Federal Tax Rebates For Hybrid Vehicles Find out if your electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on type purchase date and business or personal use

Updated based on IRS data for 2025 these 2025 and 2024 EVs and PHEVs qualify for federal tax credits of up to 7 500 under the Inflation Reduction Act If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in

Federal Tax Rebates For Hybrid Vehicles

Federal Tax Rebates For Hybrid Vehicles

https://www.jeep.com/content/dam/fca-brands/na/jeep/en_us/4xe/hero/MY22-4xe-Hybrid-Incentive-Hero-Desktop.jpg

Federal Tax Rebates Electric Vehicles ElectricRebate

https://www.electricrebate.net/wp-content/uploads/2022/09/rebates-and-tax-credits-for-electric-vehicle-charging-stations-2.jpg

Import Duty For Hybrid Vehicles Pegged At 20 Customs

https://thebftonline.com/wp-content/uploads/2021/08/import-duty.jpg

Two years ago nearly every new electric vehicle and plug in hybrid on the market qualified for a federal tax credit of up to 7 500 provided it was manufactured in North America But the All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500

Get a tax credit of up to 7 500 for new vehicles purchased before 2023 The amount varies based on battery capacity and manufacturer phase out The Inflation Reduction Act IRA provides new opportunities for consumers to save money on clean vehicles offering multiple incentives for the purchase or lease of electric vehicles EVs plug in hybrid vehicles fuel cell vehicles and

Download Federal Tax Rebates For Hybrid Vehicles

More picture related to Federal Tax Rebates For Hybrid Vehicles

Hybrid Cars Canada Rebate 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/the-8-best-hybrid-cars-in-canada-2021-top-rated-models.jpg

New Toyota Prius Starting At 2 75 Million Yen RAI STAR Corp

https://kuruma-news.jp/wp-content/uploads/2023/01/2023110_PRIUS_-13.jpg

Government Rebate For Hybrid Cars Ontario 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/used-ev-rebate-going-away-for-phevs-in-ontario-by-end-of-this-weekend.jpg

We ve compiled every new plug in hybrid that is eligible to receive either the partial 3750 or the full 7500 federal incentive Which EVs qualify for tax credits Here s a list of car models new and used that qualify for EV federal tax credits

All electric and plug in hybrid vehicles purchased new from 2010 through 2022 may be eligible for a federal income tax credit of up to 7 500 The credit amount will vary The Inflation Reduction Act of 2022 expanded the scope of clean vehicle tax credits to include certain plug in hybrid electric vehicles PHEVs fuel cell vehicles and all

PDF Evaluating Tax Rebates For Hybrid Vehicles

https://i1.rgstatic.net/publication/229005068_Evaluating_Tax_Rebates_for_Hybrid_Vehicles/links/00b7d51c9a36b72f23000000/largepreview.png

All About Tax Credit For EV PHEV And Hybrid Cars CarBuzz

https://cdn.carbuzz.com/gallery-images/1600/954000/800/954828.jpg

https://www.irs.gov › clean-vehicle-tax-credits

Find out if your electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on type purchase date and business or personal use

https://www.consumerreports.org › cars › hybrids-evs › ...

Updated based on IRS data for 2025 these 2025 and 2024 EVs and PHEVs qualify for federal tax credits of up to 7 500 under the Inflation Reduction Act

The Inflation Reduction Act And The New Tax Incentives Rebates For High

PDF Evaluating Tax Rebates For Hybrid Vehicles

Hybrid Cars With Rebates 2023 Carrebate

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

Federal Rebates For Hybrid Cars 2023 Carrebate

Are There Any Tax Rebates For Hybrid Cars In 2022 2023 Carrebate

Are There Any Tax Rebates For Hybrid Cars In 2022 2023 Carrebate

Tamil Nadu Offers Road Tax Exemption On Hybrid Vehicles Team BHP

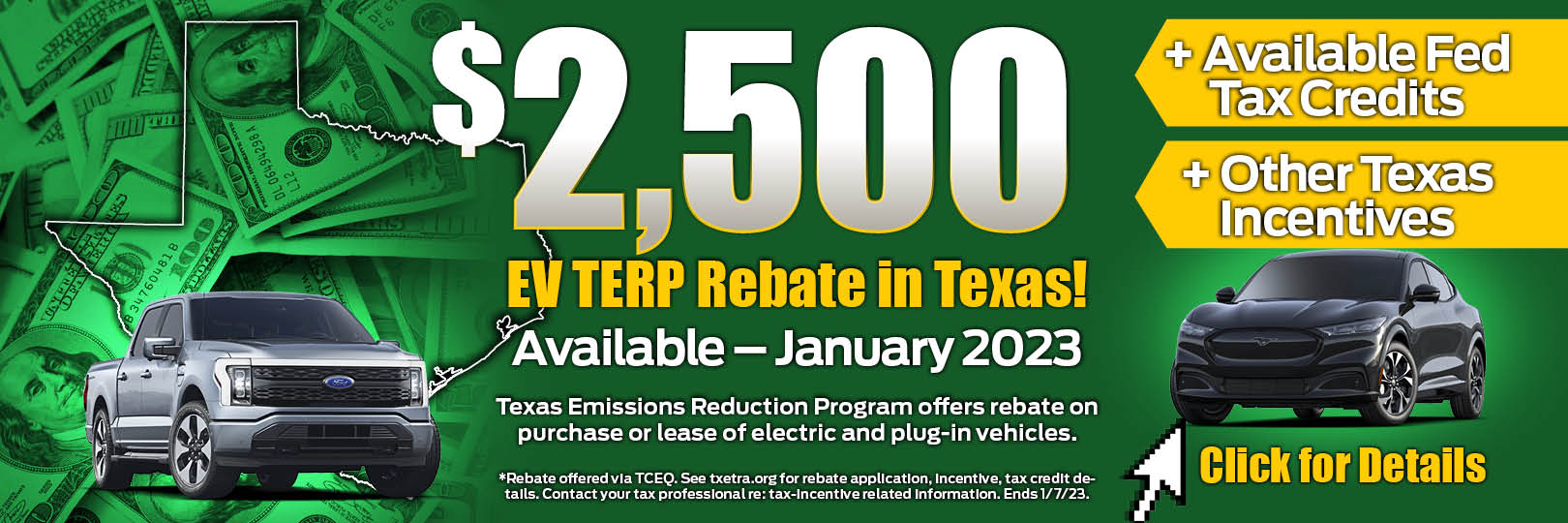

Planet Ford EV Plug in Hybrid Vehicle Rebate Program Randall Reed s

Are There Any Tax Rebates For Hybrid Cars In 2022 2023 Carrebate

Federal Tax Rebates For Hybrid Vehicles - Two years ago nearly every new electric vehicle and plug in hybrid on the market qualified for a federal tax credit of up to 7 500 provided it was manufactured in North America But the