Federal Tax Recovery Rebate Credit Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your Web 13 avr 2022 nbsp 0183 32 The 2021 Recovery Rebate Credit can reduce any taxes owed or be included in the tax refund for the 2021 tax year Filers must ensure to not mix

Federal Tax Recovery Rebate Credit

Federal Tax Recovery Rebate Credit

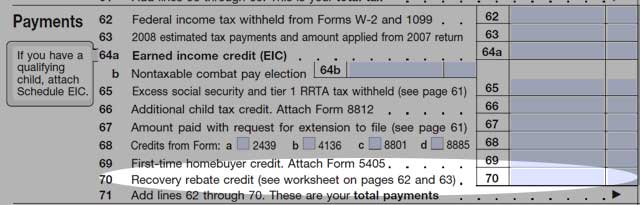

http://www.consumerismcommentary.com/wp-content/uploads/2009/01/recovery-rebate-credit-1040.jpg

Recovery Credit Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/10/What-Does-The-Recovery-Rebate-Form-Look-Like.png

How Do I Claim The Recovery Rebate Credit On My Ta

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/e3d7f0ce-2b70-4164-b921-f7ef2ca8a52f.default.png

Web 10 d 233 c 2021 nbsp 0183 32 If you re eligible for the Recovery Rebate Credit you ll need to file a 2020 tax return to claim the credit even if you don t usually file a tax return This credit is Web 15 mars 2023 nbsp 0183 32 Claim the 2021 Recovery Rebate Credit You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return Individuals can view the total amount of their third Economic

Web 2021 Recovery Rebate Credit If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021 Form Web 15 janv 2021 nbsp 0183 32 For 2021 eligible taxpayers who did not receive the full amount can claim it as the Recovery Rebate Credit when they file their 2020 tax return Use IRS Free File

Download Federal Tax Recovery Rebate Credit

More picture related to Federal Tax Recovery Rebate Credit

Federal Recovery Rebate Credit Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/irs-1040-form-recovery-rebate-credit-irs-releases-draft-of-form-1040-5.jpg?fit=1140%2C641&ssl=1

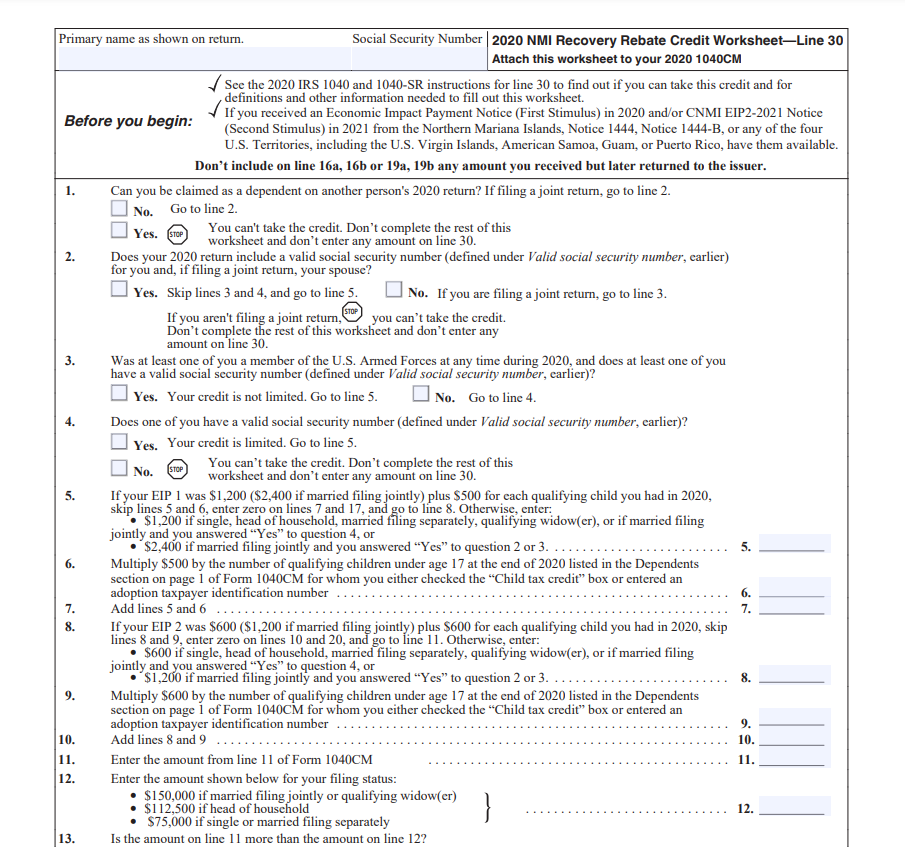

What Is The Recovery Rebate Credit CD Tax Financial

https://cdtax.com/wp-content/uploads/2021/02/Recovery-Rebate-Worksheet-1-1187x1536.png

1040 Recovery Rebate Credit Drake20

https://kb.drakesoftware.com/Site/Uploads/Images/RRC reduction.jpg

Web 12 oct 2022 nbsp 0183 32 What s the Recovery Rebate Credit If you didn t get a third stimulus check or you didn t get the full amount you may be able to claim the recovery rebate credit on Web When you file your 2021 tax return you can use the Recovery Rebate Credit RRC to claim any missing amounts from the third EIP Do I qualify for the Recovery Rebate Credit

Web 1 d 233 c 2022 nbsp 0183 32 The 2020 Recovery Rebate Credit is actually a tax year 2020 tax credit The government sent payments beginning in April of 2020 and a second round beginning in Web 8 mars 2022 nbsp 0183 32 Who Is Eligible to Claim the Recovery Rebate Credit When considering the Recovery Rebate Credit the first question to answer is who was eligible for the

IRS Releases Draft Form 1040 Here s What s New For 2020 Financial

https://specials-images.forbesimg.com/imageserve/5f3ed6a781053fc5c2f9ef85/960x0.jpg?fit=scale

1040 EF Message 0006 Recovery Rebate Credit Drake20

https://kb.drakesoftware.com/Site/Uploads/Images/16934 image 3.jpg

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-c...

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

Recovery Rebate Credit Worksheet Federal Tax Credits TaxUni Recovery

IRS Releases Draft Form 1040 Here s What s New For 2020 Financial

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

The Recovery Rebate Credit Calculator MollieAilie

The Recovery Rebate Credit Calculator MollieAilie

1040 Line 30 Recovery Rebate Credit Recovery Rebate

Recovery Rebate Credit Worksheet Federal Tax Credits TaxUni Recovery

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Federal Tax Recovery Rebate Credit - Web 2021 Recovery Rebate Credit If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021 Form