Federal Tax Rebate For Furnace Web 30 d 233 c 2022 nbsp 0183 32 The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements windows doors skylights insulation electrical plus furnaces boilers and central air

Web 1 janv 2023 nbsp 0183 32 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or Web 30 d 233 c 2022 nbsp 0183 32 New federal income tax credits are available through 2032 providing up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent Improvements such as installing heat

Federal Tax Rebate For Furnace

Federal Tax Rebate For Furnace

https://murrayssolutions.com/wp-content/uploads/2021/11/furnaceRebate2.jpg

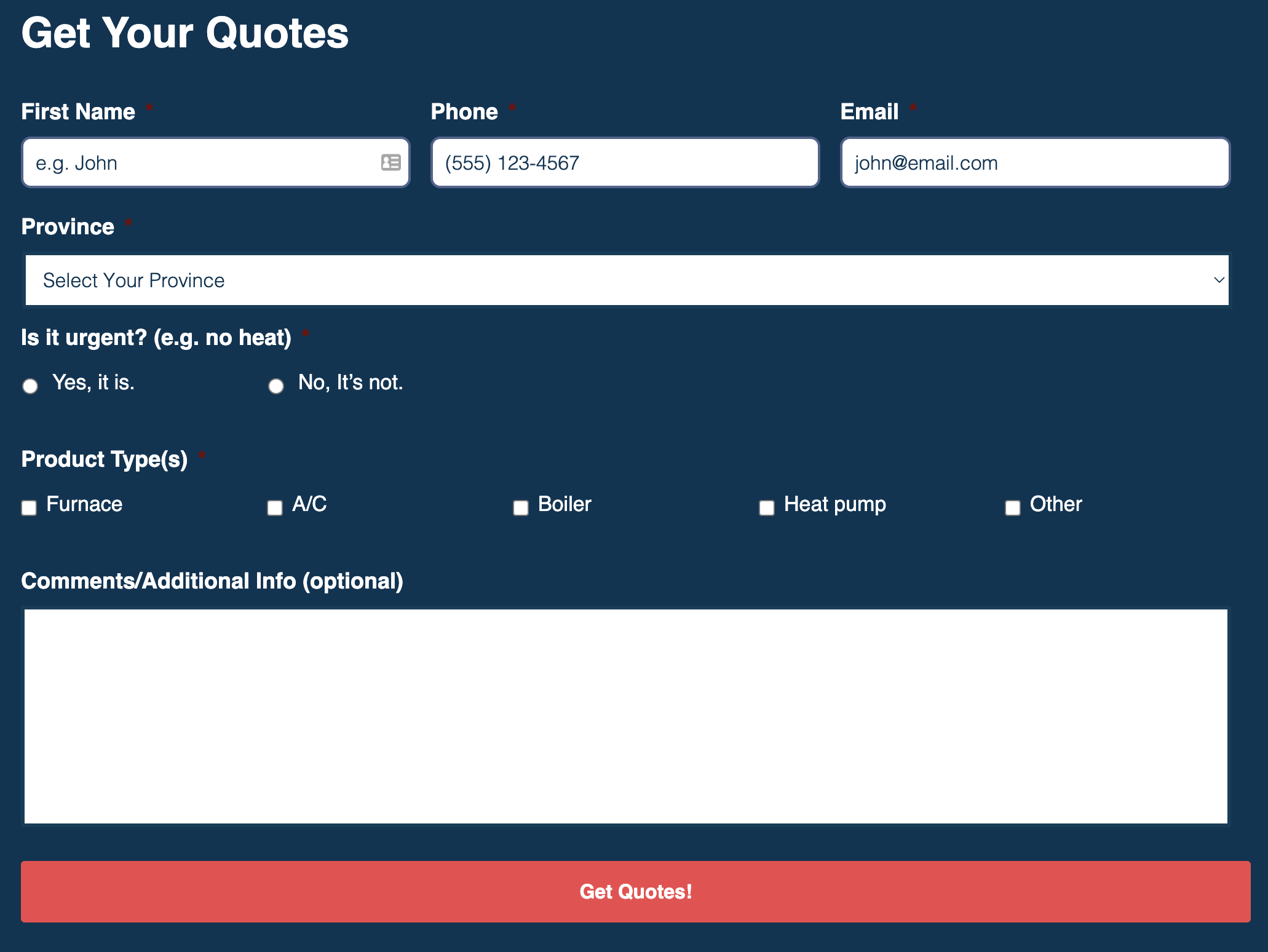

Rebates For Replacing Furnace Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/11/Lennox-Rebate-Form-768x673.png

Rebate For New Furnace 2022 Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2022/08/fortis-rebates-for-furnaces-2020-tek-climate-heating-and-air-conditioning.jpg

Web 22 d 233 c 2022 nbsp 0183 32 IR 2022 225 December 22 2022 WASHINGTON The Internal Revenue Service today released frequently asked questions FAQs about energy efficient home improvements and residential clean energy property credits in Fact Sheet FS 2022 40 PDF Web 26 juil 2023 nbsp 0183 32 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Get details on the Energy Efficient Home Improvement Credit

Web 27 avr 2021 nbsp 0183 32 In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy property expenditures paid or incurred by the taxpayer during Web SCEP Announces 8 5 Billion Home Energy Rebate Programs The U S Department of Energy s Karen Zelmar explains the Inflation Reduction Act s Home Energy Rebate Programs and their top energy savings goals Video courtesy of the U S Department of

Download Federal Tax Rebate For Furnace

More picture related to Federal Tax Rebate For Furnace

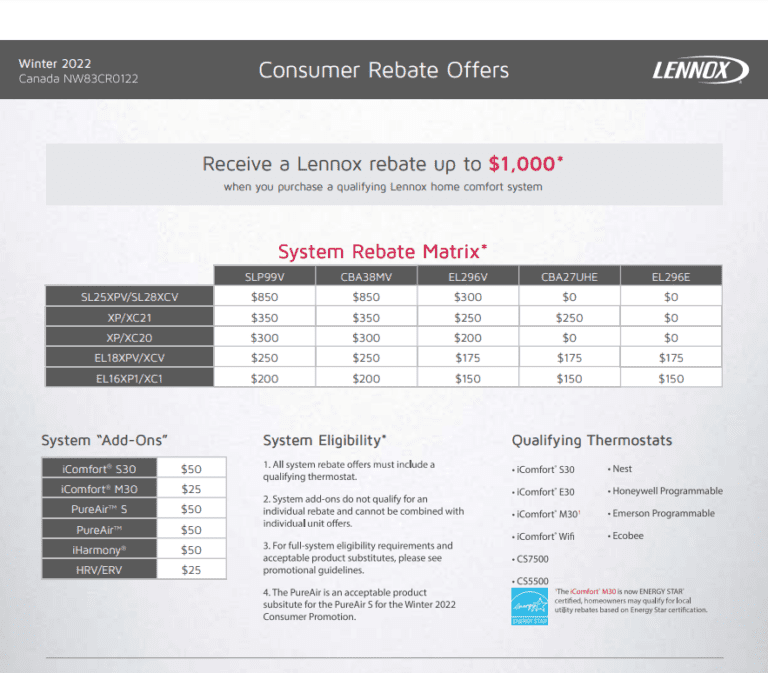

Rebates Tax Credits On Energy Efficient HVAC Equipment BETLEM

https://betlem.com/images/hvac-furnace-air-conditioning-savings-chart-final-9-22-2022.png

Learn How You Can Save With Rebates Martino HVAC Furnace Rebate

https://www.martinohvac.com/wp-content/uploads/2021/03/furnace-rebate.png

Furnaces Alpine Refrigeration Inc

https://alpinegreen.net/wp-content/uploads/2019/02/Furnaces-Rebate.png

Web 16 janv 2023 nbsp 0183 32 Gas propane or oil furnaces and fans 150 Advanced Main Air Circulating Fan 50 Qualifying Home Improvements Windows skylights and doors that have achieved Energy Star ratings could be eligible for a credit equal to 10 of their cost Web 9 sept 2022 nbsp 0183 32 1 750 for a heat pump water heater 8 000 for a heat pump for space heating and cooling 840 for electric stoves cooktops ranges ovens and electric heat pump clothes dryers 4 000 for an

Web There is a 1 200 aggregate yearly tax credit maximum for all building envelope components home energy audits and energy property Electric or natural gas heat pump water heaters electric or natural gas heat pumps and biomass stoves and biomass Web The furnace rebates section of the Gas Furnace Guide is designed to let visitors find quick reference to special offers gas furnace rebates manufacturer incentives and tax credits that are currently being offered by leading gas furnace manufacturers and other sources

Connecticut Rebates

https://www.star-supply.com/images/content/Gas_Furnace_Rebate.PNG

Rebates And Energy Star Tax Credits Michigan C C Heat Air

https://candcheat.com/wp-content/uploads/Gas-Furnace-and-Boiler-Tune-up-DTE-Rebate.png

https://www.energystar.gov/about/federal_tax_credits/natural_gas...

Web 30 d 233 c 2022 nbsp 0183 32 The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements windows doors skylights insulation electrical plus furnaces boilers and central air

https://www.irs.gov/credits-deductions/energy-efficient-home...

Web 1 janv 2023 nbsp 0183 32 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or

Government Rebate For Furnaces Printable Rebate Form

Connecticut Rebates

Piedmont Natural Gas Rebate Form Fill Online Printable Fillable

Top Mass Save Rebate Form Templates Free To Download In PDF Format

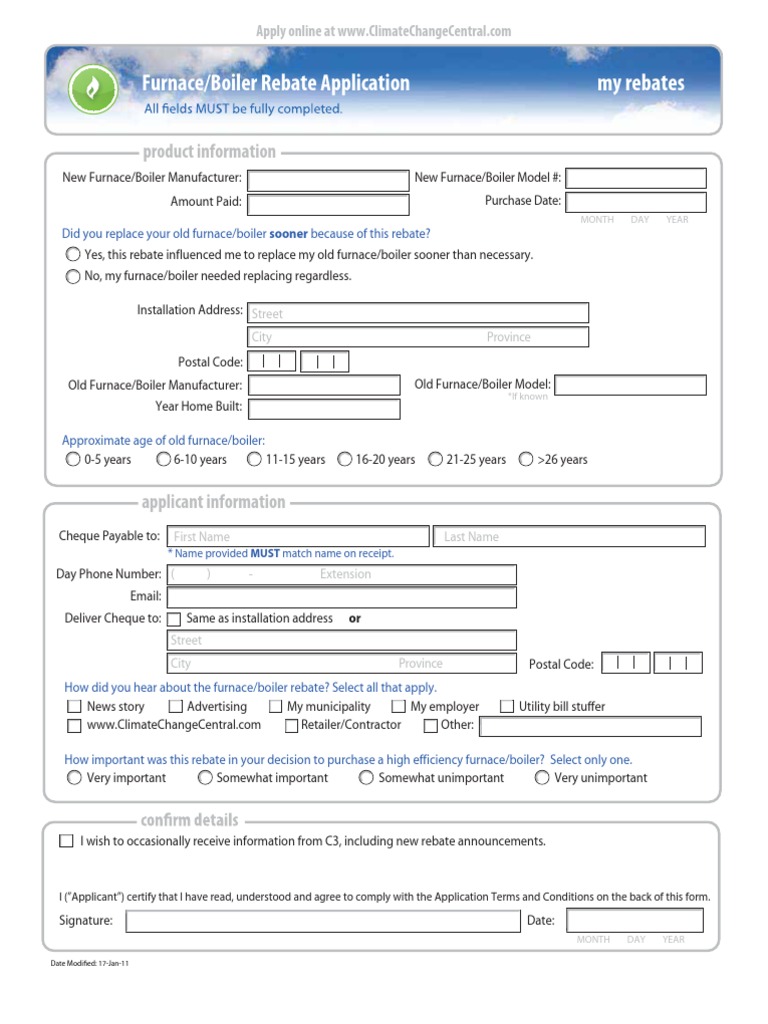

Furnace Boiler Rebate Application My Rebates Product Information

2023 FEDERAL TAX REBATES FOR HIGH EFFICIENCY SYSTEMS Heating Air

2023 FEDERAL TAX REBATES FOR HIGH EFFICIENCY SYSTEMS Heating Air

Air Conditioner Tax Rebate 3 Tips To Help Repair Your Central Air

Federal Rebates For Heat Pumps HERETAB

How To Find Federal Tax Credits Rebates For HVAC Upgrades

Federal Tax Rebate For Furnace - Web 26 juil 2023 nbsp 0183 32 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Get details on the Energy Efficient Home Improvement Credit