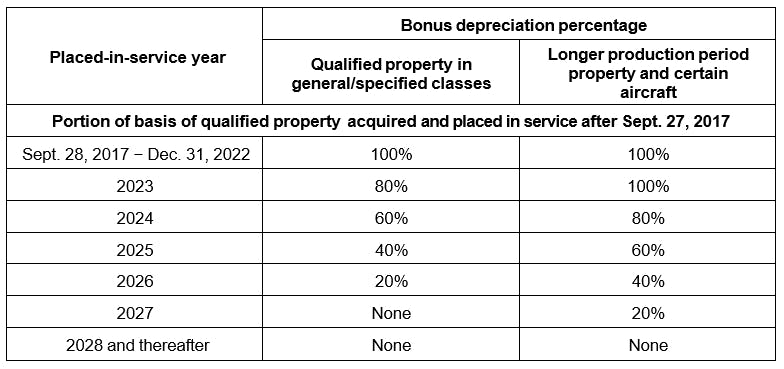

Federal Tax Depreciation Rules It is the name given for the tax rules that allow a taxpayer to recover through depreciation deductions the cost of property used in a trade or business or to produce income These rules are mandatory and generally apply to tangible

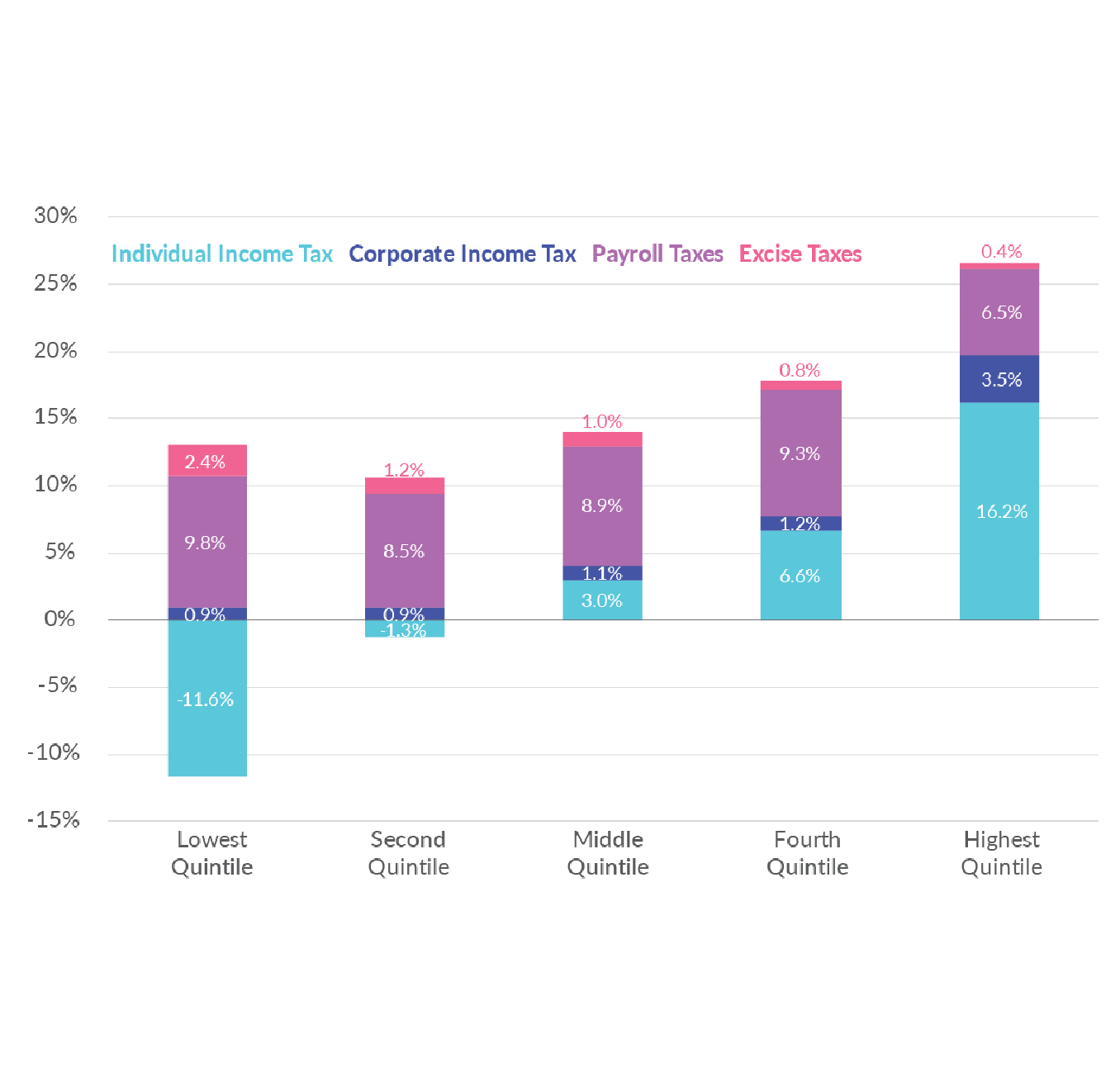

Learn how the depreciation rules are changing in 2024 2025 Understand bonus depreciation reductions timelines and strategies to maximize savings Under the new law the bonus depreciation rates are as follows A transition rule provides that for a taxpayer s first taxable year ending after Sept 27 2017 the taxpayer may elect to apply a 50 allowance instead of the 100 allowance

Federal Tax Depreciation Rules

Federal Tax Depreciation Rules

https://i.ytimg.com/vi/ZizhGmO8PSM/maxresdefault.jpg

Changes To Tax Depreciation Rules To Benefit Those With Intangible Assets

https://www.leadenhall.com.au/wp-content/uploads/Tax-depreciation-intangible-assets.png

Business Vehicles Tax Depreciation Rules Accounting Freedom

https://www.accountingfreedom.com/wp-content/uploads/2021/09/file.jpg

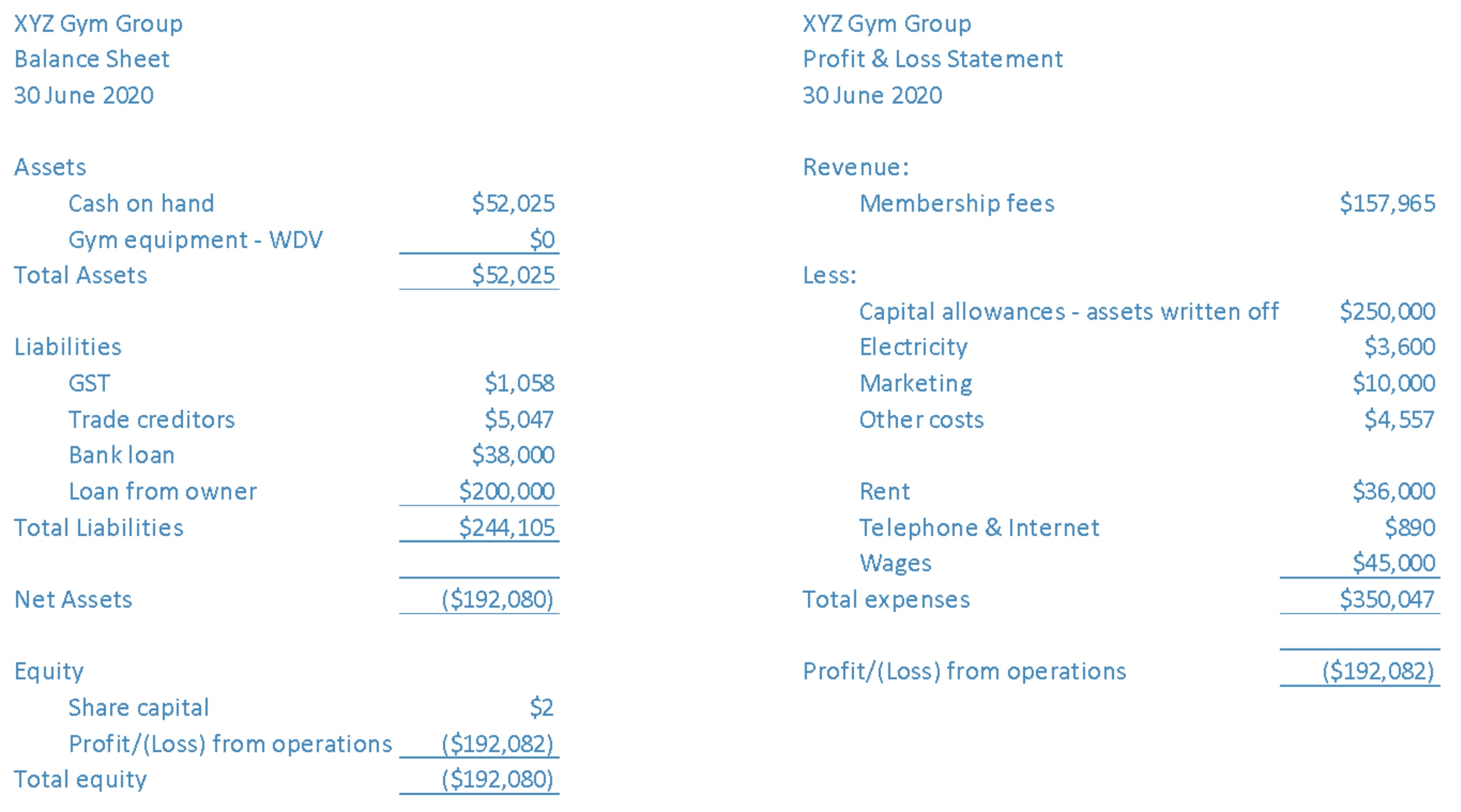

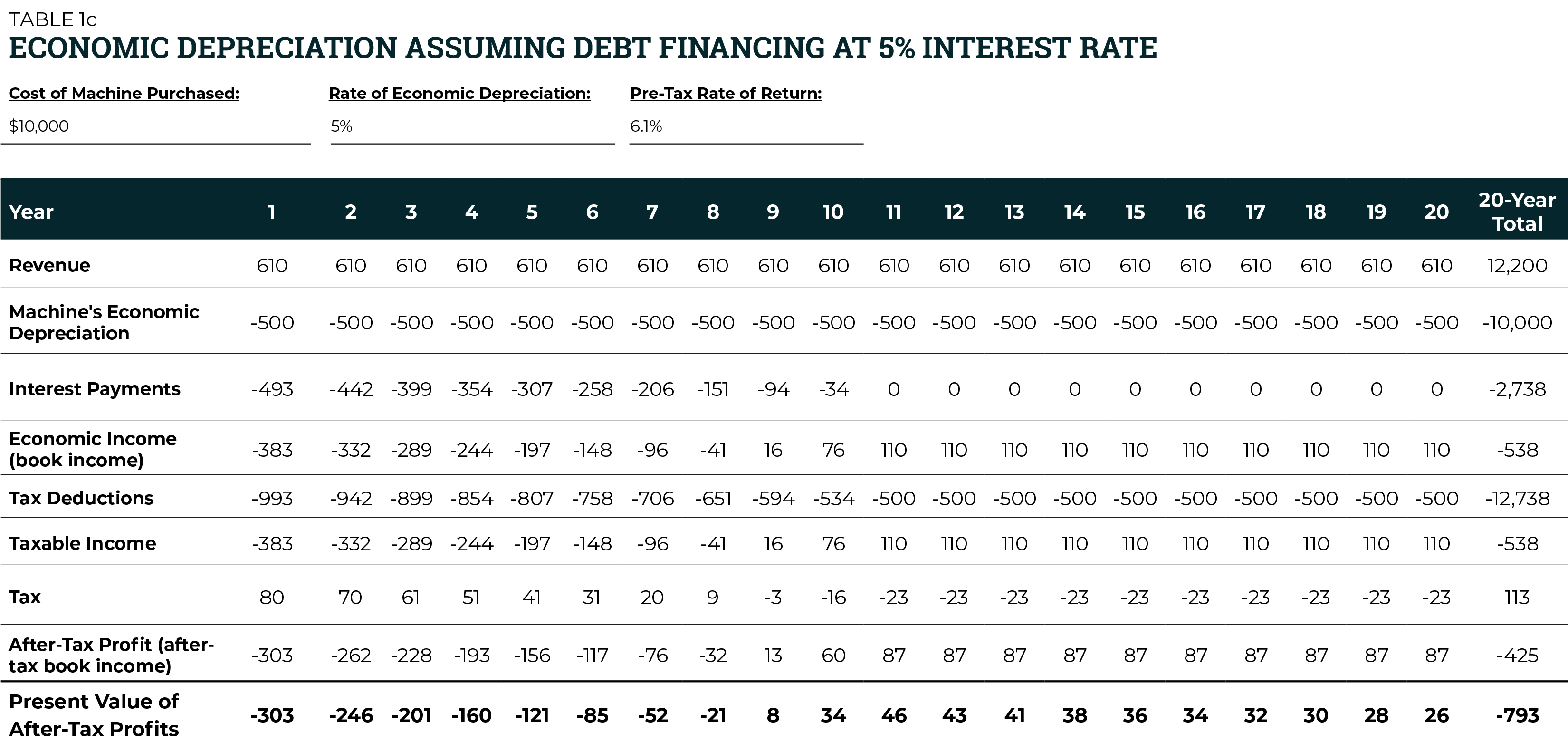

Tax depreciation generally is subject to recapture on the sale or disposition of certain property to the extent of gain which is subject to tax as ordinary income The cost of a General rule There shall be allowed as a depreciation deduction a reasonable allowance for the exhaustion wear and tear including a reasonable allowance for obsolescence

To depreciate an asset it must meet all of the following requirements according to the IRS It must be an asset that the business owns It must be used in a business or income producing activity The asset must have For businesses looking to maximize their equipment tax deductions understanding Section 179 goes beyond federal limits State specific rules can significantly impact your total tax savings

Download Federal Tax Depreciation Rules

More picture related to Federal Tax Depreciation Rules

Fed Tax Depreciation Guidelines Handout page 001 WFY

https://www.cpa-wfy.com/federal-tax-depreciation-guidelines/fed-tax-depreciation-guidelines-handout-page-001

Negative Gearing And Depreciation

https://www.capitalclaims.com.au/wp-content/uploads/2022/06/Table-1-for-handbook-tax-depreciation.jpg

Tax Depreciation Akuntansi Studocu

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/7472987808887a6f300a20a0854b1d5f/thumb_1200_1844.png

Federal tax law sets the baseline for Section 179 deductions and applies uniformly to all states when calculating your federal taxable income However states have their own tax Understanding depreciation methods is key for managing tax liabilities in Federal Income Tax Accounting These methods like MACRS and Section 179 help businesses maximize

Depreciation can be a huge tax advantage for small business owners if and that s a big if you can make sense of the IRS depreciation tables The depreciation tables spell out exactly Depreciation must be reported on Arizona s state income tax return requiring adjustments to federal figures Businesses must reconcile differences in asset classifications

Calculation Of Depreciation On Rental Property InnesLockie

https://wsp-blog-images.s3.amazonaws.com/uploads/2021/07/20042010/OFFSET.jpg

Federal Tax Rates By Income Group And Tax Source

https://taxfoundation.org/wp-content/uploads/2019/03/paf-4-featured-01.png

https://www.irs.gov › instructions

It is the name given for the tax rules that allow a taxpayer to recover through depreciation deductions the cost of property used in a trade or business or to produce income These rules are mandatory and generally apply to tangible

https://www.taxandaccounting.com › post

Learn how the depreciation rules are changing in 2024 2025 Understand bonus depreciation reductions timelines and strategies to maximize savings

Depreciation Rates For Intangible Assets Download Table

Calculation Of Depreciation On Rental Property InnesLockie

Recent Federal Budget Changed Tax Depreciation Rules The Western Producer

Changes To Depreciation Rules Under The New Tax Law Section 179 And

Accounting Vs Tax Depreciation Why Do Both QuickBooks

Depreciation Recapture In The Partnership Context

Depreciation Recapture In The Partnership Context

Depreciation Tax Shield Formula And Calculation

Macrs Depreciation Table 2017 Cabinets Matttroy

Macrs Depreciation Table 2017 39 Year Awesome Home

Federal Tax Depreciation Rules - The 179D commercial buildings energy efficiency tax deduction enables building owners to claim a tax deduction for installing qualifying systems