Federal Tax Rebate Air Conditioner Web 30 d 233 c 2022 nbsp 0183 32 The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements windows doors skylights insulation electrical plus furnaces boilers and central air

Web 22 d 233 c 2022 nbsp 0183 32 IR 2022 225 December 22 2022 WASHINGTON The Internal Revenue Service today released frequently asked questions FAQs about energy efficient home improvements and residential clean energy property credits in Fact Sheet FS 2022 40 PDF Web Public Law 117 169 136 Stat 1818 August 16 2022 commonly known as the Inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements under 167 25C of the Internal Revenue Code Code and residential energy property under

Federal Tax Rebate Air Conditioner

Federal Tax Rebate Air Conditioner

https://www.symbiontairconditioning.com/wp-content/uploads/2020/06/money-ac-graphic-2.png

Federal Tax Rebate Program Benson s Heating Air

https://www.bensonshvac.com/wp-content/uploads/Federal-Tax-Credits-for-Air-Conditioners-and-Heat-Pumps.png

Florida Energy Rebates For Air Conditioners 300 Federal Tax Credit

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2022/09/florida-energy-rebates-for-air-conditioners-300-federal-tax-credit.jpg?w=400&ssl=1

Web 26 juil 2023 nbsp 0183 32 Central air conditioners water heaters furnaces boilers and heat pumps Biomass stoves and boilers Home energy audits The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up Web 13 avr 2023 nbsp 0183 32 The federal Inflation Reduction Act passed in 2022 expanded and extended federal income tax credits available for energy efficiency home improvements including HVAC system components An array of Energy Star certified equipment is eligible for the

Web 30 d 233 c 2022 nbsp 0183 32 The Inflation Reduction Act of 2022 provides federal tax credits and deductions that empower Americans to make homes and buildings more energy efficient to help reduce energy costs while Web Guidance for Program Administrators Draft Tribal Rebates Allocations Available Frequently Asked Questions About the Home Energy Rebates On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act IRA into law

Download Federal Tax Rebate Air Conditioner

More picture related to Federal Tax Rebate Air Conditioner

Ladwp Rebates Air Conditioners Central Air Conditioners Get Up To

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2023/01/ladwp-rebates-air-conditioners-central-air-conditioners-get-up-to.jpg?fit=1280%2C800&ssl=1

Mitsubishi Air Conditioner Tax Rebate AirRebate

https://i0.wp.com/www.airrebate.net/wp-content/uploads/2022/10/mitsubishi-air-conditioner-tax-rebate.jpg?w=1046&h=574&ssl=1

Mass Save Rebates Air Conditioner 2020 Mass Save Rebates Tjs Radiant

https://i0.wp.com/www.masssaverebate.net/wp-content/uploads/2022/10/mass-save-rebates-air-conditioner-2020-mass-save-rebates-tjs-radiant-36.jpg?resize=768%2C922&ssl=1

Web 30 d 233 c 2022 nbsp 0183 32 Under the Inflation Reduction Act of 2022 federal income tax credits for energy efficiency home improvements will be available through 2032 A broad selection of ENERGY STAR certified equipment Web 12 janv 2023 nbsp 0183 32 While the total limit for an energy efficiency tax credit in one year is 3 200 aggregate limits also apply The amount breaks down into two categories A maximum of 2 000 may be applied to any

Web Here are the highlights of ENERGY STAR certified equipment that is eligible for the tax credits Products That Qualify Central air conditioning 300 for air conditioners recognized as ENERGY STAR Most Efficient Air Web 16 janv 2023 nbsp 0183 32 What is a Federal Energy Tax Credit The Federal Energy Tax Credit is a specified amount that the homeowner can subtract from the taxes owed to the IRS to help offset the cost of HVAC improvements If for 2022 you owed 3 500 in Federal tax but

Tax Rebate On Energy Efficient Air Conditioners AirRebate

https://i0.wp.com/www.airrebate.net/wp-content/uploads/2022/10/tax-rebate-on-energy-efficient-air-conditioners.jpeg?resize=791%2C1024&ssl=1

How To Find Federal Tax Credits Rebates For HVAC Upgrades

https://www.blueheatingandcooling.com/wp-content/uploads/2016/10/BHC-taxcredits.jpg

https://www.energystar.gov/about/federal_tax_credits/central_air...

Web 30 d 233 c 2022 nbsp 0183 32 The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements windows doors skylights insulation electrical plus furnaces boilers and central air

https://www.irs.gov/newsroom/irs-releases-frequently-asked-questions...

Web 22 d 233 c 2022 nbsp 0183 32 IR 2022 225 December 22 2022 WASHINGTON The Internal Revenue Service today released frequently asked questions FAQs about energy efficient home improvements and residential clean energy property credits in Fact Sheet FS 2022 40 PDF

Con Edison Rebate For Split Air Conditioner Https Resource PumpRebate

Tax Rebate On Energy Efficient Air Conditioners AirRebate

Teco Rebates For Air Conditioners AirRebate

MORE GRANTS Housing Help Tax Rebates FREE Air Conditioners More

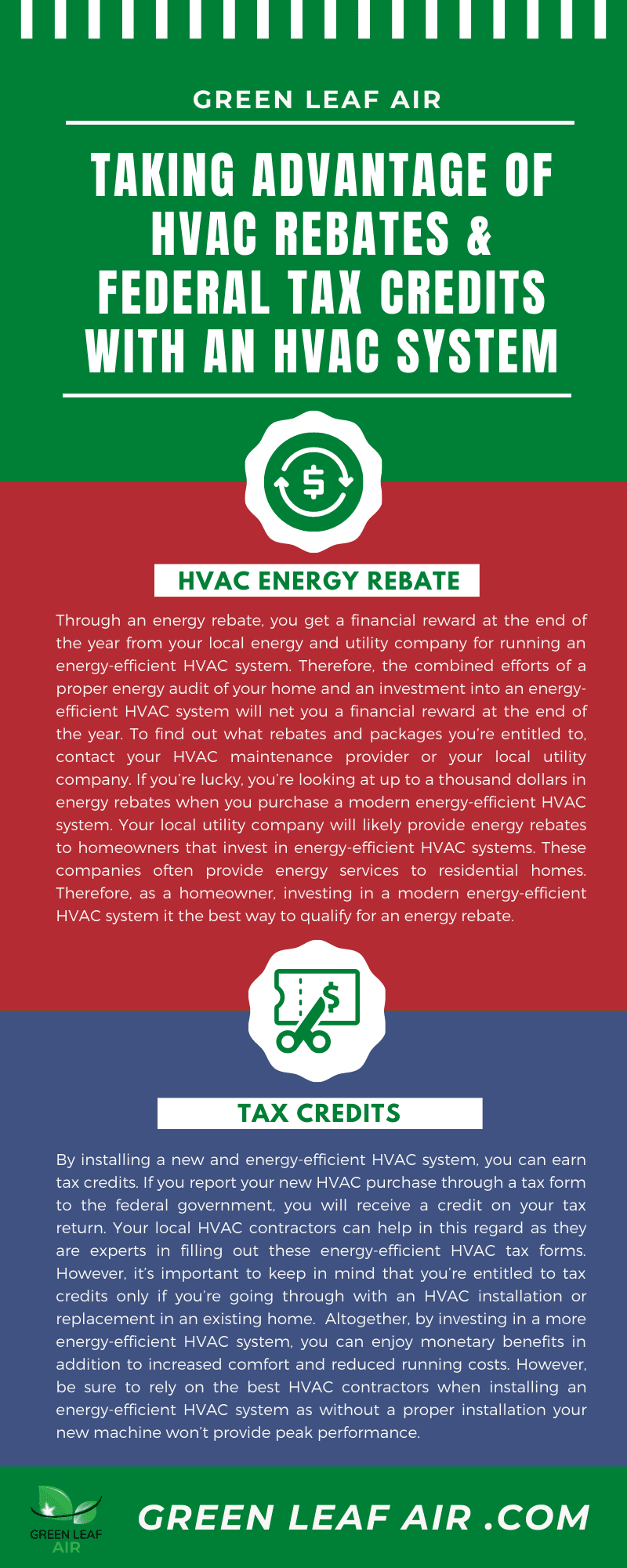

Taking Advantage Of HVAC Rebates Federal Tax Credits With An

Air Conditioner Rebates 2022 California AirRebate

Air Conditioner Rebates 2022 California AirRebate

Solar Air Conditioner Tax Rebates 2022 AirRebate

Air Conditioner Tax Rebate Federal Tax Credit For New Hvac Step By

Energy Efficient Rebates Tax Incentives For MA Homeowners Mass Save

Federal Tax Rebate Air Conditioner - Web 30 d 233 c 2022 nbsp 0183 32 The Inflation Reduction Act of 2022 provides federal tax credits and deductions that empower Americans to make homes and buildings more energy efficient to help reduce energy costs while