First Child Tax Relief Singapore Parenthood Tax Rebate PTR Share Married divorced or widowed parents may claim tax rebates of up to 20 000 per child As PTR is a one off rebate you may only claim PTR on a

You are eligible for personal reliefs and rebates if you are a Singapore Tax Resident and if you fulfilled the qualifying conditions of the reliefs and rebates Answer a few simple questions to If you are a parent you may be eligible to claim the Parenthood Tax Rebate of 5 000 for your first child 10 000 for your second child and 20 000 per child for your third and subsequent child The child must be a Singapore Citizen at the

First Child Tax Relief Singapore

First Child Tax Relief Singapore

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjM81nSzJ2QiCATWboDACN2BpfNmw-0Wf5BApuHi91cjON32r6XUxhruNbA8f0o3K_H_4oIf1B4xQE6D0tInpJ7fFjXuaqCtw3-786N9ouUQ8nKcW7kxtIy0bZOmw2wXtBmRb63A-pQjcxK9mCdSvqTGiUvUxaePn9JkzlCVQKv7Gj0EukB_pdXpC10/s1585/Individual_Tax_Relief_2021.jpg

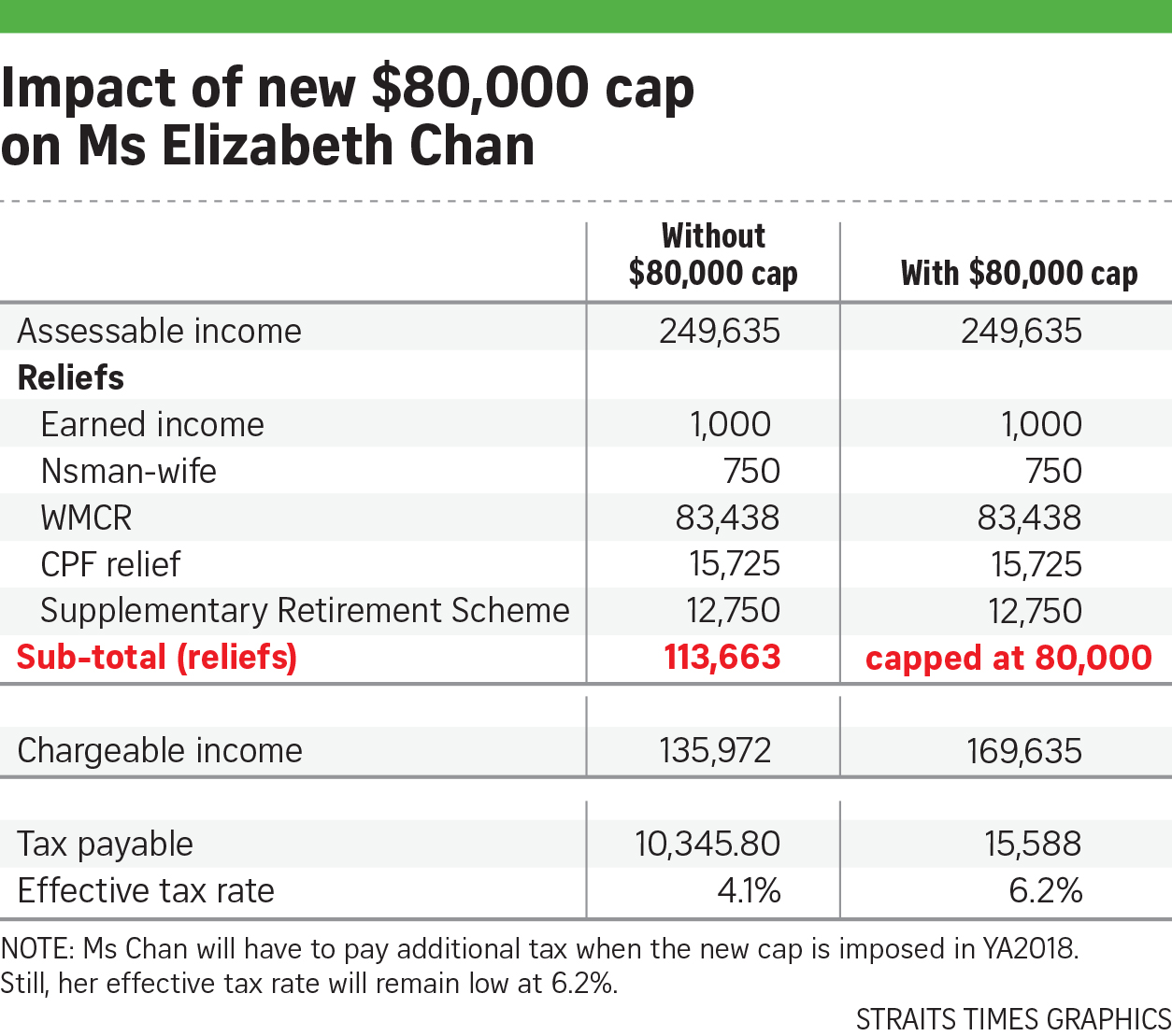

Hot Under The Collar About 80k Tax Relief Cap Business News AsiaOne

http://www.asiaone.com/sites/default/files/st_20160405_lttax_2191669.jpg

.png?sfvrsn=d0aa2658_3)

IRAS Parent Relief Handicapped Parent Relief 2022

https://www.iras.gov.sg/images/default-source/assets/example-on-sharing-of-parent-relief-(staying).png?sfvrsn=d0aa2658_3

Discover the conditions and benefits of the Parenthood Tax Rebate PTR in Singapore Learn how to qualify and claim up to 20 000 per child It will be changed from a percentage of the eligible mother s earned income to a fixed dollar tax relief for qualifying Singaporean children born or adopted on or after 1 January 2024 with effect from the YA 2025 Eligible

As a working mother you re entitled to additional tax relief via the Working Mother s Child Relief This relief offers a 15 reduction on the mother s earned income for the first child 20 for the second child and 25 for the If you are a Singapore tax residents who is married divorced or widowed the Parenthood Tax Rebate PTR can be utilised for tax rebate as per the following For 1st

Download First Child Tax Relief Singapore

More picture related to First Child Tax Relief Singapore

How The Advanced Child Tax Credit Payments Impact Your 2021 Return

https://taxprocpa.com/images/increased-child-tax-credit.jpg

10 Tax Deductions For Self Employed Persons That You May Be Missing Out

https://dollarsandsense.sg/business/wp-content/uploads/2022/04/2nd_10-Tax-Deductions-For-Self-Employed-Persons-That-You-May-Be-Missing-Out-On-infographic_12-Apr-683x1024.jpg

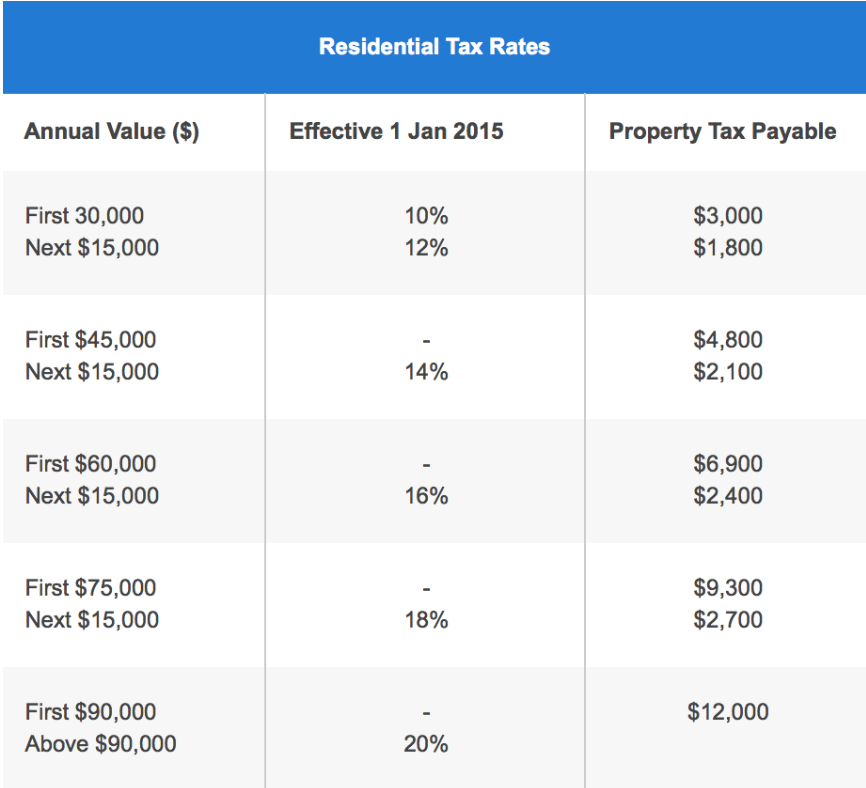

Property Tax Singapore HaykaHarveer

https://www.99.co/singapore/insider/wp-content/uploads/2016/04/Screen-Shot-2016-04-06-at-11.54.40.png

Parents can claim a one time amount of 5 000 for their first child 10 000 for their second and 20 000 for their third and each subsequent child Any unutilised balance is automatically carried forward and offsets your future For the first child the WMCR available is 15 of the mother s earned income The percentage increases to 20 for the second child and 25 for the third child and beyond A cap of S 80 000 applies to the total amount

Working mothers will be eligible to claim 8 000 for their first child 10 000 for their second child and 12 000 for their third and subsequent children Parenthood Tax Rebate PTR The PTR is a tax rebate specifically As the name implies this is only applicable for females The tax relief is as follows 1st Child 15 of mother s earned income 2nd Child 20 of mother s earned

Property Tax Singapore MoeezMiryiam

https://dollarsandsense.sg/wp-content/uploads/2022/02/Non-Owner-Occupied-Tax-Rate.png

Tax Reliefs In Singapore Everything You Need To Know 2024

https://www.instantloan.sg/wp-content/uploads/elementor/thumbs/tax-relief-singapore-q9i1txzle38wy44anisfapp88c3dqrsg5wr3rvsgzk.jpg

https://www.iras.gov.sg › ... › tax-reliefs › parenthood-tax-rebate-(ptr)

Parenthood Tax Rebate PTR Share Married divorced or widowed parents may claim tax rebates of up to 20 000 per child As PTR is a one off rebate you may only claim PTR on a

https://www.iras.gov.sg › ... › tax-reliefs

You are eligible for personal reliefs and rebates if you are a Singapore Tax Resident and if you fulfilled the qualifying conditions of the reliefs and rebates Answer a few simple questions to

Object To My Tax Bill Child Relief non Singaporean Child YouTube

Property Tax Singapore MoeezMiryiam

Best Tips To Reduce Income Tax In Singapore YA 2024

2024 Budget Covers All Segments Gives Attention To State Development

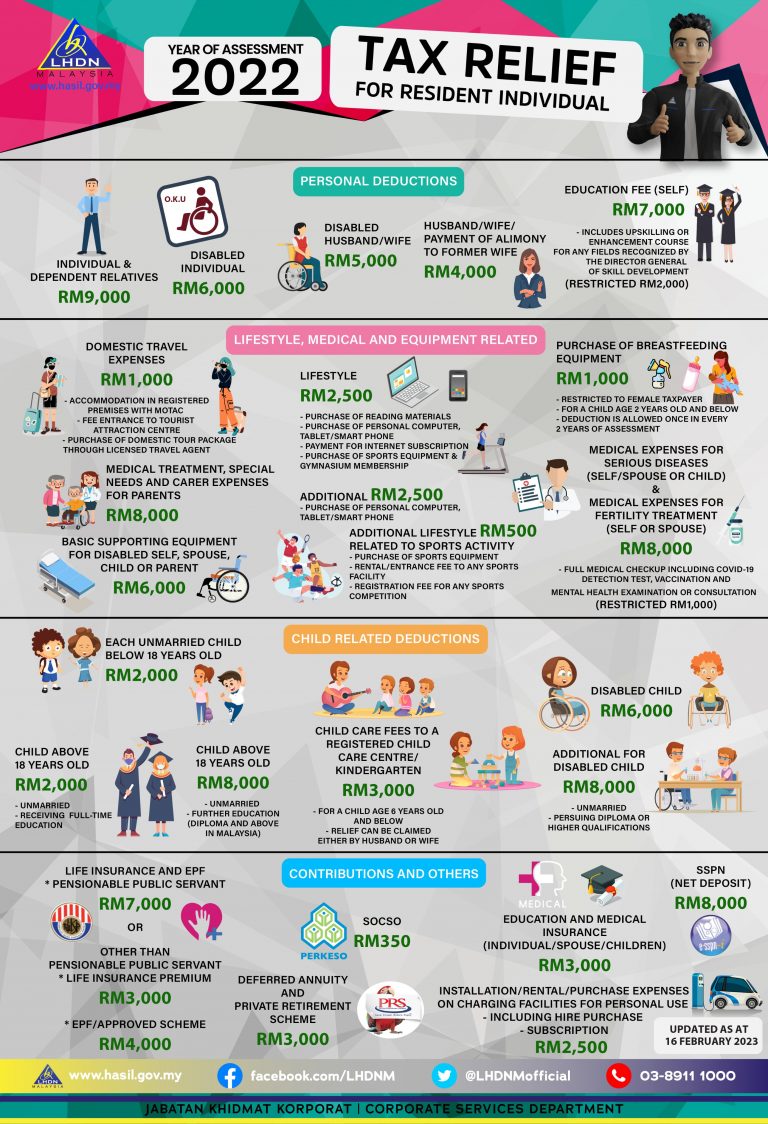

Individual Tax Relief In Malaysia CN Advisory

Singapore Tax Reliefs The Income Blog

Singapore Tax Reliefs The Income Blog

Fillable Online SRS Contributions And Tax Relief Singapore Fax Email

Income Tax Relief Malaysia 2023 Printable Forms Free Online

SINGAPORE TAXATION BASICS TO CORPORATE TAXES IN SINGAPORE

First Child Tax Relief Singapore - Being eligible allows you and your spouse to claim tax relief of 4 000 per child under QCR or 7 500 per child under HCR In this article we will walk you through the