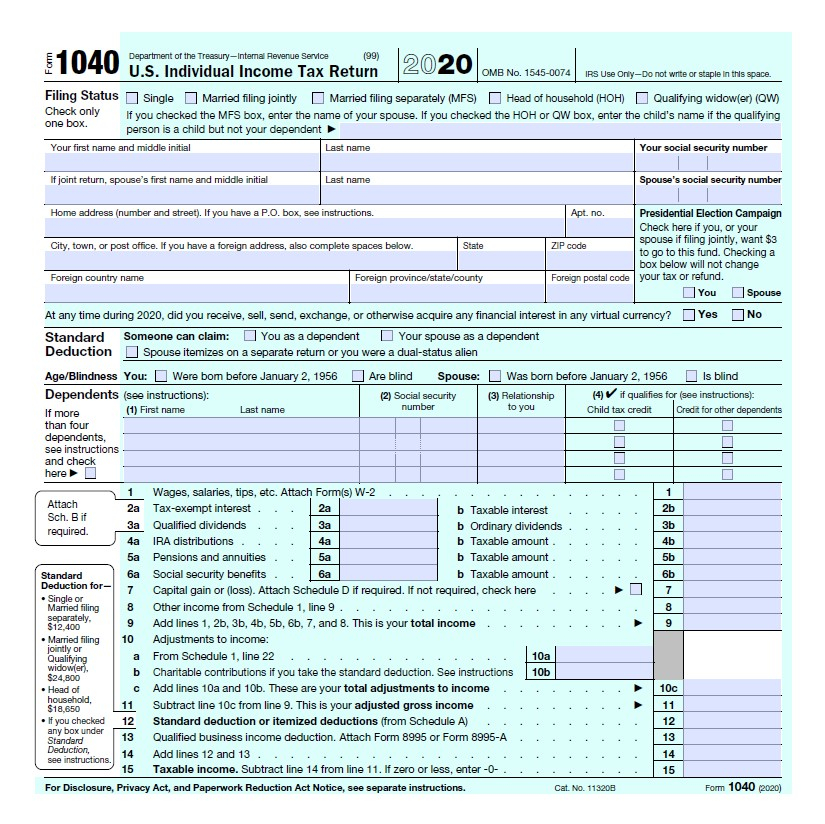

File Recovery Rebate Form Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

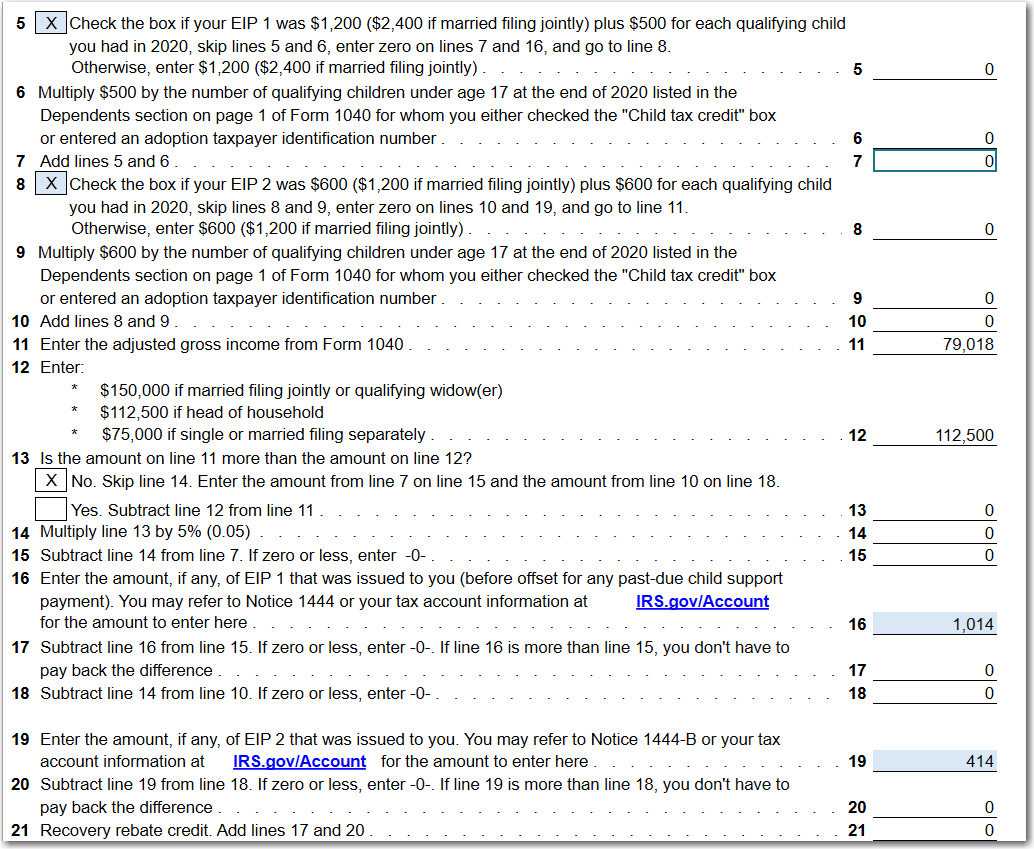

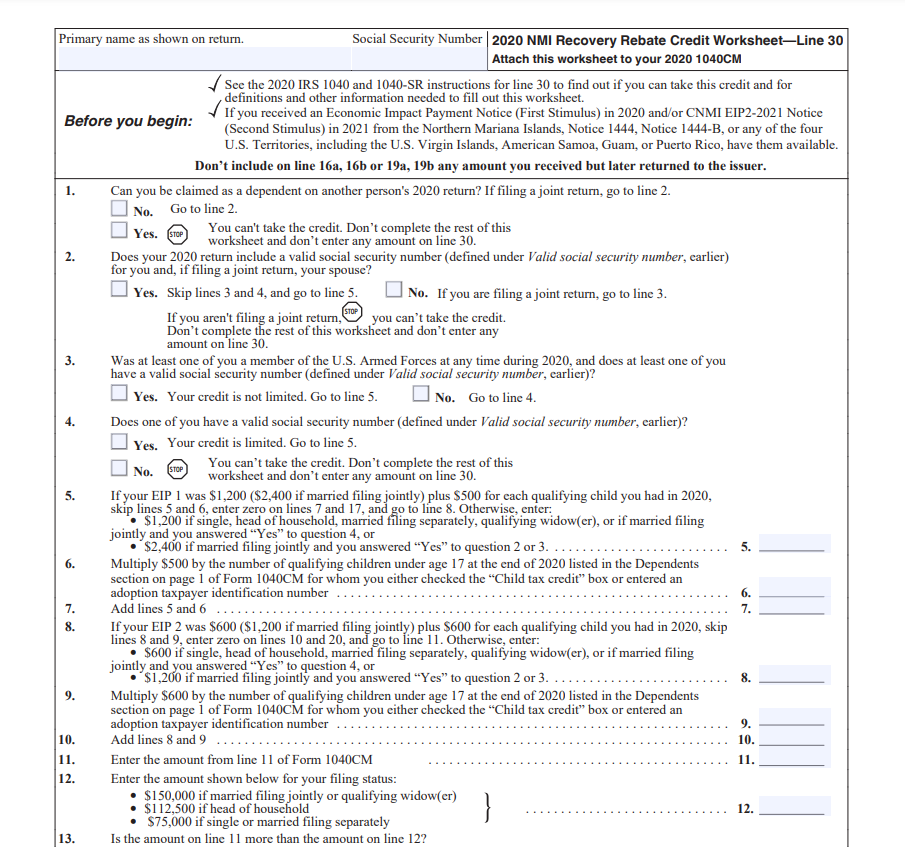

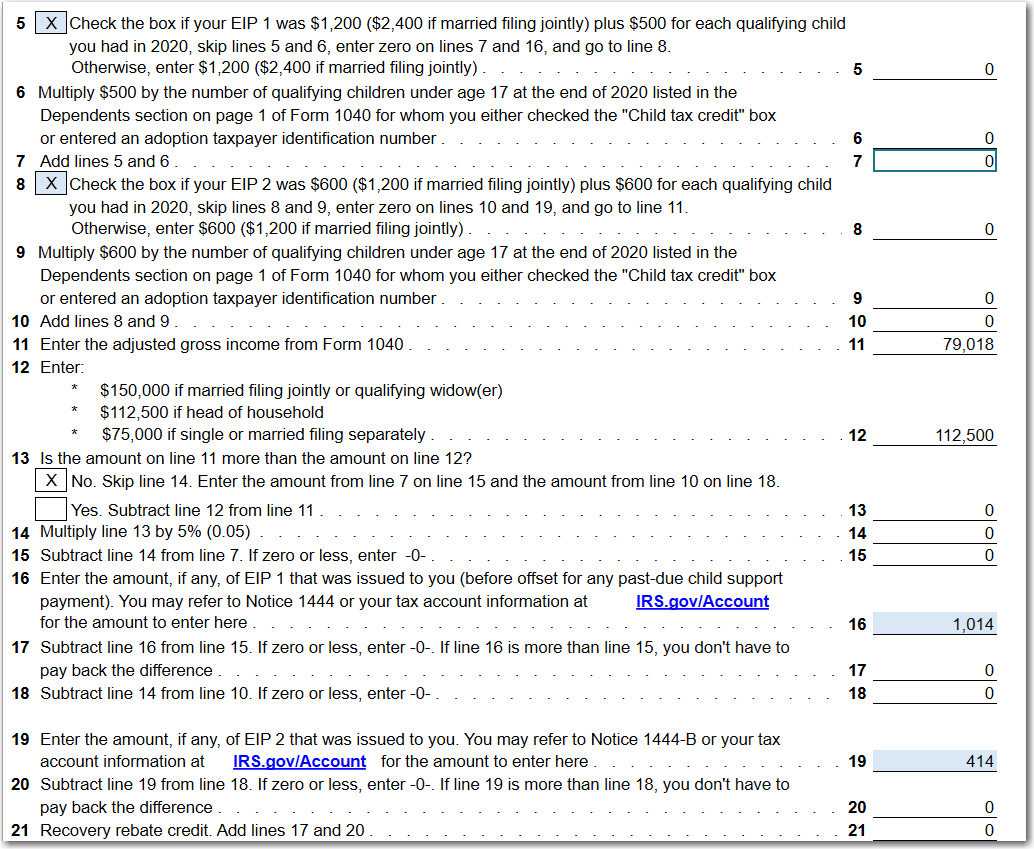

Web 13 janv 2022 nbsp 0183 32 No matter how you file you will need to do the following to claim the 2021 Recovery Rebate Credit Compute the 2021 Recovery Rebate Credit amount using tax Web 10 d 233 c 2021 nbsp 0183 32 To claim the 2020 Recovery Rebate Credit you will need to Compute the 2020 Recovery Rebate Credit amount using the line 30 worksheet found in 2020 Form

File Recovery Rebate Form

File Recovery Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/10/What-Does-The-Recovery-Rebate-Form-Look-Like.png

What Does It Mean To Claim The Recovery Rebate Credit Leia Aqui Who

https://www.legacytaxresolutionservices.com/2255lega/250w/cp12renglishpage001.png

IRS CP 11R Recovery Rebate Credit Balance Due

https://www.legacytaxresolutionservices.com/2255lega/250w/cp11r-2page001.png

Web 10 d 233 c 2021 nbsp 0183 32 If you re eligible for the Recovery Rebate Credit you ll need to file a 2020 tax return to claim the credit even if you don t usually file a tax return This credit is Web 10 d 233 c 2021 nbsp 0183 32 You must file a 2020 tax return to claim a Recovery Rebate Credit even if you don t usually file a tax return The Recovery Rebate Credit Worksheet in the 2020

Web 10 d 233 c 2021 nbsp 0183 32 Enter the amount on the Refundable Credits section of the 1040 X and include quot Recovery Rebate Credit quot in the Explanation of Changes section If you filed Web 15 janv 2021 nbsp 0183 32 IR 2021 15 January 15 2021 WASHINGTON IRS Free File online tax preparation products available at no charge launched today giving taxpayers an early

Download File Recovery Rebate Form

More picture related to File Recovery Rebate Form

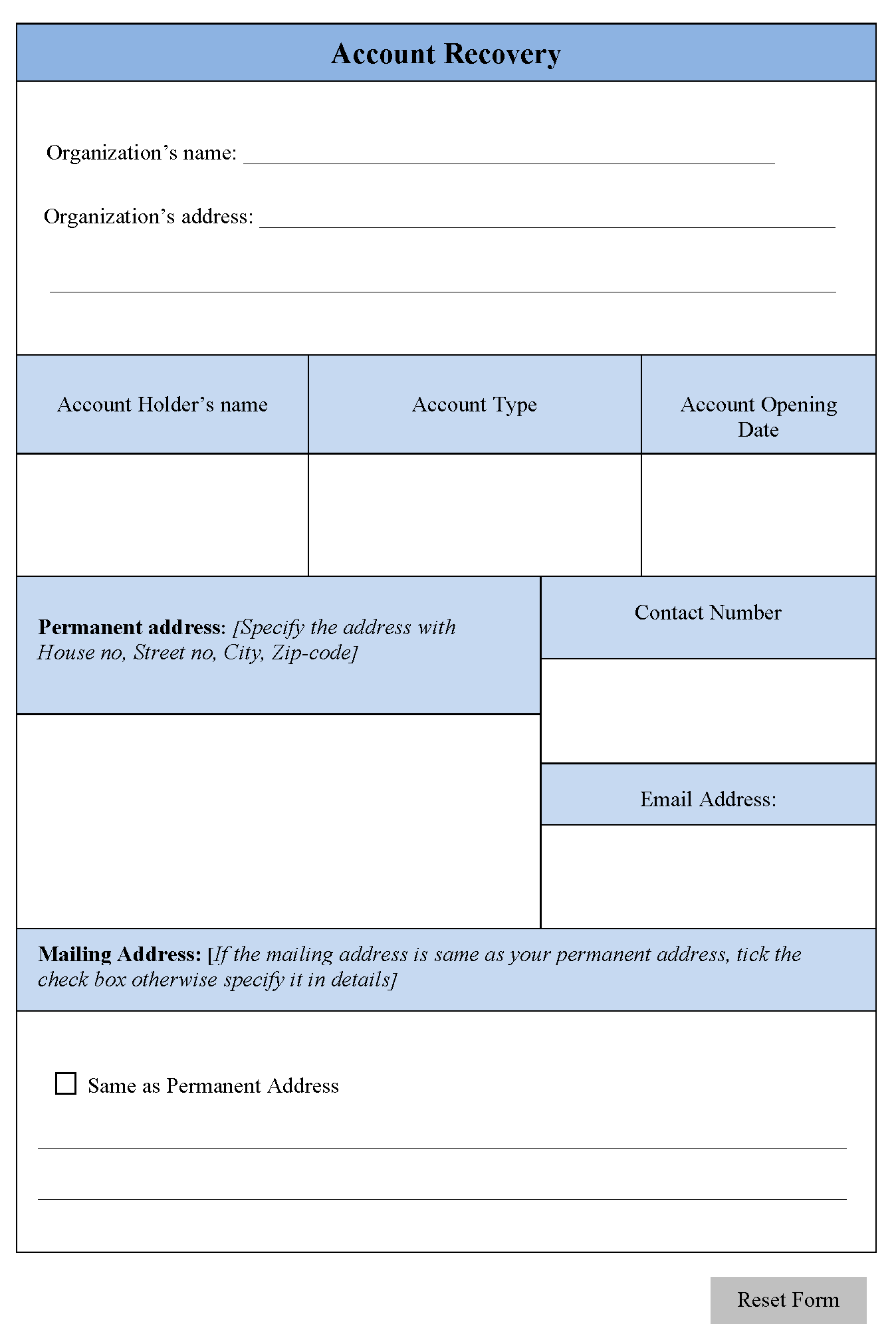

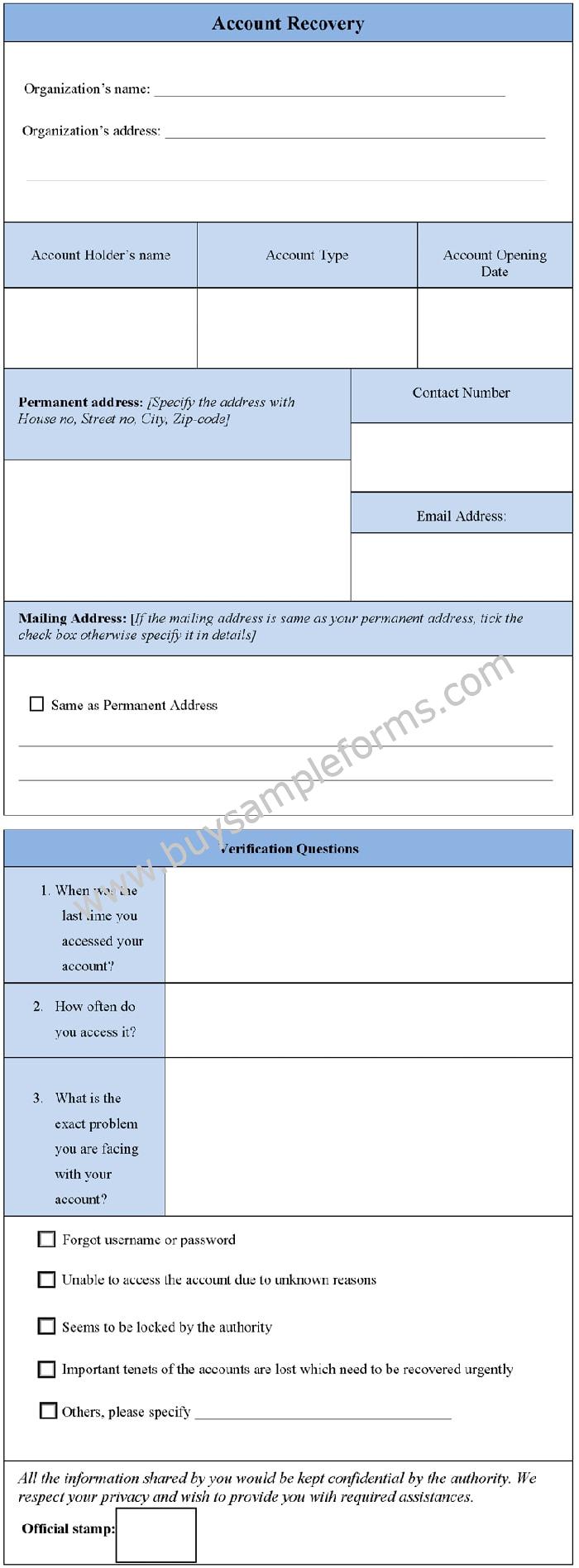

Account Recovery Form Editable Forms

http://www.editableforms.com/wp-content/uploads/2015/06/Account-Recovery-Form_Page_1.png

How Do I Claim The Recovery Rebate Credit On My Ta

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/e3d7f0ce-2b70-4164-b921-f7ef2ca8a52f.default.png

What Is A Recovery Rebate Credit 2022 Rebate2022

https://www.rebate2022.com/wp-content/uploads/2022/08/recovery-credit-printable-rebate-form.jpg

Web 27 avr 2023 nbsp 0183 32 If you re one of the many who are owed stimulus money you may be able to claim the amount as a recovery rebate tax credit on your 2020 or 2021 federal tax return Featured Partner Offers Web When you file your 2021 tax return you can use the Recovery Rebate Credit RRC to claim any missing amounts from the third EIP Do I qualify for the Recovery Rebate

Web 2021 Recovery Rebate Credit If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021 Form Web What is the Recovery Rebate Credit The Recovery Rebate Credit was added to 2020 individual tax returns in order to reconcile the Economic Impact stimulus Payments

2022 Irs Recovery Rebate Credit Worksheet Rebate2022

https://www.rebate2022.com/wp-content/uploads/2022/08/recovery-rebate-credit-worksheet-atx-line-30-covid-19-atx-community.jpg

Recovery Rebate Credit Worksheet 2020 Ideas 2022

https://i2.wp.com/lh5.googleusercontent.com/proxy/lGA90iOjY_1LO-OBBI3qmZMyKEj47RMisqIykTyVbIbO-V2GqH4xUV92z9Uq0pojRygogoMZtKIKKsqfiqET_2bvfJQoMviJq-wHNdbSR8ZyQ-ukMly2632ZZ7bKcCkHDaCeogT6Skm16tenIHu_TkBU8w=w1200-h630-p-k-no-nu

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-questions-and...

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-b...

Web 13 janv 2022 nbsp 0183 32 No matter how you file you will need to do the following to claim the 2021 Recovery Rebate Credit Compute the 2021 Recovery Rebate Credit amount using tax

Rebate Form Download Printable PDF Templateroller

2022 Irs Recovery Rebate Credit Worksheet Rebate2022

What Is The Recovery Rebate Credit CD Tax Financial

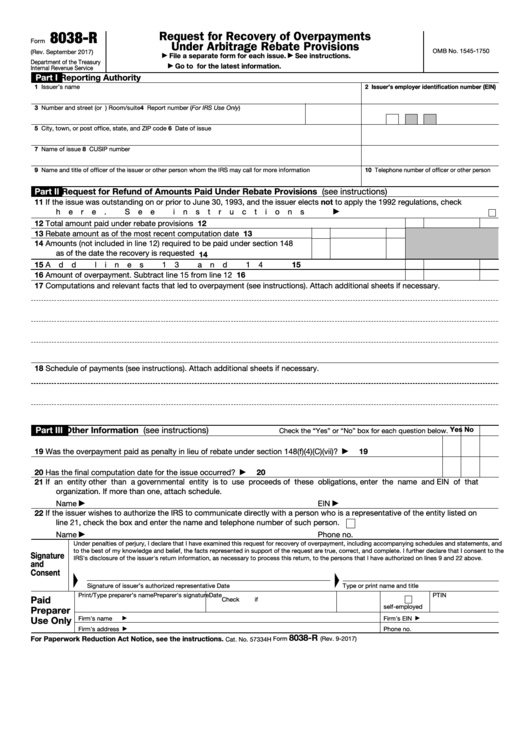

Fillable Form 8038 R Request For Recovery Of Overpayments Under

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Sample Account Recovery Form Template In Word Format

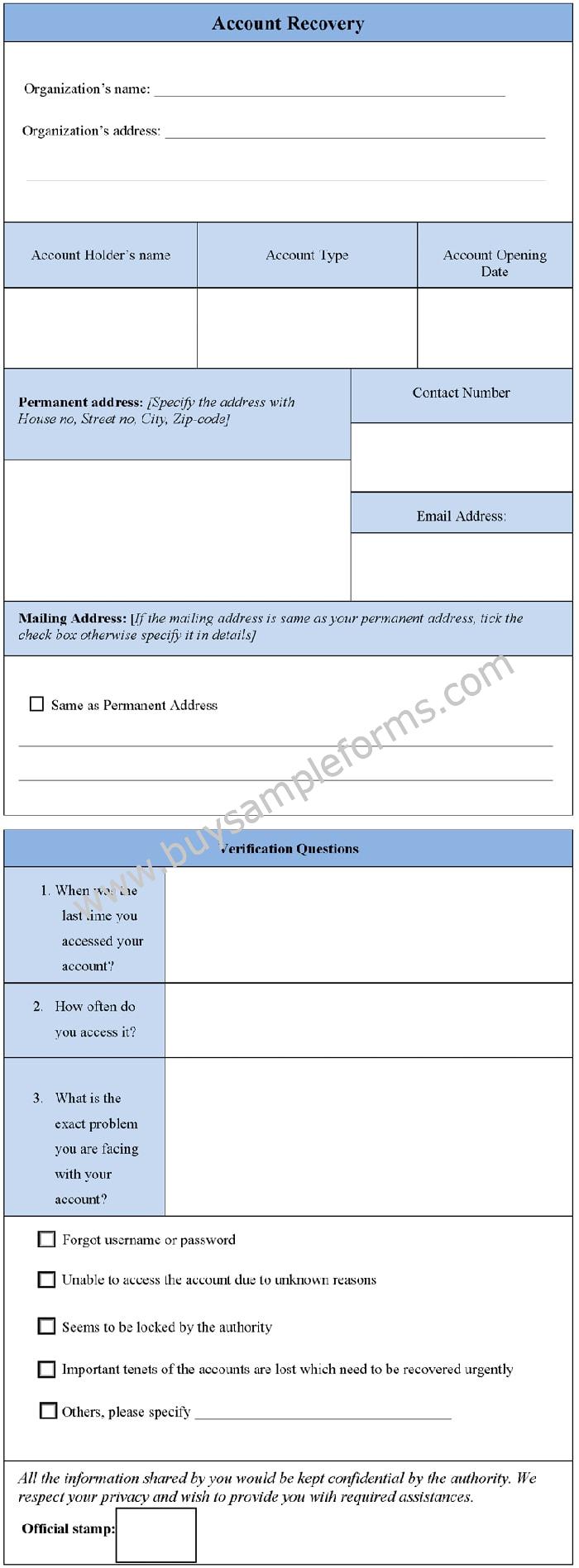

Sample Account Recovery Form Template In Word Format

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

1040 EF Message 0006 Recovery Rebate Credit Drake20

How To File And Pay Your 2020 Taxes Online The Verge Recovery Rebate

File Recovery Rebate Form - Web 8 mars 2022 nbsp 0183 32 When filing your tax return you will use Line 30 of Form 1040 or Form 1040 SR to claim the Recovery Rebate Credit You will find instructions for how to calculate