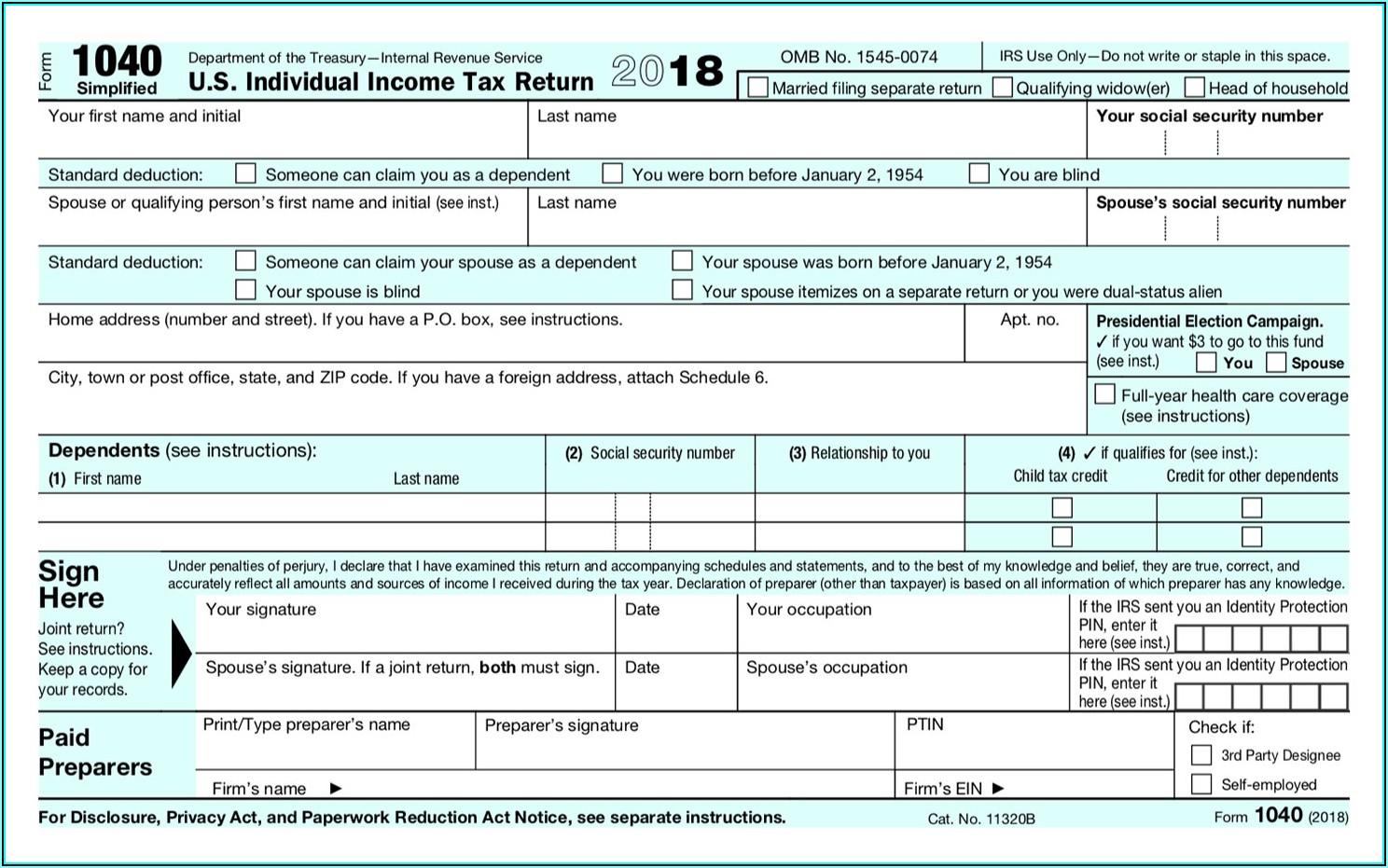

Federal Tax Form For Ev Rebate Web Form 8936 Rev January 2023 Department of the Treasury Internal Revenue Service Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled

Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section Web Used Clean Vehicle Credit Beginning January 1 2023 if you buy a qualified used electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you

Federal Tax Form For Ev Rebate

Federal Tax Form For Ev Rebate

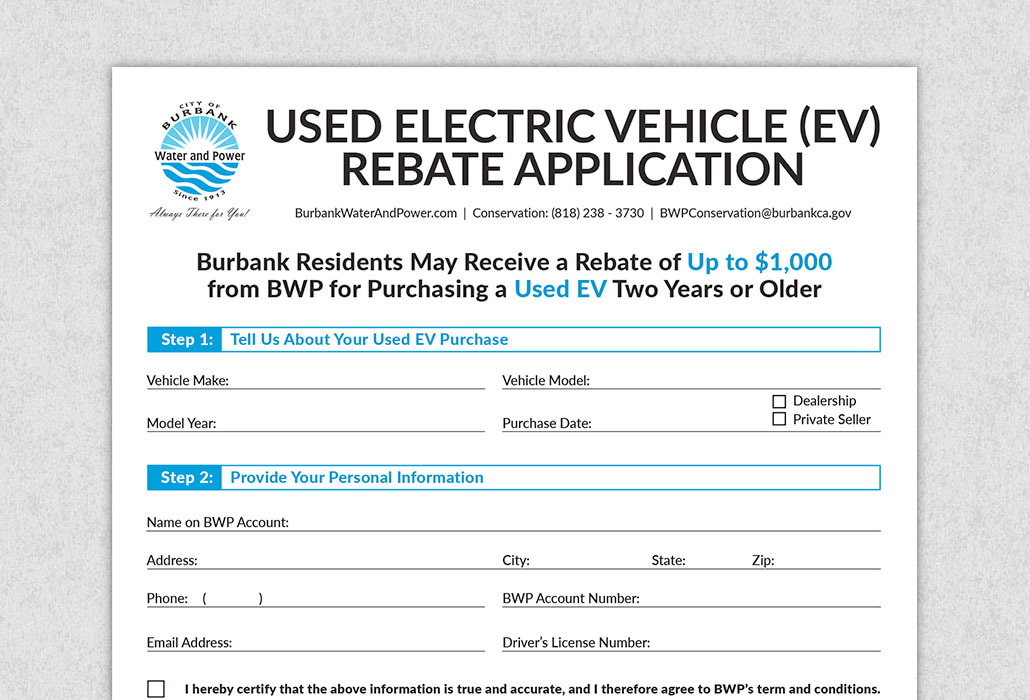

https://www.burbankwaterandpower.com/images/2020/02/11/used-ev_application_image.jpg

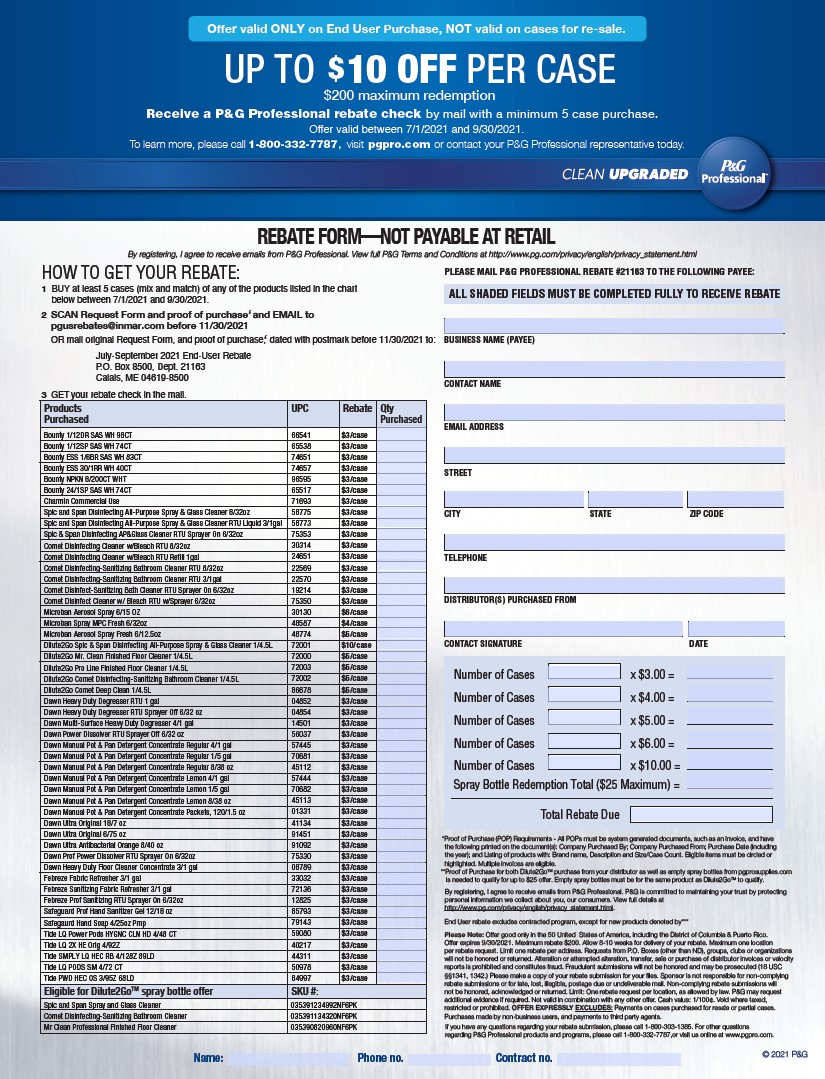

P G And E Ev Rebate Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/08/PG-Rebate-Form-2021.jpg

Federal EV 7500 Rebate For F 150 Lightning F150gen14 2021

https://www.f150gen14.com/forum/attachments/1621629715533-png.17461/

Web 5 sept 2023 nbsp 0183 32 The EV tax credit is a federal tax incentive for taxpayers looking to go green on the road Here are the rules qualifications and how to claim the credit Web 7 janv 2023 nbsp 0183 32 The tax credits for purchasing electric vehicles EVs got a major overhaul on Jan 1 EV tax credits have been around for years but they were redesigned as part of President Biden s massive

Web 5 sept 2023 nbsp 0183 32 A new federal EV tax credit for 2023 is here thanks to the Inflation Reduction Act IRA massive tax and climate legislation promoting clean energy The credit of up Web 17 ao 251 t 2022 nbsp 0183 32 All electric and plug in hybrid vehicles purchased new from 2010 through 2022 may be eligible for a federal income tax credit of up to 7 500 The credit amount

Download Federal Tax Form For Ev Rebate

More picture related to Federal Tax Form For Ev Rebate

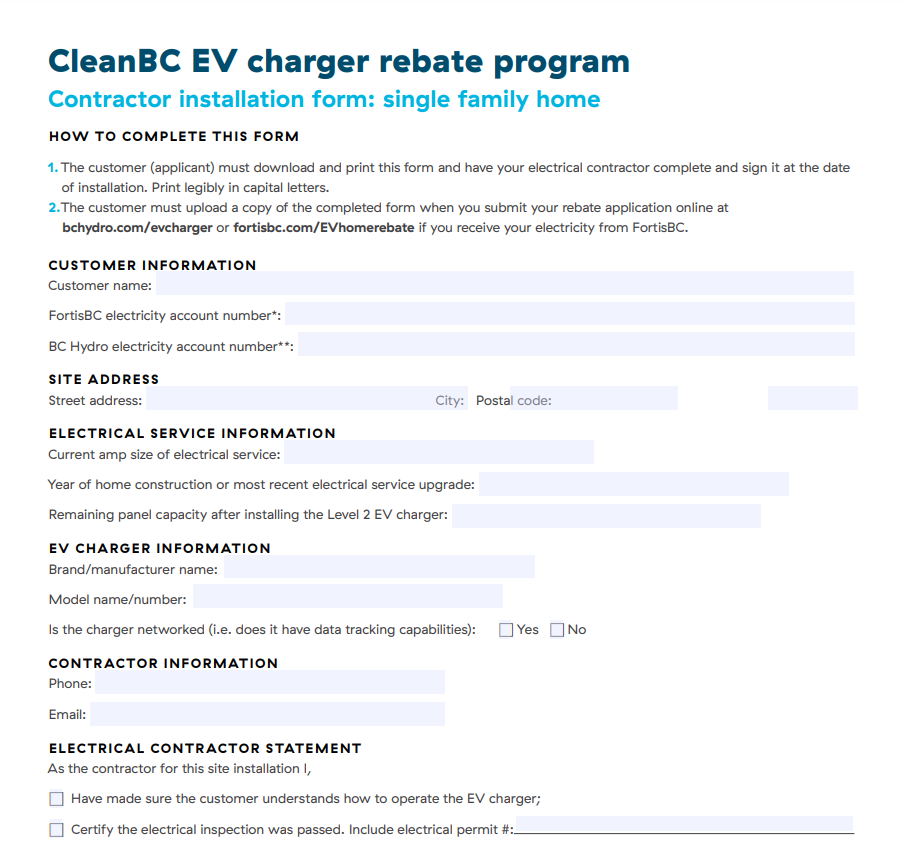

Ontario Ev Charger Rebate Form By State Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/Ontario-Ev-Charger-Rebate-Form.png

Ok Natural Gas Rebate Energy Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/250/319/250319623/large.png

Model 3 Standard And SR Qualify For Canada s Federal EV Rebate Tesla

https://www.teslaownersonline.com/attachments/3d3dc23b-4d4a-4c6a-bc01-0dbc3e4417ad-jpeg.25446/

Web 1 ao 251 t 2023 nbsp 0183 32 To claim the federal tax credit for your home EV charger or other EV charging equipment file Form 8911 with the IRS when you file your federal income tax return Web 17 janv 2023 nbsp 0183 32 Thanks to previous legislation the Federal EV Tax Credit in 2022 offers taxpayers up to 7 500 in non refundable credit on their 2022 taxes for purchasing a new EV The only disqualifications from the credit

Web 18 janv 2023 nbsp 0183 32 IRS Form 8911 may give you an idea of how much you qualify to receive as a tax credit Just make sure you save your receipts for when you file your taxes More Web Federal Tax Credit Up To 7 500 All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to

Top 19 Mor ev Application Form En Iyi 2022

https://www.cuanmor.co.uk/wp-content/uploads/2017/04/Cuan-Mor-Application-form-min-1.jpg

Property Tax Rebate Application Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/140/1407/140793/page_1_bg.png

https://www.irs.gov/pub/irs-pdf/f8936.pdf

Web Form 8936 Rev January 2023 Department of the Treasury Internal Revenue Service Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled

https://www.irs.gov/credits-deductions/credits-for-new-electric...

Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section

Printable Federal Income Tax Forms Printable Forms Free Online

Top 19 Mor ev Application Form En Iyi 2022

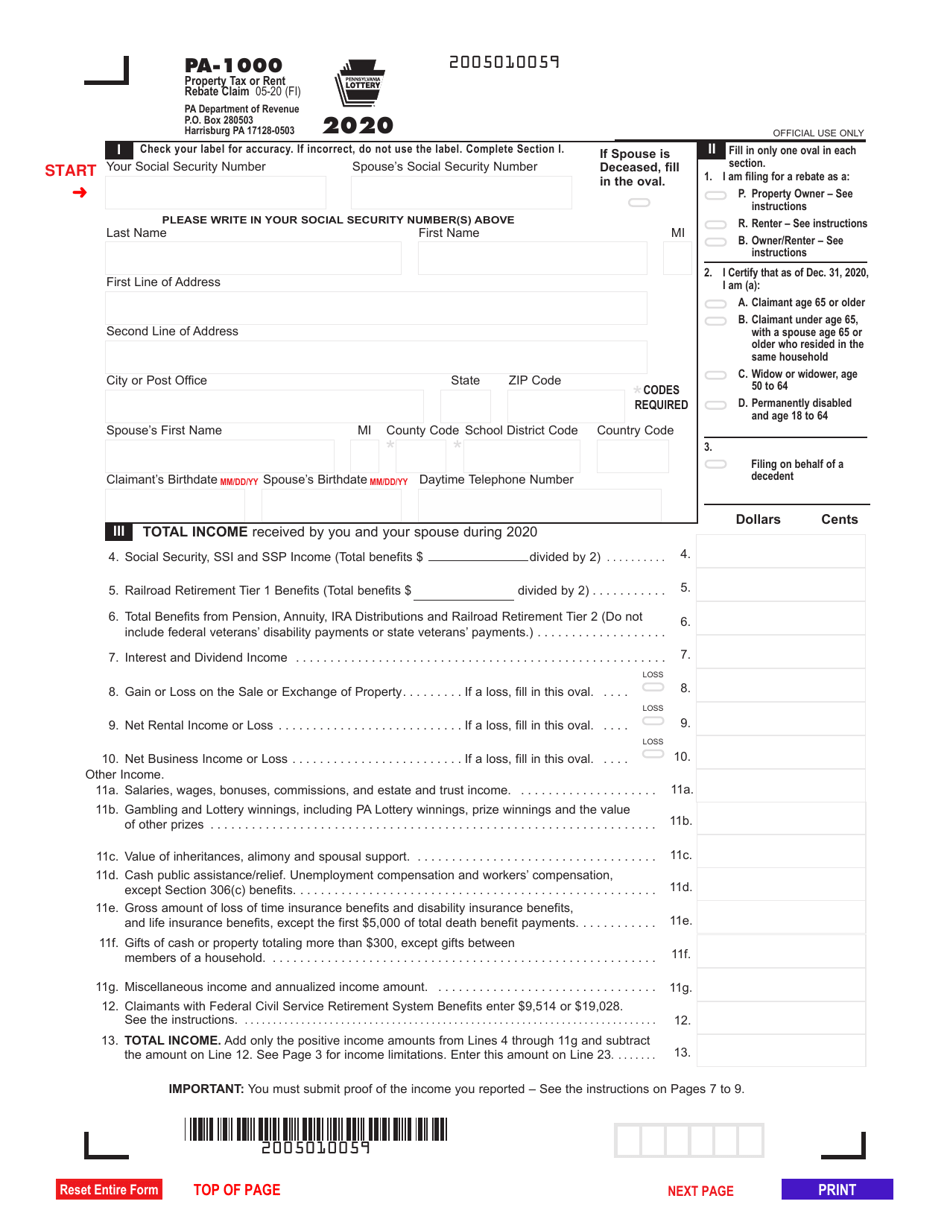

2016 Property Tax Or Rent Rebate Claim PA 1000 Forms Publications

Federal Income Tax Forms 1040ez Form Resume Examples a6YnA8P9Bg

Filing Tax Returns EV Credits Tesla Motors Club

Ev Car Tax Rebate Calculator 2022 Carrebate

Ev Car Tax Rebate Calculator 2022 Carrebate

PA Property Tax Rebate Forms Printable Rebate Form

2022 Rent Rebate Form Fillable Printable PDF Forms Handypdf

Form PA 1000 Download Fillable PDF Or Fill Online Property Tax Or Rent

Federal Tax Form For Ev Rebate - Web 5 sept 2023 nbsp 0183 32 The EV tax credit is a federal tax incentive for taxpayers looking to go green on the road Here are the rules qualifications and how to claim the credit