Federal Tax Rebates For Energy Efficiency Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

Web 26 juil 2023 nbsp 0183 32 Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on Web These home energy rebates will help American households save money on energy bills upgrade to clean energy equipment and improve energy efficiency and reduce indoor

Federal Tax Rebates For Energy Efficiency

Federal Tax Rebates For Energy Efficiency

https://assets.solar.com/wp-content/uploads/2022/08/tax-credit-form.png

Energy Efficient Rebates Tax Incentives For MA Homeowners

http://www.myenergymonster.com/ma/wp-content/uploads/sites/2/2012/08/energy-efficient-rebates-ma.png

New Energy Efficiency Rebates For Small Businesses Announced BSG

https://www.barriersciences.com/user_files/upload/New-Energy-Efficiency-Rebates-for-Small-Businesses-Announced.jpg

Web Energy gov Tax Credits Rebates amp Savings Please visit the Database of State Incentives for Renewables amp Efficiency website DSIRE for the latest state and federal incentives Web 27 avr 2021 nbsp 0183 32 In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the

Web 21 d 233 c 2022 nbsp 0183 32 December 21 2022 Office of Policy Making Our Homes More Efficient Clean Energy Tax Credits for Consumers Visit our Energy Savings Hub to learn more about Web 28 ao 251 t 2023 nbsp 0183 32 The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032

Download Federal Tax Rebates For Energy Efficiency

More picture related to Federal Tax Rebates For Energy Efficiency

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

The New Federal Tax Credits And Rebates For Home Energy Efficiency

https://www.ny-engineers.com/hs-fs/hubfs/energy efficient home.jpg?width=1500&name=energy efficient home.jpg

Stacking Energy Efficiency Rebates

https://www.barriersciences.com/user_files/upload/Picture1.png

Web 22 d 233 c 2022 nbsp 0183 32 IR 2022 225 December 22 2022 WASHINGTON The Internal Revenue Service today released frequently asked questions FAQs about energy efficient home Web investments increases which will reward greater energy efficiency For more information on these tax credits as well as related rebates administered by the Department of Energy

Web 19 ao 251 t 2022 nbsp 0183 32 The credit amount for installing clean household energy such as solar wind or geothermal has been raised from 26 to 30 from 2022 to 2032 It then falls to 26 Web With respect to the elements of an ENERGY STAR Home Upgrade these rebates would be up to 1 750 for an ENERGY STAR certified heat pump water heater 8 000 for an

Empowering Businesses With Rebates For Energy Efficiency

https://www.bigshineenergy.com/wp-content/uploads/2023/05/BSE-Empowering-Businesses-with-Incentives-and-Rebates-for-Energy-Efficiency-720x284.jpg

ENERGY STAR Ask The Experts Products ENERGY STAR

https://www.energystar.gov/sites/default/files/styles/blog_large/public/assets/images/ATE-39A-Header.jpg?itok=JzmVJ-0K

https://www.irs.gov/credits-deductions/energy-efficient-home...

Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Web 26 juil 2023 nbsp 0183 32 Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on

Rebates Tax Incentives Streamline Energy Solutions

Empowering Businesses With Rebates For Energy Efficiency

Carbon Tax Brings Ontario Energy Rebates For Small Businesses

2023 Home Energy Rebates Grants And Incentives Top Rated Barrie

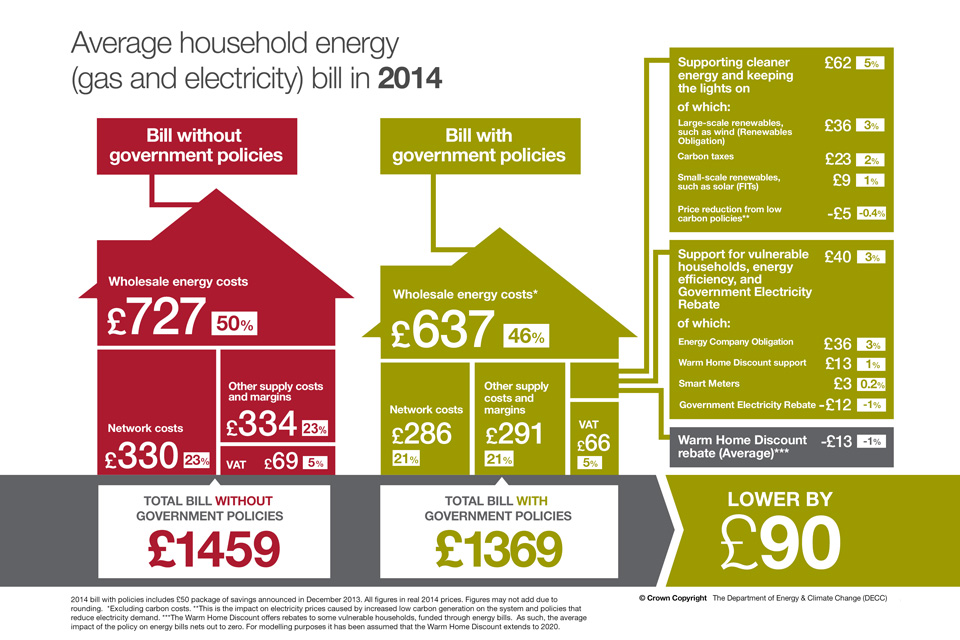

Policy Impacts On Prices And Bills GOV UK

What You Need To Know Federal Carbon Tax Takes Effect In Ont

What You Need To Know Federal Carbon Tax Takes Effect In Ont

Residents Urged To Cash Energy Rebate Cheques Rotherham Metropolitan

How Much Does The Federal Government Support The Development And

Energy Efficiency Tax Credits For 2023 Earthwise Windows

Federal Tax Rebates For Energy Efficiency - Web 13 sept 2022 nbsp 0183 32 Home Energy Efficiency Improvements The new law extends through 2032 an existing program that allows homeowners to claim a credit on their federal tax