Federal Tax Rebates For Solar Web your federal tax credit For example if your solar PV system was installed before December 31 2022 installation costs totaled 18 000 and your state government gave

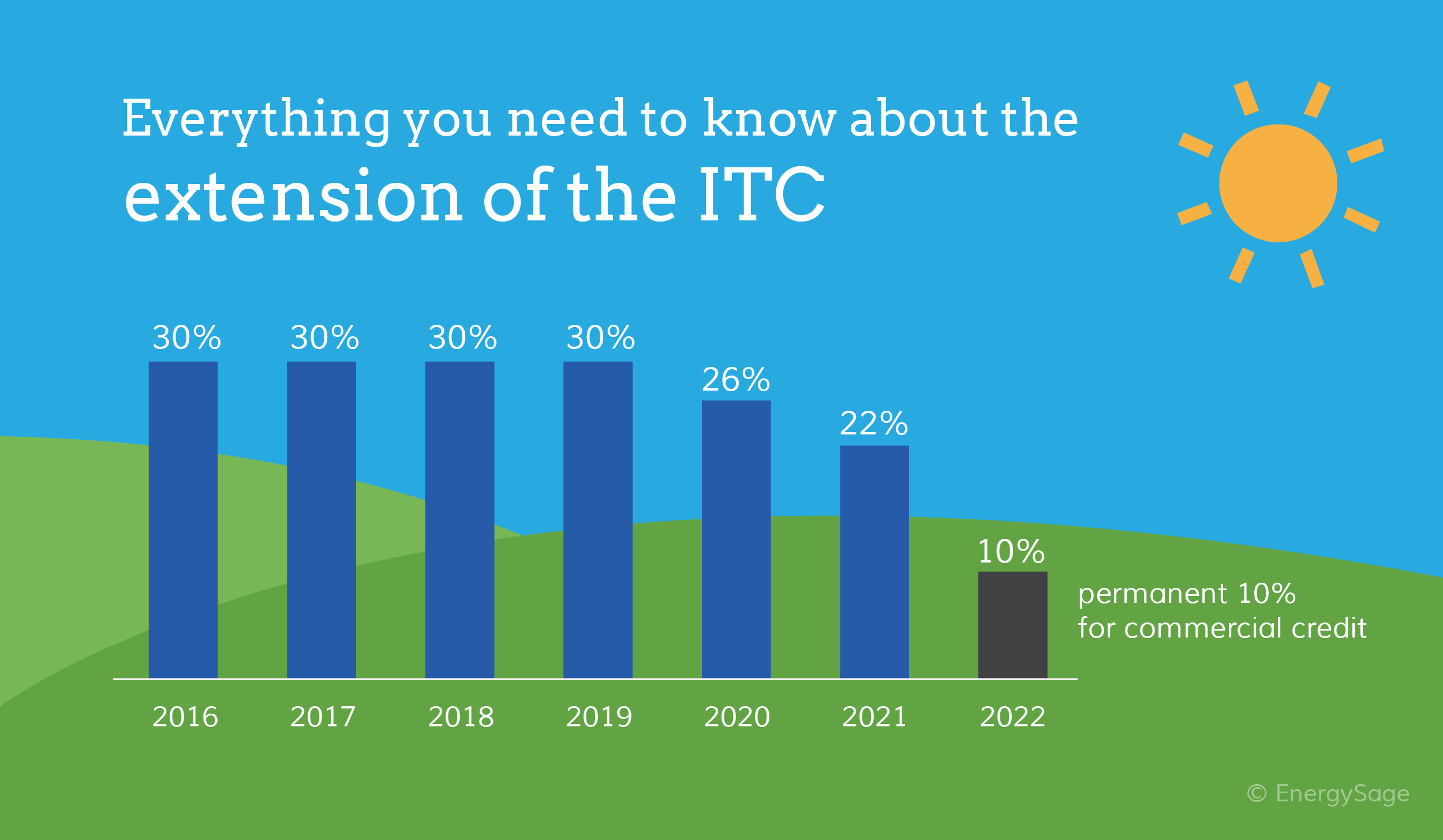

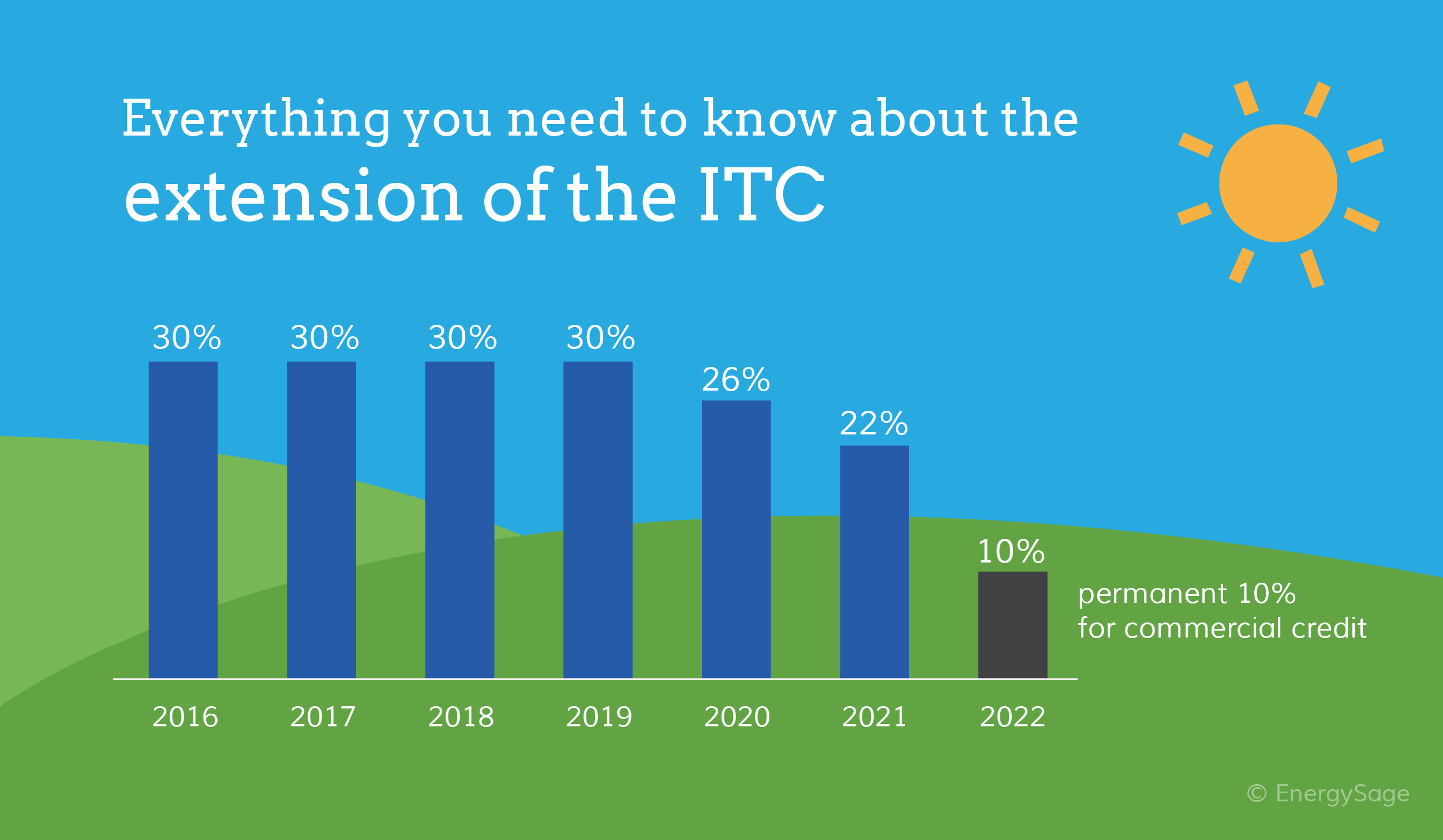

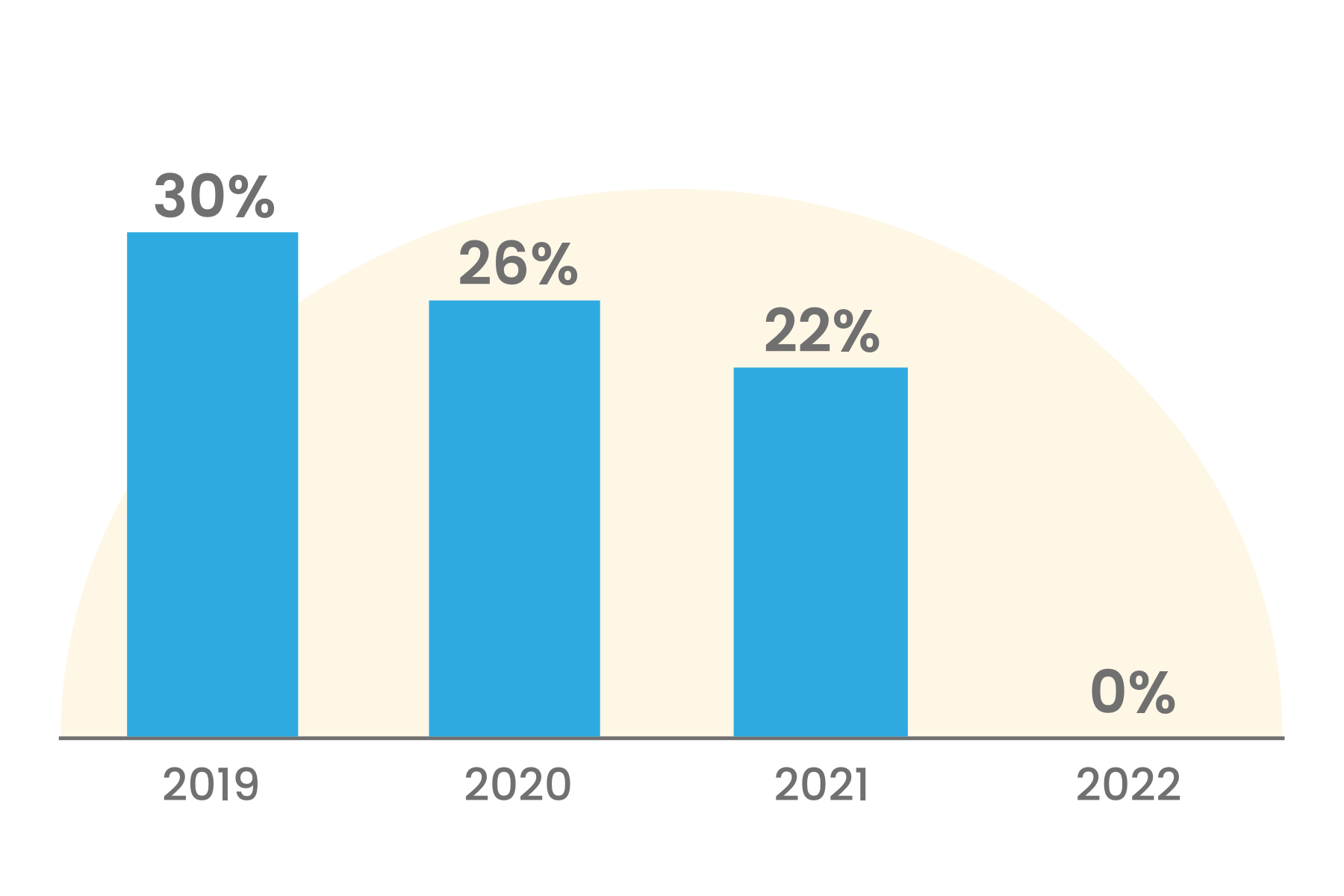

Web 8 sept 2022 nbsp 0183 32 Those who install a PV system between 2022 and 2032 will receive a 30 tax credit That will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034 If you ve already installed Web 8 sept 2022 nbsp 0183 32 Federal Solar Tax Credit Resources The U S Department of Energy DOE Solar Energy Technologies Office SETO developed three resources to help Americans navigate changes to the federal solar

Federal Tax Rebates For Solar

Federal Tax Rebates For Solar

https://greenridgesolar.com/wp-content/uploads/2019/01/tax-credit-change-.jpg

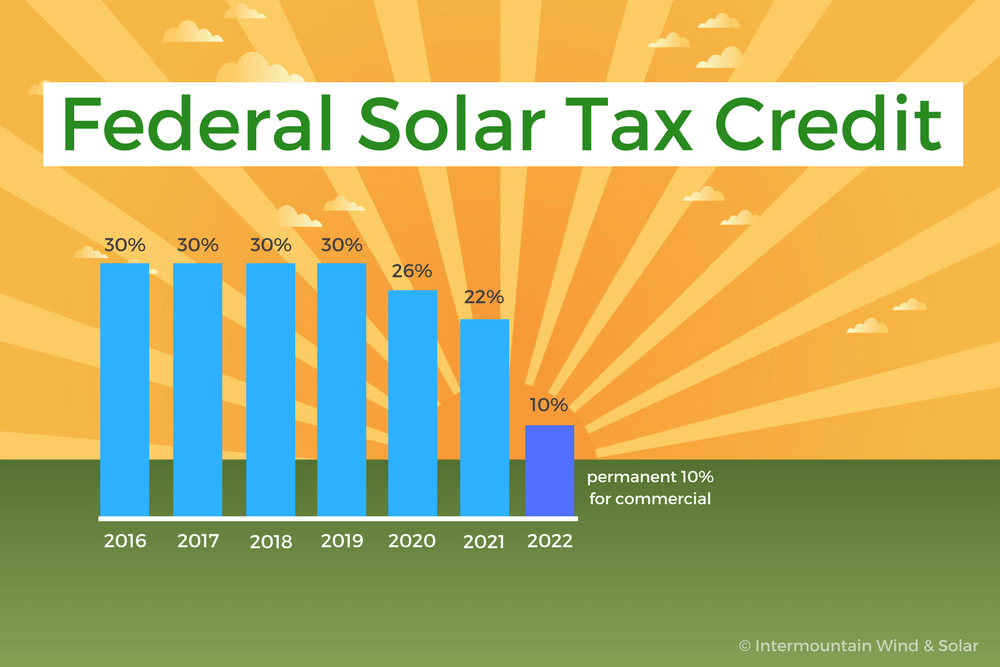

When Does The Federal Solar Tax Credit Expire IWS

https://www.intermtnwindandsolar.com/wp-content/uploads/2017/07/federal-solar-tax-credit-2017.png

Solar Tax Credits Rebates Missouri Arkansas

https://soleraenergyllc.com/wp-content/uploads/2022/07/Graphic-1000x1024.jpg

Web 26 juil 2023 nbsp 0183 32 Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on energy gov Solar wind and geothermal power generation Web For example if your solar PV system was installed in 2022 installation costs totaled 18 000 and your state government gave you a one time rebate of 1 000 for installing

Web 7 ao 251 t 2023 nbsp 0183 32 When you purchase a solar photovoltaic PV system during the tax year you are eligible for a Federal Solar Tax Credit that you can claim on your federal income Web The flagship home energy discount included in the IRA is the residential clean energy credit which offers homeowners 30 off the cost of new qualified clean energy improvements

Download Federal Tax Rebates For Solar

More picture related to Federal Tax Rebates For Solar

Congress Gets Renewable Tax Credit Extension Right Renewable Energy World

https://ilsr.org/wp-content/uploads/2016/01/federal-solar-tax-credit-phase-out-ILSR-2015-1024x768.jpeg

Solar Tax Credit Calculator KareenRoabie

https://s3.amazonaws.com/solarassets/wp-content/uploads/2022/08/solar-tax-credit-before-and-after-inflation-reduction-act-1024x1013.jpg

Bc Rebates For Solar Power PowerRebate

https://i0.wp.com/www.powerrebate.net/wp-content/uploads/2023/05/tax-rebates-for-solar-power-ineffective-for-low-income-americans-but-1.jpg?w=1050&ssl=1

Web 16 ao 251 t 2022 nbsp 0183 32 The federal solar tax credit is back to 30 and there s never been a better time to install solar and start saving on energy costs On August 16 2022 President Biden signed the Inflation Reduction Act Web 30 d 233 c 2022 nbsp 0183 32 In addition to the energy efficiency credits homeowners can also take advantage of the modified and extended Residential Clean Energy credit which provides a 30 percent income tax credit for clean energy

Web 1 ao 251 t 2023 nbsp 0183 32 The U S government offers a solar tax credit that can reach up to 30 of the cost of installing a system that uses the sun to power your home What is the federal Web No Caution If you checked the No box you cannot claim the energy efficient home improvement credit Do not complete Part II

Federal Solar Tax Credit Save Money On Solar KC Green Energy

https://www.kcgreenenergy.com/content/uploads/2018/08/updated-2020-federal-tax-incentive-for-solar-panels.png

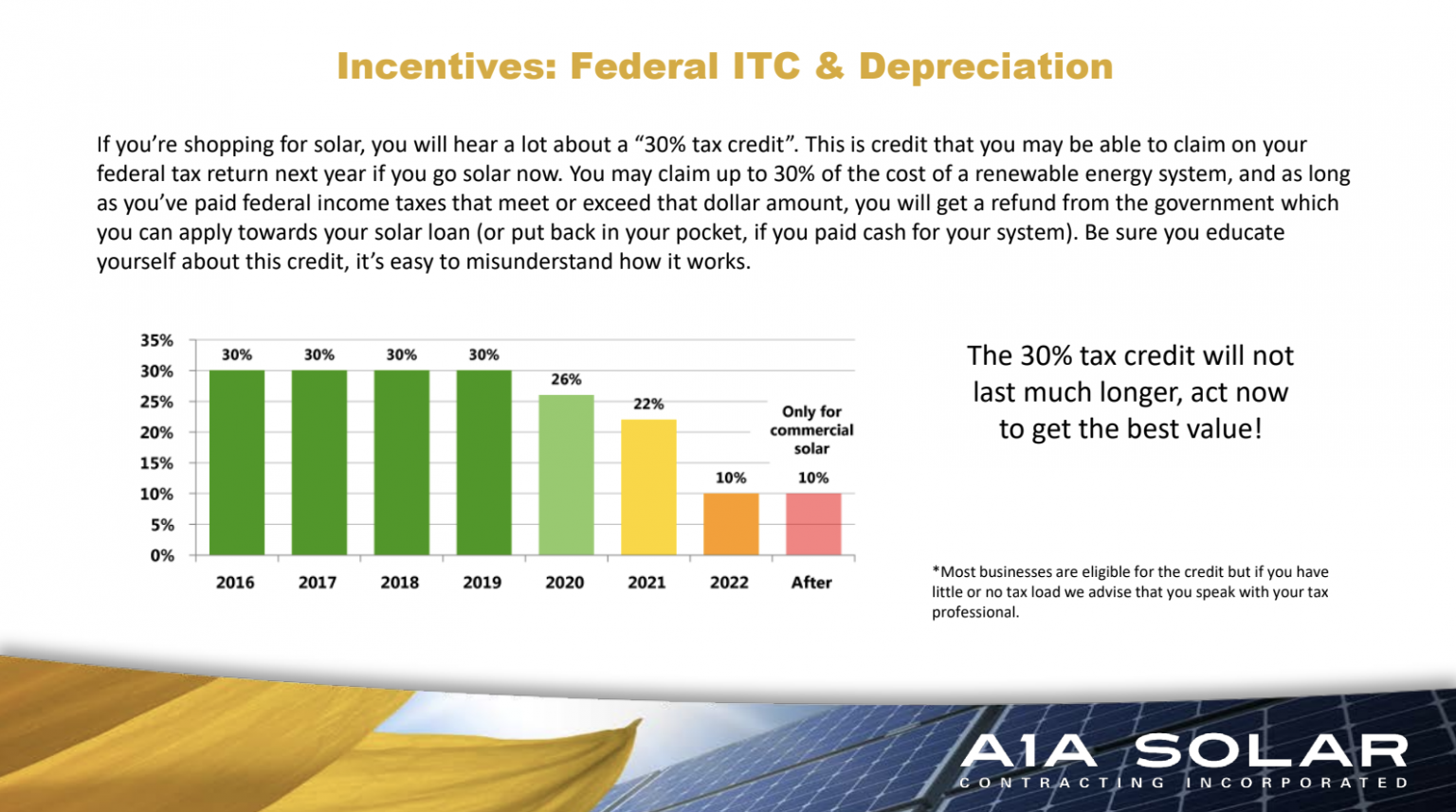

Get A 30 Federal Tax Credit For Your Solar Panel System While You Can

https://a1asolar.com/wp-content/uploads/2018/10/tax-credit-chart-1536x857.png

https://www.energy.gov/sites/default/files/2021/02/f82/Guide …

Web your federal tax credit For example if your solar PV system was installed before December 31 2022 installation costs totaled 18 000 and your state government gave

https://www.energy.gov/eere/solar/articles/sol…

Web 8 sept 2022 nbsp 0183 32 Those who install a PV system between 2022 and 2032 will receive a 30 tax credit That will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034 If you ve already installed

Solar Rebates Benefit SOLARInstallGURU Advantages Of Solar Energy Blog

Federal Solar Tax Credit Save Money On Solar KC Green Energy

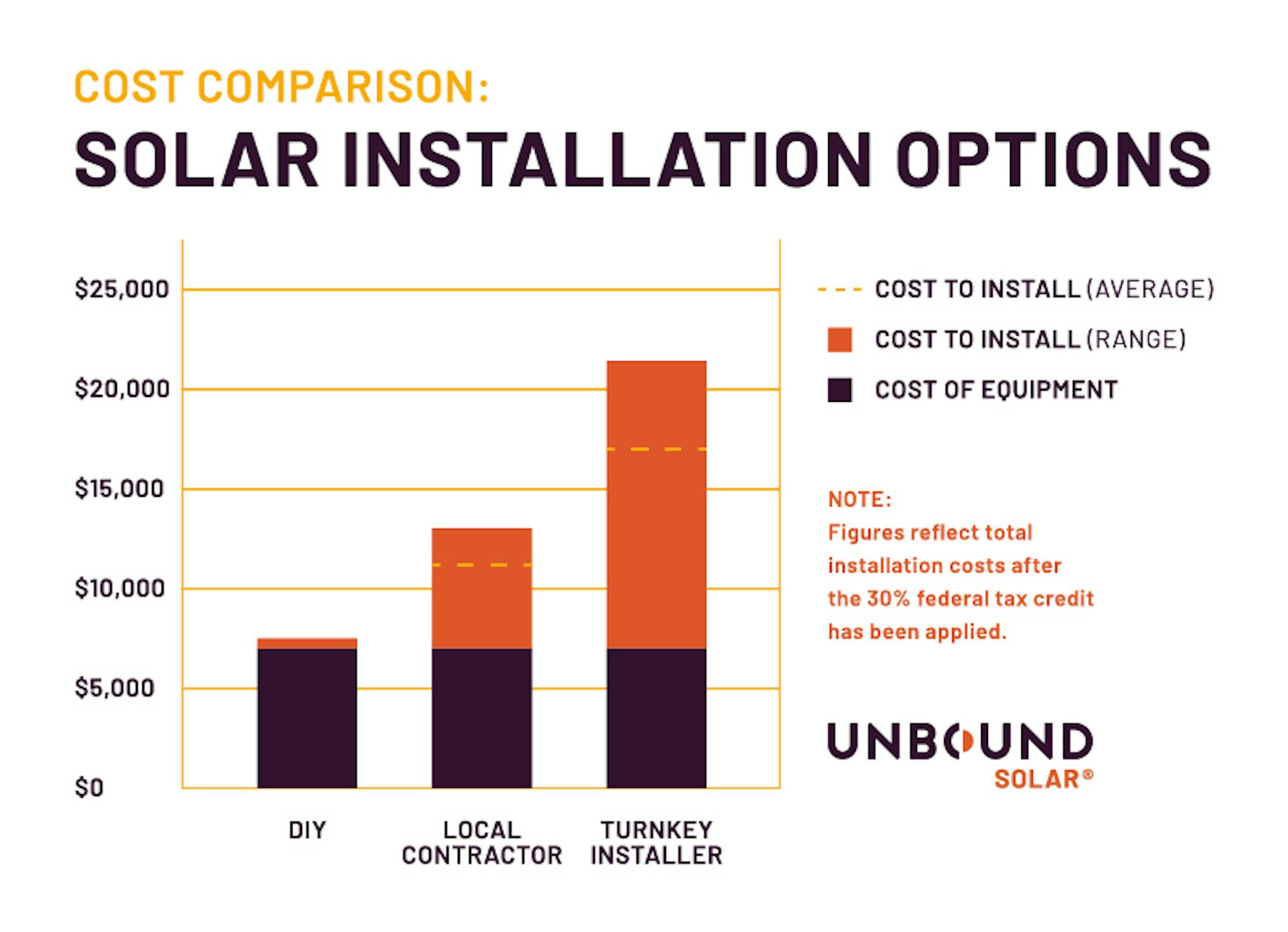

Solar Panel Tax Credit Unbound Solar

How To Claim The Federal Solar Tax Credit SAVKAT Inc

Frequently Asked Questions About The Federal Solar Tax Credit In 2020

Solar Tax Credit Chart Energy Sage Sol Luna Solar

Solar Tax Credit Chart Energy Sage Sol Luna Solar

2020 Guide To Oregon Solar Incentives Rebates Tax Credits More

Solar Tax Credit Everything A Homeowner Needs To Know Credible

Upcoming Changes To The Solar Tax Credit And How They Affect You

Federal Tax Rebates For Solar - Web 28 ao 251 t 2023 nbsp 0183 32 At 30 the tax credit is worth 7 500 for a 25 000 solar system effectively knocking the price down to 17 500 The credit was previously at 26 for