First Time Buyer Stamp Duty London First time buyers First time buyer relief is available for property purchases below specific thresholds First time buyers will not pay any stamp duty on property purchases below

You re eligible if you and anyone else you re buying with are first time buyers If the price is over 625 000 you cannot claim the relief Stamp Duty for first time buyers in London Stamp Duty is the tax charged by the Government when you buy a home or piece of land in England whether you re a first

First Time Buyer Stamp Duty London

First Time Buyer Stamp Duty London

https://www.greaterlondonproperties.co.uk/wp-content/uploads/2020/01/red-and-yellow-daisies.jpg

First Time Buyer Stamp Duty Calculator John Charcol

https://www.charcol.co.uk/fileadmin/_processed_/6/4/csm_ftb_std_calculator_cbf01c2002.jpg

First time Buyer Stamp Duty Relief NerdWallet UK

https://www.nerdwallet.com/uk/wp-content/uploads/sites/4/2023/03/Property-chains-Purchase-agreement-for-new-house-getty-images-e1679925000307-770x320.jpeg

First time buyer relief is not currently available under the new LTT system but the higher zero tax threshold of 180k should capture most first time purchases This stamp duty First time buyers no longer pay stamp duty on the first 425 000 of a home when the total purchase price is 625 000 or less as part of sweeping tax reforms

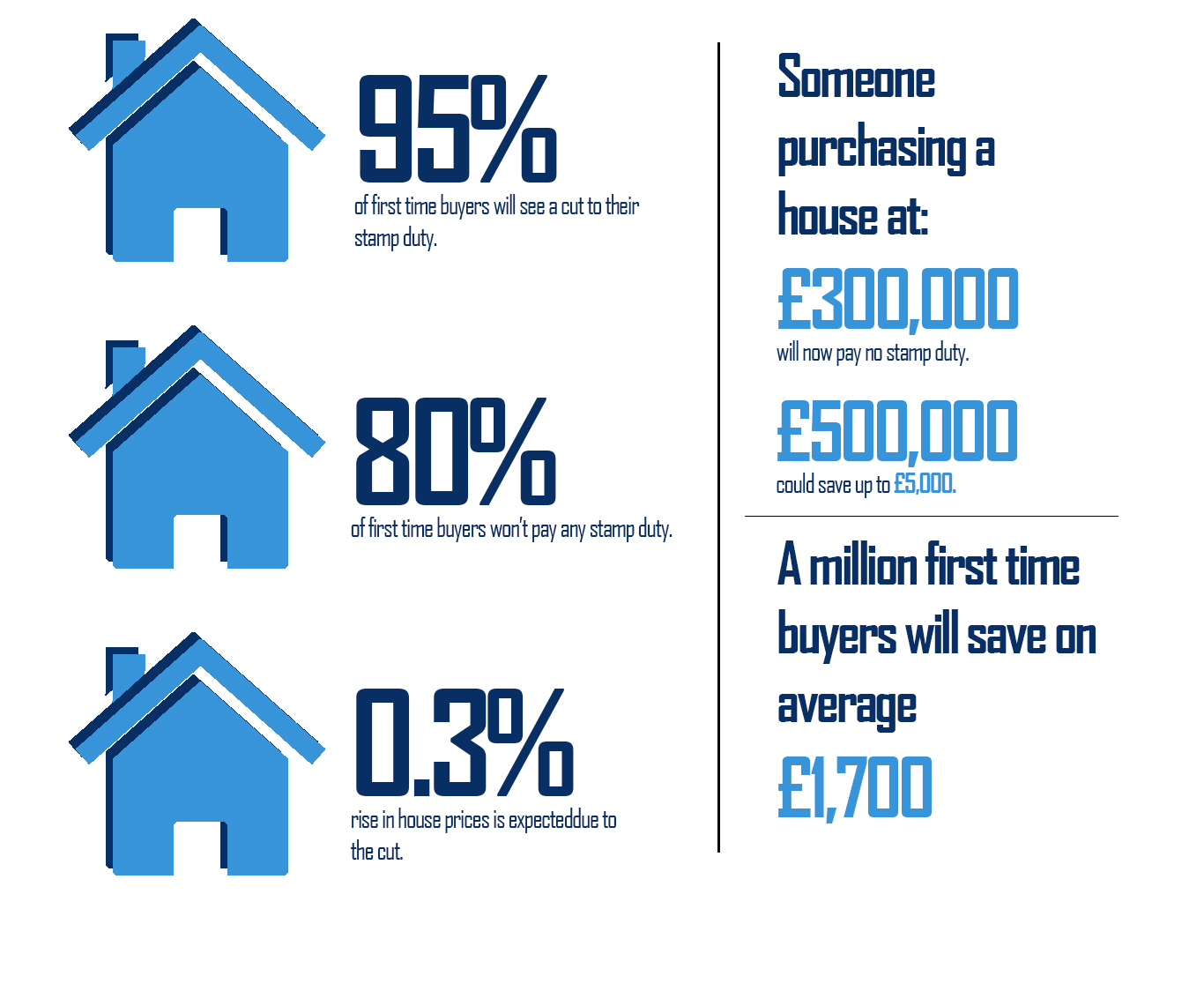

Following the Government announcement on 23rd September 2022 if you re a first time buyer purchasing a home up to 625 000 previously 500 000 the following rates First time buyer property will pay no stamp duty the stamp duty bill of the average first time buyer in London will nearly halve from 10 500 to 5 500 95 of first time buyers who

Download First Time Buyer Stamp Duty London

More picture related to First Time Buyer Stamp Duty London

Do First Time Buyers Pay Stamp Duty GCM Management Ltd

https://www.greencm.co.uk/wp-content/uploads/2021/10/first_time_buyer_stamp_duty_holiday_pandemic-970x545-HxLpMI.jpeg

First Time Buyers Benefit From The Stamp Duty Cut Nabarro McAllister

https://www.nabarromcallister.co.uk/wp-content/uploads/2017/12/stamp-duty-infographic.jpg

Stamp Duty Holiday Extended Stamp Duty Information

https://www.stamp-duty.com/wp-content/uploads/2021/03/London-768x420.jpg

You ll pay Stamp Duty on the purchase of your main property costing more than 250 000 unless you re a first time buyer The rate of Stamp Duty you pay depends on where in For the purposes of stamp duty you WON T be considered a first time buyer if you ve ever owned or part owned a property in the UK or abroad This includes if you ve ever inherited a property even if you sold it

If you are a first time buyer you may need to factor stamp duty into your budget Find out how much you are likely to pay Stamp Duty for First Time Buyers in London If you are a first time buyer the threshold for SDLT exemption in England and Northern Ireland is 300 000 There is

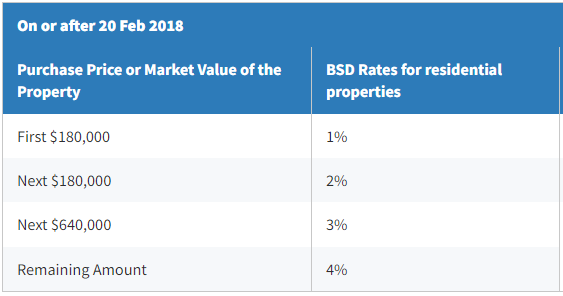

The Buyer s Stamp Duty Singapore An Essential Guide

https://www.instantloan.sg/wp-content/uploads/2022/02/Stamp-duty-singapore.jpg

An Essential Guide To Buyer s Stamp Duties In Singapore

https://www.redbrick.sg/wp-content/uploads/2022/05/StampDuty_1.png

https://www.stampdutycalculator.org.uk

First time buyers First time buyer relief is available for property purchases below specific thresholds First time buyers will not pay any stamp duty on property purchases below

https://www.gov.uk/stamp-duty-land-tax/residential-property-rates

You re eligible if you and anyone else you re buying with are first time buyers If the price is over 625 000 you cannot claim the relief

Stamp Duty For First Time Buyer

The Buyer s Stamp Duty Singapore An Essential Guide

Higher Stamp Duty Rates For Higher Valued Residential And Non

Stamp Duty So You Think You re A First time Buyer Stamp Duty

Stamp Duty For First Time Buyers A Guide And Explanation

Property Tax Singapore NelleNavdeep

Property Tax Singapore NelleNavdeep

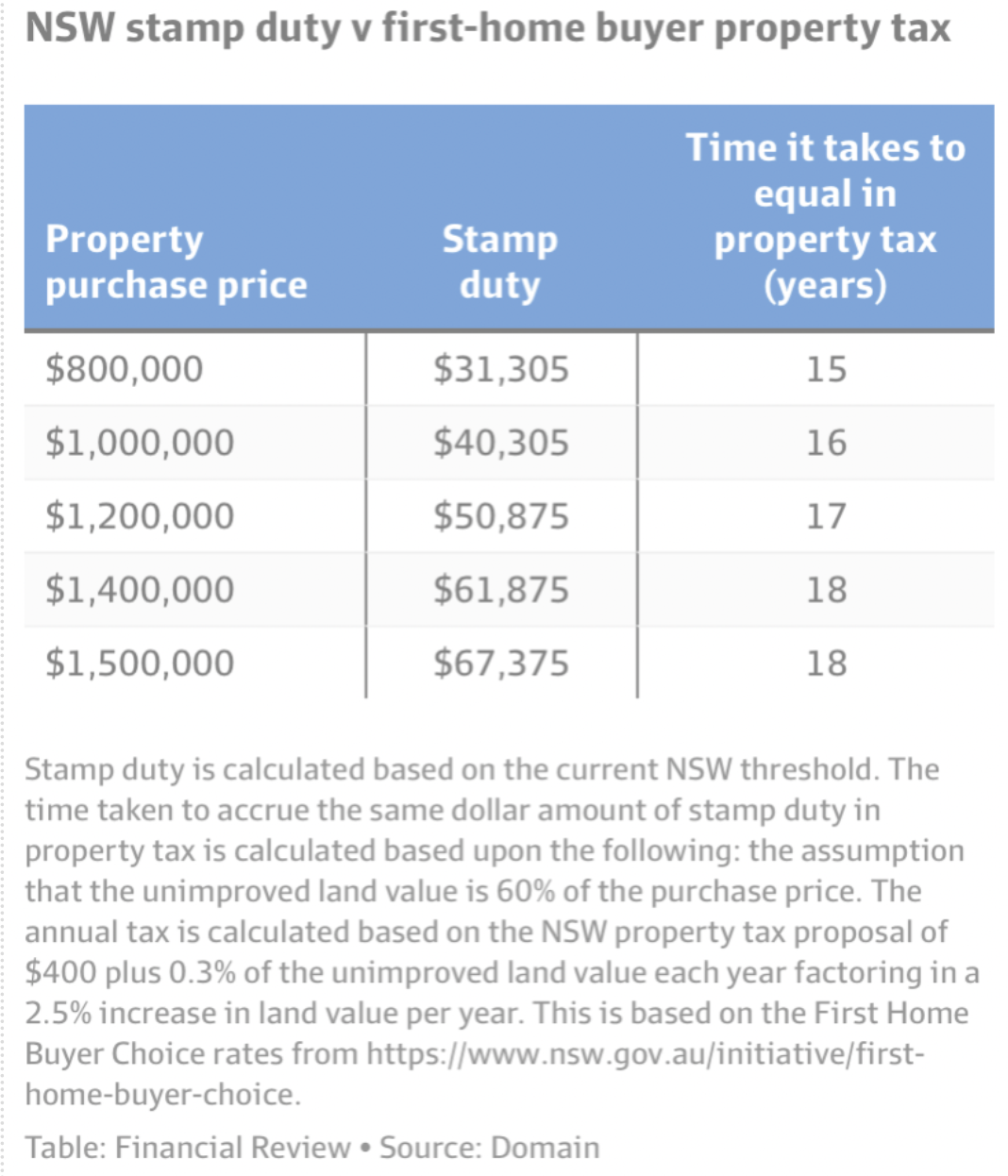

Stamp Duty Vs Land Tax Which Will Cost You More YIP

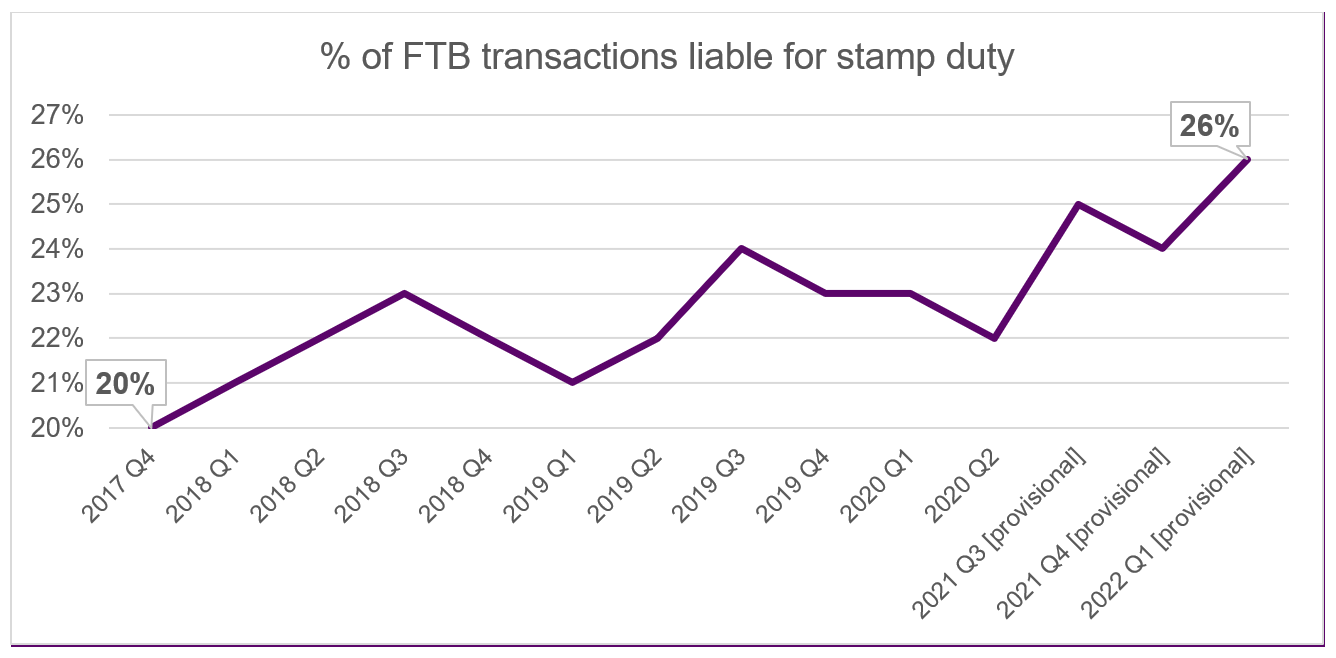

Double Whammy For First Time Buyers As 1 In 4 Pay Stamp Duty Alongside

Stamp Duty For First time Buyers Rules Around Exemption Ideal Home

First Time Buyer Stamp Duty London - First time buyer property will pay no stamp duty the stamp duty bill of the average first time buyer in London will nearly halve from 10 500 to 5 500 95 of first time buyers who