Federal Tax Rebate For Heating And Cooling Web 30 d 233 c 2022 nbsp 0183 32 New federal income tax credits are available through 2032 providing up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent Improvements such as installing heat

Web 22 d 233 c 2022 nbsp 0183 32 The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide Web 26 juil 2023 nbsp 0183 32 2023 through 2032 30 up to a maximum of 1 200 biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Get details on the

Federal Tax Rebate For Heating And Cooling

Federal Tax Rebate For Heating And Cooling

https://www.bensonshvac.com/wp-content/uploads/Federal-Tax-Credits-for-Air-Conditioners-and-Heat-Pumps.png

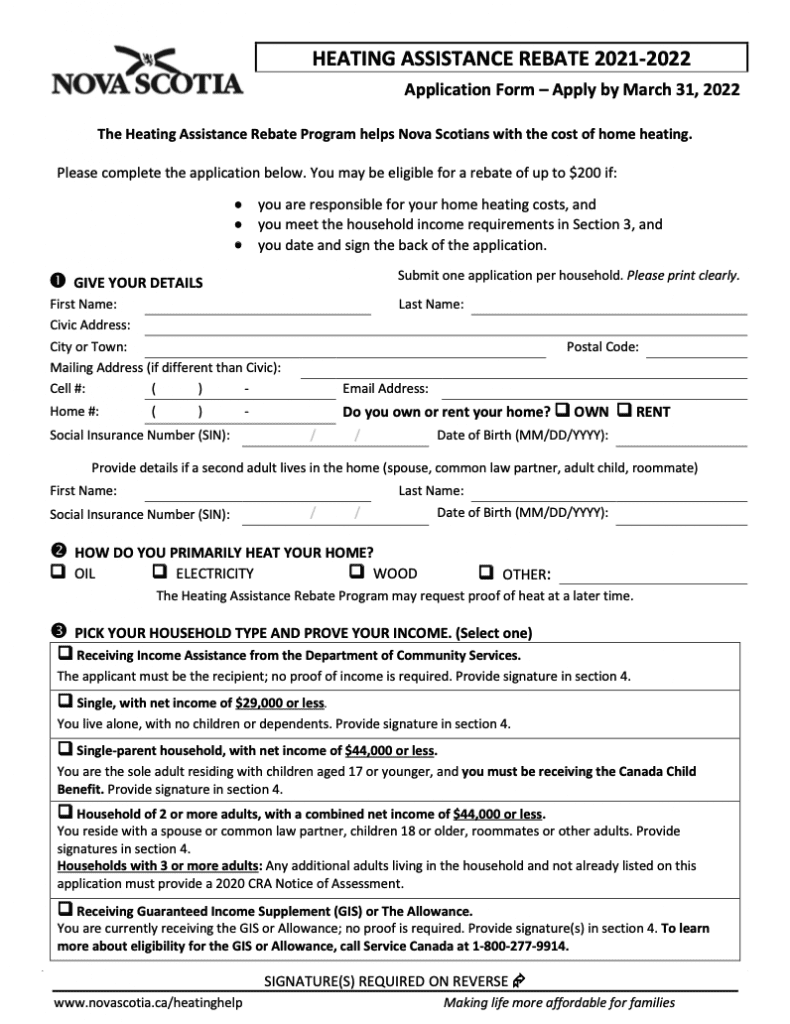

Mass Save Rebates BDL Heating And Cooling Mass Save Rebate

https://i0.wp.com/www.masssaverebate.net/wp-content/uploads/2023/05/mass-save-rebates-bdl-heating-and-cooling.jpg?fit=800%2C657&ssl=1

2022 Government Heating Cooling System Rebates FurnacePrices Ca

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2023/01/2022-government-heating-cooling-system-rebates-furnaceprices-ca.png?resize=768%2C540&ssl=1

Web 9 sept 2022 nbsp 0183 32 8 000 for a heat pump for space heating and cooling 840 for electric stoves cooktops ranges ovens and electric heat pump clothes dryers 4 000 for an Web The law includes 391 billion to support clean energy and address climate change including 8 8 billion in rebates for home energy efficiency and electrification projects

Web 28 ao 251 t 2023 nbsp 0183 32 How It Works The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 Web Insulation and weatherization 1 600 Unlike the tax credits these rebates are based on your income level If you make less than 80 of your area s median income you can

Download Federal Tax Rebate For Heating And Cooling

More picture related to Federal Tax Rebate For Heating And Cooling

Heating And Cooling Rebates Dakota Electric Association PowerRebate

https://i0.wp.com/www.powerrebate.net/wp-content/uploads/2022/10/heating-and-cooling-rebates-dakota-electric-association.gif?fit=608%2C551&ssl=1

2020 HVAC Rebates Federal Tax Credits DTC Air Conditioning Heating

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2023/01/2020-hvac-rebates-federal-tax-credits-dtc-air-conditioning-heating.jpg?fit=2400%2C1256&ssl=1

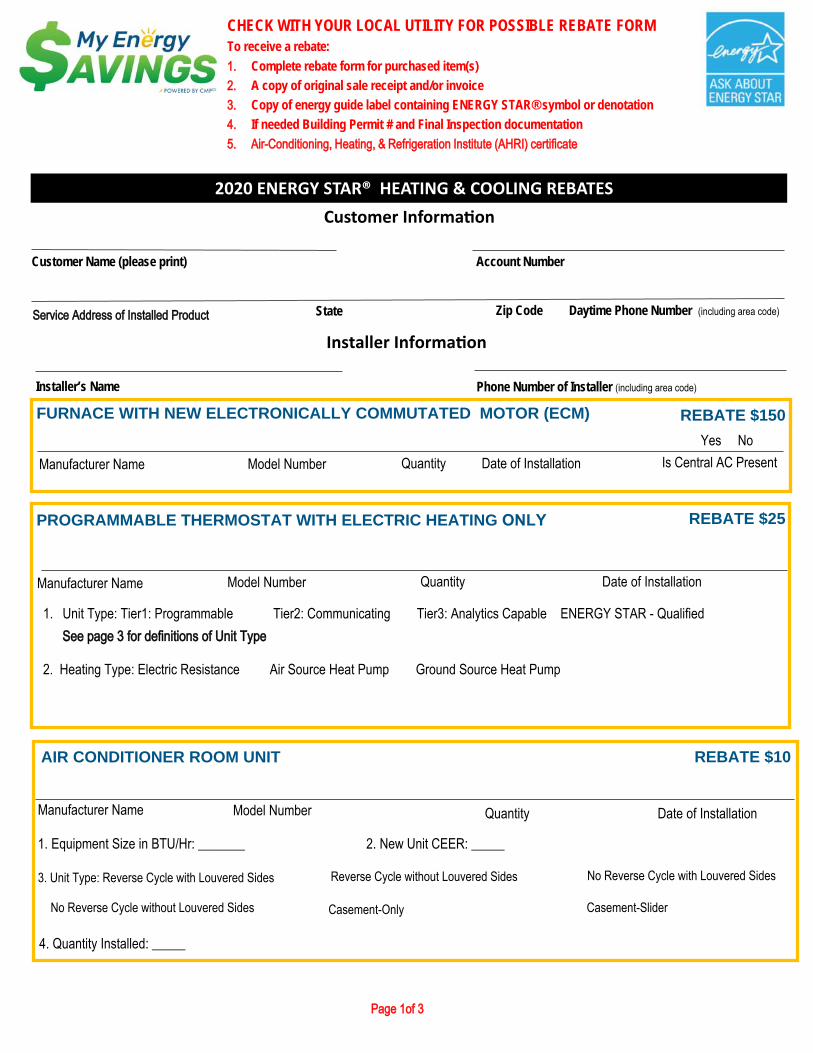

PDF 20 ENERGY STAR HEATING COOLING REBATES Customer Informa On

https://img.dokumen.tips/doc/image/5f0e90937e708231d43fda1e/20-energy-star-heating-cooling-rebates-customer-informa-on-fairfax-ed07e7cf-6e14-4ce9.jpg

Web 15 ao 251 t 2022 nbsp 0183 32 So for a 10 000 heat pump and heat pump water heater you could get 4 875 back depending on specifics If your household income is more than 150 percent Web 3 f 233 vr 2023 nbsp 0183 32 Heat pumps are rapidly gaining popularity as an energy efficient option for home heating and cooling With a 30 percent tax credit available for a range of heat

Web 30 of cost up to 600 each for a qualified air conditioner or gas furnace with an annual cap of 1 200 Up to 2 000 with a qualified heat pump heat pump water heater or Web 1 ao 251 t 2023 nbsp 0183 32 For qualifying central air conditioners installed in your primary residence between January 1 2023 and December 31 2032 you can claim a tax credit of 30 of

Mass Save Rebates BDL Heating And Cooling PumpRebate

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2023/01/mass-save-rebates-bdl-heating-and-cooling.png

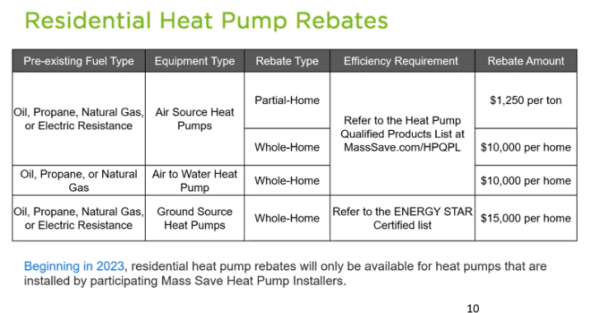

Heating Rebates 2022 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/02/Heating-Rebate-Nova-Scotia-2022-790x1024.png

https://www.energystar.gov/about/federal_tax…

Web 30 d 233 c 2022 nbsp 0183 32 New federal income tax credits are available through 2032 providing up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent Improvements such as installing heat

https://www.irs.gov/newsroom/irs-releases-frequently-asked-questions...

Web 22 d 233 c 2022 nbsp 0183 32 The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide

Government Rebates For Geothermal Heating PumpRebate

Mass Save Rebates BDL Heating And Cooling PumpRebate

Federal Tax Rebates LatestRebate

Payment Plans Whitcher Plumbing Heating

Mass Save Rebates BDL Heating And Cooling

Rebates ABE Heating Cooling

Rebates ABE Heating Cooling

Florida Energy Rebates For Air Conditioners 300 Federal Tax Credit

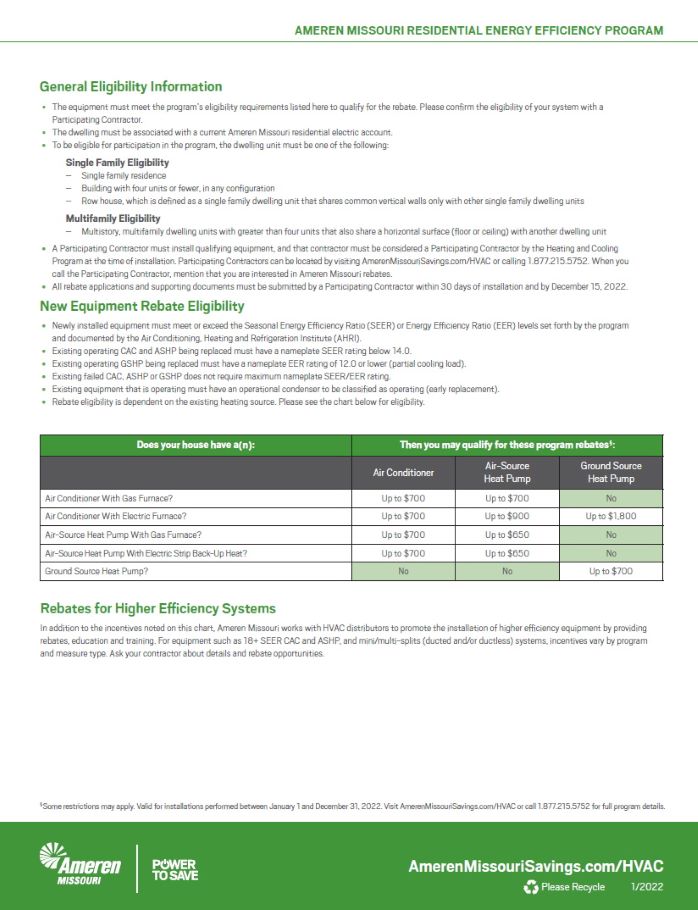

Ameren Missouri Heating Cooling Rebates Air Pro Heating Cooling

The Inflation Reduction Act And The New Tax Incentives Rebates For High

Federal Tax Rebate For Heating And Cooling - Web 9 sept 2022 nbsp 0183 32 8 000 for a heat pump for space heating and cooling 840 for electric stoves cooktops ranges ovens and electric heat pump clothes dryers 4 000 for an