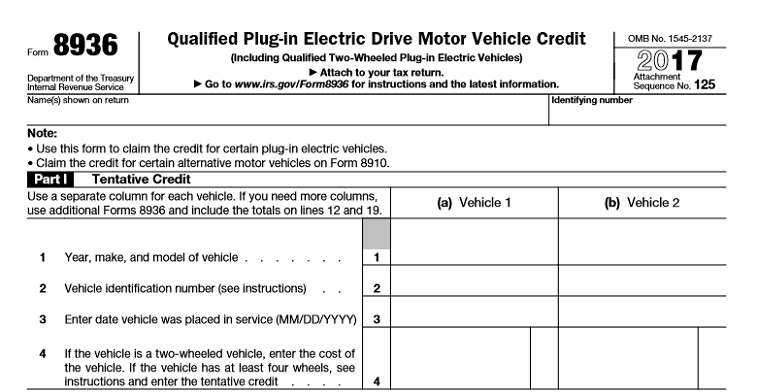

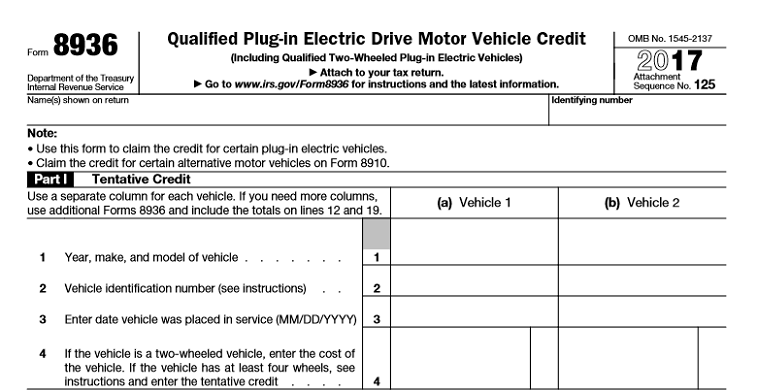

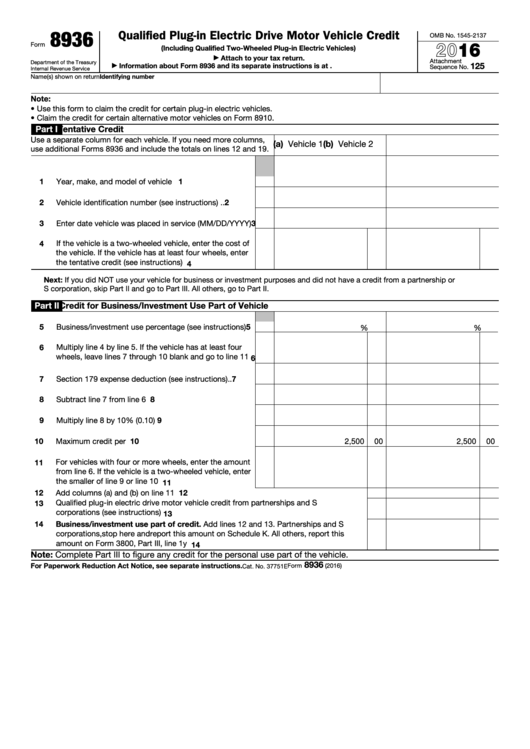

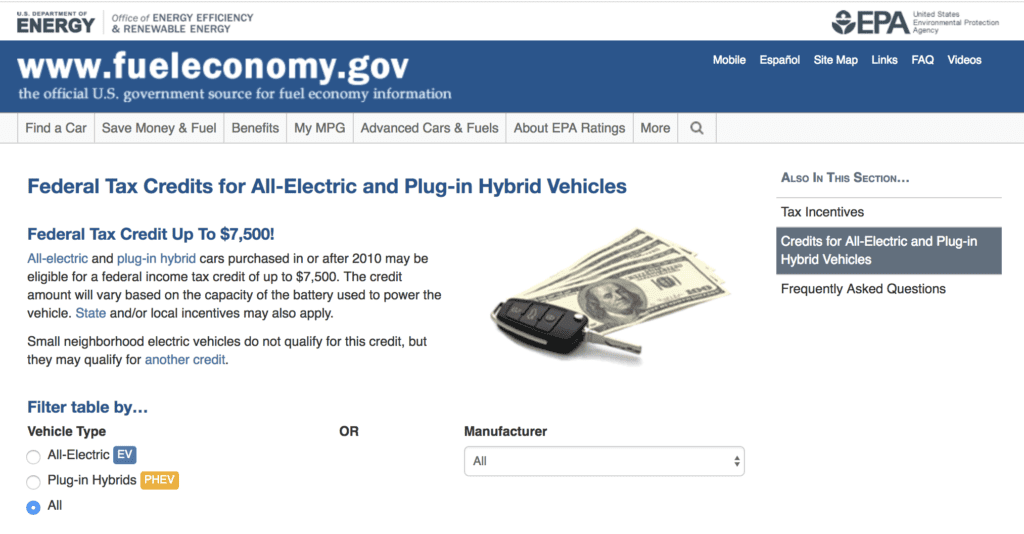

Federal Tax Rebate Electric Vehicle Tentative Credit Instructions Web Purpose of Form Use Form 8936 to figure your credit for qualified plug in electric drive motor vehicles you placed in service during your tax year Also use Form 8936 to figure

Web Form 8936 Rev January 2023 Department of the Treasury Internal Revenue Service Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code

Federal Tax Rebate Electric Vehicle Tentative Credit Instructions

Federal Tax Rebate Electric Vehicle Tentative Credit Instructions

https://www.cheatsheet.com/wp-content/uploads/2018/09/Untitled.png

Form 8936 Qualified Plug in Electric Drive Motor Vehicle Credit 2014

http://www.formsbirds.com/formimg/tax-payment-forms/8292/form-8936-qualified-plug-in-electric-drive-motor-vehicle-credit-2014-l1.png

Electric Car Available Rebates 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/06/electric-vehicle-rebates-now-available-in-maine-nrcm-1.jpg

Web 16 ao 251 t 2022 nbsp 0183 32 If you bought a new qualified plug in electric vehicle EV between 2010 and 2022 you may be eligible for a new electric vehicle tax credit up to 7 500 under Web 12 avr 2023 nbsp 0183 32 The Inflation Reduction Act of 2022 made several changes to the tax credits provided for qualified plug in electric drive motor vehicles including adding fuel cell

Web 7 janv 2023 nbsp 0183 32 The tax credits for purchasing electric vehicles EVs got a major overhaul on Jan 1 EV tax credits have been around for years but they were redesigned as part of President Biden s Web Instructions for Formular 8936 Introductory Material Save Developments What s New Instructions for Form 8936 01 2023 Internal Revenue Service Credits for New

Download Federal Tax Rebate Electric Vehicle Tentative Credit Instructions

More picture related to Federal Tax Rebate Electric Vehicle Tentative Credit Instructions

The Florida Hybrid Car Rebate Save Money And Help The Environment

https://cdn.osvehicle.com/do_hybrid_cars_get_a_tax_rebate.png

Tax Credits For Electric Vehicles TaxProAdvice

https://img.taxproadvice.com/wp-content/uploads/electric-vehicle-tax-credits-what-you-need-to-know-doty-pruett-and.jpeg

Tax Rebates For Electric Cars Michigan 2022 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/electric-vehicle-rebate-available-until-3-31-mcleod-cooperative-power-11.png

Web As of 2023 preowned plug in electric and fuel cell EVs qualify for a credit of up to 30 of their purchase price maxing out at 4 000 The used EV tax credit can only be claimed Web Used Clean Vehicle Credit Beginning January 1 2023 if you buy a qualified used electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you

Web On the consumer side the income cap to be eligible for the credit is 150 000 for single filers 225 000 for head of household and 300 000 for joint filers There will be an Web 10 janv 2023 nbsp 0183 32 Use Form 8936 to figure your credit for qualified plug in electric drive motor vehicles you placed in service during your tax year Also use Form 8936 to figure your

Electric Vehicle Rebates Dakota Electric Association

https://www.dakotaelectric.com/wp-content/uploads/2019/06/REVOLT-1200x489.gif

Is There A Tax Cut For A Used Electric Car OsVehicle

https://cdn.osvehicle.com/is_there_a_tax_credit_for_a_used_electric_car.jpg

https://www.irs.gov/pub/irs-pdf/i8936.pdf

Web Purpose of Form Use Form 8936 to figure your credit for qualified plug in electric drive motor vehicles you placed in service during your tax year Also use Form 8936 to figure

https://www.irs.gov/pub/irs-pdf/f8936.pdf

Web Form 8936 Rev January 2023 Department of the Treasury Internal Revenue Service Qualified Plug in Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled

Fillable Form 8936 Qualified Plug In Electric Drive Motor Vehicle

Electric Vehicle Rebates Dakota Electric Association

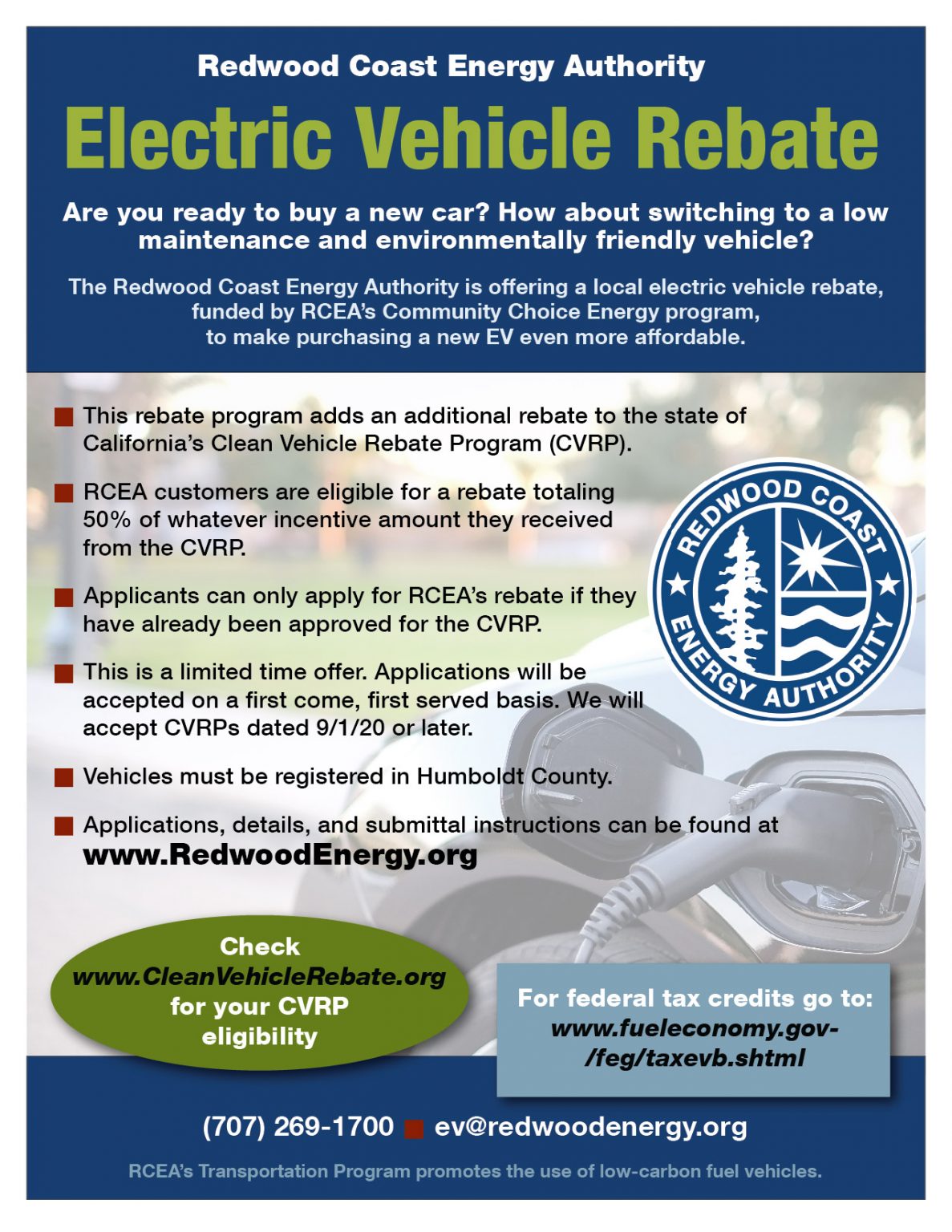

Electric Vehicle Rebate Redwood Coast Energy Authority

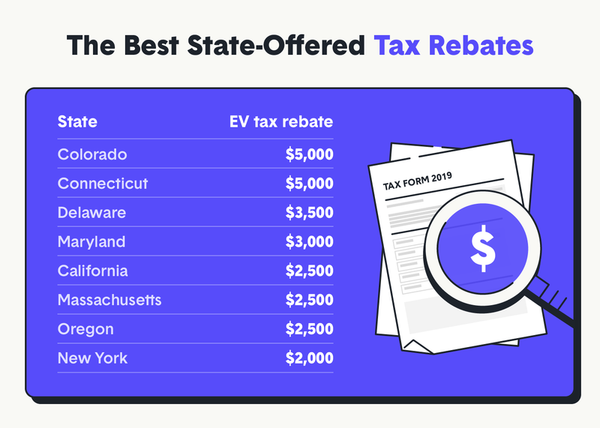

Electric Vehicle Incentives In 8 US States

How Does Federal Rebate On Electric Cars Work 2022 Carrebate

What Is The Tax Rebate For Electric Cars 2023 Carrebate

What Is The Tax Rebate For Electric Cars 2023 Carrebate

Federal Tax Rebates Electric Vehicles ElectricRebate

EVs Officially Exempted From Road Tax Until 2025 OKU Also Get Rebate

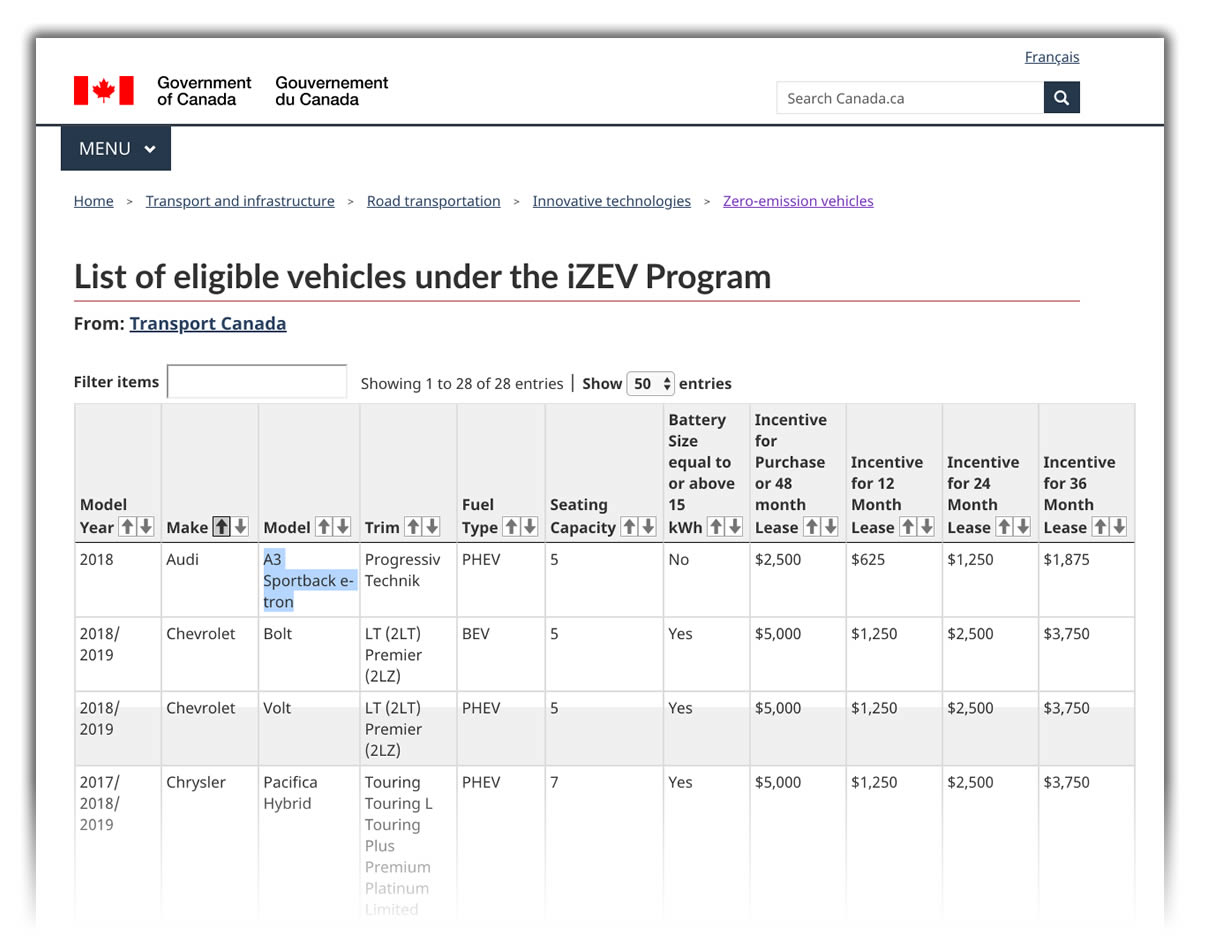

Government Of Canada Electric Vehicle Rebates ElectricRebate

Federal Tax Rebate Electric Vehicle Tentative Credit Instructions - Web 16 ao 251 t 2022 nbsp 0183 32 If you bought a new qualified plug in electric vehicle EV between 2010 and 2022 you may be eligible for a new electric vehicle tax credit up to 7 500 under