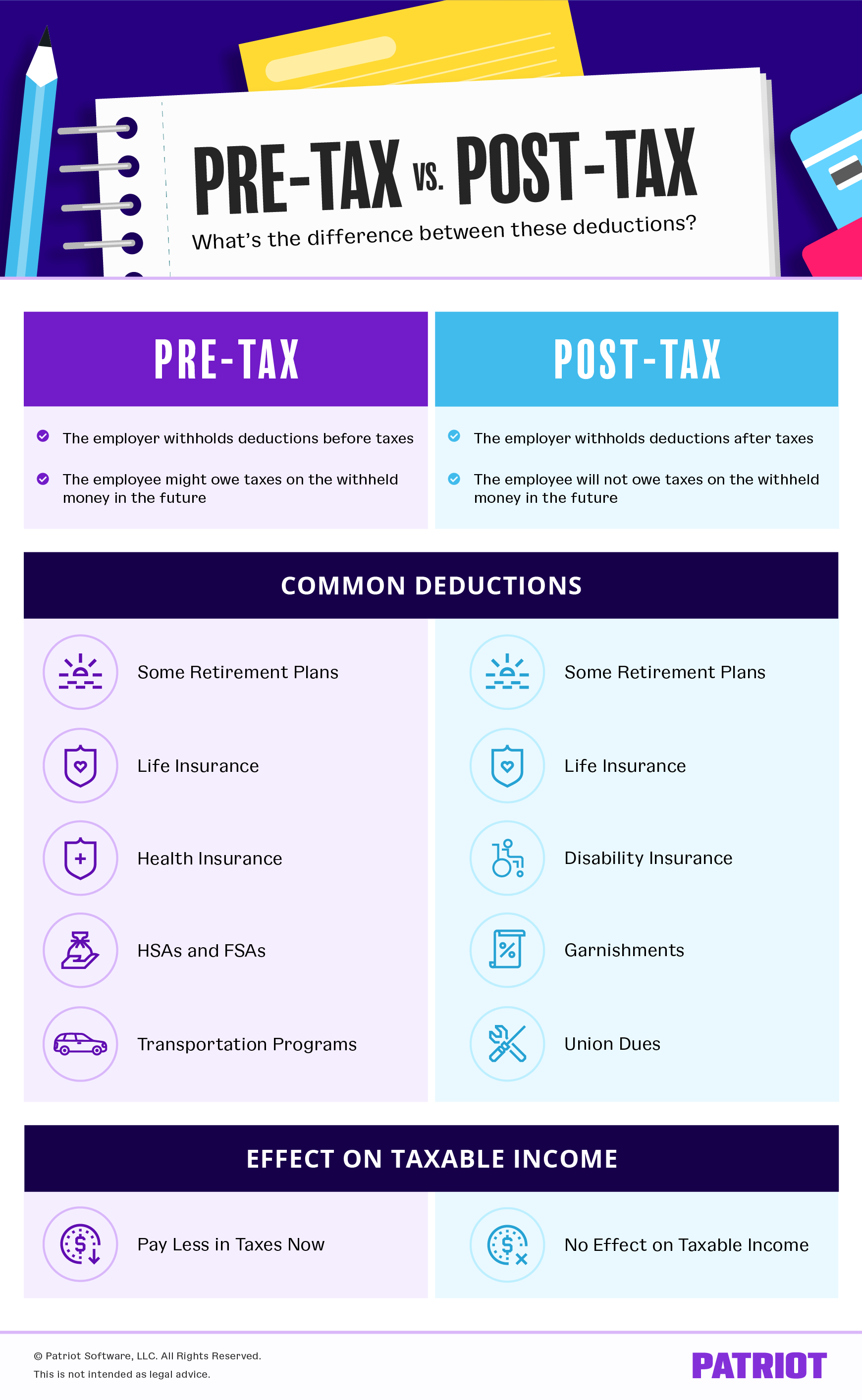

Is Wages Or Salary Before Or After Federal Tax Deductions Federal

https://www.patriotsoftware.com/wp-content/uploads/2017/03/pre-tax-vs-post-tax.png

What Is Standard Deduction Amount Chapter 5 Income From Salary Ded

https://d1avenlh0i1xmr.cloudfront.net/4f7f3000-1b0f-4d88-99ce-268ca881f421/standard-deduction.png

Your 2017 Tax Preparation Checklist The Motley Fool

https://g.foolcdn.com/editorial/images/436027/tax-form_tax-deductions_gettyimages-515708887.jpg

Thankfully tax credits and tax deductions can reduce your tax bill and ease the frustration of owing too much money to the IRS Here are some common IRS tax deductions and credits In the U S the federal income tax is progressive meaning that the tax rate increases as your income rises Currently tax rates are separated into seven different

The standard deduction is the portion of income not subject to tax that can be used to reduce your tax bill For 2023 the standard deduction was 13 850 for individuals 27 700 State and local taxes You can deduct up to 10 000 or 5 000 if married filing separately of the state and local taxes you paid in 2023 The combined limit applies to

How To Fully Maximize Your 1099 Tax Deductions Steady

https://assets-global.website-files.com/621d1e290115eacf9e46133d/624df23abd74b382b485fa82_Maximize_Tax_Deductions-01.png

How To Find Average Income Tax Rate Parks Anderem66

https://files.taxfoundation.org/20200714164745/Tax-Basics-How-Is-Tax-Liability-Calculated.png

https://www.financestrategists.com › tax › tax...

Deductions reduce your taxable income while credits reduce your tax There are various deductions and credits available each with its own eligibility requirements For

https://www.ramseysolutions.com › taxes › what-is-a-tax-deduction

Simply put a tax deduction is an expense that can be subtracted from your income to reduce how much you pay in taxes Tax deductions are a good thing because they lower

Tax Deductions And Credits Related To Education Expenses

How To Fully Maximize Your 1099 Tax Deductions Steady

Standard Deduction 2020 Self Employed Standard Deduction 2021

Tax Reduction Company Inc

What Is A Tax Deduction Definition Examples Calculation

Irs Standard Deduction 2019 Over 65 Standard Deduction 2021

Irs Standard Deduction 2019 Over 65 Standard Deduction 2021

What Is The Difference Between A Tax Credit And Tax Deduction

Tax Deductions You Can Deduct What Napkin Finance

Tax Deductions For The Self Employed Invoicera Blog

Federal Tax Deductions Amount Meaning - What are tax deductions and how do they work And why are tax deductions so important The purpose of tax deductions is to decrease your taxable income thus decreasing the amount of tax you owe to the federal government