First Time Buyer Stamp Duty Relief The current SDLT thresholds are 250 000 for residential properties 425 000 for first time buyers buying a residential property worth 625 000 or less 150 000 for non residential land

You may be eligible for Stamp Duty Land Tax SDLT reliefs if you re buying your first home and in certain other situations These reliefs can reduce the amount of tax you pay You must Stamp duty relief is designed to reduce the amount of tax paid when buying a property There are various types of stamp duty relief This article focuses on first time buyer relief First time buyer stamp duty relief was first introduced in November 2017 with a threshold of 300 000 The threshold was increased in September 2022 to 425 000

First Time Buyer Stamp Duty Relief

First Time Buyer Stamp Duty Relief

https://www.formevo.co.uk/sdlt-declaration-1-first-time-buyer-s-declaration-stamp-duty-land-tax-first-time-buyer-s-relief-only-preview-page-background-wMrTxv2UX2TjjzkY-1.php

First Time Buyer Stamp Duty Relief Greater London Properties GLP

https://www.greaterlondonproperties.co.uk/wp-content/uploads/2020/01/red-and-yellow-daisies.jpg

First Time Buyer Stamp Duty Relief Properties Available Tanya Dreams

https://www.tanyadreams.com/wp-content/uploads/2022/02/Live-and-work-but-do-not-forget-to-play-to-have-fun-in-life-and-really-enjoy-it.-18.png

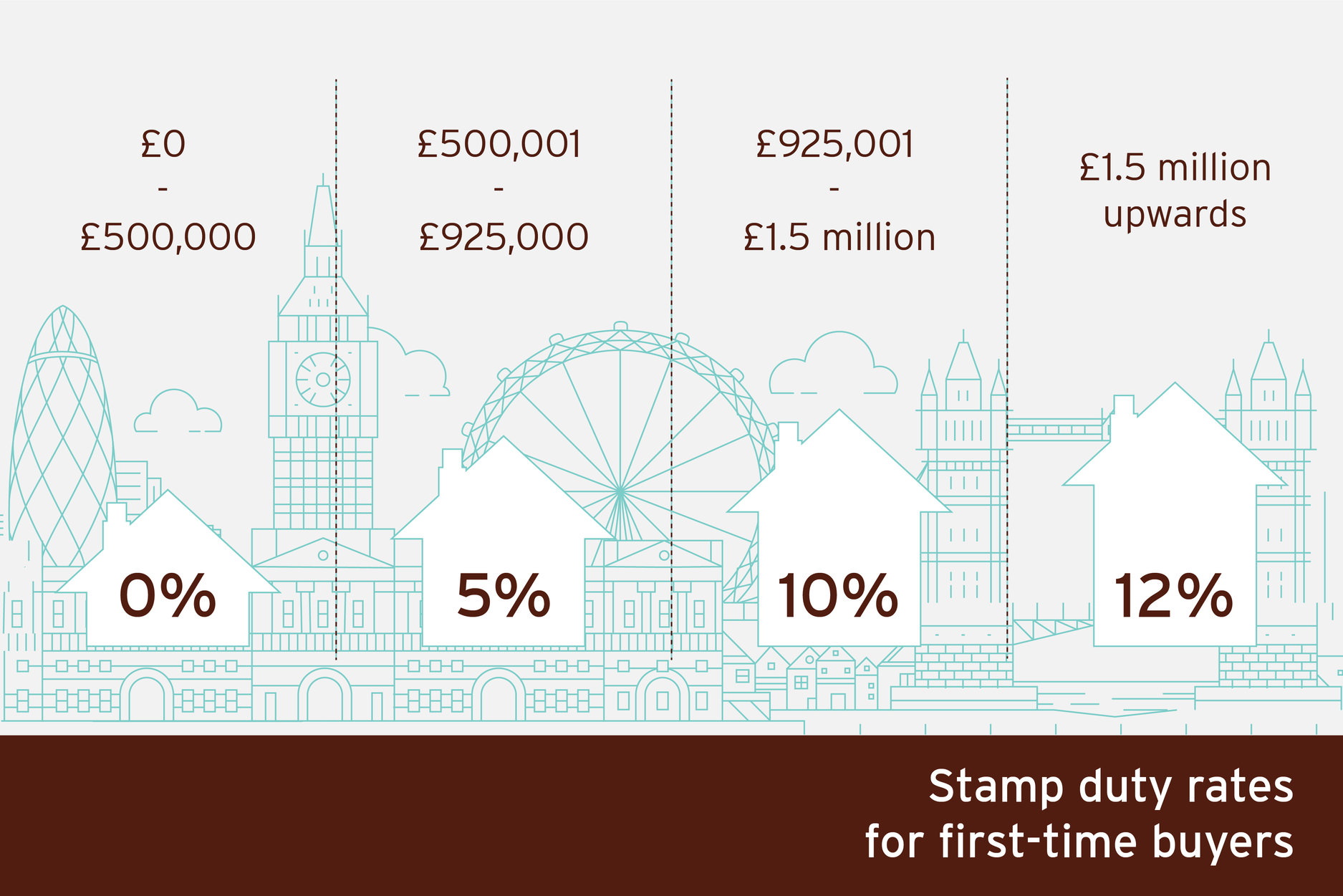

First time buyer stamp duty relief was introduced by the government to reduce the upfront costs of buying your first home First time buyer stamp duty relief is only applicable if you are buying a property you intend to live in If you re a first time buyer in England or Northern Ireland you will pay no Stamp Duty on property purchases up to 425 000 This is called first time buyers relief For properties costing up to 625 000 you will pay no Stamp Duty on the first 425 000

It was announced1 in the Budget on 22 November 2017 that relief from Stamp Duty Land Tax SDLT became available for first time buyers paying up to 500 000 for a dwelling within England Wales2 and Northern Ireland completing3 on or after Budget Day There is no end date built into the relief Unlike the other countries there is no extra relief for first time buyers Here are the rates you ll need to pay Land transaction tax rates Wales 1 Rate applies to relevant portion of the purchase price

Download First Time Buyer Stamp Duty Relief

More picture related to First Time Buyer Stamp Duty Relief

First Time Buyer Stamp Duty Relief Properties Available Tanya Dreams

https://www.tanyadreams.com/wp-content/uploads/2022/02/NEW-Blog-Images-19.png

First Time Buyer Stamp Duty Relief Stamp Duty Information

https://www.stamp-duty.com/wp-content/uploads/2020/01/house-garden1.jpg

.jpg)

First Time Buyer Stamp Duty Changes

https://www.reallymoving.com/getattachment/bfffb5d4-d550-4894-a1f3-55b9c85b6c6c/first-time-buyer-stamp-duty-(4).jpg

You get a relief from SDLT if you and the person you are buying with if you are buying with someone else are first time buyers purchasing a residential property of 625 000 or less This Stamp Duty Land Tax relief for first time buyers was introduced through Budget 2017 become applicable on residential property purchases on 22 November 2017 The relief applies to house purchases in England and Northern

[desc-10] [desc-11]

First Time Buyer Stamp Duty Relief Bluebell Mortgages

https://www.bluebellmortgages.co.uk/wp-content/uploads/2017/08/stamp-duty-1024x382.jpg

Do You Qualify For first Time Buyer Stamp Duty Relief And Exemptions

https://www.thomasoliveruk.co.uk/news-images/2018-Jan/stamp-duty-relief-specialist--20.jpg

https://www.gov.uk/stamp-duty-land-tax

The current SDLT thresholds are 250 000 for residential properties 425 000 for first time buyers buying a residential property worth 625 000 or less 150 000 for non residential land

https://www.gov.uk/stamp-duty-land-tax/reliefs-and-exemptions

You may be eligible for Stamp Duty Land Tax SDLT reliefs if you re buying your first home and in certain other situations These reliefs can reduce the amount of tax you pay You must

Nearly 70 000 First time Buyers Save Thousands With New Stamp Duty

First Time Buyer Stamp Duty Relief Bluebell Mortgages

First Time Buyer Stamp Duty Calculator John Charcol

Do First Time Buyers Pay Stamp Duty GCM Management Ltd

Will My Son Get first time Buyer Stamp Duty Relief If We Get A Joint

Government Announces Stamp Duty Relief For First Time Buyers

Government Announces Stamp Duty Relief For First Time Buyers

Why Stamp Duty Relief Has Not Boosted First time Buyers Mortgage

Stamp Duty Relief To Help Revive The Housing Market Avery Surveys

Stamp Duty Buying Advice For London Properties Marsh Parsons

First Time Buyer Stamp Duty Relief - First time buyer stamp duty relief was introduced by the government to reduce the upfront costs of buying your first home First time buyer stamp duty relief is only applicable if you are buying a property you intend to live in