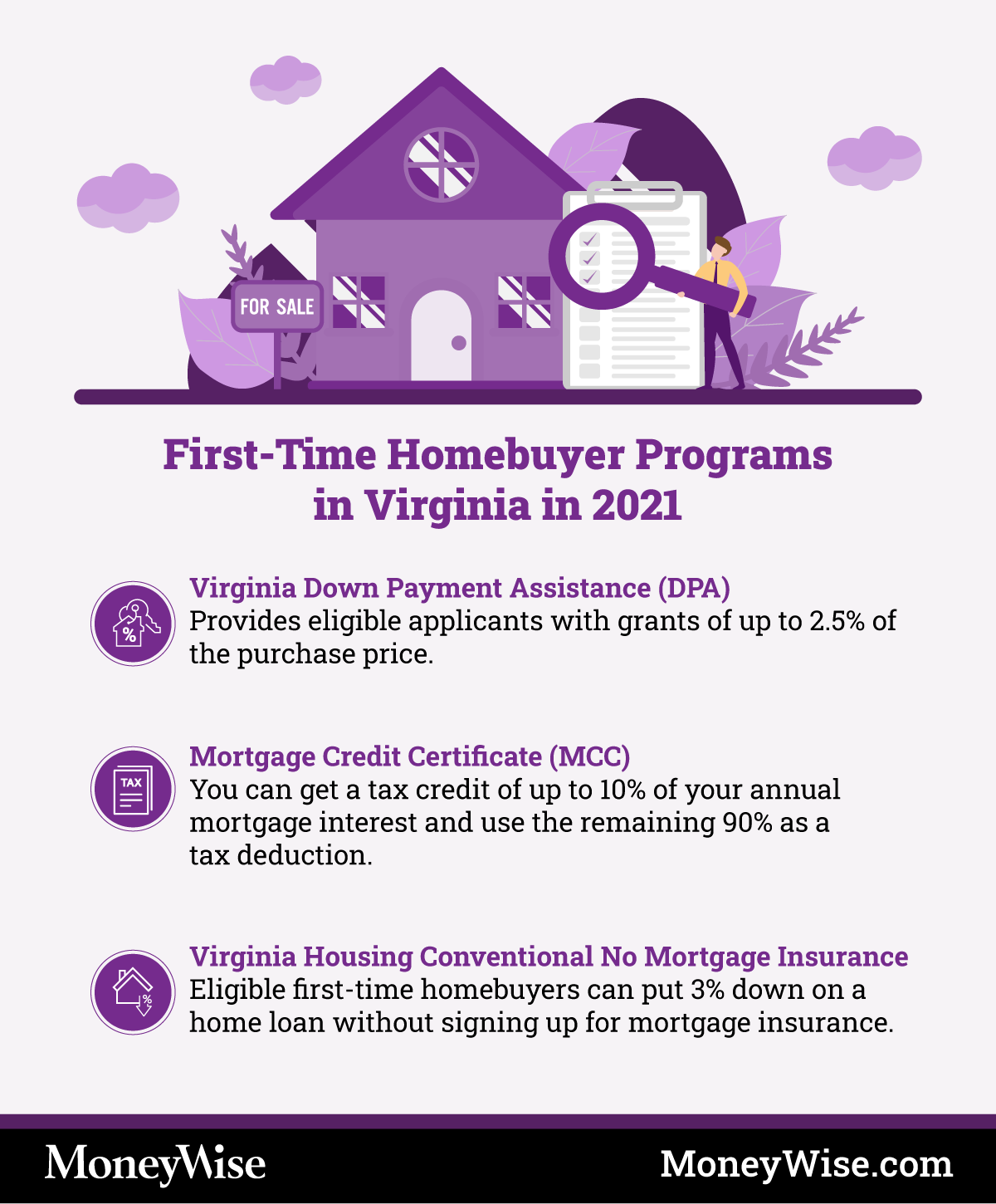

First Time Home Buyers Tax Rebate Web 23 mai 2023 nbsp 0183 32 After the passage of new legislation in December of 2022 eligible first time home buyers can claim a 10 000 non refundable

Web Beginning January 1 2017 no land transfer tax would be payable by qualifying first time purchasers on the first 368 000 of the value of the consideration for eligible homes Web Visit the First Time Home Buyer Incentive for more detail Home Buyers Amount The Home Buyers Amount offers a 5 000 non refundable income tax credit amount on a

First Time Home Buyers Tax Rebate

First Time Home Buyers Tax Rebate

https://canadian-data.com/wp-content/uploads/2023/04/First-Time-Home-Buyer.jpg

Tax Credits Rebates For First Time Home Buyers In Toronto First

https://i.pinimg.com/originals/73/83/a3/7383a34119ed5366c234bae48ff59560.jpg

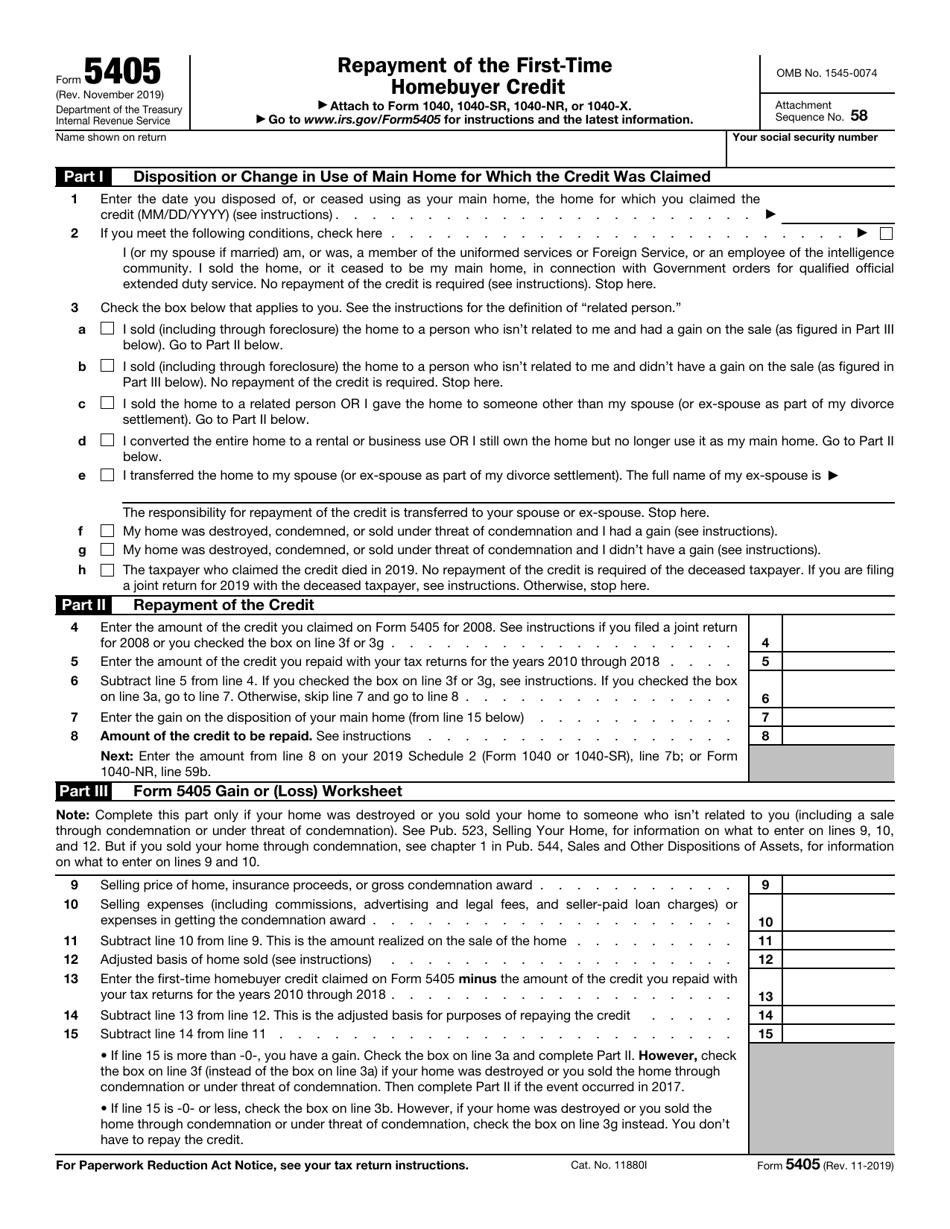

IRS Form 5405 Download Fillable PDF Or Fill Online Repayment Of The

https://data.templateroller.com/pdf_docs_html/2017/20173/2017391/irs-form-5405-repayment-of-the-first-time-homebuyer-credit_print_big.png

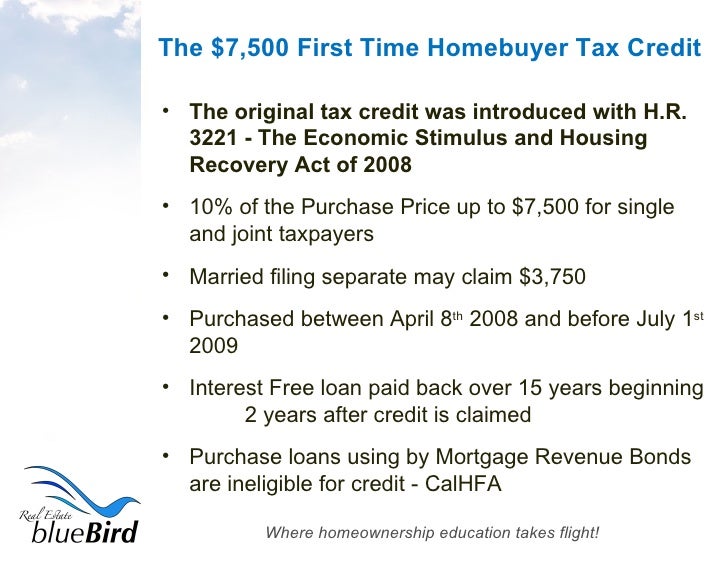

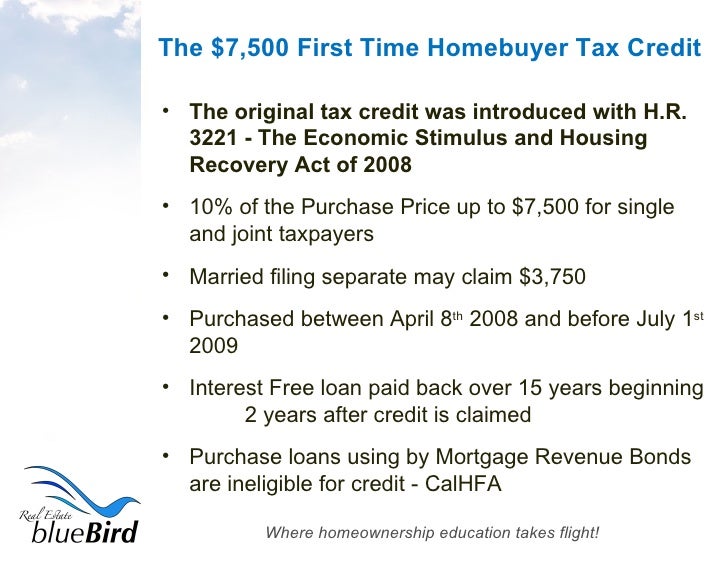

Web 22 mai 2023 nbsp 0183 32 The First Time Homebuyer Tax Credit is a tax refund from the U S Treasury paid to eligible first time home buyers and cashed in when federal taxes get filed The refund is neither a loan like some Web 10 juin 2023 nbsp 0183 32 Updated June 10 2023 The Federal Government introduced the first time homebuyers tax credit in the 2009 Federal Budget The non refundable tax credit is

Web 1 sept 2023 nbsp 0183 32 The program gives eligible first time home buyers up to a 10 000 non refundable income tax credit on qualifying homes resulting in up to 1 500 rebate back Web You may be eligible to save up to 40 000 tax free to buy a home with an annual contribution limit of 8 000 Learn more about the First Home Savings Account Your

Download First Time Home Buyers Tax Rebate

More picture related to First Time Home Buyers Tax Rebate

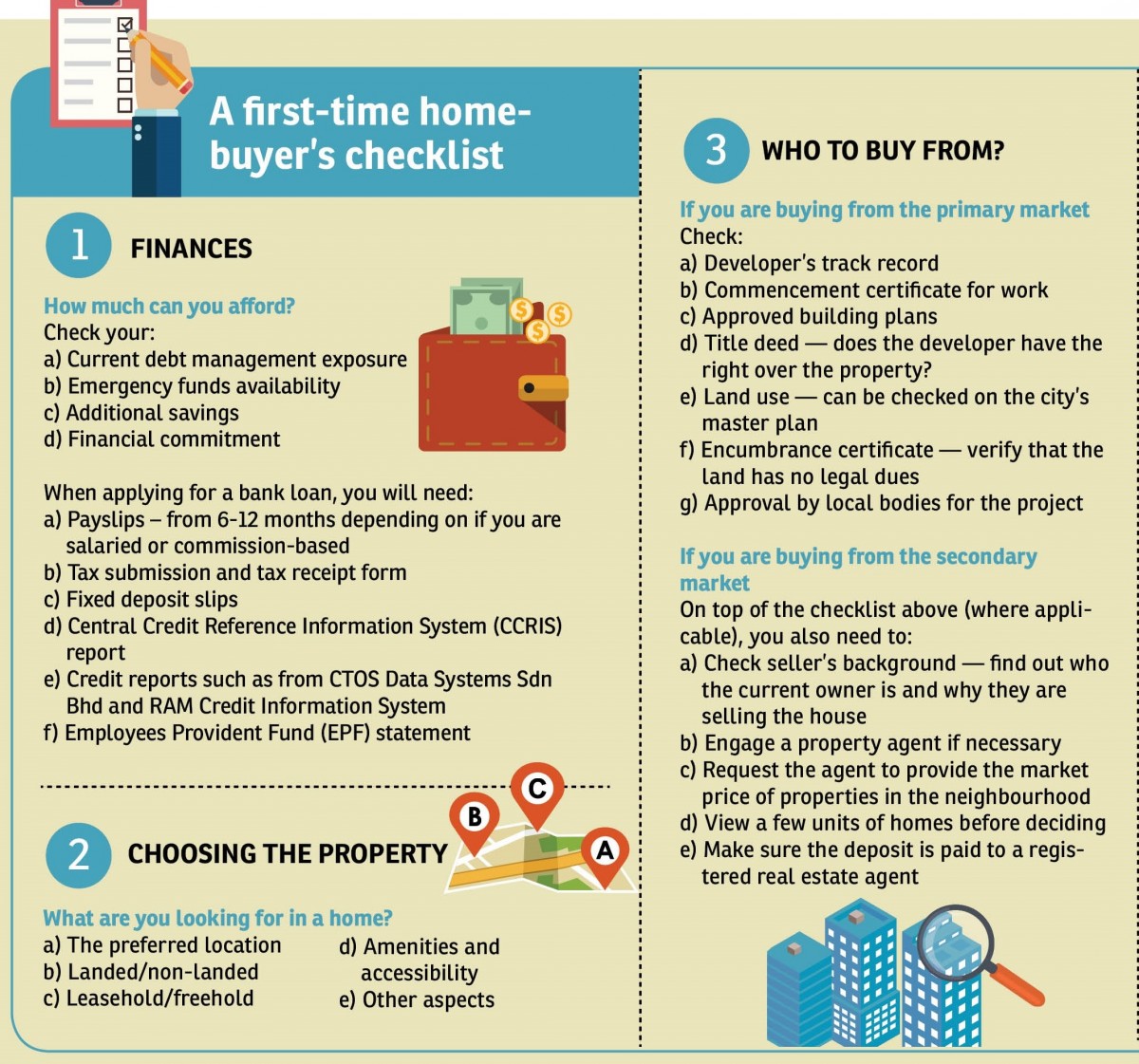

What Is The First Time Home Buyer Tax Credit 2017 Buy Walls

https://dbv47yu57n5vf.cloudfront.net/s3fs-public/editorial/my/2017/January/08/Checklist1a.jpg

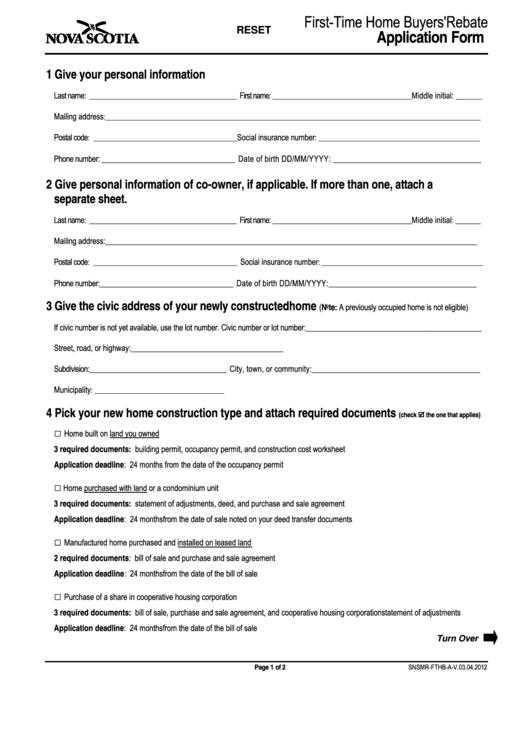

Fillable First Time Home Buyers Rebate Application Form Printable Pdf

https://data.formsbank.com/pdf_docs_html/54/549/54949/page_1_thumb_big.png

Are You To Be A First Time Home Buyer A 8000 Tax Credit Is Available

http://activerain.com/image_store/uploads/1/2/5/4/6/ar123656254464521.jpg

Web Until 2022 the Home Buyers Tax Credit at current taxation rates worked out to a rebate of 750 for all first time homebuyers However in the 2022 budget the rebate amount Web 6 mai 2022 nbsp 0183 32 Effective in the 2022 tax year this would double the credit to 10 000 for first time home buyers This tax credit is a non refundable income tax credit on line 31270 of your tax return This tax credit can be

Web 27 juin 2022 nbsp 0183 32 You ll receive the maximum Ontario land transfer tax refund amount if you re a first time home buyer that is purchasing a home in Ontario with a price of 368 000 or Web 19 mai 2022 nbsp 0183 32 If you are a first time home buyer British Columbia offers a land transfer tax refund of up to 8 000 for properties worth below 525 000 The refund covers the full

Spring Special For First Time Home Buyers 500 Rebate At Closing

https://i.pinimg.com/736x/e5/29/89/e52989801da41abb8e6acc480b2c2cd3--first-time-home-buyers-first-home.jpg

13 Easy Tips How To Qualify For First Time Homebuyer Tax Credit

https://i.pinimg.com/736x/ed/95/83/ed958370f9ecd20b66bb431da0e7a58b.jpg

https://www.nerdwallet.com/ca/mortgages/firs…

Web 23 mai 2023 nbsp 0183 32 After the passage of new legislation in December of 2022 eligible first time home buyers can claim a 10 000 non refundable

https://www.ontario.ca/.../land-transfer-tax-refunds-first-time-homebuyers

Web Beginning January 1 2017 no land transfer tax would be payable by qualifying first time purchasers on the first 368 000 of the value of the consideration for eligible homes

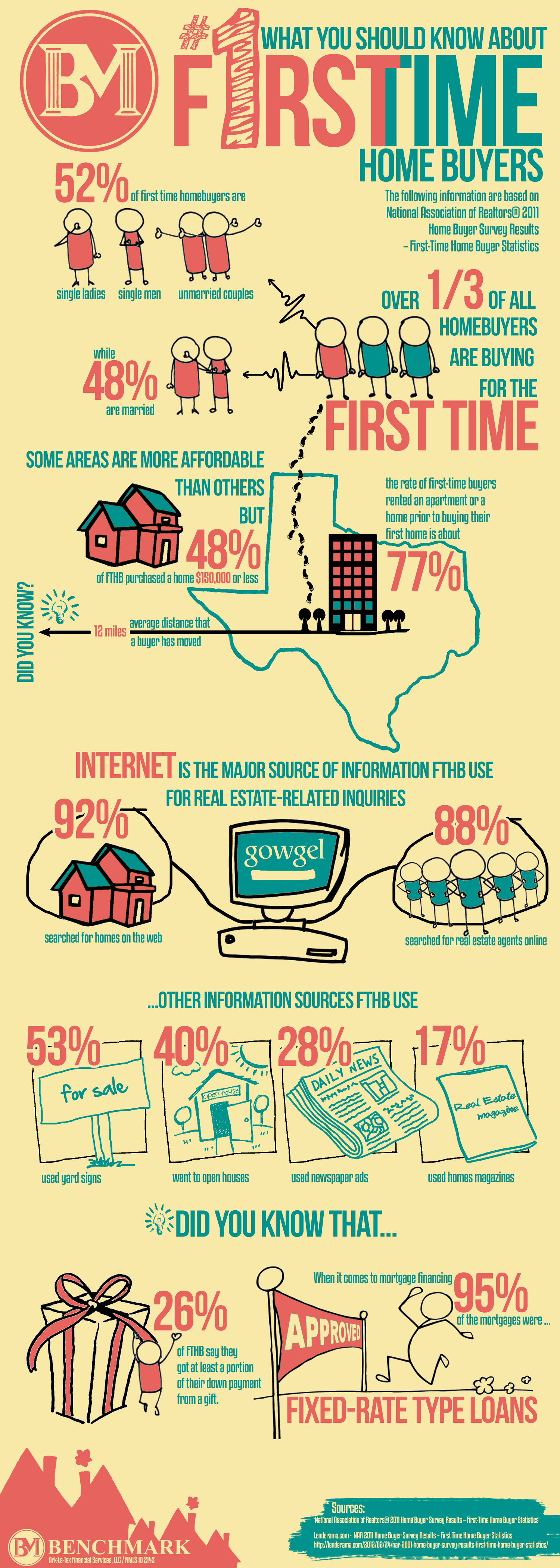

The Average First Time Home Buyer INFOGRAPHIC Dominic Tudor

Spring Special For First Time Home Buyers 500 Rebate At Closing

Get First Time Home Buyer Down Payment Assistance PNG First Home

Do I Have To Pay Back First Time Homebuyer Tax Credit Tax Credits

Chicago Northwest Suburbs Real Estate First Time Home Buyers 8000

Understanding The First Time Homebuyer Tax Credit

Understanding The First Time Homebuyer Tax Credit

Micastle ca Yang Yang Broker Of Record First Time Home Buyer

First Time Home Buyer Tax Credit Ultimate Guide To Getting The Most

Tax Benefits Of First Time Home Buyers BenefitsTalk

First Time Home Buyers Tax Rebate - Web 10 juin 2023 nbsp 0183 32 Updated June 10 2023 The Federal Government introduced the first time homebuyers tax credit in the 2009 Federal Budget The non refundable tax credit is