Fidelity Hsa Eligible Expenses List For more information and a complete list of qualified medical expenses see IRS Publication 502 At age 65 you can spend your HSA dollars on anything not just medical expenses and you won t incur the 20 penalty The withdrawal will

The information provided herein is general in nature and provides examples of eligible qualified medical expenses based on IRS Publications 502 and 969 and other IRS guidance The Take tax free1 distributions from your HSA to pay for qualified medical expenses

Fidelity Hsa Eligible Expenses List

Fidelity Hsa Eligible Expenses List

https://www.mymoneyblog.com/wordpress/wp-content/uploads/2021/11/hsa_better.jpg

New Expenses Now Eligible For Your HSA FSA Funds Flyte HCM

https://flytehcm.com/wp-content/uploads/2020/04/Pharmacy-Over-the-Counter-scaled.jpeg

2022 HSA Eligible Expenses SmartAsset

https://dr5dymrsxhdzh.cloudfront.net/blog/images/a0a156a2c/2022/04/hsa-1-1.jpg

What is an HSA eligible health plan An HSA eligible health plan is an HDHP that satisfies certain IRS requirements with respect to deductibles and out of pocket expenses You generally pay Here are 9 ways to spend from your HSA Sign up for Fidelity Viewpoints weekly email for our latest insights 1 Use your HSA debit card Pay for qualified medical expenses

It is the HSA account holder s responsibility to determine whether a particular expense is a qualified medical expense The information provided herein is general in nature and provides FSA and HSA Eligibility List Search for eligible Flexible Spending Account and Health Savings Account expenses

Download Fidelity Hsa Eligible Expenses List

More picture related to Fidelity Hsa Eligible Expenses List

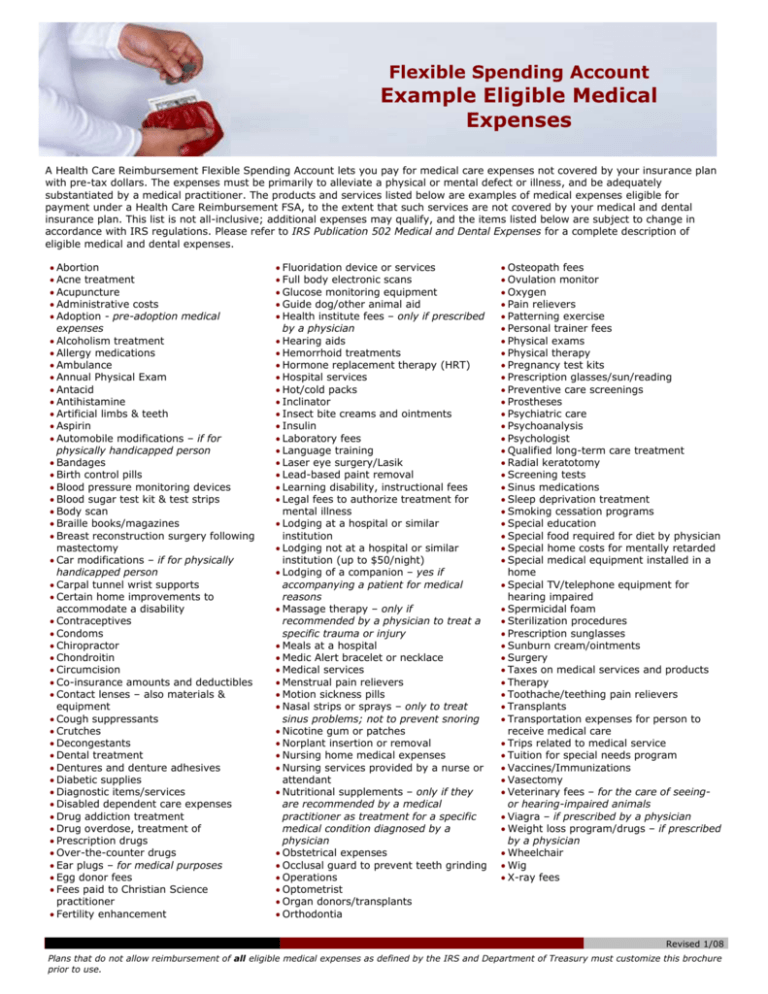

Flexible Spending Account Example Eligible Medical Expenses

https://s3.studylib.net/store/data/007783568_2-ce6693b5ed4cb9d25441e26bfd42732d-768x994.png

Ready To Use Your 529 Plan Coldstream

https://www.coldstream.com/wp-content/uploads/2022/09/Ready-to-Use-Your-529-Account-Graphic.jpg

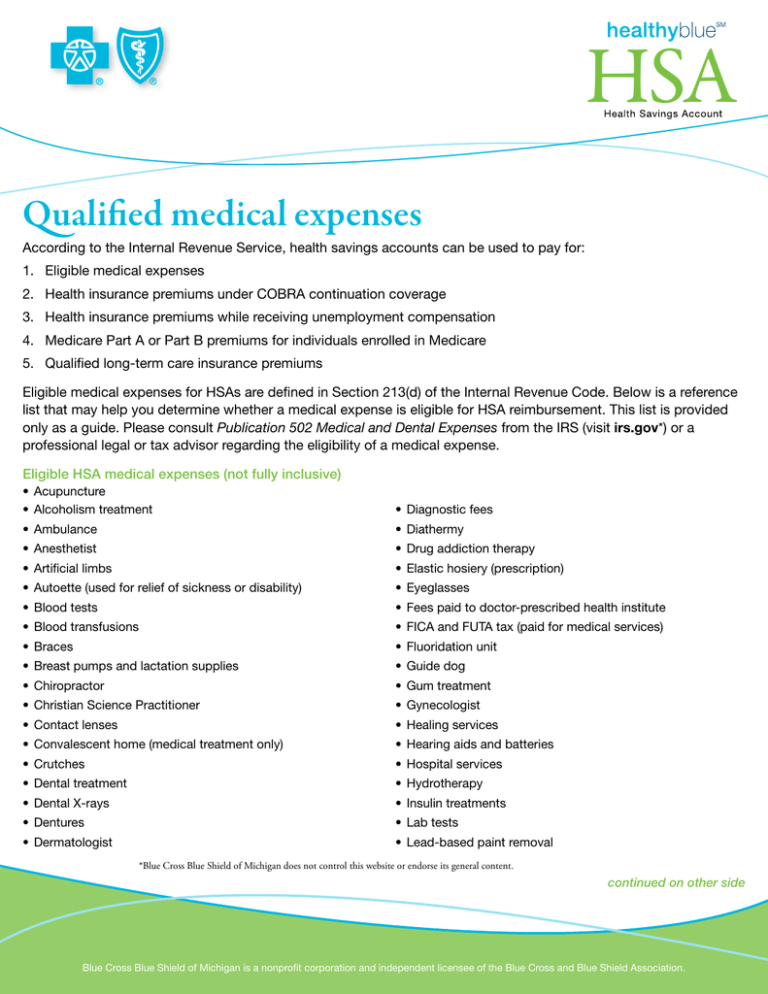

HSA Qualified Medical Expenses

https://s2.studylib.net/store/data/012820623_1-1132dc89d22ae76677bae033049228ca-768x994.png

Consider saving to pay for future qualified medical expenses including those in retirement Choose how to invest your HSA Understand your payment and reimbursement options A health savings account HSA paired with an HSA eligible health plan HEHP can help you save and pay for qualified medical expenses lower your taxes and even save for retirement

What expenses are eligible to purchase with HSA funds Refer to the HSA Eligibility List for a comprehensive look at many of the items covered by an HSA Learn what counts as an eligible health savings account expense HSAs offer tax benefits and cover IRS approved health expenses reducing taxable income Funds for HSAs

HSA Health Savings Account Sound Benefit Administration

https://soundadmin.com/wp-content/uploads/2016/11/HSA-p.jpg

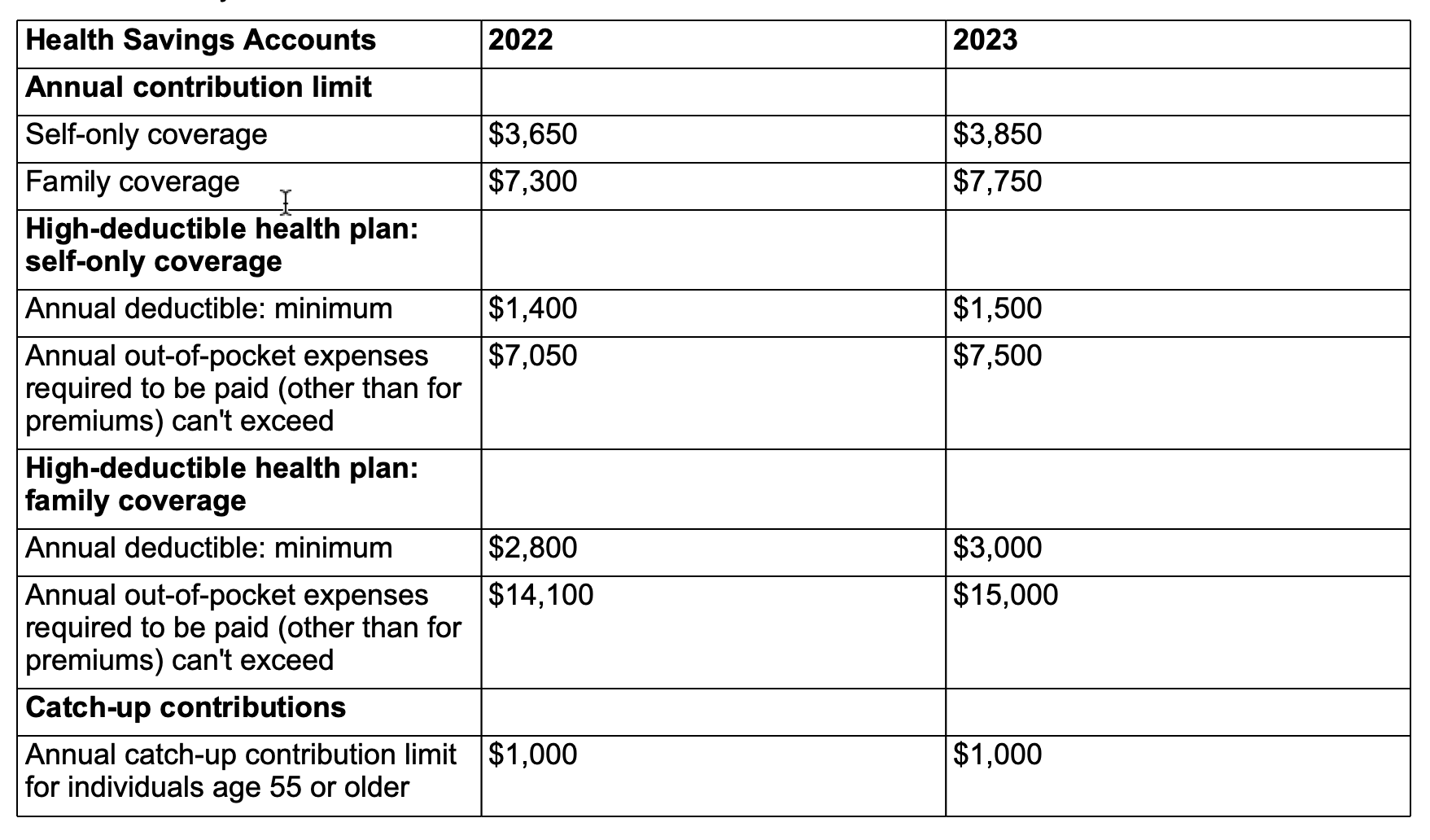

IRS Releases 2023 Key Numbers For Health Savings Accounts Ballast

https://ballastadvisors.com/wp-content/uploads/IRS-Key-HSA-numbers-2023.png

https://www.fidelity.com › go › hsa › how-t…

For more information and a complete list of qualified medical expenses see IRS Publication 502 At age 65 you can spend your HSA dollars on anything not just medical expenses and you won t incur the 20 penalty The withdrawal will

https://communications.fidelity.com › wi › HSAQME...

The information provided herein is general in nature and provides examples of eligible qualified medical expenses based on IRS Publications 502 and 969 and other IRS guidance The

The Clock Is Ticking The End Of The National Emergency Rules For FSAs

HSA Health Savings Account Sound Benefit Administration

FSA Eligible Expense List Flexbene

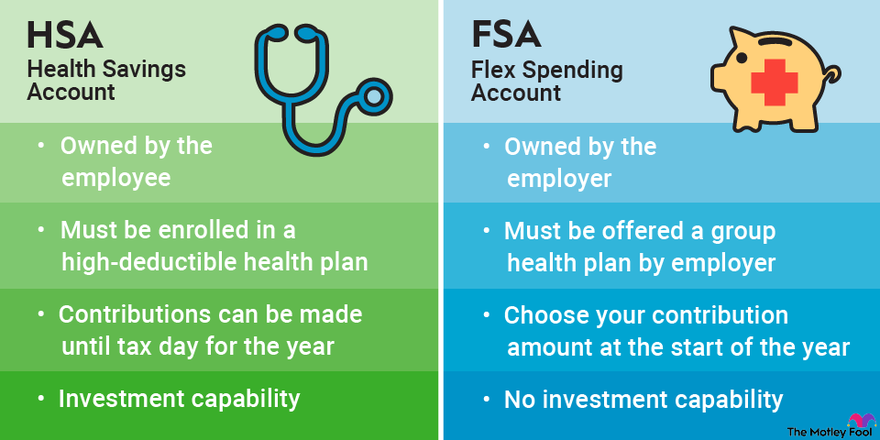

HSA Vs FSA Accounts Side by Side Healthcare Comparison The Motley Fool

What Are The Options FSA Setup Decisions Sound Benefit Administration

FSA Eligible Health Care Expenses

FSA Eligible Health Care Expenses

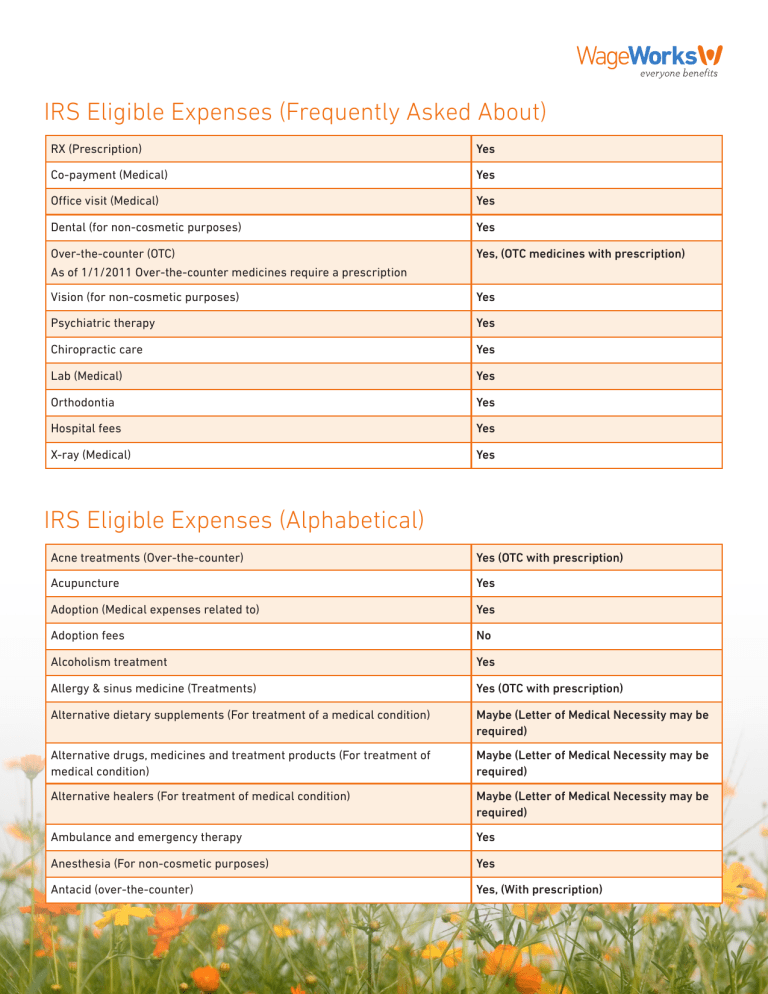

IRS Eligible Expenses

A Wealth Of Flexibility Employer Contributions In Health Flexible

Hsa Sunscreen Rules V9306 1blu de

Fidelity Hsa Eligible Expenses List - An HSA account lets you save pre tax dollars to pay for qualified medical expenses and withdrawals are tax free if you use it for qualified medical expenses Learn More