Federal Tax Rebate For New Air Conditioner If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations work If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022

Federal Tax Rebate For New Air Conditioner

Federal Tax Rebate For New Air Conditioner

https://inmanair.com/wp-content/uploads/2022/08/ZR1_9901.jpg

What Is 87 A Rebate Free Tax Filer Blog

https://blog.freetaxfiler.com/wp-content/uploads/2022/09/Tax-Rebate-1.jpg

Federal Tax Credits For Air Conditioners Heat Pumps 2023

https://kobiecomplete.com/wp-content/uploads/2023/01/federal-tax-credits-2023-graphic-white-web.png

The rebates can help you save money on select home improvement projects that can lower your energy bills DOE estimates these rebates will save households up to 1 billion annually on energy bills and support over 50 000 U S jobs How To Qualify For and Claim HVAC Tax Rebates You can claim your residential energy tax incentive when you file your federal income taxes For federal tax returns filed between 2023 and 2032 you are eligible to claim a credit equal to 30 of the cost of your installation

The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your primary residence after December 31 2021 you may be eligible to claim them on your taxes when you file for 2022 The IRS issued statistics on the Inflation Reduction Act clean energy tax credits for tax year 2023 Taxpayers have claimed more than 6 billion in credits for residential clean energy investments which include solar electricity generation solar water heating and battery storage and more than 2 billion for energy efficient home

Download Federal Tax Rebate For New Air Conditioner

More picture related to Federal Tax Rebate For New Air Conditioner

Rebates

https://cljgives.org/wp-content/uploads/2017/08/20170809-MM0000809-rebates.png

Tax Rebate For Individuals Swaper Investing Blog

https://swaper.com/blog/wp-content/uploads/SWAPER_blogpost_tax_1920x1080.png

Older Disabled Residents Can File For Property Tax Rent Rebate Program

https://cdn.centraljersey.com/wp-content/uploads/sites/28/2022/01/20425_rev_rentRebate_NK_01-scaled.jpg

Q Who is eligible for tax credits A Homeowners including renters for certain expenditures who purchase energy and other efficient appliances and products Q What do consumers do to get the credit s A Fill out IRS Form 5695 following IRS instructions and include it when filing your tax return Include any relevant product receipts Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent

Laura Feiveson Deputy Assistant Secretary for Microeconomic PolicyMatthew Ashenfarb Research Economist Office of Climate Energy Economics The Inflation Reduction Act or IRA extended and expanded tax credits that help households invest in residential clean energy such as solar panels as well as home energy efficiency New The new federal rebates for HVAC systems run through 2032 and include 8 8 billion for the Home Energy Rebates according to the U S Department of Energy Inflation Reduction Act tax credits are benefits from the government when taxpayers make energy efficient upgrades to their property

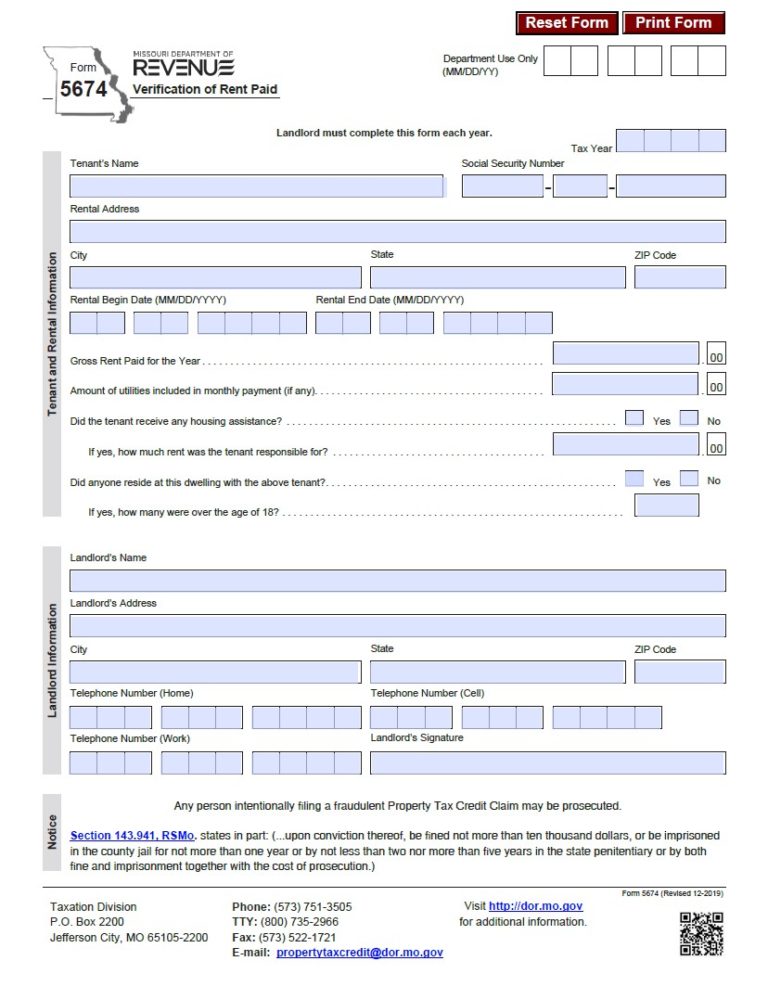

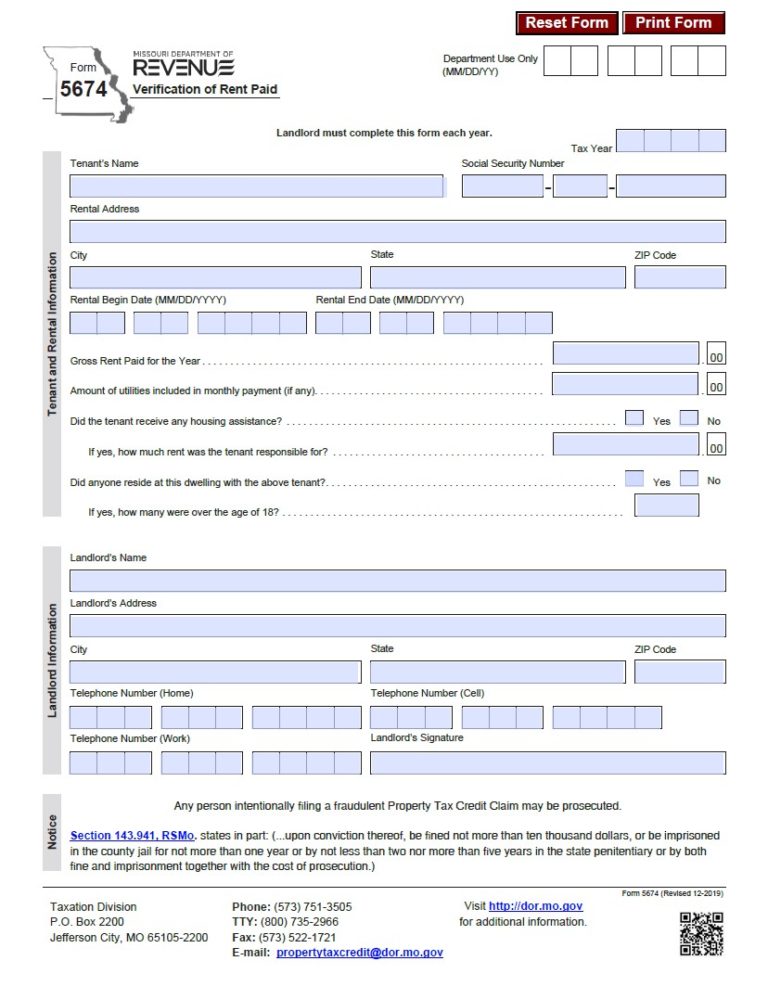

Rent Rebate Missouri Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/08/Rent-Rebate-Form-Missouri-2021-768x999.jpg

Pennsylvania s Property Tax Rent Rebate Program May Help Low income

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/1648504189519-EYNC86JYEGG20QUA9STL/2022-PA+Dept+of+Revenue+property+tax-rent+rebate_Page_1.jpg

https://www.irs.gov/credits-deductions/energy...

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022

https://www.irs.gov/newsroom/irs-releases...

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations work

Ductless Air Conditioner Ronusa

Rent Rebate Missouri Printable Rebate Form

Air Conditioning Installation Greenway Heating Cooling

Daewoo Air Conditioners In Ghana Daewoo Air Conditioner 2 5HP In Ghana

Rheem Installed Classic Packaged Air Conditioner System HSINSTRHECPAC

.png?ixlib=gatsbyFP&auto=compress%2Cformat&fit=max&fit=crop&w=1200&h=630&dpr=2)

Mechanics Tax Rebate Don t Let Your Tool Tax Throw A Spanner In The

.png?ixlib=gatsbyFP&auto=compress%2Cformat&fit=max&fit=crop&w=1200&h=630&dpr=2)

Mechanics Tax Rebate Don t Let Your Tool Tax Throw A Spanner In The

2023 Rent Rebate Form Printable Forms Free Online

Air Conditioner Proair Heating And Cooling

Is Section 87A Rebate For Everyone SR Academy India

Federal Tax Rebate For New Air Conditioner - Get the details on the new federal tax credits for HVAC installations that will go into effect in 2022 Learn how you can use this information to increase your sales and grow your business