Federalelectric Vehicle Tax Rebate Web 7 mai 2022 nbsp 0183 32 Federal income tax credit up to 7 500 Currently 7 500 is the maximum amount available to buyers of new fully electric or plug in hybrid cars leasing only

Web You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Web 31 mars 2023 nbsp 0183 32 How many EVs are currently eligible for federal tax credits Currently 21 vehicles are eligible for federal tax credits up to 7 500 That will change on April 18

Federalelectric Vehicle Tax Rebate

Federalelectric Vehicle Tax Rebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/06/inspirational-federal-electric-vehicle-tax-credit-used-cars.png?w=541&h=428&ssl=1

Federal Rebate For Electric Cars FederalProTalk

https://www.federalprotalk.com/wp-content/uploads/electric-vehicle-rebate-available-until-331-mcleod-cooperative-power.png

Federal Tax Rebates Electric Vehicles ElectricRebate

https://www.electricrebate.net/wp-content/uploads/2022/09/rebates-and-tax-credits-for-electric-vehicle-charging-stations-2.jpg

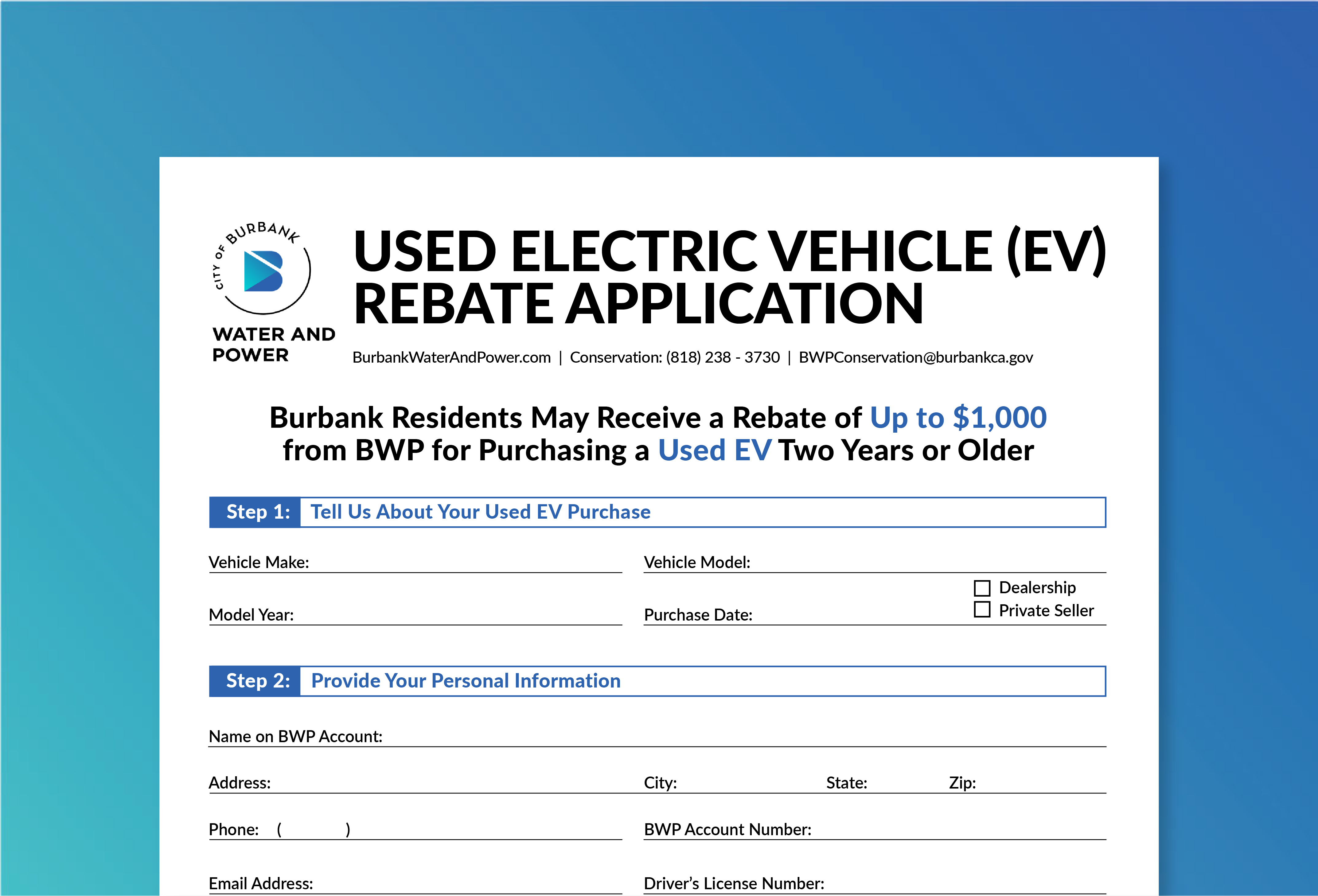

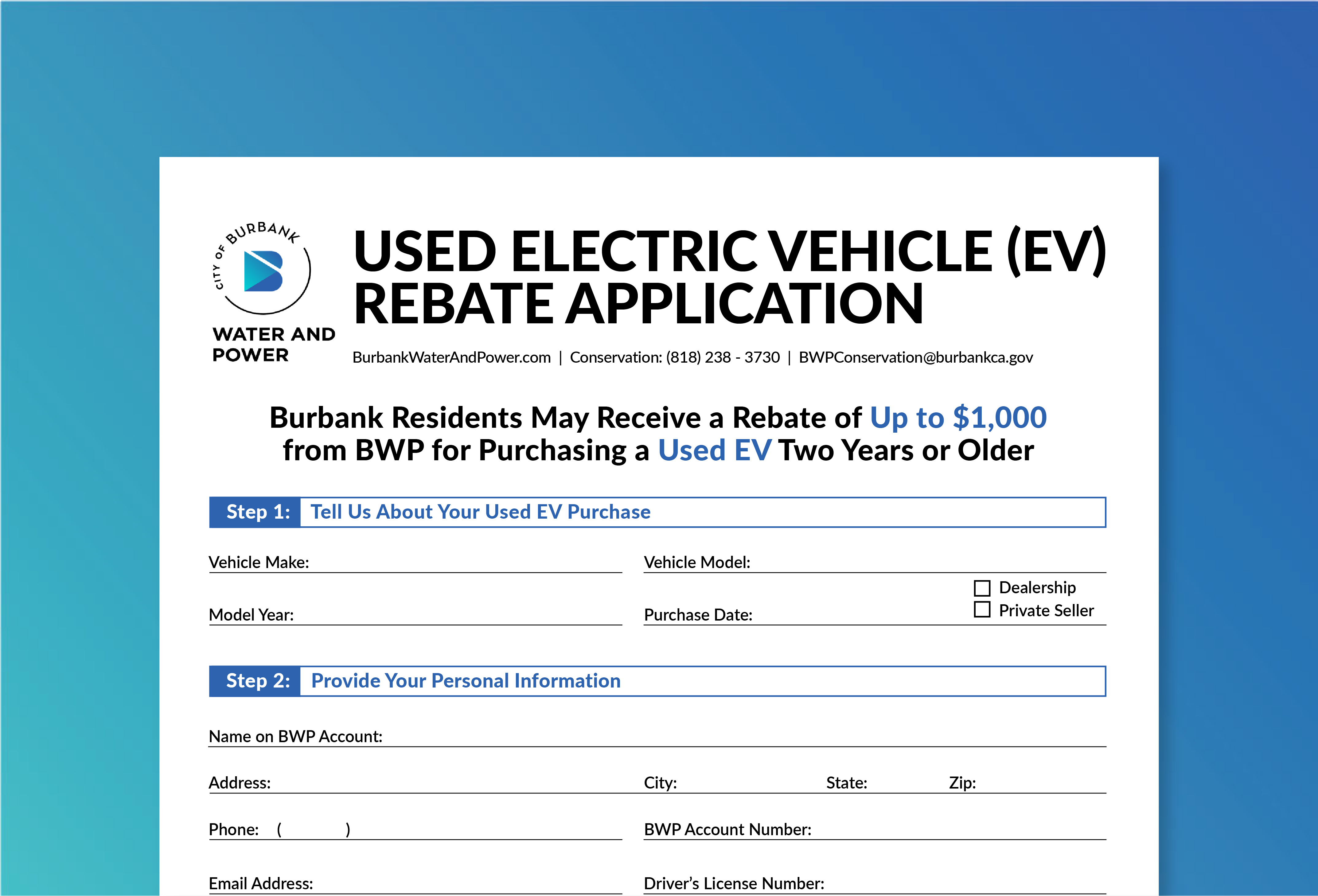

Web 7 janv 2023 nbsp 0183 32 If you buy a used electric vehicle model year 2021 or earlier you can get up to 4 000 back as a tax credit This tax credit has an income cap too 150 000 for a Web Find out if your electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on type purchase date and business or personal use Buying a New Vehicle for

Web 17 ao 251 t 2022 nbsp 0183 32 All electric and plug in hybrid vehicles purchased new from 2010 through 2022 may be eligible for a federal income tax credit of up to 7 500 The credit amount Web New EVs are eligible for a 7 500 credit for now until the Treasury and IRS release further guidance That guidance could mean automakers have to have increasing

Download Federalelectric Vehicle Tax Rebate

More picture related to Federalelectric Vehicle Tax Rebate

Electric Vehicle Rebates For The USA

http://evrebates.org/evrebates.jpg

How The Federal Electric Vehicle EV Tax Credit Works EVAdoption

https://evadoption.com/wp-content/uploads/2017/07/Screen-Shot-2017-07-22-at-1.03.16-AM.png

Ev Tax Credit 2022 Retroactive Shemika Wheatley

https://images.hgmsites.net/med/ev-tax-credit-support--climate-nexus-may-2019_100702679_m.jpg

Web 29 d 233 c 2022 nbsp 0183 32 The Treasury Department on Thursday published a partial list of new electric and plug in hybrid cars that will qualify for tax credits of up to 7 500 Web 15 f 233 vr 2023 nbsp 0183 32 Buyers of new plug in EVs or fuel cell electric vehicles may qualify for a credit up to 7 500 The vehicle must be bought for personal transportation and not for

Web 17 ao 251 t 2022 nbsp 0183 32 About 20 electric and plug in hybrid vehicles from model years 2022 and 2023 are still eligible for the up to 7 500 in federal tax rebates under the Inflation Web 7 ao 251 t 2023 nbsp 0183 32 The US Treasury has released new guidelines on the electric vehicle tax credit in the Inflation Reduction Act which seem to suggest that leased vehicles can

Does Your EV Qualify For A 7 500 Federal Tax Rebate Mike Anderson

http://blog.mikeandersonchevymerrillville.com/wp-content/uploads/2023/04/MACM-7500-EV-Federal-Credit.png

Federal Electric Car Rebate Usa 2022 ElectricRebate

https://www.electricrebate.net/wp-content/uploads/2022/09/california-s-ev-rebate-changes-a-good-model-for-the-federal-ev-tax-5.png

https://www.bloomberg.com/news/articles/2022-05-07/what-to-know-about...

Web 7 mai 2022 nbsp 0183 32 Federal income tax credit up to 7 500 Currently 7 500 is the maximum amount available to buyers of new fully electric or plug in hybrid cars leasing only

https://www.irs.gov/credits-deductions/credits-for-new-clean-vehicles...

Web You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation

Federal Electric Vehicle Rebate ElectricRebate

Does Your EV Qualify For A 7 500 Federal Tax Rebate Mike Anderson

Federal Electric Car Rebate Rules ElectricRebate

How The Federal EV Tax Credit Amount Is Calculated For Each EV EVAdoption

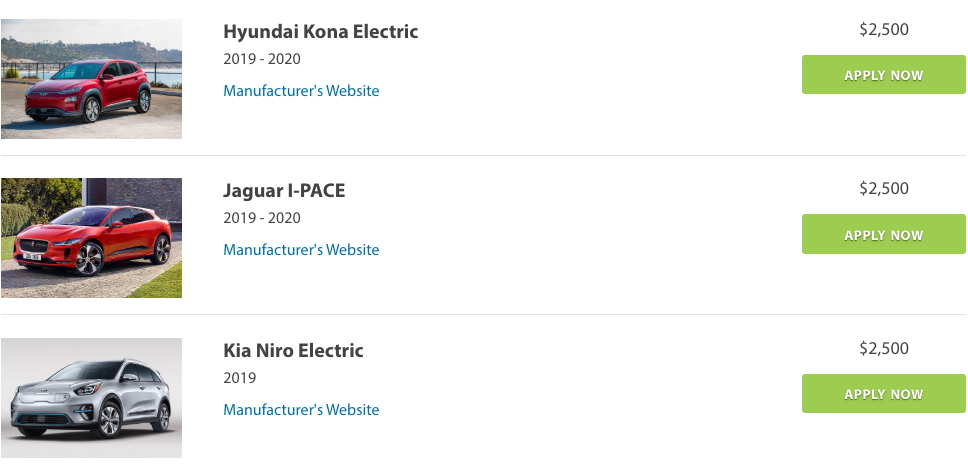

Electric Car Available Rebates 2023 Carrebate

Used Electric Vehicle Rebate

Used Electric Vehicle Rebate

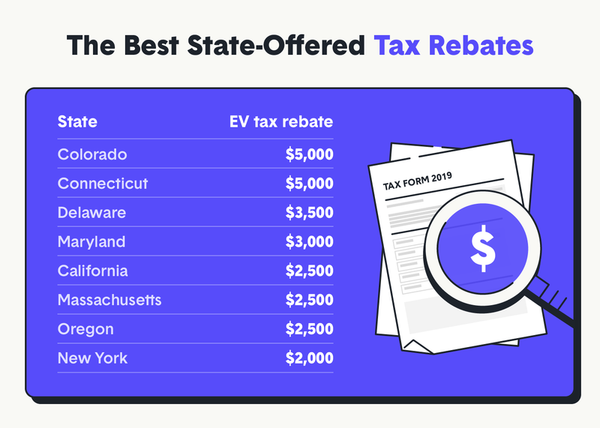

These Eight States Offer The Best Electric Vehicle Incentives

Electric Vehicle EV Incentives Rebates

Tax Credit For Electric Vehicle TaxProAdvice

Federalelectric Vehicle Tax Rebate - Web 17 ao 251 t 2022 nbsp 0183 32 All electric and plug in hybrid vehicles purchased new from 2010 through 2022 may be eligible for a federal income tax credit of up to 7 500 The credit amount