Federal Tax Exemption 2023 Explore updated credits deductions and exemptions including the standard deduction personal exemption Alternative Minimum Tax AMT Earned Income Tax Credit EITC Child Tax Credit CTC capital gains

Over 50 federal income tax provisions are indexed for inflation These include the tax brackets the personal exemption which is unavailable until 2026 under current law and Premium tax credit for 2023 you don t need the information in Part II of Form 1095 C For more information on who is eligible for the premium tax credit see the Instructions for Form 8962

Federal Tax Exemption 2023

Federal Tax Exemption 2023

https://images.squarespace-cdn.com/content/v1/58cf3fa8e6f2e19aff948d4c/1593946918567-M3LZJC3J24BR72W9BKW6/Sales+Tax+Certificate.jpg

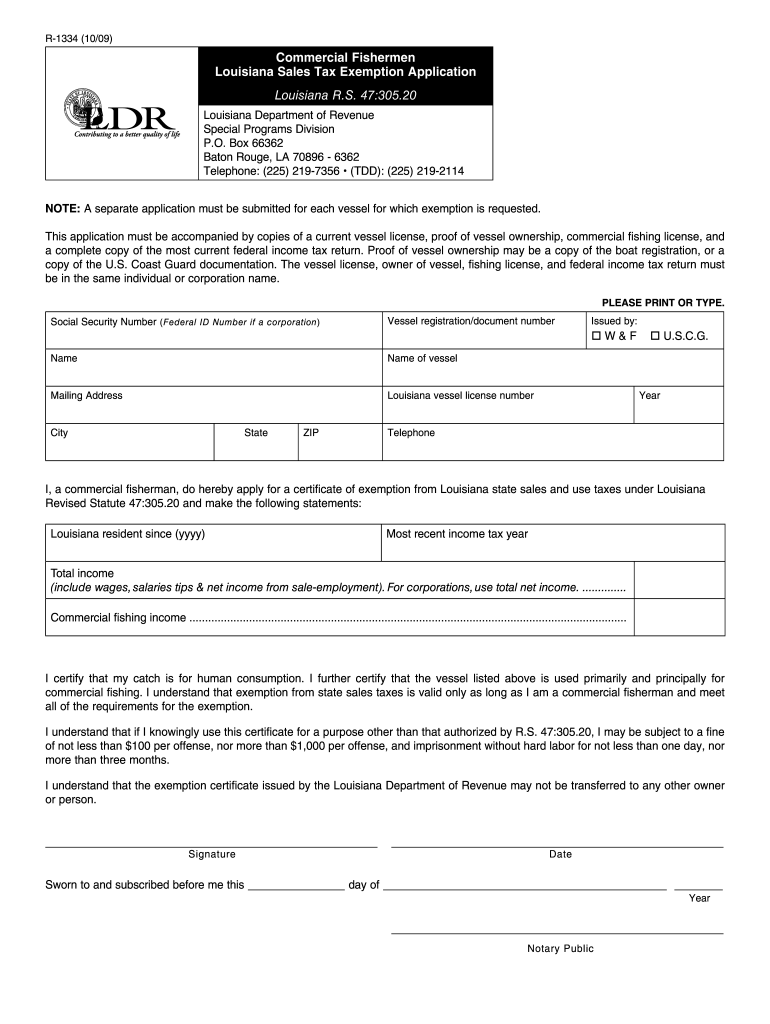

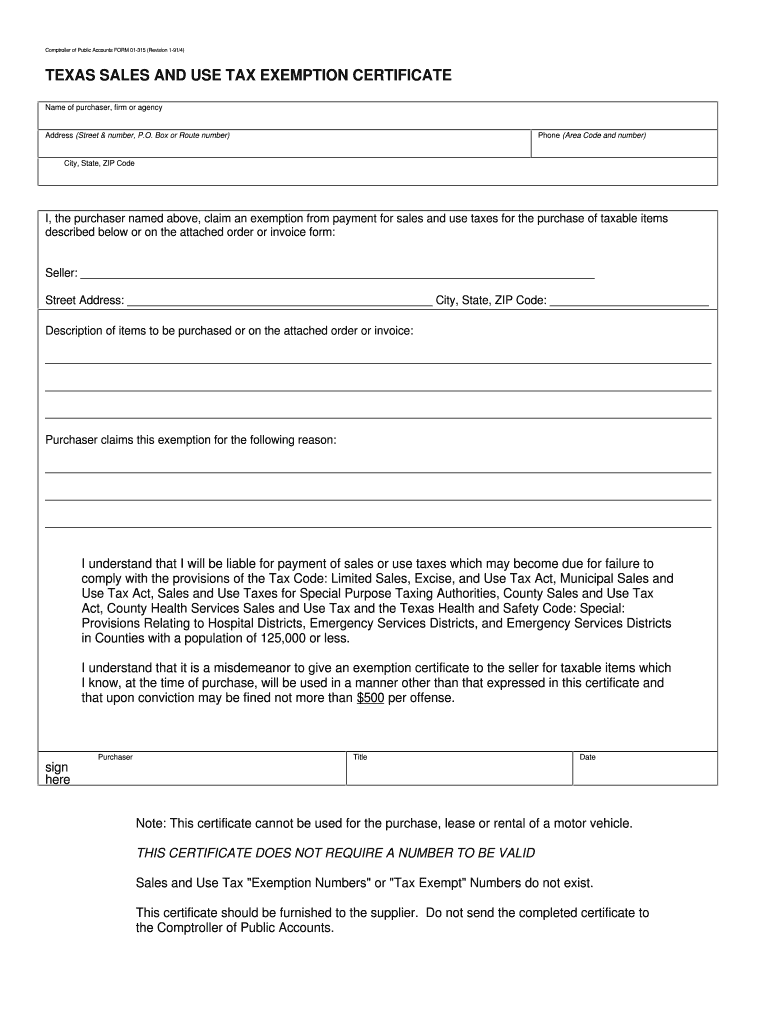

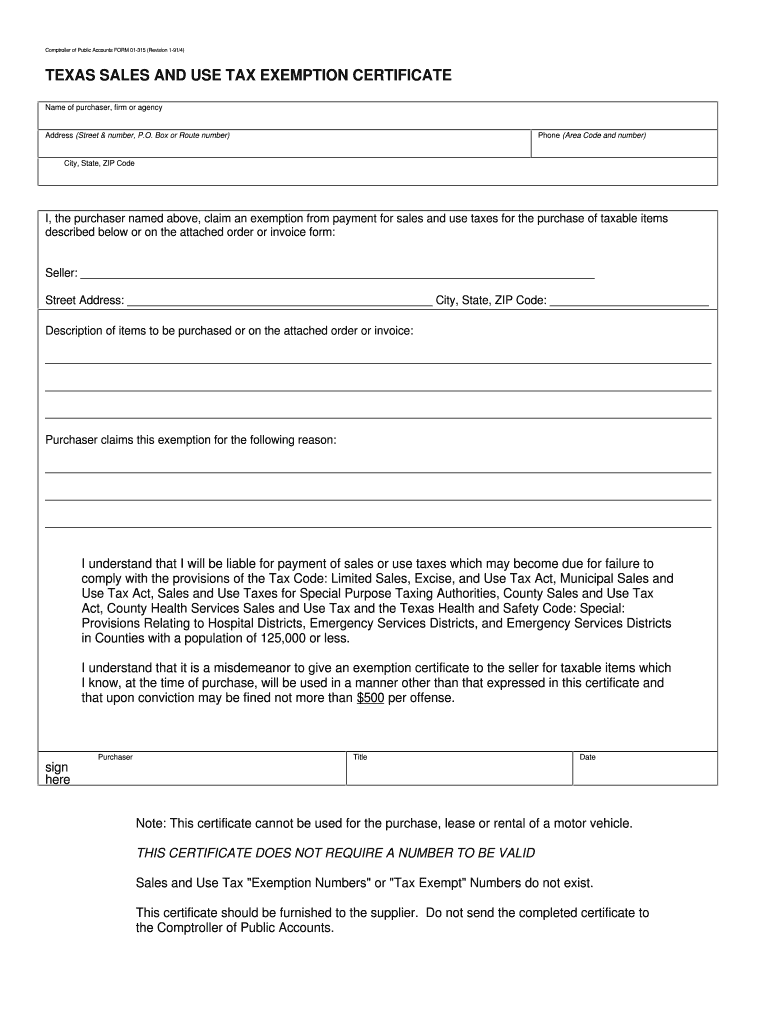

Louisiana Resale Certificate PDF Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/11/44/11044386/large.png

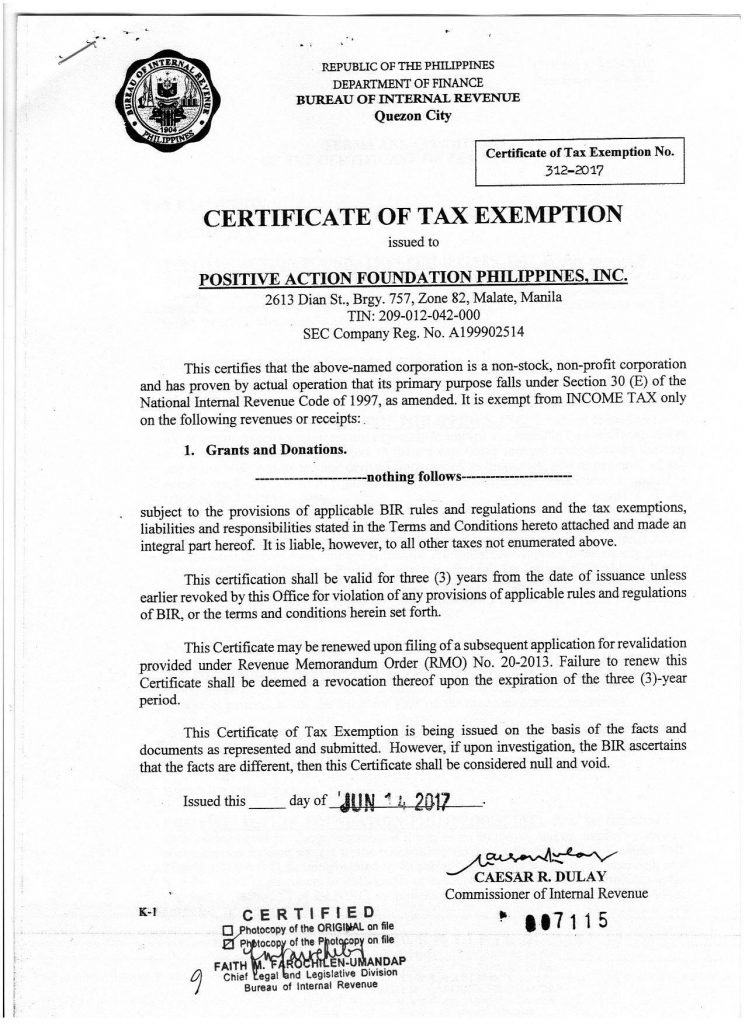

Tax Exemption Certificate Sachet Riset

https://pafpi.org/wp-content/uploads/2017/07/2017-PAFPI-Certificate-of-TAX-Exemption-745x1024.jpg

The Internal Revenue Service has released dozens of inflation adjustments affecting individual income tax brackets deductions and credits for 2023 and no Taxable income equals adjusted gross income minus deductions or exemptions One common deduction taken by most taxpayers is the standard deduction which in 2023 is 13 850 for

Gift and Estate Tax Exemption The amount you can give during your lifetime or at your death and be exempt from federal estate and gift taxes has risen from 12 060 000 to Find the 2025 tax rates for money you earn in 2025 See current federal tax brackets and rates based on your income and filing status

Download Federal Tax Exemption 2023

More picture related to Federal Tax Exemption 2023

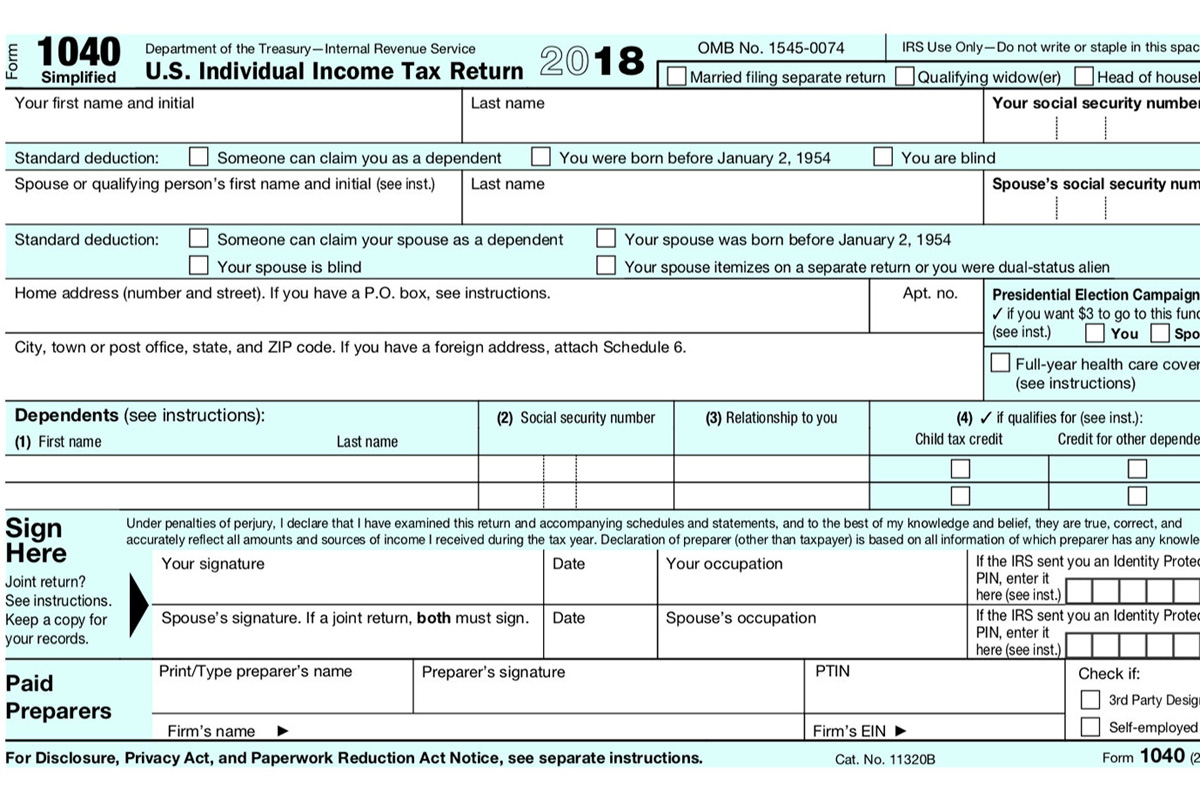

Appeals Court Upholds Federal Tax Exemption For Clergy Housing Expenses

https://www.episcopalnewsservice.org/wp-content/uploads/2019/03/ens_031819_TaxForm.jpg

Tax Exempt Form Tn Fill And Sign Printable Template Online Bank2home

https://www.signnow.com/preview/1/649/1649273/large.png

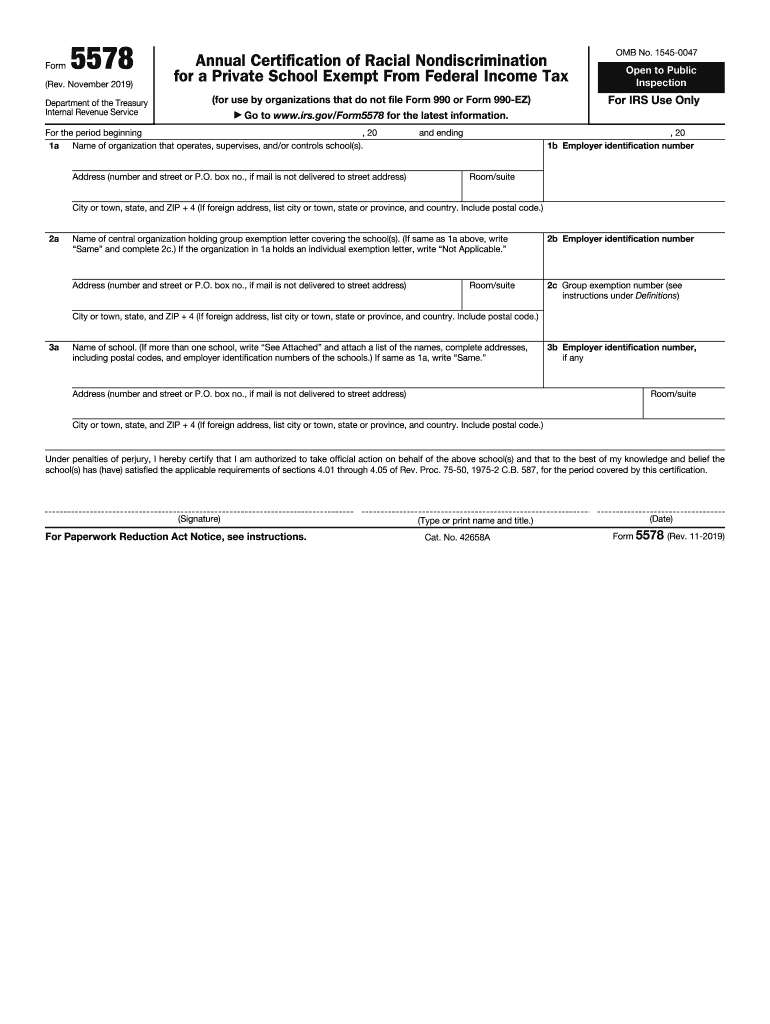

2019 2024 Form IRS 5578 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/489/187/489187873/large.png

Amid soaring inflation the IRS this week announced higher federal income tax brackets and standard deductions for 2023 The agency has boosted the income thresholds Income Level If you are a single filer and earned less than 12 550 in 2023 you are likely exempt from paying federal income tax because your income is below the standard deduction threshold Filing Status Married

For taxable years beginning in 2023 the standard deduction amount under 63 c 5 for an individual who may be claimed as a dependent by another taxpayer cannot The TCJA substantially altered and revised the base level exemptions for the federal income tax the Standard Deduction Personal Exemption and Child Tax Credit In

Nevada Tax Exemption Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/45/978/45978382/large.png

Federal Estate And Gift Tax Exemption Set To Rise Substantially For

https://mpmlaw.com/wp-content/uploads/2022/09/estate-tax.png

https://taxfoundation.org › data › all › federal

Explore updated credits deductions and exemptions including the standard deduction personal exemption Alternative Minimum Tax AMT Earned Income Tax Credit EITC Child Tax Credit CTC capital gains

https://crsreports.congress.gov › product › pdf › RL

Over 50 federal income tax provisions are indexed for inflation These include the tax brackets the personal exemption which is unavailable until 2026 under current law and

State Lodging Tax Exempt Forms ExemptForm

Nevada Tax Exemption Fill Online Printable Fillable Blank PdfFiller

Virginia Sales Tax Exemption Form St 11 Fill Out And Sign Printable

Mass W 4 Form 2023 Printable Forms Free Online

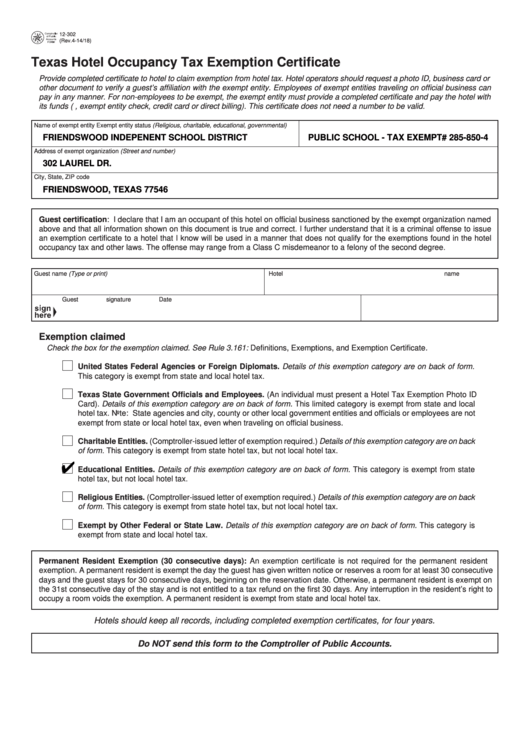

Fillable Texas Hotel Occupancy Tax Exemption Certificate Printable Pdf

Texas Tax Exempt PDF 1991 2024 Form Fill Out And Sign Printable PDF

Texas Tax Exempt PDF 1991 2024 Form Fill Out And Sign Printable PDF

California Ag Tax Exemption Form Fill Online Printable Fillable

Sales Use Tax Exempt Form 2023 North Carolina ExemptForm

State Tax Exemption Map National Utility Solutions

Federal Tax Exemption 2023 - Here s what that means If you earned 75 000 in 2023 and file as a single taxpayer taking the standard deduction of 13 850 will reduce your taxable income to