Federal Tax Rebate 2023 Web 19 oct 2022 nbsp 0183 32 The IRS has released higher federal tax brackets for 2023 to adjust for inflation The standard deduction is increasing to 27 700 for married couples filing

Web If you place in service a new plug in electric vehicle EV or fuel cell vehicle FCV in 2023 or after you may qualify for a clean vehicle tax credit Find information on credits for used Web 5 sept 2023 nbsp 0183 32 NEW For the 2023 tax year the IRS has announced that most state rebate payments won t be taxable on your federal return However there could be some exceptions in some state payments and

Federal Tax Rebate 2023

Federal Tax Rebate 2023

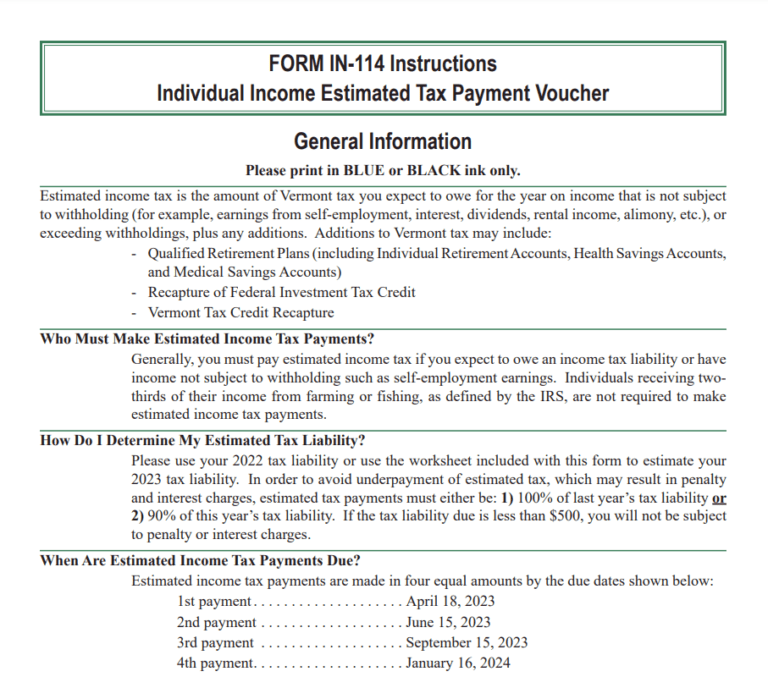

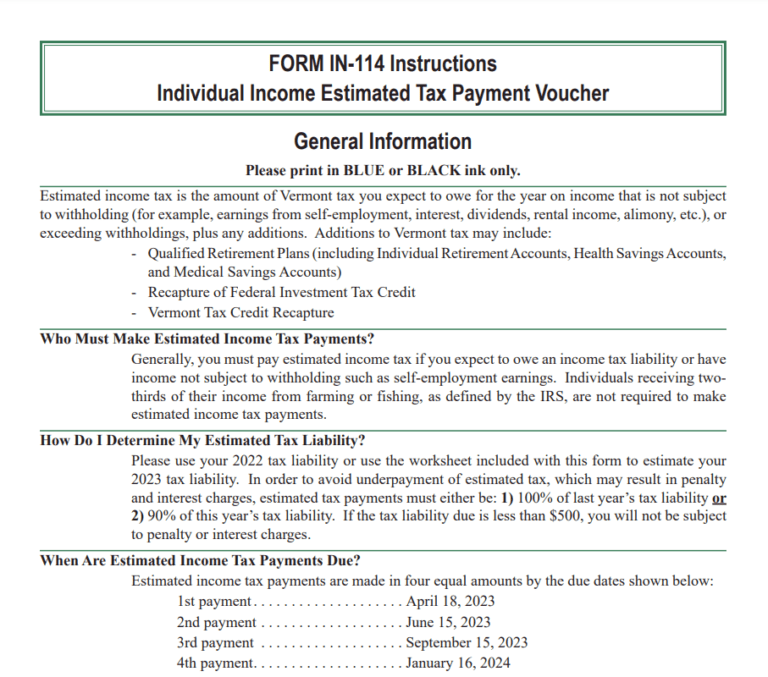

https://printablerebateform.net/wp-content/uploads/2023/05/Vermont-Tax-Rebate-2023-768x677.png

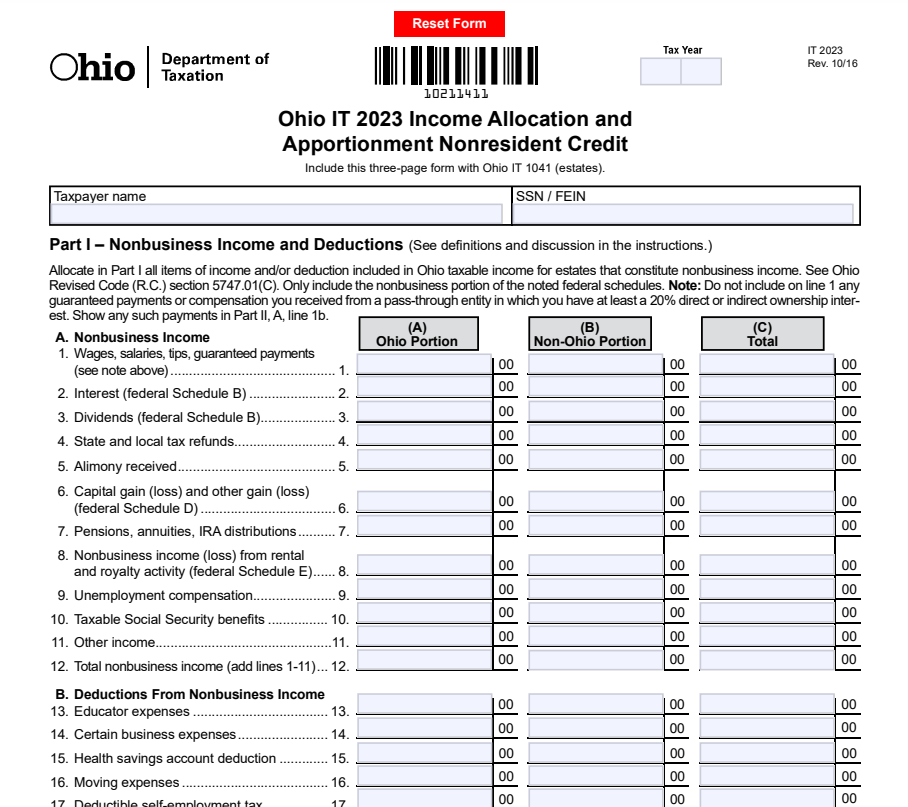

Ohio Tax Rebate 2023 Maximize Your Tax Savings Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/04/Ohio-Tax-Rebate-2023.png

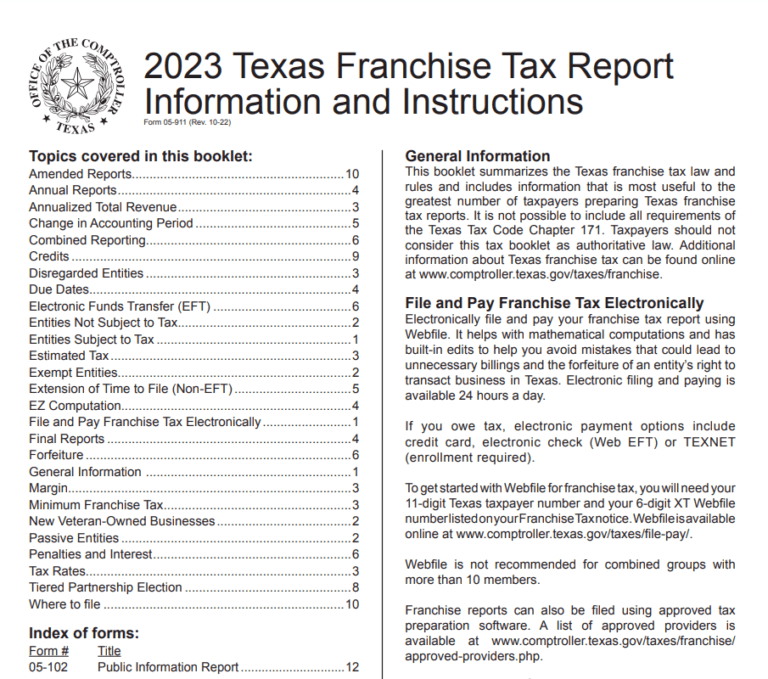

Texas Tax Rebate 2023 Everything You Need To Know Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/05/Texas-Tax-Rebate-2023-768x679.png

Web 5 sept 2023 nbsp 0183 32 The EV tax credit income limit for married couples filing jointly is 300 000 And if you file as head of household and make more than 225 000 you also won t be Web 1 janv 2023 nbsp 0183 32 Clean Vehicle Credits If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can

Web 7 janv 2023 nbsp 0183 32 Updated April 3 202311 10 AM ET Camila Domonoske Enlarge this image For the first time in years some Teslas will qualify for a 7 500 federal tax credit for new electric vehicles But only Web 1 sept 2023 nbsp 0183 32 The Inflation Reduction Act set MSRP caps on what vehicles can qualify for the 7 500 tax credit with a threshold of 55k for cars and 80k for trucks and SUVs

Download Federal Tax Rebate 2023

More picture related to Federal Tax Rebate 2023

Maximize Your Savings New Jersey Tax Rebate 2023 Tax Rebate

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/New-Jersey-Tax-Rebate-2023.jpg?ssl=1

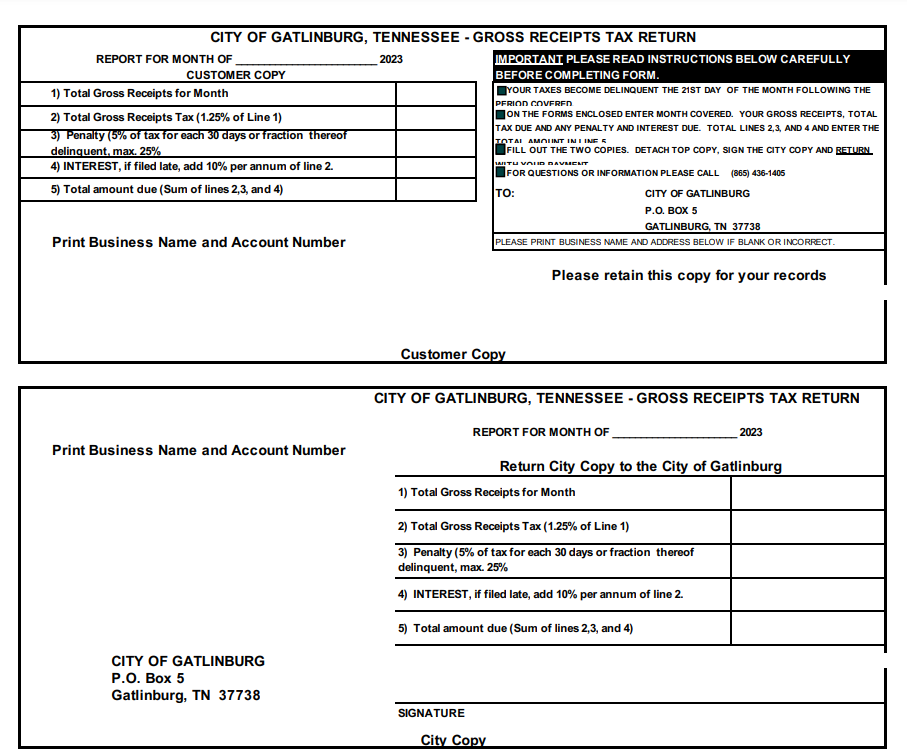

Tennessee Tax Rebate 2023 A Comprehensive Guide Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/05/Tennessee-Tax-Rebate-2023.png

Minnesota Tax Rebate 2023 Your Comprehensive Guide Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/04/Minnesota-Tax-Rebate-2023-768x679.png

Web See 7 States Considering More Stimulus Checks in 2023 Alabama In May Alabama lawmakers approved a one time tax rebate that will give 150 to single people and 300 Web Federal Tax Credits for Plug in Electric and Fuel Cell Electric Vehicles Purchased in 2023 or After Federal Tax Credit Up To 7 500 All electric plug in hybrid and fuel cell electric

Web 14 mai 2023 nbsp 0183 32 Federal Tax Rebate 2023 Welcome to our comprehensive guide on the Federal Tax Rebate 2023 This article will provide you with all the essential details you need to know about the Web 28 ao 251 t 2023 nbsp 0183 32 The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through

Georgia Income Tax Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/03/Georgia-Tax-Rebate-2023-768x683.png

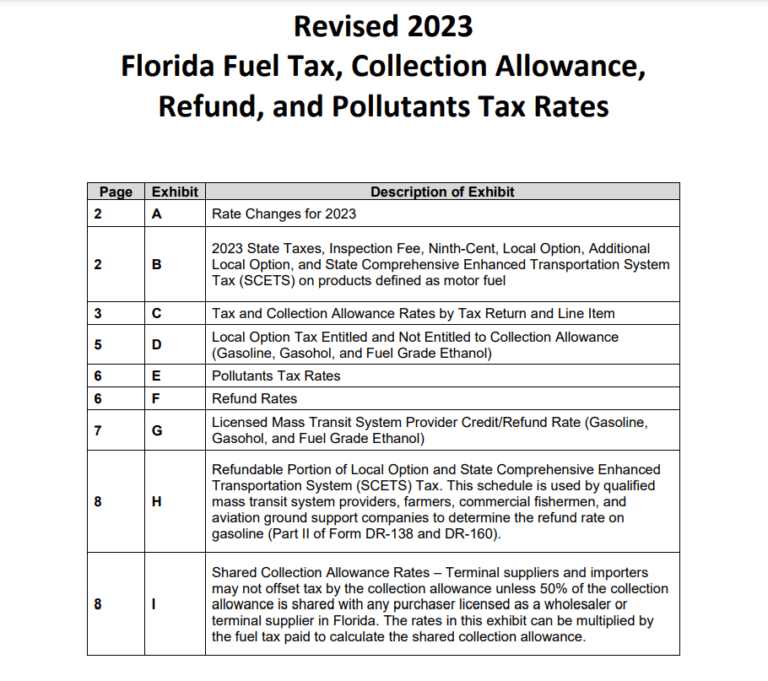

Florida Tax Rebate 2023 Get Tax Relief And Boost Economic Growth

https://printablerebateform.net/wp-content/uploads/2023/03/Florida-Tax-Rebate-2023-768x681.png

https://www.cnbc.com/2022/10/19/irs-here-are-the-new-income-tax...

Web 19 oct 2022 nbsp 0183 32 The IRS has released higher federal tax brackets for 2023 to adjust for inflation The standard deduction is increasing to 27 700 for married couples filing

https://www.irs.gov/credits-deductions/credits-for-new-clean-vehicles...

Web If you place in service a new plug in electric vehicle EV or fuel cell vehicle FCV in 2023 or after you may qualify for a clean vehicle tax credit Find information on credits for used

Property Tax Rebate New York State Printable Rebate Form

Georgia Income Tax Rebate 2023 Printable Rebate Form

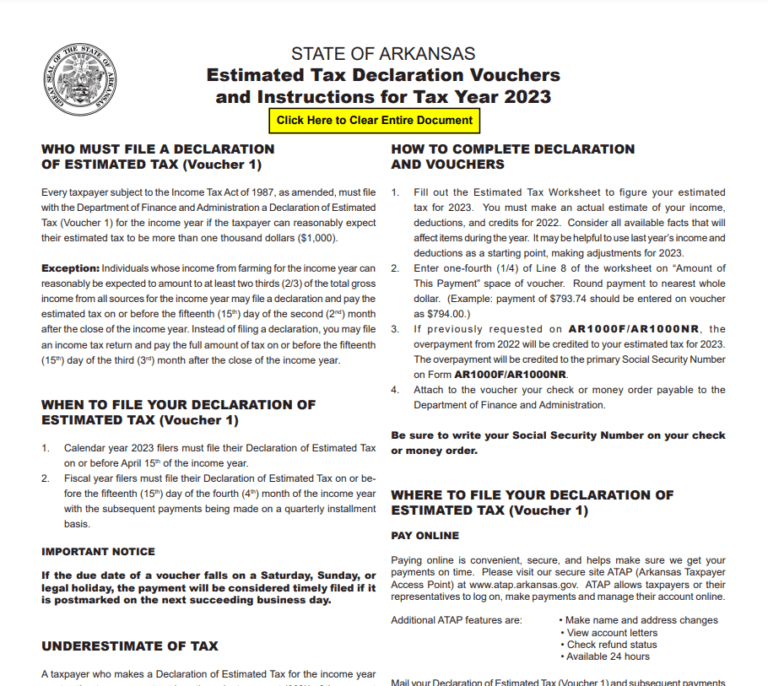

Arkansas Tax Rebate 2023 Printable Rebate Form

Maine Tax Relief 2023 Printable Rebate Form

Delaware Tax Rebate 2023 Printable Rebate Form

Michigan Tax Rebate 2023 Eligibility Types Deadlines How To Claim

Michigan Tax Rebate 2023 Eligibility Types Deadlines How To Claim

Illinois Property Tax Rebate Form 2023 Printable Rebate Form

Missouri State Tax Rebate 2023 Printable Rebate Form

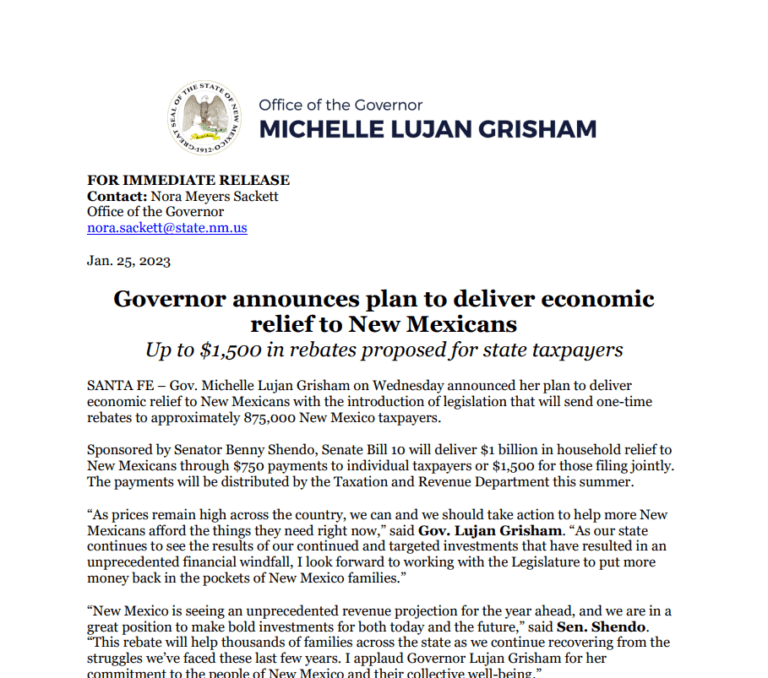

New Mexico Tax Rebate 2023 Eligibility How To Claim And Deadlines

Federal Tax Rebate 2023 - Web 1 janv 2023 nbsp 0183 32 Clean Vehicle Credits If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can