First Home Owners Tax Exemption Verkko 13 lokak 2023 nbsp 0183 32 THE GOVERNMENT of Prime Minister Petteri Orpo NCP on Thursday unveiled a proposal to scrap the transfer tax exemption granted to first time home

Verkko 12 lokak 2023 nbsp 0183 32 The transfer tax is roughly two to four percent of a home s value First time buyers are exempt from this tax if they are between the ages of 18 and 39 and Verkko First time home buyers are exempt from asset transfer tax until the end of the year Another significant benefit is that the asset transfer tax exemption that applies to first

First Home Owners Tax Exemption

First Home Owners Tax Exemption

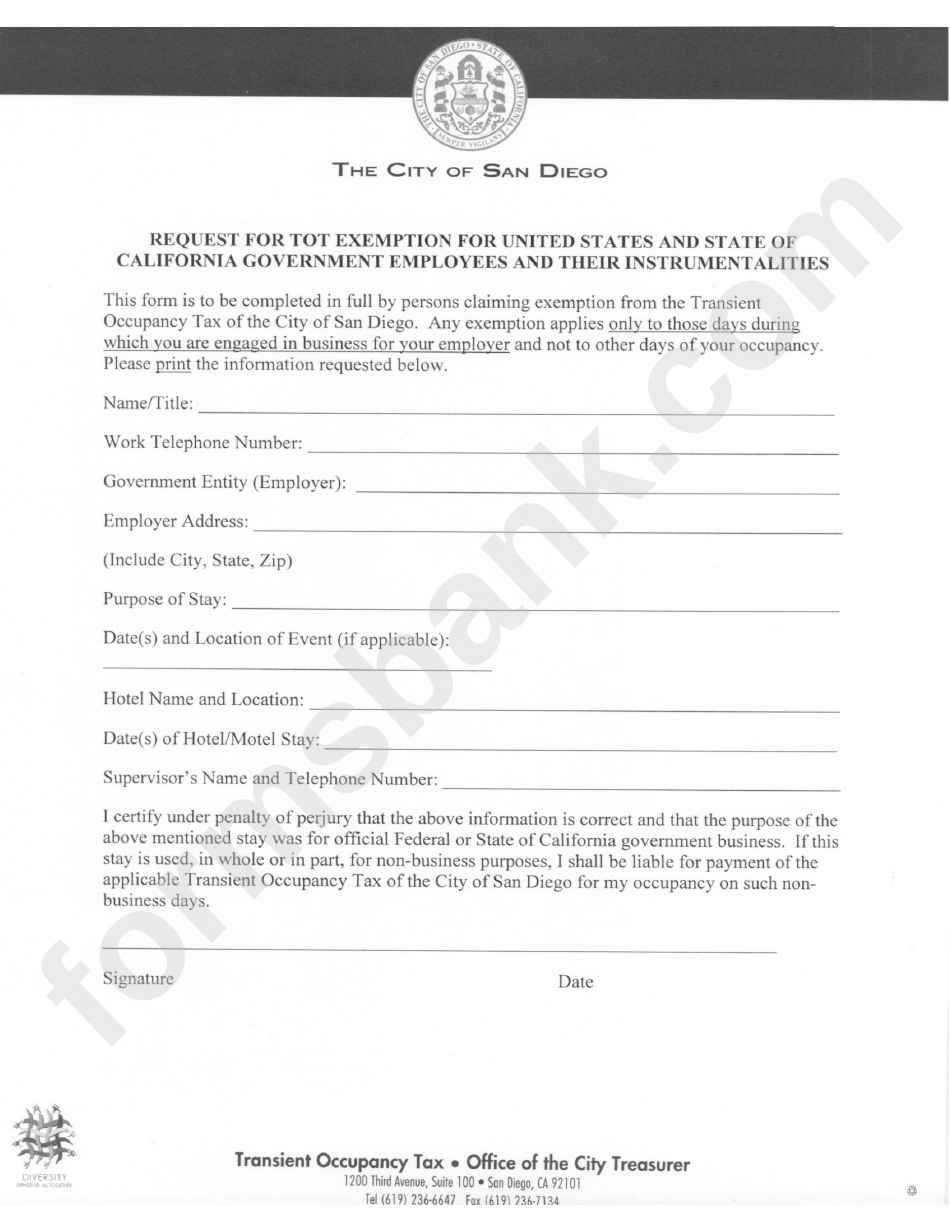

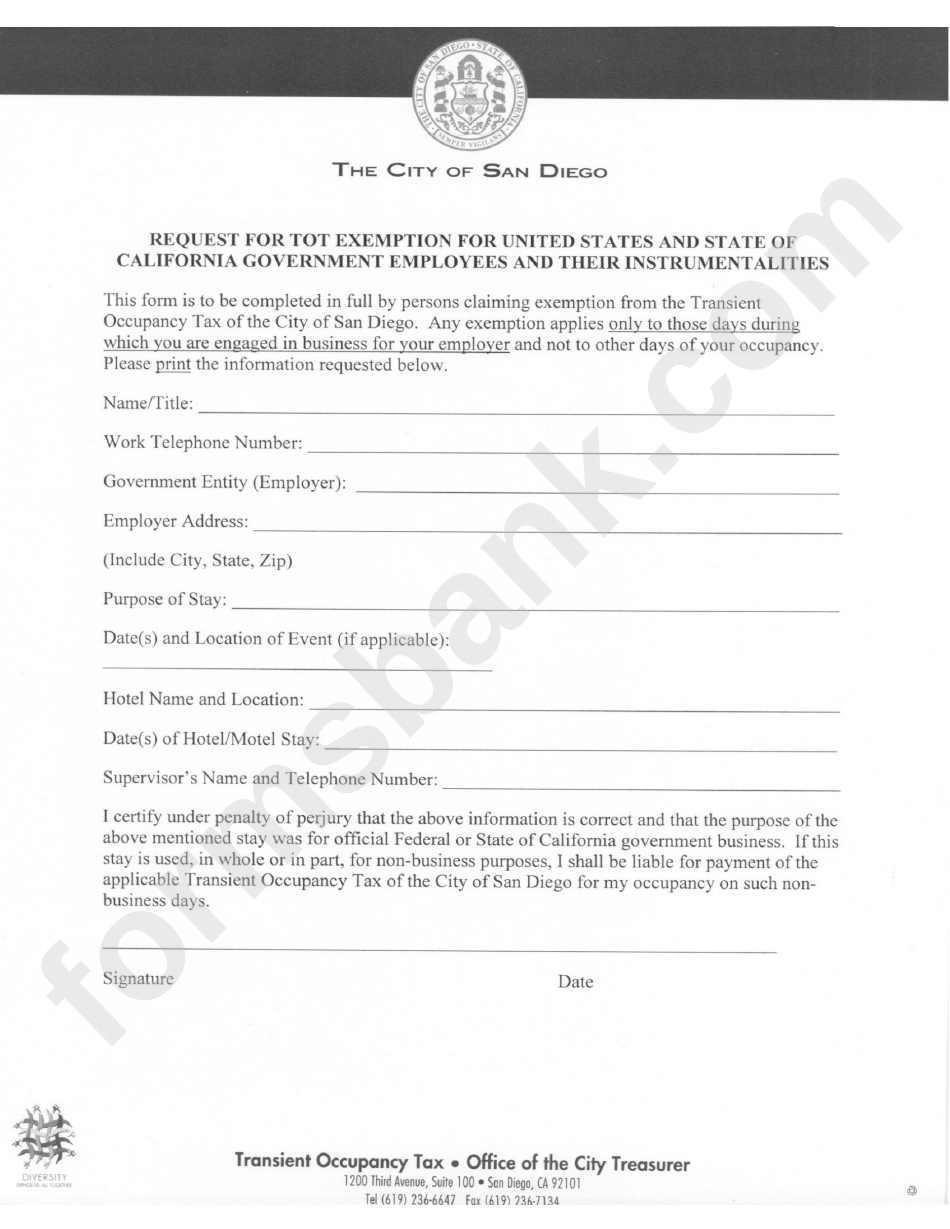

https://www.exemptform.com/wp-content/uploads/2022/08/request-for-tot-exemption-for-united-states-and-state-of-california-1.png

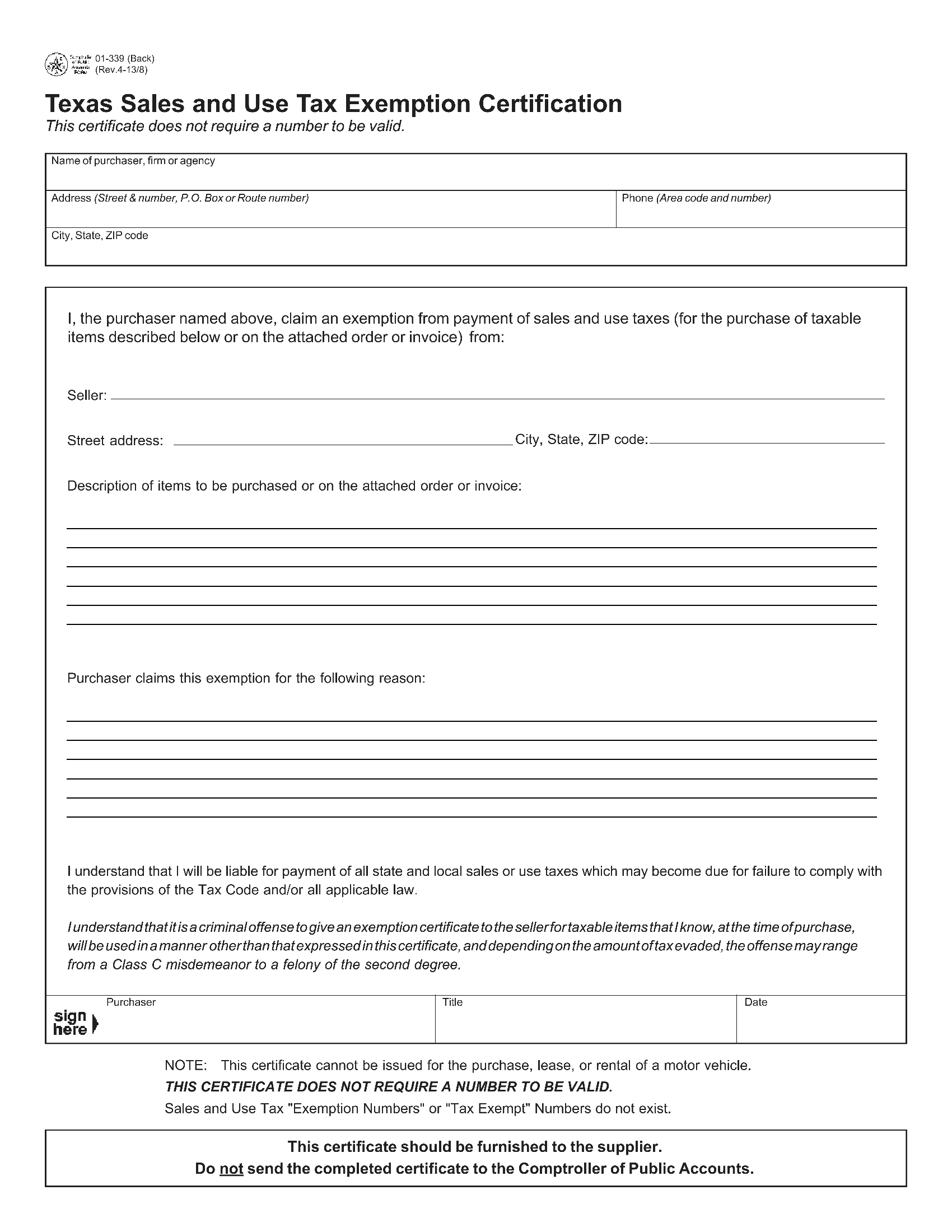

Texas Sales And Use Tax Exemption Certification Forms Docs 2023

https://blanker.org/files/images/01-339b.png

Business Tax Expenses Worksheet

https://i.pinimg.com/originals/6f/eb/d5/6febd52815bdd63ebb68a598d20ee5d5.png

Verkko The findings show tha t first time home purchases drop by roughly 30 at the age threshold of 40 years where buyers become ineligible for the tax exemption Verkko Since 1991 Finland has subsidized homeownership with first time homebuyer s stamp duty and transfer tax exemptions Under certain conditions buyers with ownership

Verkko The Finnish first time homebuyer s transfer tax exemption evidence on the effects of transfer taxes Tekij 228 Silvennoinen Erkka Muu tekij 228 Helsingin yliopisto Verkko Since 1991 Finland has subsidized homeownership with first time homebuyer s stamp duty and transfer tax exemptions Under certain conditions buyers with ownership

Download First Home Owners Tax Exemption

More picture related to First Home Owners Tax Exemption

Nysc Exemption Letter How To Apply And Collect Nysc Exemption Letter

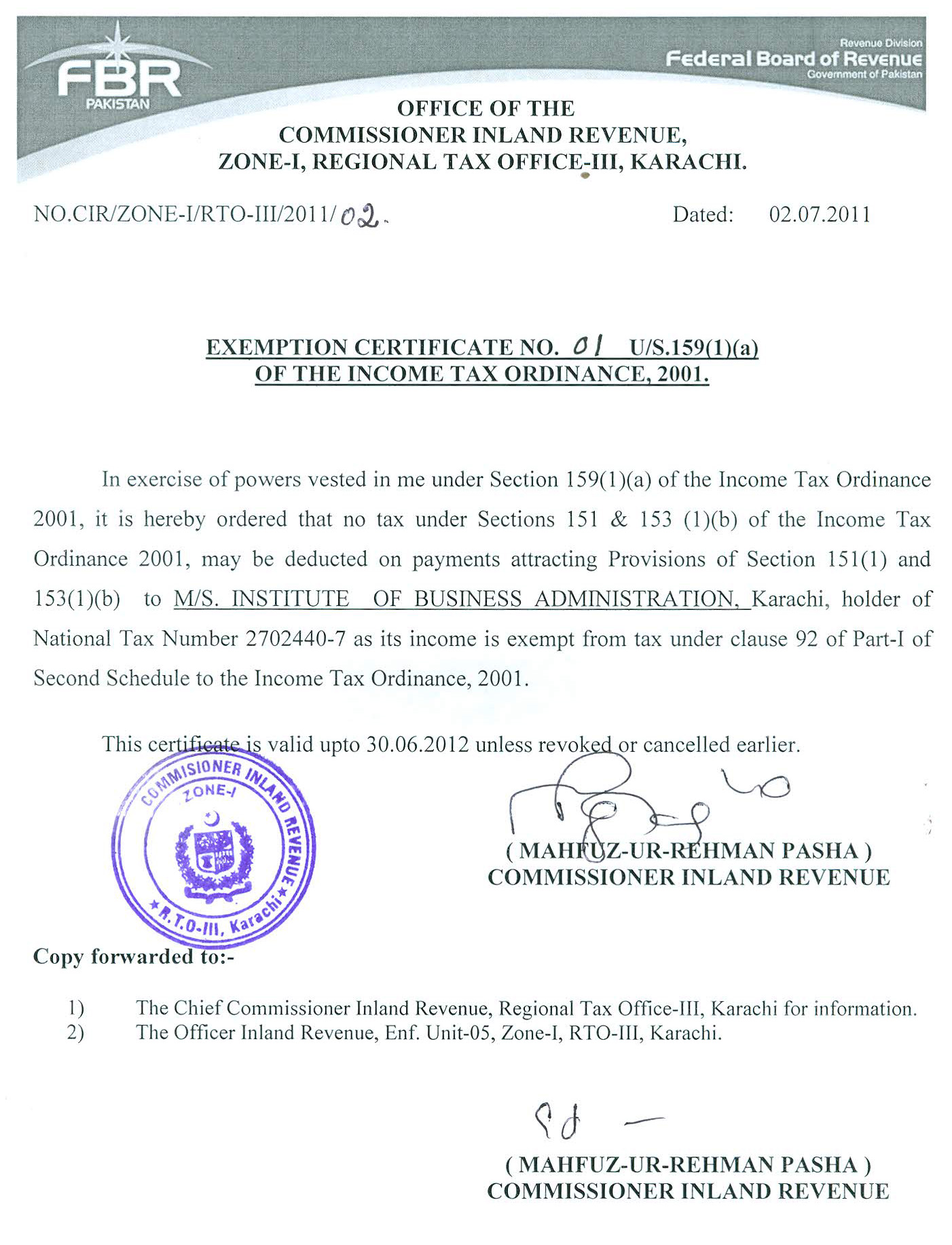

https://www.iba.edu.pk/News/tax/images/Income_Tax_Exemption_Certificate.jpg

Declaration Of Property Ownership Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/394/126/394126985/large.png

The B C Speculation And Vacancy Tax SVT What You Need To Know

https://www.purtzki.com/2015/wp-content/uploads/2019/01/iStock-585501196-property-taxes.jpg

Verkko 24 hein 228 k 2023 nbsp 0183 32 Once approved your exemption lasts until the home s ownership changes or you no longer use the home as your primary residence The homeowner s Verkko 11 rivi 228 nbsp 0183 32 Property owners in Florida may be eligible for exemptions and additional benefits that can reduce their property tax liability The homestead exemption and

Verkko 10 elok 2023 nbsp 0183 32 The new tax free First Home Savings Account is a registered savings account that helps Canadians become first time home buyers by contributing up to Verkko A Homeowner Exemption provides property tax savings by reducing the equalized assessed value Automatic Renewal Yes this exemption automatically renews each

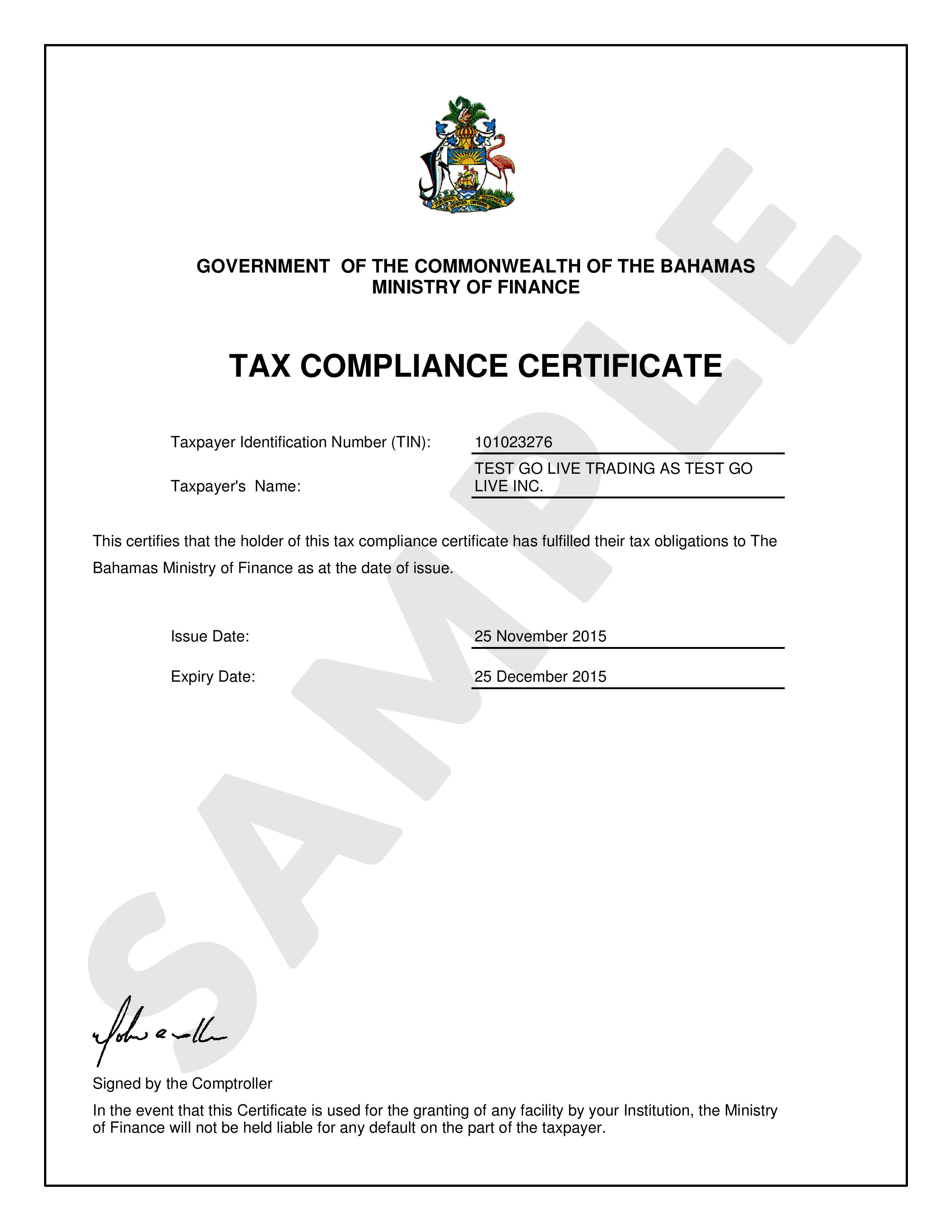

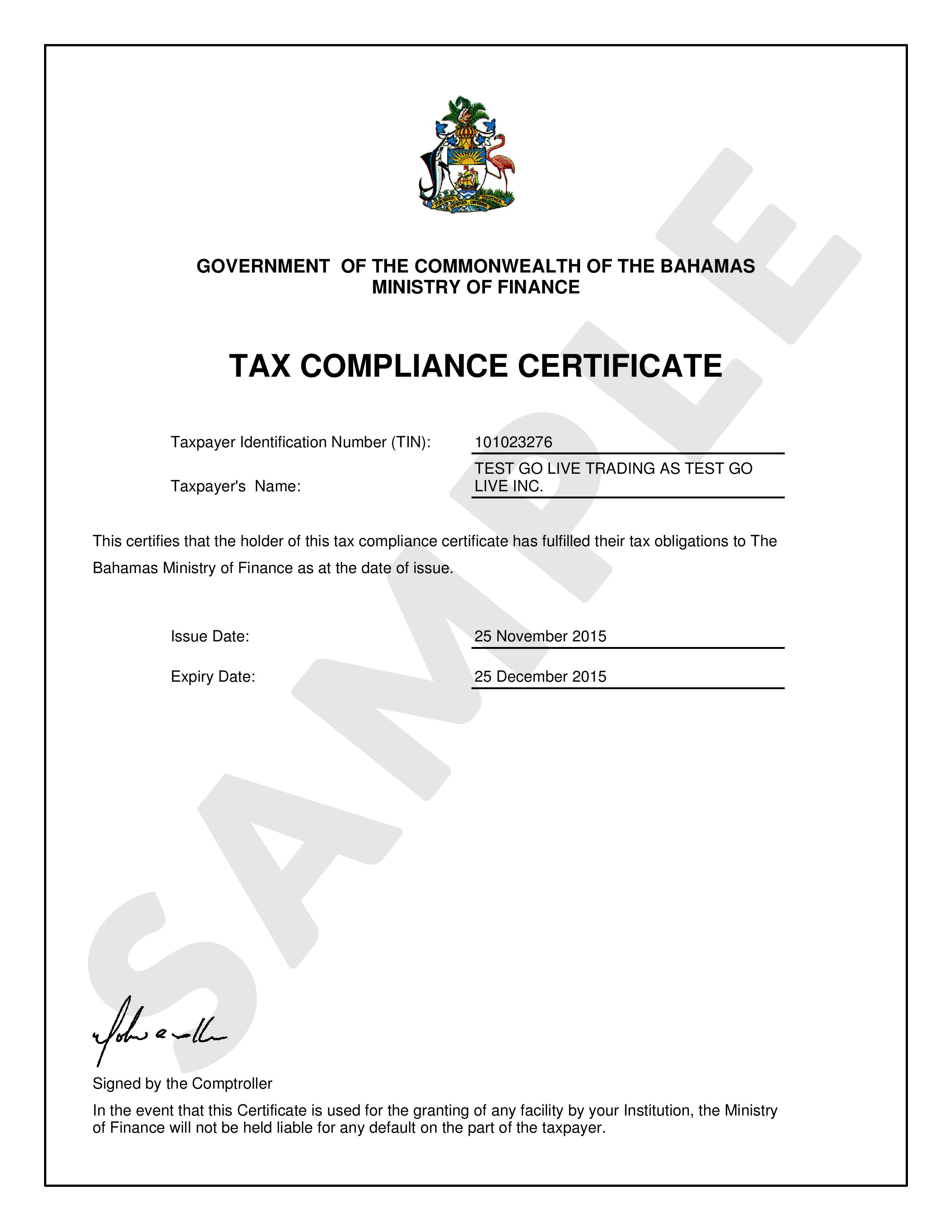

Tax Compliance Certificate Department Of Inland Revenue

https://inlandrevenue.finance.gov.bs/wp-content/uploads/2015/11/TAXCOMPLIANECERTIFICATE.jpg

Harris County Homestead Exemption Form ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/harris-county-homestead-exemption-form-printable-pdf-download-3.png

https://www.helsinkitimes.fi/finland/finland-news/domestic/24317...

Verkko 13 lokak 2023 nbsp 0183 32 THE GOVERNMENT of Prime Minister Petteri Orpo NCP on Thursday unveiled a proposal to scrap the transfer tax exemption granted to first time home

https://yle.fi/a/74-20054997

Verkko 12 lokak 2023 nbsp 0183 32 The transfer tax is roughly two to four percent of a home s value First time buyers are exempt from this tax if they are between the ages of 18 and 39 and

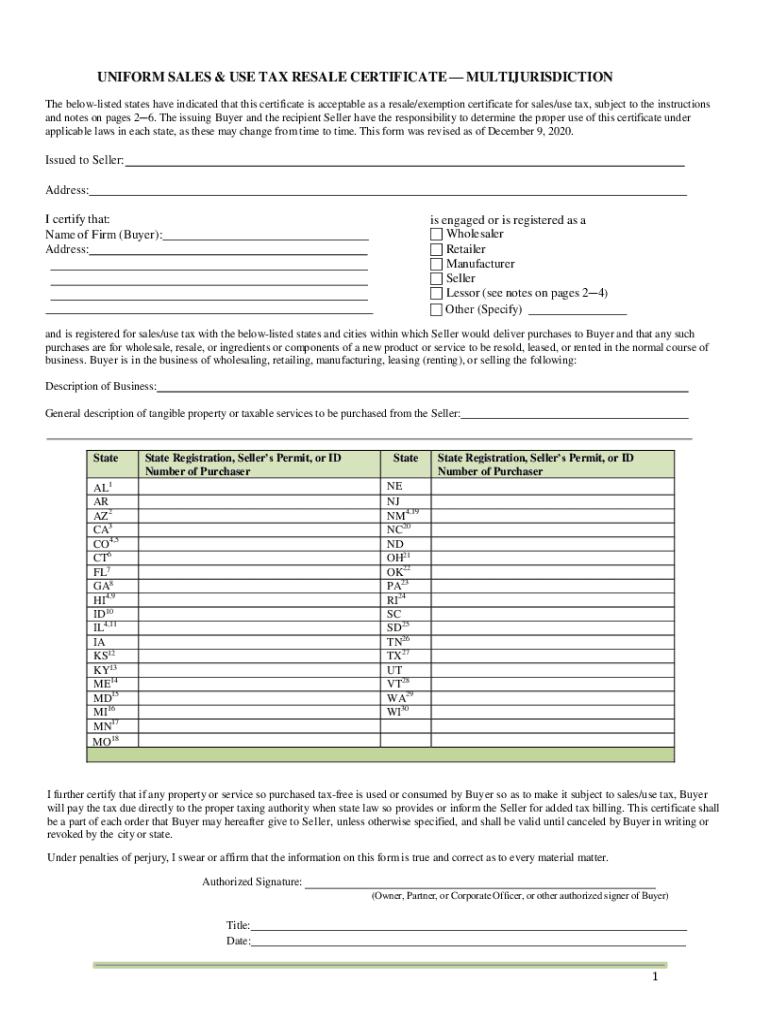

MTC Uniform Sales Use Tax Certificate Multijurisdiction 2020 2022

Tax Compliance Certificate Department Of Inland Revenue

Texas Sales And Use Tax Exemption Blank Form

Texas Sales Tax Exemption Certificate From The Texas Human Rights

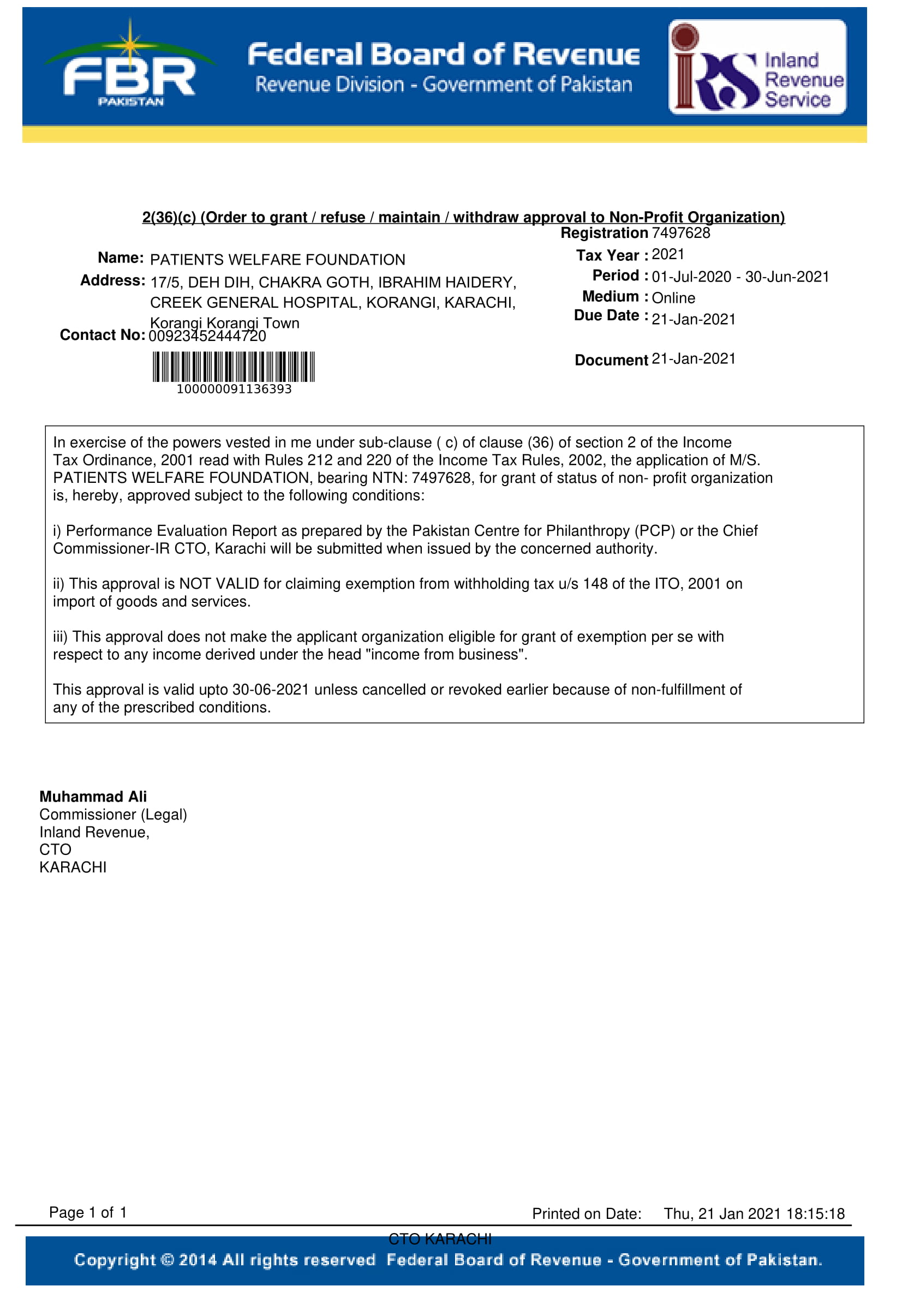

Tax Exemption Certificate PWF Pakistan

Difference Between Tax Exemption Tax Deduction And Tax Rebate The

Difference Between Tax Exemption Tax Deduction And Tax Rebate The

Stamp Duty Exemption For First time Home Owners Buying Properties Below

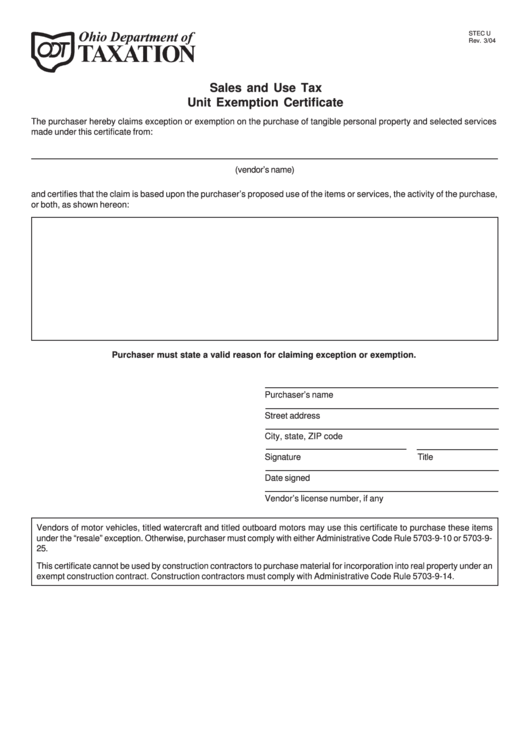

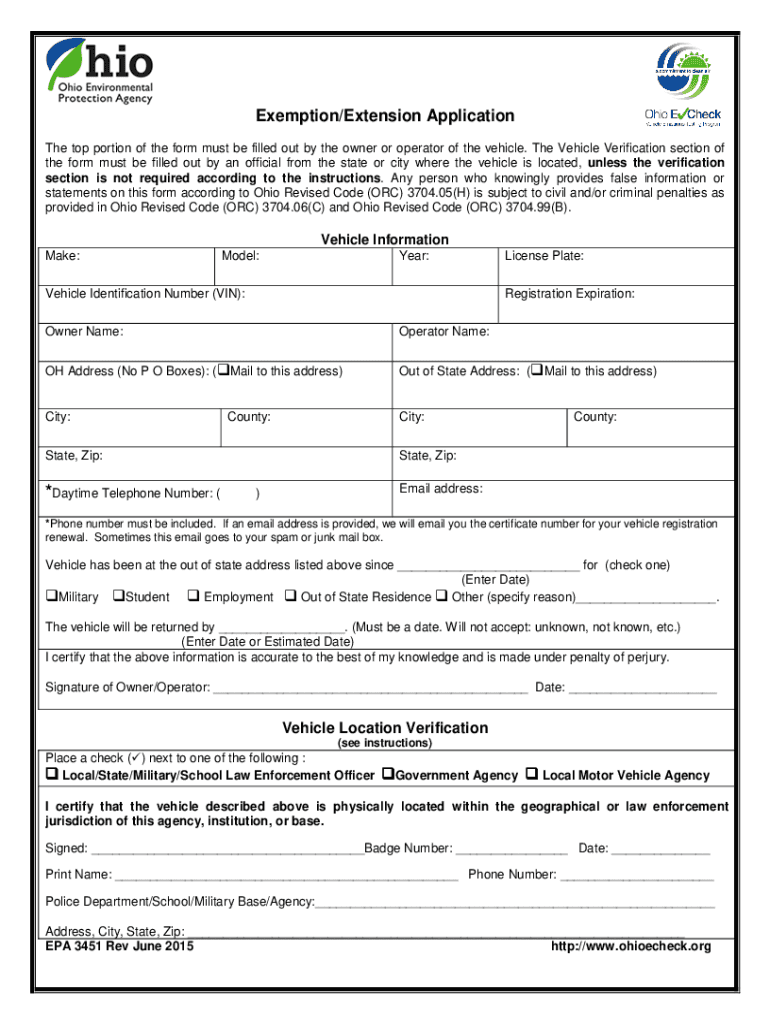

For The Tax Exempt In Ohio 2015 2024 Form Fill Out And Sign Printable

Historical Estate Tax Exemption Amounts And Tax Rates

First Home Owners Tax Exemption - Verkko The Finnish first time homebuyer s transfer tax exemption evidence on the effects of transfer taxes Tekij 228 Silvennoinen Erkka Muu tekij 228 Helsingin yliopisto